What does a Staff Accountant do?

A Staff Accountant plays a key role in managing the financial health of a company. This person ensures all financial records are accurate. They prepare and review financial documents, such as invoices and receipts. The Staff Accountant also tracks income and expenses. They help prepare budgets and financial forecasts. This role ensures the company operates efficiently and complies with financial regulations.

In addition, a Staff Accountant collaborates with other departments. They provide financial insights to support decision-making. They often work on audits and tax preparation. This role requires strong attention to detail and analytical skills. It also demands knowledge of accounting principles and practices. A Staff Accountant helps maintain the financial stability and growth of a business.

Staff Accountants usually work in an office setting. They use accounting software to manage financial data. This role can be found in various industries, including manufacturing, retail, and services. Attention to detail and accuracy are crucial. Being a Staff Accountant means contributing to the financial success of a company.

How to become a Staff Accountant?

Becoming a Staff Accountant is a rewarding career path that offers stability and growth. This role involves managing financial records, preparing budgets, and ensuring compliance with tax laws. Following a structured approach can help one achieve this goal efficiently. Let’s explore the steps to becoming a Staff Accountant.

First, gaining the right education is crucial. Most employers require at least a bachelor’s degree in accounting or a related field. This foundational education provides the necessary knowledge of accounting principles and practices. Some accountants choose to pursue a Master’s degree in accounting or a related field to enhance their credentials and job prospects. Professional certification, such as becoming a Certified Public Accountant (CPA), can also improve job opportunities and career advancement.

An outline of steps to become a Staff Accountant includes:

- Earn a degree in accounting or a related field.

- Gain relevant work experience through internships or entry-level positions.

- Pursue professional certifications, such as the CPA certification.

- Develop essential skills, such as proficiency in accounting software and strong analytical abilities.

- Apply for positions and continue professional development.

How long does it take to become a Staff Accountant?

The journey to becoming a Staff Accountant includes several steps. Most people start by earning a college degree. This often takes four years. Some might choose a bachelor's degree in accounting. Others might select a business degree with a focus on accounting. After earning the degree, many seek internships or entry-level positions. These roles can last from a few months to a couple of years. Gaining experience helps with understanding financial tasks and reporting.

To enhance career prospects, some Staff Accountants pursue certifications. The Certified Public Accountant (CPA) exam is one option. Preparing for and passing this exam can take extra time. It often requires studying and passing several exams. Other certifications, such as the Certified Management Accountant (CMA), may also be pursued. These credentials can lead to better job opportunities and higher pay. The total time to reach full readiness can vary. But most accountants reach the Staff Accountant level in about five to seven years. This includes education, experience, and certifications.

Staff Accountant Job Description Sample

A Staff Accountant plays a vital role in an organization's financial operations. This position involves preparing financial statements, managing accounts, ensuring accuracy and compliance with financial regulations, and providing support to senior accounting staff.

Responsibilities:

- Prepare and review general ledger accounts and ensure accuracy.

- Assist in the preparation of monthly, quarterly, and annual financial statements.

- Reconcile bank accounts, credit card accounts, and other financial transactions.

- Process accounts payable and accounts receivable functions.

- Assist in the preparation of budgets and forecasts.

Qualifications

- Bachelor's degree in Accounting, Finance, or related field.

- Certified Public Accountant (CPA) designation preferred.

- Minimum of 2-3 years of experience in a similar role.

- Strong knowledge of generally accepted accounting principles (GAAP).

- Proficiency in accounting software (e.g., QuickBooks, SAP, Oracle).

Is becoming a Staff Accountant a good career path?

Working as a Staff Accountant offers a solid foundation in financial reporting and analysis. This role involves handling a company's daily financial transactions. Tasks include preparing balance sheets, profit and loss statements, and other financial reports. The position provides a clear view of the company's financial health.

