What does a Assessor do?

An Assessor works to determine the value of properties for various purposes, such as taxation. They inspect buildings, land, and other assets to gather data. Assessors use this data to calculate property values. This job requires attention to detail and strong analytical skills. Assessors also need good communication skills to explain their findings.

The role of an Assessor includes preparing detailed property descriptions, keeping accurate records, and meeting deadlines. They must stay up-to-date with real estate trends and local laws. Assessors often work in government offices, real estate firms, or appraisal companies. This position plays a key role in ensuring fair and accurate property assessments, which are vital for tax collection and property transactions.

How to become a Assessor?

Becoming an assessor requires a clear path and dedication. Follow these steps to start your career as an assessor. This profession offers great opportunities for those who seek to contribute to fair assessments and evaluations.

First, understand what an assessor does. An assessor evaluates properties, businesses, or other items for tax or other purposes. Knowing the job's details will help you prepare for the role. Research the industry to learn about the different types of assessments and the skills needed.

- Earn the necessary education. Most assessor roles require at least a bachelor’s degree in business, finance, or a related field. Some jobs may need a master's degree.

- Gain relevant experience. Look for internships or entry-level jobs in assessment, real estate, or finance. This experience will help you understand the field better.

- Obtain the required certifications. Some regions or employers may need specific certifications. Check local or state requirements for assessors.

- Network with professionals in the field. Attend industry events, join professional groups, and connect with others. Networking can provide job leads and insights into the industry.

- Apply for assessor positions. Look for job openings in government agencies, real estate firms, or financial institutions. Prepare a strong resume and cover letter.

By following these steps, you can set yourself up for a successful career as an assessor. Dedication and preparation will help you achieve your goal. Always stay informed about industry changes and continue learning to stay competitive.

How long does it take to become a Assessor?

The journey to becoming an assessor can vary. Factors like education, experience, and location play a role. Generally, it takes several years to gain the needed skills and qualifications. Most assessors hold a bachelor's degree in a related field.

First, an individual needs to complete a bachelor's program, usually taking four years. This education focuses on subjects like real estate, finance, or appraisal. After graduation, gaining experience is key. Many assessors work as apprentices or junior assessors. This hands-on experience can take 2-4 years. Some assessors also need to pass a licensing exam. This exam tests knowledge and skills in the field. Passing the exam allows an individual to become a licensed assessor. The total time to become a qualified assessor can range from six to eight years.

Assessor Job Description Sample

The Assessor is responsible for evaluating individuals, programs, or organizations against a set of standards to ensure compliance and effectiveness. This role involves conducting assessments, analyzing data, and providing recommendations for improvement.

Responsibilities:

- Conduct comprehensive assessments of individuals, programs, or organizations to evaluate compliance with standards and effectiveness.

- Analyze assessment data and prepare detailed reports with findings, conclusions, and recommendations.

- Collaborate with other professionals to develop and implement assessment strategies and tools.

- Review and update assessment criteria and standards as needed to reflect best practices and industry changes.

- Provide training and support to staff on assessment methodologies and tools.

Qualifications

- Bachelor's degree in a relevant field (e.g., Education, Business, Psychology, etc.). A Master's degree is preferred.

- Proven experience in conducting assessments and analyzing data to inform decision-making.

- Strong understanding of assessment methodologies and tools.

- Excellent analytical, problem-solving, and critical thinking skills.

- Effective communication skills, both written and verbal, with the ability to present complex information clearly.

Is becoming a Assessor a good career path?

An Assessor examines properties and businesses to figure out their value. This job is important for things like taxes and sales. People in this role travel to different places to check the value of properties. They need to be very detailed and good with numbers.

Working as an Assessor has many good points. It offers steady pay and often comes with benefits like health insurance. Assessors can find jobs in many areas, from local governments to big companies. This job gives you the chance to meet new people and see different places. But, there are also some challenges. Assessors may work long hours and deal with tight deadlines. The job can be stressful because of the need to be very accurate.

Here are some pros and cons of being an Assessor:

- Pros:

- Steady income

- Good benefits

- Variety of work locations

- Opportunities to travel

- Cons:

- Long working hours

- High stress levels

- Need for great attention to detail

- Occasional travel to less desirable areas

What is the job outlook for a Assessor?

The job market for Assessors shows promising opportunities for professionals in this field. The Bureau of Labor Statistics (BLS) indicates an average of 6,900 job positions available annually. This consistent demand suggests that the field remains stable and offers steady prospects for job seekers. With an expected job openings percent change of 4.6% from 2022 to 2032, career growth in this profession is anticipated to be moderate.

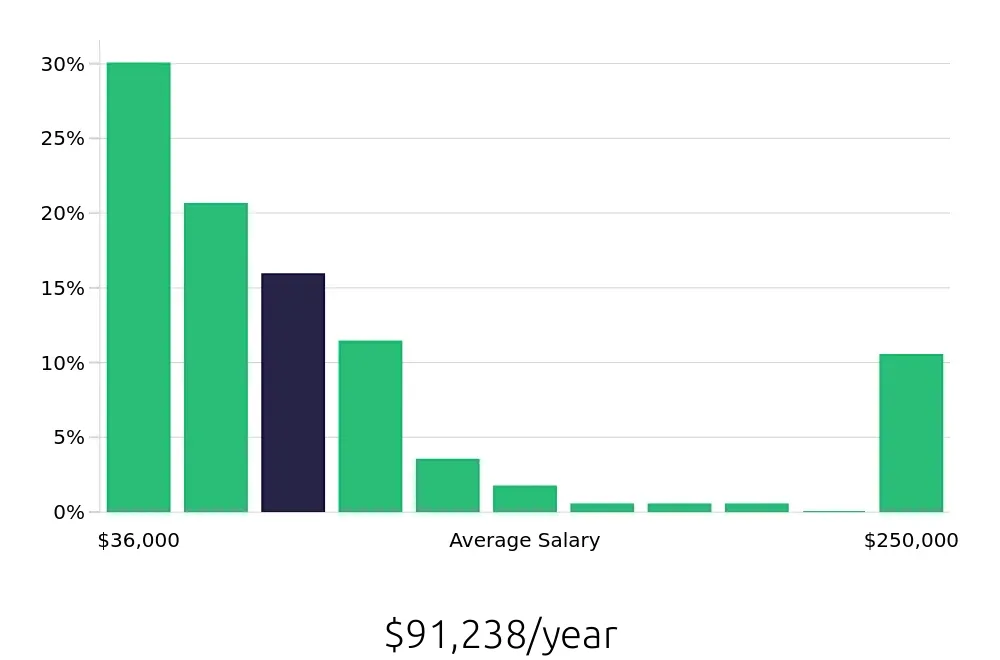

Assessors play a crucial role in evaluating properties, businesses, and other assets to determine their value. This role is essential in various sectors, including real estate, finance, and government. The national average annual compensation for Assessors stands at $76,110, with an hourly rate of $36.59, according to the BLS. These figures reflect the value placed on the expertise required for this role, making it an attractive career option for those in the market.

For job seekers, the outlook for Assessors includes not just a steady number of positions but also competitive compensation. The moderate job openings growth rate points to a field that is neither oversaturated nor in decline, allowing for a balanced job market. With the right qualifications and experience, professionals can expect to find fulfilling opportunities that align with their career aspirations.

Currently 158 Assessor job openings, nationwide.

Continue to Salaries for Assessor