What does a Commercial Credit Analyst do?

A Commercial Credit Analyst evaluates the creditworthiness of businesses seeking commercial loans or credit. This role involves analyzing financial statements, assessing business credit histories, and predicting the likelihood of repayment. The analyst often works closely with the lending department to make informed decisions on loan approvals. They prepare detailed reports and recommend credit limits based on the risk assessment.

Responsibilities of a Commercial Credit Analyst include reviewing financial data, conducting market research, and understanding industry trends. They must have strong analytical skills to interpret complex financial information. Communication is key, as they need to clearly present their findings to internal teams and sometimes to clients. Attention to detail and the ability to make sound financial judgments are essential in this role. A Commercial Credit Analyst helps businesses secure the credit they need while managing the risk for the financial institution.

How to become a Commercial Credit Analyst?

Becoming a Commercial Credit Analyst involves several key steps. It's a rewarding career that blends financial analysis with risk management. Following these steps will help someone get on the right path to success.

First, gaining the right education is important. A bachelor's degree in finance, business, or a related field provides a strong foundation. This education covers essential topics such as accounting, economics, and financial analysis.

- Get a Degree: Start with a bachelor's degree in finance, business, or a related field.

- Gain Experience: Work in roles that offer finance, accounting, or credit experience. Internships and entry-level jobs are a good start.

- Obtain Certification: Consider certifications like the Certified Credit Executive (CCE) or similar credentials. These add value to the resume and show commitment to the field.

- Develop Analytical Skills: Focus on honing skills in data analysis, financial modeling, and risk assessment. These skills are crucial for evaluating creditworthiness.

- Network and Apply: Use professional networks and job boards to find openings. Tailor the resume to highlight relevant experience and skills.

With dedication and the right steps, anyone can become a Commercial Credit Analyst. This career offers stability and the chance to make impactful financial decisions.

How long does it take to become a Commercial Credit Analyst?

To work as a Commercial Credit Analyst, one must understand business credit. This role involves assessing companies' credit risks. It takes time to learn these skills. Most analysts start with a bachelor's degree in finance, economics, or a related field. This education usually lasts four years.

After college, gaining experience becomes crucial. Many analysts start in entry-level positions. They learn about credit analysis and risk assessment. This hands-on experience can take two to four years. Some may pursue certifications, like the Certified Credit Expert (CCE) from the National Association of Credit Management (NACM). This adds value to their resume and skills. With dedication and experience, a professional can become a Commercial Credit Analyst in five to six years.

Commercial Credit Analyst Job Description Sample

As a Commercial Credit Analyst, you will be responsible for assessing the creditworthiness of commercial entities, providing financial analysis and recommendations to ensure minimal credit risk exposure.

Responsibilities:

- Evaluate the creditworthiness of commercial entities by analyzing financial statements, credit reports, and other relevant data.

- Conduct in-depth financial analysis to assess the ability of clients to meet their financial obligations.

- Prepare detailed credit reports and recommendations based on financial assessments.

- Monitor and review ongoing credit exposures to ensure compliance with credit policies and guidelines.

- Collaborate with internal teams such as sales, collections, and loan officers to provide credit-related information and support.

Qualifications

- Bachelor's degree in Finance, Business Administration, Accounting, or a related field.

- Minimum of 2-3 years of experience in commercial credit analysis or a related role.

- Strong understanding of financial statements, credit scoring models, and credit risk assessment.

- Excellent analytical and critical thinking skills.

- Ability to interpret and evaluate complex financial data.

Is becoming a Commercial Credit Analyst a good career path?

A Commercial Credit Analyst plays a crucial role in the financial health of businesses. This professional assesses the creditworthiness of companies seeking loans or lines of credit. They analyze financial data, market trends, and industry risks. Their goal is to help companies secure the credit they need to grow. This role requires a strong understanding of finance and a keen eye for detail.

This career offers several advantages. Analysts can enjoy job stability in the financial sector. The role often provides a clear career progression path, including opportunities for advancement to senior analyst positions or management roles. Working in this field can be intellectually stimulating, as it involves solving complex financial puzzles. However, it can also be stressful, with high stakes decisions that can impact businesses’ financial health. The job demands strong analytical skills and attention to detail.

Consider these pros and cons before pursuing a career as a Commercial Credit Analyst:

- Pros:

- Stable job opportunities

- Clear career progression

- Intellectually stimulating work

- Competitive salary

- Cons:

- High stress levels

- Long hours, especially during financial reviews

- Need for continuous learning to keep up with financial regulations

- Limited travel opportunities compared to some other finance roles

What is the job outlook for a Commercial Credit Analyst?

A Commercial Credit Analyst plays a key role in assessing the creditworthiness of businesses. This role examines financial statements, market conditions, and industry trends. It is essential for making informed lending and investment decisions.

The job outlook for Commercial Credit Analysts is stable. The Bureau of Labor Statistics (BLS) reports about 1,200 positions opening each year. However, the demand is expected to decrease by 5.8% from 2022 to 2032. Despite this decline, the need for professionals who can analyze and manage credit risks remains crucial.

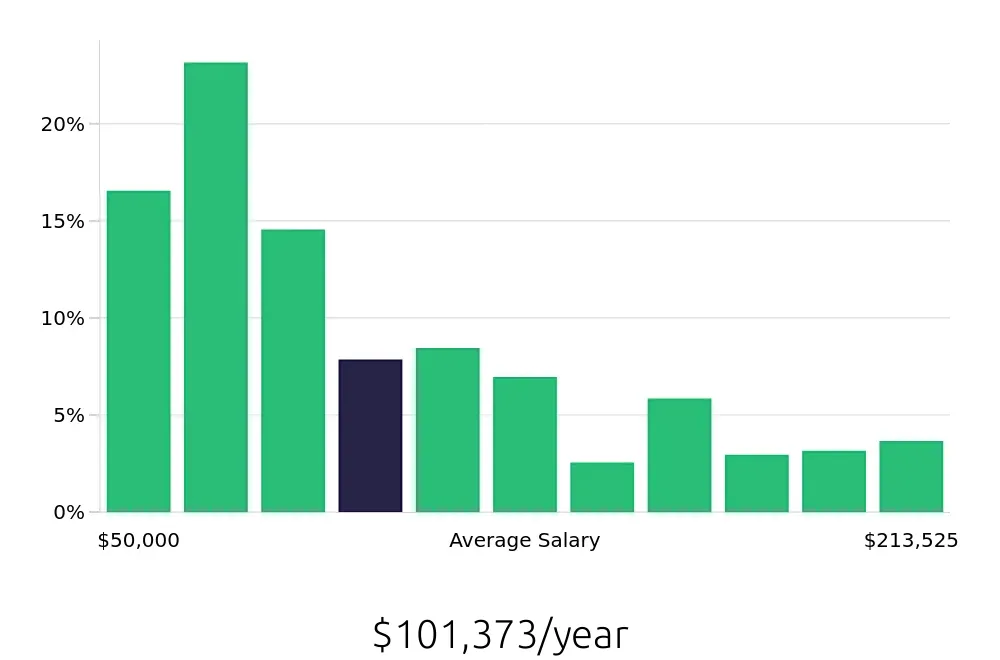

Commercial Credit Analysts earn a good salary. The BLS states that the average annual compensation is $50,380. On an hourly basis, analysts earn around $24.22. These figures highlight the value placed on this role within the financial sector. As businesses continue to grow and need credit assessments, skilled analysts will find opportunities.

Currently 102 Commercial Credit Analyst job openings, nationwide.

Continue to Salaries for Commercial Credit Analyst