What does a Accounting Clerk do?

An Accounting Clerk plays a vital role in ensuring a company's financial records are accurate and up-to-date. This position involves managing financial transactions, preparing reports, and supporting the finance team. Daily tasks include processing payments, recording expenses, and reconciling bank statements. The Accounting Clerk ensures all financial data is correct and complete.

The Accounting Clerk also supports the preparation of financial statements and budgets. They help the finance team by organizing documents, maintaining records, and assisting with audits. Accuracy and attention to detail are key skills for this role. The Accounting Clerk ensures that financial operations run smoothly, helping the company maintain its financial health.

Key responsibilities may include:

- Recording financial transactions

- Preparing and processing payments

- Reconciling bank statements

- Supporting financial statement preparation

- Assisting with budgeting and audits

How to become a Accounting Clerk?

Becoming an Accounting Clerk involves a clear process that leads to a rewarding career in finance. It requires dedication and the right steps to gain necessary skills and qualifications. Follow these steps to embark on a successful career as an Accounting Clerk.

First, complete a high school diploma or equivalent. This is a foundational step that opens doors to further education and training. Next, consider taking courses in accounting, finance, or business. These courses provide essential knowledge and skills needed for the job. Gaining experience through internships or entry-level positions is also crucial. This hands-on experience helps build practical skills and knowledge.

- Complete high school education.

- Enroll in accounting or finance courses.

- Gain experience through internships or entry-level jobs.

- Obtain necessary certifications if required by employers.

- Network with professionals in the field to find job opportunities.

By following these steps, one can build a solid foundation for a career as an Accounting Clerk. Each step is designed to equip aspiring professionals with the skills and experience needed to succeed in this field.

How long does it take to become a Accounting Clerk?

The journey to becoming an Accounting Clerk varies based on several factors. Typically, many people enter this role with a high school diploma or equivalent, which takes about four years to complete. Some may find entry-level positions with only a few months of specialized training, while others choose to pursue a post-secondary certificate or associate degree. This can add an additional one to two years to the timeline. Those who take the time to advance their skills and knowledge may find more opportunities and better job prospects.

For those who wish to advance, gaining experience and possibly additional certifications can lead to roles with greater responsibilities. Many Accounting Clerks work towards becoming Bookkeepers or even advance to roles like Senior Accounting Clerk or Accounting Manager. Certifications such as Certified Accounting Clerk (CAC) or Certified Bookkeeper (CBK) can enhance qualifications and open more doors. A clear commitment to professional development often results in a quicker rise within the accounting field.

Accounting Clerk Job Description Sample

We are seeking a detail-oriented Accounting Clerk to join our finance team. The ideal candidate will be responsible for maintaining financial records, processing transactions, and assisting with various accounting tasks to support the smooth operation of our accounting department.

Responsibilities:

- Maintain accurate and complete financial records, including ledgers and journals.

- Process daily transactions, including accounts payable and receivable.

- Prepare and reconcile bank statements, ensuring all transactions are accurately recorded.

- Assist in the preparation of financial reports, budgets, and forecasts.

- Support the monthly, quarterly, and annual closing processes.

Qualifications

- Bachelor’s degree in Accounting, Finance, or related field.

- Previous experience as an Accounting Clerk or similar role.

- Proficiency in accounting software and Microsoft Office Suite.

- Strong attention to detail and accuracy in data entry and record-keeping.

- Understanding of Generally Accepted Accounting Principles (GAAP).

Is becoming a Accounting Clerk a good career path?

The role of an Accounting Clerk combines several important tasks in a business setting. These tasks range from managing financial records to ensuring accuracy in financial data. Many businesses rely on Accounting Clerks to maintain the financial health of the company. This career path offers a blend of office work and direct involvement in financial processes.

