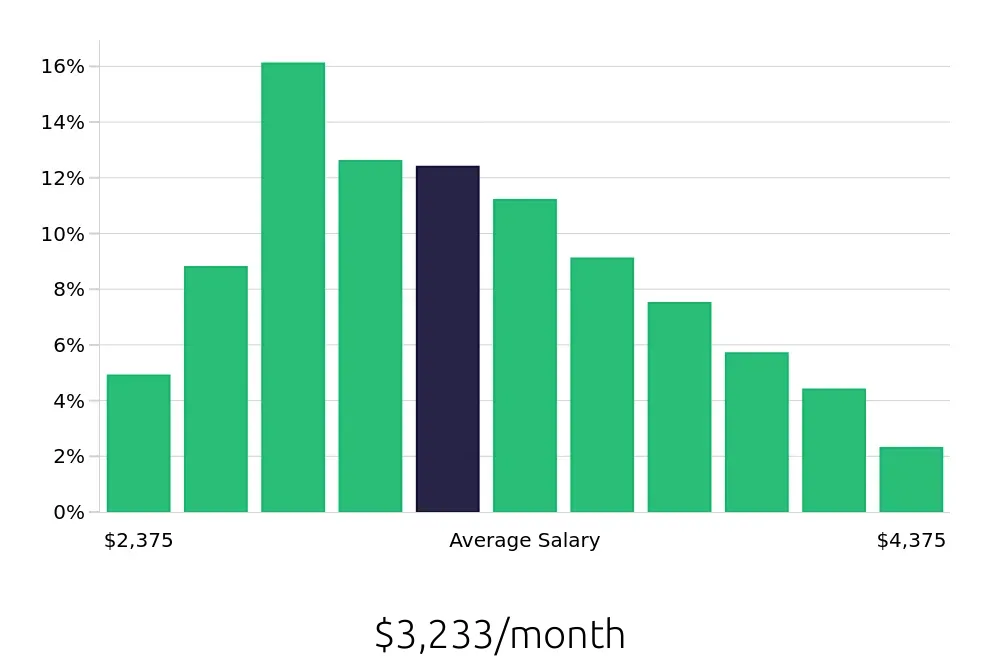

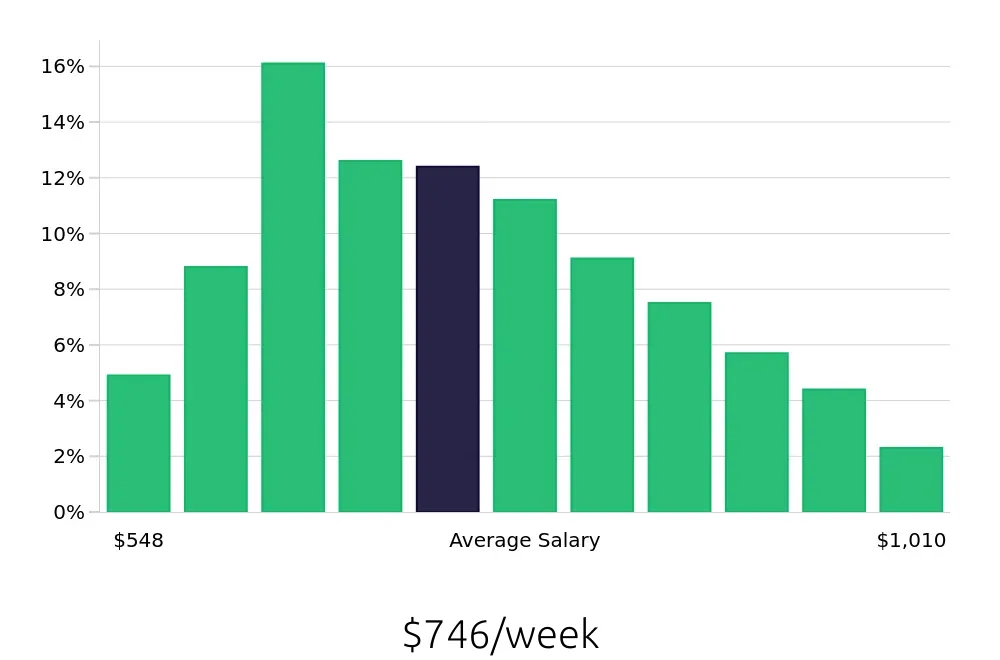

How much does a Teller make?

Tellers often start with a modest salary, but there is potential for growth. The average yearly salary for tellers stands at around $38,801. This range can vary based on location and experience. For those just beginning, salaries often start between $28,500 and $32,864. However, as tellers gain more experience, they can expect to see their salaries increase.

