What does a Asset Manager do?

An Asset Manager plays a crucial role in overseeing and handling a company's assets. This includes physical assets like buildings and machinery, as well as financial assets such as stocks and bonds. The Asset Manager ensures that the organization's assets are used effectively to achieve its goals. They keep detailed records of all assets, track their performance, and make recommendations for improvements or replacements.

Responsibilities of an Asset Manager often involve collaborating with different departments to understand their asset needs. They develop strategies to maximize the value of the organization's assets, ensuring they are maintained in good condition and used efficiently. Asset Managers also handle budgets and monitor spending to ensure cost-effective use of resources. Their work helps the organization to be financially prudent and operationally efficient. Effective Asset Management can lead to cost savings, improved productivity, and better overall performance for the organization.

How to become a Asset Manager?

Becoming an Asset Manager involves a clear path and specific steps. It requires a blend of education, experience, and networking. Following these steps can help anyone navigate this career journey. Start with understanding the role and its requirements. Then, build the necessary qualifications. Next, gain relevant experience. After that, develop key skills. Finally, network and seek job opportunities.

The first step is to research what an Asset Manager does. Asset Managers oversee investments for clients. They must understand financial markets, investments, and risk management. The next step is to get a degree in finance, economics, or a related field. A bachelor's degree is often the minimum requirement. Gaining experience through internships or entry-level positions in finance can be very helpful. Next, obtain relevant certifications, such as the Chartered Financial Analyst (CFA) designation. Develop skills like analytical thinking, communication, and problem-solving. Networking with professionals in the field can open doors to job opportunities. Look for roles in investment firms, banks, or financial services companies.

Follow these steps to build a successful career as an Asset Manager. Start with education and end with networking. This path requires dedication and effort, but it leads to a rewarding career.

- Research the role of an Asset Manager

- Get a degree in finance, economics, or a related field

- Gain experience through internships or entry-level positions

- Obtain relevant certifications like the CFA designation

- Develop key skills such as analytical thinking and communication

How long does it take to become a Asset Manager?

Pursuing a career as an Asset Manager involves a mix of education, experience, and certifications. Most Asset Managers hold at least a bachelor’s degree in finance, economics, or business. This education takes about four years to complete. Some may opt for a master’s degree, which adds another two years. During this time, gaining relevant experience through internships or entry-level jobs is key. This helps in understanding the field better.

After completing formal education, gaining practical experience is essential. This often starts with entry-level positions in finance or investment firms. Professionals may spend 2-5 years in these roles to understand asset management. Gaining certifications such as the Chartered Financial Analyst (CFA) can also enhance career prospects. This process typically takes around three years, including studying and passing exams. Asset Managers who focus on specific types of assets, like real estate or hedge funds, may need additional training or experience. This can add another year or two to the timeline. Balancing education, experience, and certifications sets a solid foundation for a successful career in asset management.

Asset Manager Job Description Sample

An Asset Manager is responsible for overseeing an organization's physical and financial assets to ensure they are utilized effectively to maximize their value and profitability. This role requires strategic planning, risk management, and strong analytical skills to make informed decisions about asset acquisition, maintenance, and disposal.

Responsibilities:

- Develop and implement asset management strategies to optimize the utilization and performance of assets.

- Conduct regular assessments of current assets to identify areas for improvement and potential for cost savings.

- Collaborate with cross-functional teams to ensure asset management practices align with overall business objectives.

- Monitor market trends and economic conditions to make informed decisions about asset acquisition and disposal.

- Prepare and present detailed reports on asset performance, financial status, and strategic recommendations to senior management.

Qualifications

- Bachelor’s degree in Finance, Business Administration, or a related field; Master’s degree preferred.

- Proven experience in asset management or a similar role within a corporate or financial services environment.

- Strong understanding of asset valuation, financial analysis, and investment strategies.

- Proficiency in using asset management software and tools.

- Excellent analytical, problem-solving, and decision-making skills.

Is becoming a Asset Manager a good career path?

