What does a Broker do?

A Broker acts as a liaison between buyers and sellers, facilitating transactions in various markets. This role involves understanding market trends and client needs to match the right buyers with the right sellers. The Broker must analyze market data, assess client requirements, and present suitable options. This position requires strong communication skills to negotiate deals and ensure satisfaction on both sides of the transaction.

In addition to negotiation, a Broker must handle paperwork and ensure that all legal and regulatory requirements are met. This includes preparing contracts, managing documentation, and ensuring compliance with industry standards. The Broker also provides advice and guidance to clients, helping them make informed decisions. The role demands a combination of market knowledge, customer service skills, and attention to detail. A successful Broker builds strong relationships with clients and maintains a reputation for reliability and integrity.

How to become a Broker?

Becoming a broker can be a rewarding career choice. It involves helping people buy, sell, or trade different kinds of assets. This role requires certain qualifications and steps. Here, we outline a clear path to becoming a successful broker.

The journey to becoming a broker starts with education. Gaining knowledge in finance, economics, and business helps. Many brokers also have a background in law or real estate. A bachelor's degree is often the first step. Look for programs that offer courses in finance, business, and economics.

- Get the right education: Obtain a bachelor’s degree in finance, business, or a related field.

- Gain experience: Work in the finance or real estate sector to build skills and knowledge.

- Pass the required exams: Different brokerages require different exams. Make sure to study and pass these exams.

- Apply for a license: Submit an application to the state regulatory body to become licensed.

- Join a brokerage firm: Find a firm that fits your career goals and start working as a broker.

To ensure success, brokers must continue learning. The financial industry is always changing. Staying updated with new laws and trends is crucial. Networking with other professionals also helps in growing your career. By following these steps, anyone can become a successful broker.

How long does it take to become a Broker?

Starting a career as a broker involves several steps, each with its own timeline. The path generally includes education, licensing, and gaining experience. Most people find that the journey takes several years to complete. Education often takes about four years if you pursue a bachelor’s degree in a related field like finance, business, or economics.

Licensing is another crucial step. This often requires passing an exam specific to the type of brokerage work you want to do. The time to prepare for and pass this exam can vary, but it usually takes several months. Gaining practical experience by working under a licensed broker can take additional time, often up to two years. This hands-on experience is important for building a client base and understanding the market.

In summary, the total time to become a broker can range from three to seven years. This includes education, licensing, and gaining necessary experience. Each step is important to ensure you are well-prepared and compliant with industry regulations.

Broker Job Description Sample

The Broker is responsible for providing expert advice and guidance on financial products, managing client relationships, and ensuring compliance with regulatory standards. They act as a liaison between clients and financial institutions to facilitate transactions.

Responsibilities:

- Act as a liaison between clients and financial institutions to facilitate transactions.

- Provide expert advice and guidance on financial products and services.

- Develop and maintain strong relationships with clients to ensure satisfaction and retention.

- Stay updated on market trends and regulatory changes to provide informed recommendations.

- Prepare and submit detailed reports on transactions and client interactions.

Qualifications

- Bachelor’s degree in Finance, Business, or a related field.

- Minimum of 3-5 years of experience in a brokerage or financial advisory role.

- Relevant certifications such as CFA, CFP, or CPA are highly preferred.

- Strong knowledge of financial products, services, and market trends.

- Excellent communication and interpersonal skills.

Is becoming a Broker a good career path?

The career path of a broker offers dynamic opportunities in various markets. Brokers connect buyers and sellers, earning commissions on transactions. This role demands strong communication skills and a deep understanding of the market. Brokers work in different sectors, from real estate to financial markets. Their work often involves negotiating deals and advising clients. This career can be exciting and rewarding, but it also comes with its challenges.

A broker can enjoy numerous benefits. They often have the chance to work independently. This allows for flexibility in scheduling. Brokers can earn significant income through commissions. Success in this role often depends on personal effort and networking skills. However, the job can also be demanding. Brokers must stay updated on market trends. They often face high-pressure situations, needing to close deals quickly. Balancing these aspects can be tough. Despite the challenges, many find the career fulfilling.

When considering a career as a broker, it is important to weigh the pros and cons.

- Pros:

- Opportunities for independence

- Potential for high earnings

- Variety of markets to work in

- Skill development in negotiation and communication

- Cons:

- High competition and pressure

- Need for continuous market knowledge

- Long hours and demanding schedules

- Income can be variable and uncertain

What is the job outlook for a Broker?

The job outlook for Brokers remains positive, with an average of 51,600 job positions expected per year according to the Bureau of Labor Statistics (BLS). This means a steady stream of opportunities for those entering the field. The BLS also predicts a 3.3% increase in job openings from 2022 to 2032, showing a growing demand for skilled professionals in this sector.

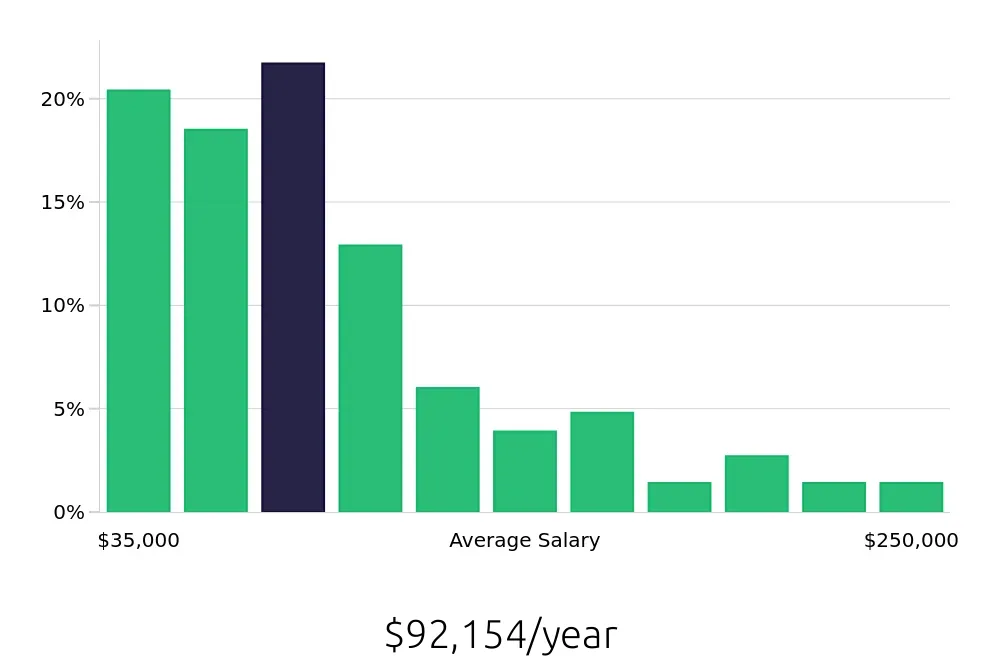

Prospective job seekers can look forward to an average national annual compensation of $73,010. This figure highlights the potential for a rewarding career in brokerage. Additionally, the average hourly compensation stands at $35.1, offering another angle to consider the financial benefits of this profession. These figures suggest a promising future for those who pursue a career as a Broker.

Apart from the financial incentives, the field of brokerage offers various benefits such as the ability to work with diverse clients and the potential for career growth. The demand for brokers in sectors like real estate, insurance, and securities suggests a dynamic work environment. Job seekers aiming for a stable and potentially lucrative career will find the outlook for Brokers quite encouraging.

Currently 74 Broker job openings, nationwide.

Continue to Salaries for Broker