Several factors influence a teller's salary. These include the size of the bank, the city in which they work, and their specific duties. Larger banks in busy cities often pay more than smaller, local banks. Additionally, tellers who take on extra responsibilities, such as handling special accounts or training new staff, may see higher earnings. Job seekers should consider these factors when looking at salary data.

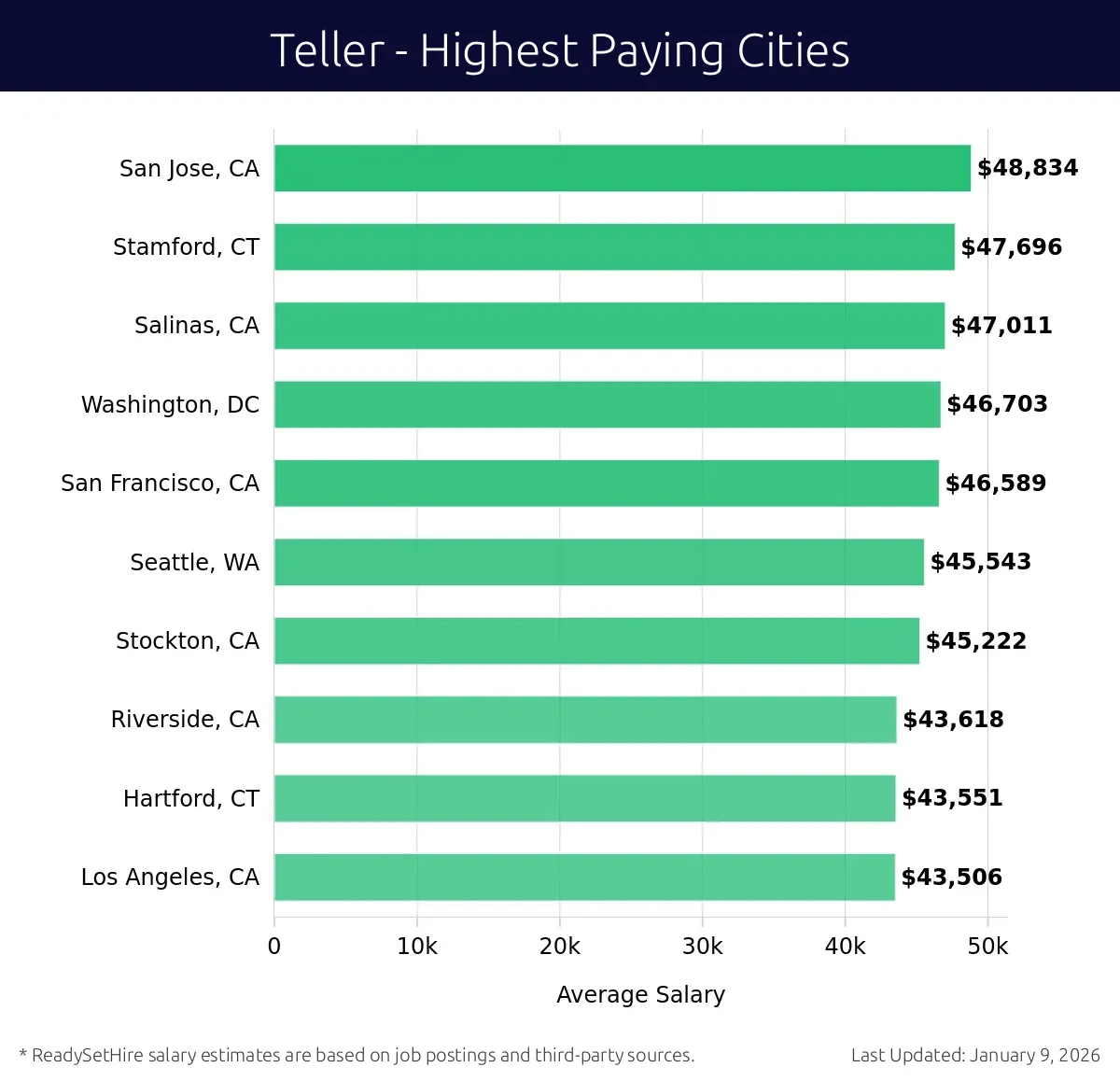

What are the highest paying cities for a Teller?

-

San Jose, CA

Average Salary: $48,834

In San Jose, financial service jobs thrive with tech influence. Banks like Bank of America and Wells Fargo offer ample opportunities. The tech boom adds to the dynamic work environment.

Find Teller jobs in San Jose, CA

-

Stamford, CT

Average Salary: $47,696

Stamford's banking sector is robust with major companies like Chase and Citibank. The city’s business-friendly environment makes it a great place for finance careers. Stamford offers a mix of stability and growth.