Asset management offers an exciting career path for those passionate about finance and investment. Asset managers work with clients to manage and grow their investments. They analyze market trends, make investment decisions, and monitor performance. This role requires strong analytical skills and a deep understanding of financial markets. Asset managers often work in financial firms, banks, or investment companies.

Working as an asset manager has its own set of advantages and challenges. Here are some pros and cons to consider.

- Pros:

- High earning potential: Asset managers can earn substantial salaries, especially in large firms.

- Career growth: This field offers opportunities for advancement and specialization.

- Variety of clients: Asset managers may work with individuals, corporations, or institutional clients.

- Cons:

- High stress: The job can be stressful, especially during market volatility.

- Long hours: Asset managers often work long hours, especially during market openings and closings.

- Continuous learning: The field requires ongoing education to keep up with market trends and regulations.

What is the job outlook for a Asset Manager?

The job outlook for Asset Managers is promising for job seekers looking to enter the finance industry. According to the Bureau of Labor Statistics (BLS), the field sees an average of 69,600 job positions opened each year. This trend offers ample opportunities for those seeking a career in asset management. With a 16% expected growth in job openings from 2022 to 2032, individuals can anticipate a stable and growing market for their skills.

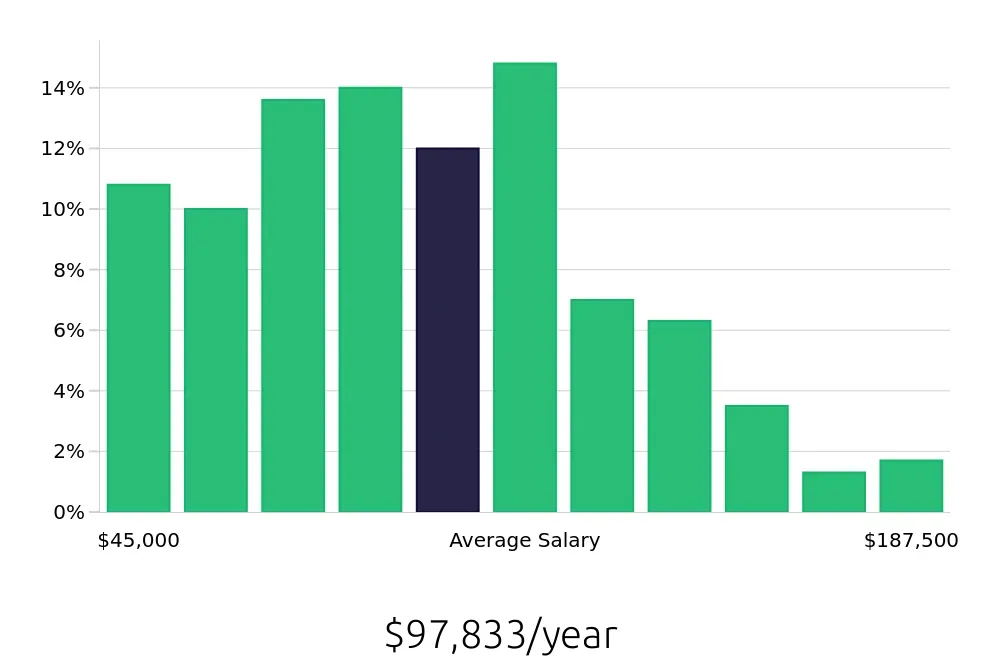

Asset Managers play a crucial role in managing investment portfolios and financial assets for clients. This responsibility makes them highly valuable in the finance sector. The average national annual compensation for Asset Managers stands at $174,820, indicating a lucrative career path for those willing to pursue it. Additionally, the average national hourly compensation is $84.05, reflecting the high demand for skilled professionals in this field.

For job seekers, this data suggests that a career in asset management is not only stable but also financially rewarding. The combination of consistent job openings and attractive compensation makes this a compelling career choice. With the right qualifications and experience, Asset Managers can expect to find rewarding and well-paying positions within the industry.

Currently 108 Asset Manager job openings, nationwide.

Continue to Salaries for Asset Manager