What does a Assets Specialist do?

An Assets Specialist oversees the management and maintenance of a company's physical and financial assets. This role involves tracking inventory, ensuring assets are correctly recorded, and verifying their locations. The specialist also monitors asset usage and conditions to prevent loss or theft. They work closely with various departments to ensure assets are utilized efficiently and effectively. This role requires attention to detail and strong organizational skills.

Assets Specialists often prepare reports and documentation related to asset management. They collaborate with the finance team to reconcile asset records with financial statements. They may also handle the procurement and disposal of assets. This position demands a good understanding of accounting principles and inventory management systems. Assets Specialists play a crucial role in maintaining the integrity and value of a company's assets, ensuring they are used to their fullest potential.

How to become a Assets Specialist?

Becoming an Assets Specialist involves a structured path that combines education, experience, and specialized training. This career allows professionals to manage and oversee company assets effectively. Following the right steps ensures a successful transition into this role.

The journey to becoming an Assets Specialist includes several key steps. First, gaining a foundational education in business or a related field sets the stage. Next, acquiring practical experience through internships or entry-level positions provides hands-on learning. Then, obtaining relevant certifications can enhance job prospects. Networking with industry professionals and staying updated with industry trends are crucial next steps. Finally, continuing education and professional development ensures ongoing success in the field.

Here are the steps to become an Assets Specialist:

- Earn a relevant degree: Start with a bachelor's degree in business, finance, or a related field.

- Gain experience: Seek internships or entry-level positions in asset management or related areas.

- Obtain certifications: Consider certifications such as the Certified Asset Manager (CAM) credential.

- Network: Connect with industry professionals through events, seminars, and online platforms.

- Continue learning: Pursue ongoing education and professional development opportunities.

How long does it take to become a Assets Specialist?

The path to becoming an Asset Specialist can vary. Many individuals enter this field with a mix of education and experience. Typically, this means having a bachelor's degree in a relevant field such as finance, business, or real estate. Some employers prefer candidates who hold a master's degree in a related discipline. After earning a degree, most people gain experience through internships or entry-level positions. This practical experience helps build the necessary skills for the job.

The timeline for gaining expertise depends on several factors. Those who work steadily in the field often reach a proficient level in two to four years. This includes understanding financial regulations, asset valuation, and investment strategies. Experienced Asset Specialists may find opportunities for advancement within this time frame. A few may choose further education or certifications to enhance their skills. This can take an additional year or two. Networking and gaining industry experience also play a key role in career progression.

Assets Specialist Job Description Sample

The Assets Specialist plays a crucial role in managing the company's assets, ensuring their proper maintenance, utilization, and documentation. This position is responsible for overseeing asset inventories, tracking asset lifecycle, and ensuring compliance with company policies and regulatory requirements.

Responsibilities:

- Manage asset inventories and ensure accuracy and completeness of asset records.

- Conduct regular physical audits of assets to ensure they are accounted for and properly utilized.

- Maintain and update asset databases, including asset tags, serial numbers, and location.

- Oversee the acquisition, installation, and maintenance of assets, ensuring they meet company standards and requirements.

- Collaborate with various departments to ensure assets are deployed efficiently and effectively.

Qualifications

- Bachelor’s degree in Business Administration, Finance, or a related field.

- Minimum of 3 years of experience in asset management, facilities management, or a related field.

- Strong knowledge of asset management systems and software.

- Excellent organizational and analytical skills.

- Attention to detail and accuracy in record-keeping.

Is becoming a Assets Specialist a good career path?

An Assets Specialist plays a crucial role in managing and overseeing an organization's valuable resources. This professional ensures that assets are acquired, maintained, and disposed of efficiently. They work across various sectors, including real estate, equipment, and intellectual property.

The role involves detailed tracking, reporting, and strategic planning to maximize the use and value of assets. Specialists often collaborate with finance, operations, and IT departments to align asset management with broader organizational goals. Their work helps in reducing costs, improving efficiency, and ensuring compliance with regulations.

