What does a Accounting Coordinator do?

An Accounting Coordinator plays a key role in managing a company's financial records. They work closely with the accounting team to ensure accuracy and efficiency. This position involves preparing financial statements, managing accounts payable and receivable, and assisting with budgeting and forecasting. The Accounting Coordinator also handles invoicing and ensures timely payments to vendors. They often use accounting software to track financial data and prepare reports.

In addition to these tasks, the Accounting Coordinator may also assist with audits and tax preparations. They ensure compliance with financial regulations and internal policies. This role requires strong attention to detail and excellent organizational skills. The Accounting Coordinator must be able to communicate effectively with other departments and stakeholders. They often work in a team environment, collaborating with accountants and financial analysts to support the company's financial goals.

How to become a Accounting Coordinator?

Becoming an Accounting Coordinator involves a series of steps that require dedication and the right skills. This role is crucial in managing financial records and ensuring accuracy. It is a rewarding career path for those interested in finance and accounting. Follow these steps to start your journey as an Accounting Coordinator.

First, gaining the right education is essential. Most employers look for candidates with at least an associate's degree in accounting or a related field. Some may prefer a bachelor's degree. This education provides the foundation for understanding financial principles and practices. Second, developing key skills is important. Skills such as attention to detail, proficiency in accounting software, and strong analytical abilities are crucial. These skills help in managing financial data effectively.

- Earn a relevant degree.

- Develop key skills.

- Gain experience through internships or entry-level positions.

- Obtain certifications if desired.

- Apply for Accounting Coordinator positions.

Third, gaining experience is vital. Internships or entry-level positions in accounting can provide practical experience. This experience helps in understanding how to apply theoretical knowledge in real-world scenarios. Fourth, obtaining certifications can enhance your resume. Certifications such as Certified Accounting Technician (CAT) or Certified Bookkeeper (CB) can make you more competitive. Finally, applying for Accounting Coordinator positions is the last step. Tailor your resume and cover letter to highlight your education, skills, and experience. Networking with professionals in the field can also open up job opportunities.

How long does it take to become a Accounting Coordinator?

The journey to becoming an Accounting Coordinator often begins with a solid educational foundation. Most employers look for candidates with at least an associate's degree in accounting, business, or a related field. This typically takes two years to complete. Some may choose to pursue a bachelor's degree, which adds another two years. This extra education can open more job opportunities and lead to higher positions.

After completing education, gaining practical experience is key. Many new graduates start with entry-level positions in accounting. This helps them learn the basics and gain valuable skills. Experience levels vary, but most find a solid footing in about one to two years. Some may take longer if they are balancing work with further studies or certifications. Certifications, such as the Certified Accounting Coordinator (CAC) or Certified Bookkeeper (CB), can enhance job prospects and career growth. These certifications usually require passing an exam and meeting certain experience criteria.

Accounting Coordinator Job Description Sample

The Accounting Coordinator is responsible for supporting the accounting department by managing financial transactions, maintaining accurate records, and assisting with the preparation of financial reports. This role requires strong attention to detail, excellent organizational skills, and the ability to work collaboratively within a team.

Responsibilities:

- Assist in the preparation of financial statements, budgets, and reports.

- Manage accounts payable and accounts receivable processes.

- Reconcile bank statements and ensure timely payment of vendor invoices.

- Maintain accurate and up-to-date financial records and documentation.

- Support the month-end and year-end closing processes.

Qualifications

- Bachelor’s degree in Accounting, Finance, or a related field.

- CPA or CMA certification is a plus.

- Minimum of 2-3 years of experience in accounting or a related role.

- Proficiency in accounting software (e.g., QuickBooks, SAP, Oracle).

- Strong knowledge of accounting principles and practices.

Is becoming a Accounting Coordinator a good career path?

An Accounting Coordinator plays a key role in managing financial records and ensuring accuracy in financial transactions. This role often involves working closely with accountants and financial managers. It requires strong attention to detail and proficiency in accounting software. The job can be found in various industries, including finance, manufacturing, and healthcare.