Find Teller jobs in Stamford, CT

-

Salinas, CA

Average Salary: $47,011

Salinas features a tight-knit community with banking roles at local credit unions and banks. The agricultural economy creates a unique setting for finance professionals. It’s a place where relationships matter.

Find Teller jobs in Salinas, CA

-

Washington, DC

Average Salary: $46,703

In Washington, DC, work as a financial service employee in prestigious banks like Capital One. The political hub provides a unique backdrop for career growth. The city's vibrant culture enriches the work experience.

Find Teller jobs in Washington, DC

-

San Francisco, CA

Average Salary: $46,589

San Francisco's banking industry is diverse, with major players like JPMorgan Chase. The tech-driven economy offers innovative opportunities. Working here means being part of a fast-paced, exciting environment.

Find Teller jobs in San Francisco, CA

-

Seattle, WA

Average Salary: $45,543

Seattle's financial scene includes major banks such as Wells Fargo. The tech industry's presence adds a modern touch to banking roles. The city’s progressive atmosphere fosters career advancement.

Find Teller jobs in Seattle, WA

-

Stockton, CA

Average Salary: $45,222

Stockton provides a supportive environment for finance careers with banks like Rabobank. The agriculture sector influences job opportunities. It’s a place where personal relationships can boost career growth.

Find Teller jobs in Stockton, CA

-

Riverside, CA

Average Salary: $43,618

Riverside's banking jobs are available at large institutions like Chase. The city’s growing economy creates a stable job market. A friendly environment makes it a great place for newcomers.

Find Teller jobs in Riverside, CA

-

Hartford, CT

Average Salary: $43,551

Hartford offers banking roles in companies like People's United Bank. The insurance industry's presence adds to job stability. It’s a city where dedication can lead to long-term career success.

Find Teller jobs in Hartford, CT

-

Los Angeles, CA

Average Salary: $43,506

In Los Angeles, banks like Bank of America and Wells Fargo offer diverse opportunities. The entertainment industry adds a unique flair to the work environment. It’s a city of endless possibilities for career growth.