Choosing this career path offers several benefits:

- Stability: Many organizations value their assets, ensuring steady job opportunities.

- Diverse Experience: This role provides experience in various areas, from real estate to IT.

- Strategic Importance: Assets Specialists contribute directly to an organization’s bottom line and strategic goals.

- Growth Potential: Opportunities for advancement to higher roles, such as Asset Manager or Director of Asset Management.

However, there are also some challenges to consider:

- Regulatory Compliance: Keeping up with laws and regulations can be demanding.

- Technical Skills: Requires proficiency in specialized software and systems.

- Detail-Oriented: The job demands a high level of attention to detail and accuracy.

- Pressure: Often involves managing critical assets, which can lead to high-pressure situations.

What is the job outlook for a Assets Specialist?

Becoming an Assets Specialist offers promising career prospects for job seekers. The Bureau of Labor Statistics (BLS) reports an average of 101,300 job positions available each year for this role. This steady demand indicates a reliable job market. With approximately 101,300 positions opening annually, job seekers can find plenty of opportunities to enter this field.

The outlook for Assets Specialists is positive, with a projected job openings percent change of 2.8% from 2022 to 2032, according to the BLS. This growth suggests a stable and expanding job market. As businesses continue to need professionals who can manage and oversee their assets, the demand for skilled Assets Specialists will likely remain strong. Job seekers will have ample chances to secure roles in this growing field.

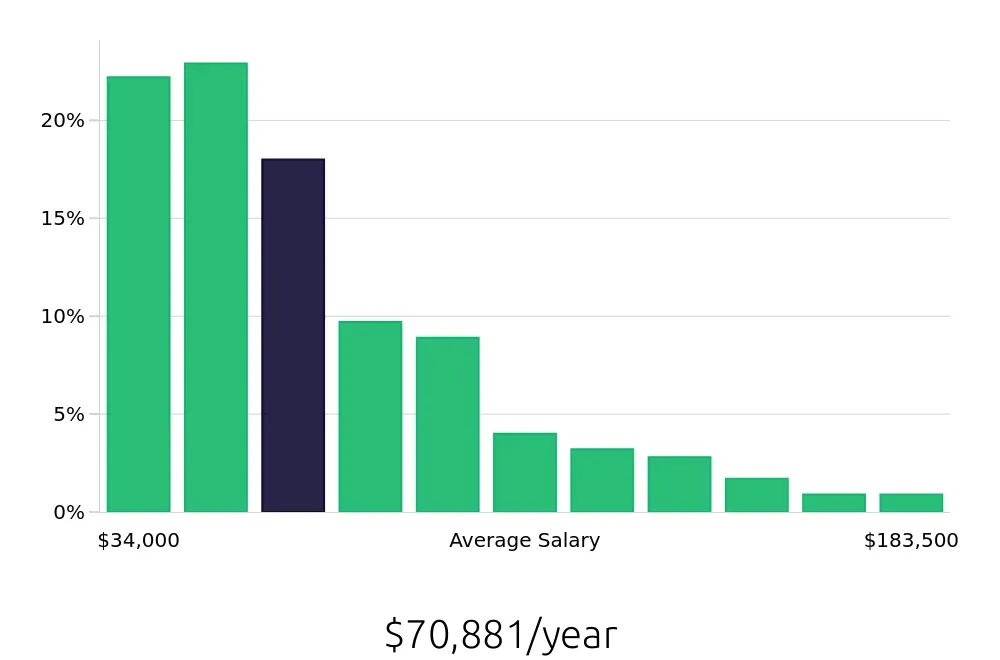

Assets Specialists can expect a competitive average national annual compensation of $39,270, as reported by the BLS. This salary provides a good income for those who enter the field. Along with the annual compensation, the average national hourly compensation is $18.88, offering fair pay for the expertise and responsibilities involved. These figures make the role of an Assets Specialist an attractive option for many job seekers.

Currently 47 Assets Specialist job openings, nationwide.

Continue to Salaries for Assets Specialist