Working as an Accounting Coordinator offers several benefits. It can lead to a stable career with good job security. The role provides opportunities to learn about financial management and accounting practices. It also offers the chance to work in a team and contribute to the financial health of an organization. However, there are some challenges to consider. The job can be stressful, especially during busy periods like tax season. It may also require long hours and attention to detail, which can be demanding.

Here are some pros and cons to consider:

- Pros:

- Job stability

- Opportunities for learning

- Teamwork environment

- Contribution to financial health

- Cons:

- Potential stress during busy periods

- Long working hours

- Need for strong attention to detail

What is the job outlook for a Accounting Coordinator?

The job outlook for Accounting Coordinators is a key consideration for job seekers. According to the Bureau of Labor Statistics (BLS), there are about 183,900 job positions available each year. This role is essential in managing financial records and ensuring accuracy in financial reporting. While the BLS predicts a 6.2% decrease in job openings from 2022 to 2032, the demand for skilled Accounting Coordinators remains steady. This slight decline may be due to automation and changes in business practices, but it does not diminish the importance of this role.

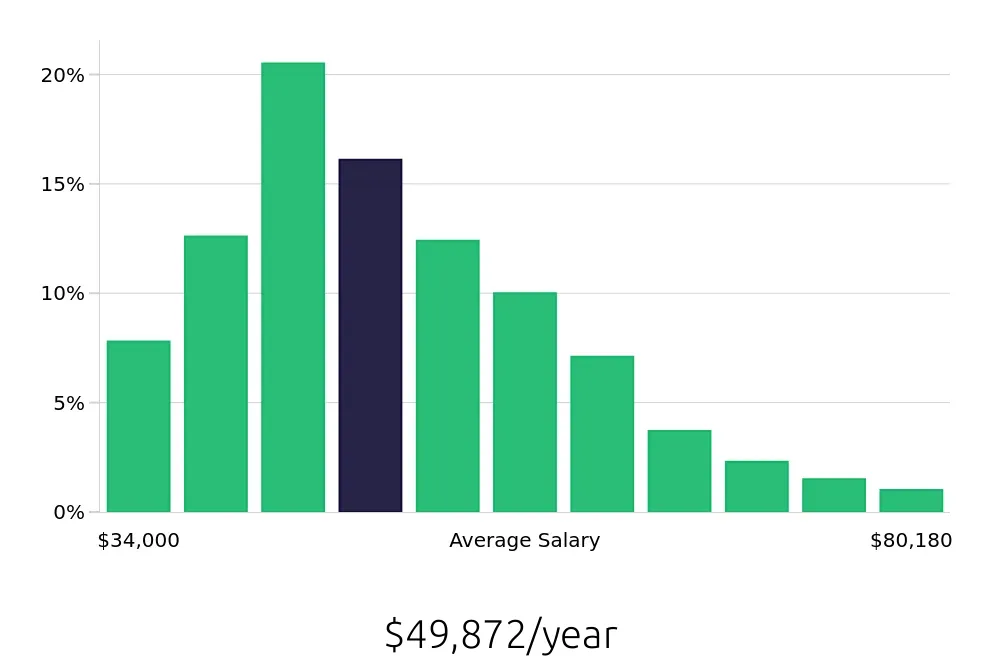

Accounting Coordinators earn a competitive salary, with an average national annual compensation of $49,580. This figure reflects the value placed on the skills and responsibilities of this position. The average national hourly compensation stands at $23.84, offering a clear picture of the financial rewards associated with this career. These figures are crucial for job seekers looking to understand the financial benefits of pursuing a career in accounting coordination. The compensation aligns with the critical nature of the work performed by these professionals.

Job seekers should note that while the number of job openings may decrease slightly, the role of Accounting Coordinators is still vital. This position requires strong attention to detail, proficiency in accounting software, and a solid understanding of financial principles. The skills needed for this role are transferable and can open doors to various career advancements. Therefore, despite the projected decrease in job openings, the career path for Accounting Coordinators remains a promising one for those with the right qualifications and dedication.

Currently 386 Accounting Coordinator job openings, nationwide.

Continue to Salaries for Accounting Coordinator