Working as an Accounting Clerk has many benefits. First, the role provides a solid foundation in accounting principles. It often includes training on various accounting software, which can be valuable skills for future jobs. Also, Accounting Clerks usually work in an office environment, which can mean more stability and fewer physical demands compared to some other jobs. However, there are also challenges to consider. The work can sometimes be repetitive and require long hours, especially during busy periods like tax season. Some Accounting Clerks may also find that career advancement can be slow without additional education or experience.

Here are some pros and cons of being an Accounting Clerk:

- Pros:

- Gain experience in accounting principles

- Learn to use various accounting software

- Typically work in a stable office environment

- Cons:

- Work can be repetitive

- Long hours may be needed during busy times

- Career advancement may require more education or experience

What is the job outlook for a Accounting Clerk?

Becoming an Accounting Clerk presents a solid career opportunity for job seekers. The field maintains a steady job market, with an average of 183,900 positions available each year, according to the Bureau of Labor Statistics (BLS). While there is a projected decline of 6.2% in job openings from 2022 to 2032, this slight decrease does not overshadow the overall stability of the role. Securing a job as an Accounting Clerk means entering a field that values accuracy and attention to detail.

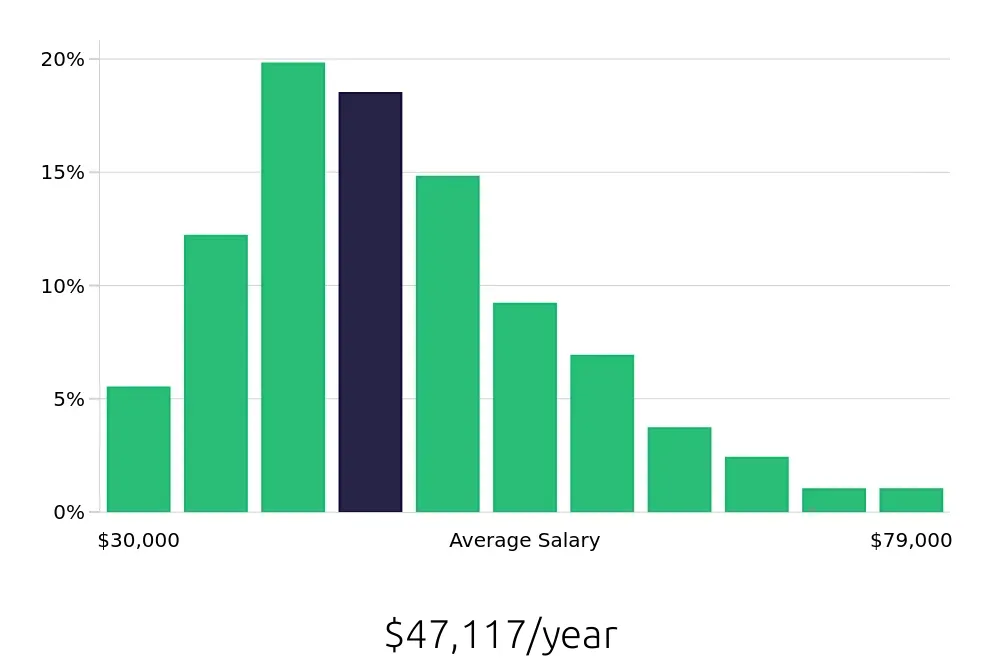

The financial rewards for Accounting Clerks are also worth noting. On average, these professionals earn an annual salary of $49,580, making it a respectable income level. Hourly, the compensation stands at $23.84, which provides a clear understanding of the financial benefits associated with the job. This stable pay, combined with the consistent job availability, offers job seekers a reliable career path.

For those who thrive in structured and detail-oriented environments, the Accounting Clerk role offers both job security and attractive financial rewards. Despite the projected decline in job openings, the consistent demand and competitive salary make this career path an excellent choice for job seekers seeking stability and growth. The field of accounting, with its essential role in business operations, continues to provide valuable opportunities for those entering or transitioning into this profession.

Currently 1,910 Accounting Clerk job openings, nationwide.

Continue to Salaries for Accounting Clerk