Staff Accountants play a crucial role in ensuring accuracy and compliance. They work closely with other finance team members and sometimes with auditors. This role can lead to various career paths. Staff Accountants may advance to Senior Accountant, Financial Manager, or even Chief Financial Officer. The skills gained are valuable and transferrable across many industries.

Like any career, the path of a Staff Accountant has its pros and cons. Consider these before making a decision:

- Pros:

- Steady income: Many companies need Staff Accountants year-round.

- Skill development: Gain skills in accounting software, financial reporting, and compliance.

- Career advancement: Opportunities to move up to higher positions with more responsibility.

- Cons:

- Repetitive tasks: Some daily tasks can be routine and unchanging.

- Pressure: The role can be stressful, especially during tax season or audits.

- Limited advancement: Opportunities for career growth might be slower in smaller companies.

What is the job outlook for a Staff Accountant?

The job outlook for Staff Accountants shows promising growth, with an average of 126,500 positions available each year. This consistent demand reflects a stable career path in the finance sector. The Bureau of Labor Statistics (BLS) projects a 4.4% increase in job openings from 2022 to 2032, highlighting the importance of qualified professionals in this field.

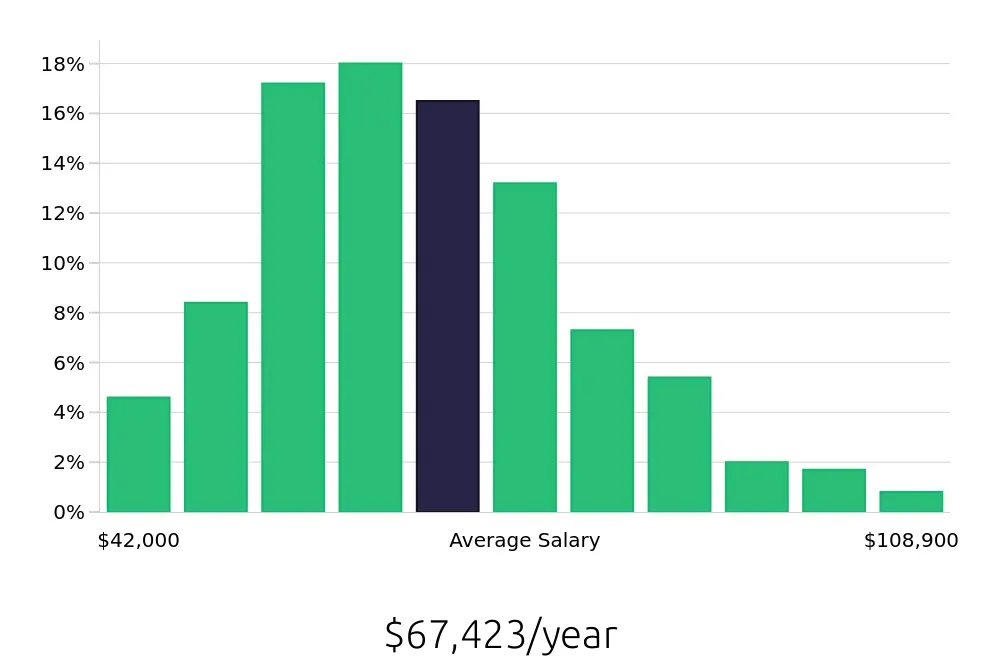

Staff Accountants enjoy a competitive average annual salary of $90,780 across the nation. This reflects the value placed on their skills and responsibilities. The hourly compensation stands at $43.65, providing financial stability for those in the role. These figures make Staff Accounting an attractive career choice for individuals seeking a balance between job security and remuneration.

Aside from the financial benefits, Staff Accountants benefit from diverse work environments and opportunities for career advancement. Companies across various sectors, including healthcare, retail, and manufacturing, require the expertise of Staff Accountants. This versatility allows professionals to explore different industries and potentially enhance their career trajectory.

Currently 2,117 Staff Accountant job openings, nationwide.

Continue to Salaries for Staff Accountant