Find Teller jobs in Los Angeles, CA

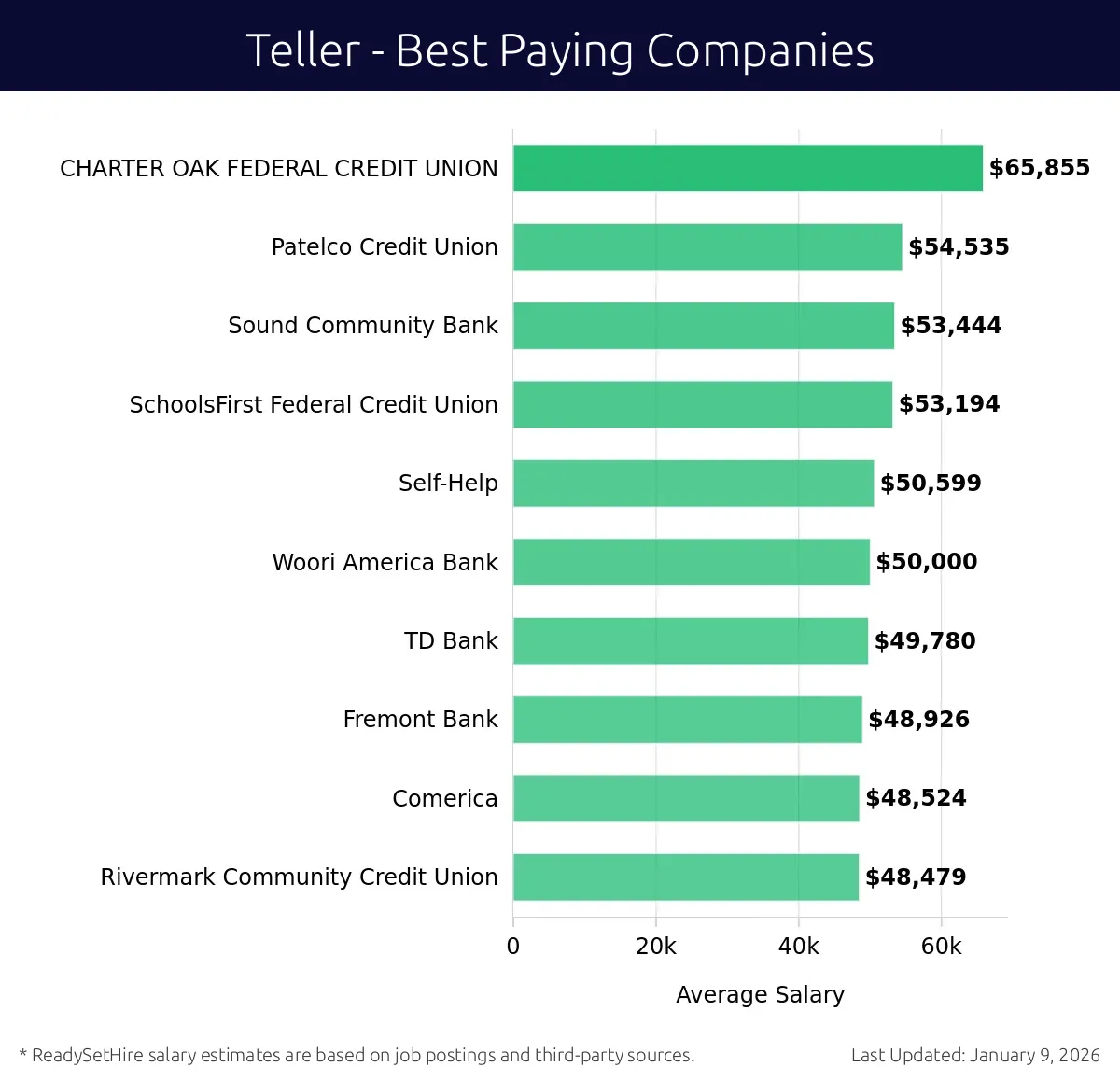

What are the best companies a Teller can work for?

-

CHARTER OAK FEDERAL CREDIT UNION

Average Salary: $65,855

Charter Oak Federal Credit Union offers competitive pay for Teller positions. Job duties involve handling transactions and customer service in Connecticut locations. Employees have opportunities to grow within the company.

-

Patelco Credit Union

Average Salary: $54,535

Patelco Credit Union pays well for Teller roles. These professionals work in California branches, providing excellent customer service. Patelco values its employees and offers a positive work environment.

-

Sound Community Bank

Average Salary: $53,444

Sound Community Bank offers a good salary for Tellers. Employees in Washington state branches assist customers with banking needs. The company values community involvement and offers benefits to support this.

-

SchoolsFirst Federal Credit Union

Average Salary: $53,194

SchoolsFirst Federal Credit Union provides a competitive wage for Teller positions. Tellers in California handle transactions and customer inquiries. The company focuses on member satisfaction and employee well-being.

-

Self-Help

Average Salary: $50,599

Self-Help offers a solid salary for Tellers. Employees work in North Carolina branches, ensuring smooth transaction processing. The company promotes a collaborative culture and professional growth.

-

Woori America Bank

Average Salary: $50,000

Woori America Bank provides a fair salary for Tellers. They work in New York branches, focusing on customer service and financial transactions. The bank values diversity and offers training opportunities.

-

TD Bank

Average Salary: $49,780

TD Bank pays well for Teller positions. Tellers in various locations assist customers with banking needs. The bank offers a supportive work environment and opportunities for career advancement.

-

Fremont Bank

Average Salary: $48,926

Fremont Bank offers a good salary for Tellers. They work in California branches, handling transactions and customer inquiries. The bank encourages teamwork and professional development.

-

Comerica

Average Salary: $48,524

Comerica provides a decent salary for Tellers. Employees work in branches across several states, ensuring smooth financial transactions. The company values employee satisfaction and offers a positive work culture.

-

Rivermark Community Credit Union

Average Salary: $48,479

Rivermark Community Credit Union offers a fair salary for Tellers. They work in Oregon branches, providing excellent customer service. The credit union focuses on community engagement and employee growth.

How to earn more as a Teller?

Working as a teller in a bank can offer a stable and rewarding career. Many tellers aim to earn more and find ways to advance their careers. This article explores effective strategies to increase earnings as a teller.

First, gaining more experience can lead to higher earnings. Banks often reward tellers who demonstrate a strong understanding of their roles with better pay. Tell your manager about your achievements and ask for additional responsibilities. This shows your dedication and can lead to a raise. Also, seek opportunities to learn about different banking services. This knowledge can make you more valuable to your employer.

Next, consider obtaining additional certifications. These can help you stand out and earn more. Certifications in areas like customer service, banking operations, and financial planning can make you more attractive to employers. Many banks offer training programs and pay for certifications. Check with your employer for available options. Completing these courses can lead to higher-paying positions.

- Gain Experience: Take on more tasks and responsibilities.

- Certifications: Get training and certifications in banking services.

- Customer Service Skills: Improve your ability to help customers.

- Technology Skills: Learn to use new banking software and tools.

- Additional Roles: Consider taking on extra duties, like loan processing or account management.