What does a Commercial Insurance Inspector do?

A Commercial Insurance Inspector examines businesses to assess their insurance needs. They visit commercial properties to review the premises and identify potential risks. This role involves meeting with business owners to understand their operations and needs. Inspectors then prepare detailed reports that insurance companies use to determine coverage and premiums. This position requires strong analytical skills and attention to detail.

Inspectors must stay updated on insurance laws and industry standards. They often work independently but also collaborate with claims adjusters and underwriters. The goal is to help businesses get the right insurance policies. Inspectors must communicate clearly and professionally with clients. They play a crucial role in protecting businesses from financial risks. Attention to safety and compliance is key in this job. Inspectors ensure that businesses follow regulations and maintain safe environments.

How to become a Commercial Insurance Inspector?

To become a Commercial Insurance Inspector, follow a clear path that combines education, experience, and certification. This role involves inspecting businesses and properties to assess insurance risks. By understanding the necessary steps, professionals can effectively enter this rewarding field.

Here are the essential steps to becoming a Commercial Insurance Inspector:

- Obtain a high school diploma or GED. This is the first step to entering any career field.

- Gain relevant experience. Work in a related field such as real estate, property management, or insurance. This helps build a solid foundation of knowledge.

- Pursue additional education. Consider enrolling in a vocational school or community college to study insurance. These programs can provide valuable insights and skills.

- Get certified. Look for certifications from professional organizations. The American Institute for Chartered Property Casualty Underwriters (AICPCU) offers the CPCU designation, which is highly regarded in the industry.

- Network and apply for jobs. Connect with industry professionals through events, online forums, and social media. Apply to positions that match your skills and experience.

How long does it take to become a Commercial Insurance Inspector?

Interest in becoming a commercial insurance inspector continues to grow as more companies seek professionals who can accurately assess risks and ensure policies meet industry standards. The journey to this career can vary, but understanding the timeline can help set clear expectations.

Generally, individuals first need a high school diploma or GED. Some start by gaining experience in related fields such as construction, real estate, or customer service. Pursuing a bachelor's degree in business administration, criminal justice, or a similar field can provide a strong foundation. Typically, this academic step takes four years. After completing education, gaining practical experience through internships or entry-level positions is crucial. Many find roles as loss prevention specialists or claims adjusters helpful in this regard. This phase may last two to five years. Additional certifications, such as those offered by the American Institute for Chartered Property Casualty Underwriters (AIPCPO), can enhance job prospects and career advancement. These certifications may take several months to a year to obtain. In total, it often takes between five to nine years to become fully qualified as a commercial insurance inspector.

Commercial Insurance Inspector Job Description Sample

A Commercial Insurance Inspector plays a critical role in assessing and evaluating commercial property for insurance purposes. They conduct site inspections, review policy applications, and analyze risk factors to determine coverage and premium rates.

Responsibilities:

- Conduct site inspections of commercial properties to assess risk factors and potential liabilities.

- Review and evaluate insurance policy applications for accuracy and completeness.

- Collect and analyze data to determine coverage needs and premium rates.

- Collaborate with underwriters to provide risk assessments and recommendations.

- Prepare detailed inspection reports and documentation.

Qualifications

- Bachelor’s degree in Business, Insurance, Risk Management, or a related field.

- Professional insurance certifications (e.g., CIC, AIC) are preferred.

- Minimum of 3 years of experience in commercial insurance inspection or a related role.

- Strong understanding of commercial property types and insurance policies.

- Excellent analytical, problem-solving, and critical-thinking skills.

Is becoming a Commercial Insurance Inspector a good career path?

A Commercial Insurance Inspector works for an insurance company. They visit businesses to assess their risk for insurance claims. They look at buildings, equipment, and safety measures. Their job helps determine how much an insurance policy will cost. This role requires good attention to detail and the ability to write clear reports.

Working as a Commercial Insurance Inspector has several benefits. Inspectors often enjoy a stable job with good pay. The job can lead to other opportunities, like management roles. Inspectors also have the chance to travel and meet different types of businesses. However, the job also has some challenges. Inspectors spend much time on the road, which can be tiring. They must also handle stressful situations when investigating accidents or claims.

Here are some pros and cons to consider:

- Pros:

- Stable job with good pay

- Opportunities for career advancement

- Travel to various locations

- Meeting different types of businesses

- Cons:

- Long hours on the road

- Potential stress from investigating claims

- Need for good attention to detail

What is the job outlook for a Commercial Insurance Inspector?

Commercial insurance inspectors enjoy a stable and promising job outlook. The Bureau of Labor Statistics (BLS) projects about 21,500 job openings annually. Despite a slight decrease of -3.1% in job openings from 2022 to 2032, the role remains vital. Professionals in this field benefit from consistent demand and a reliable career path.

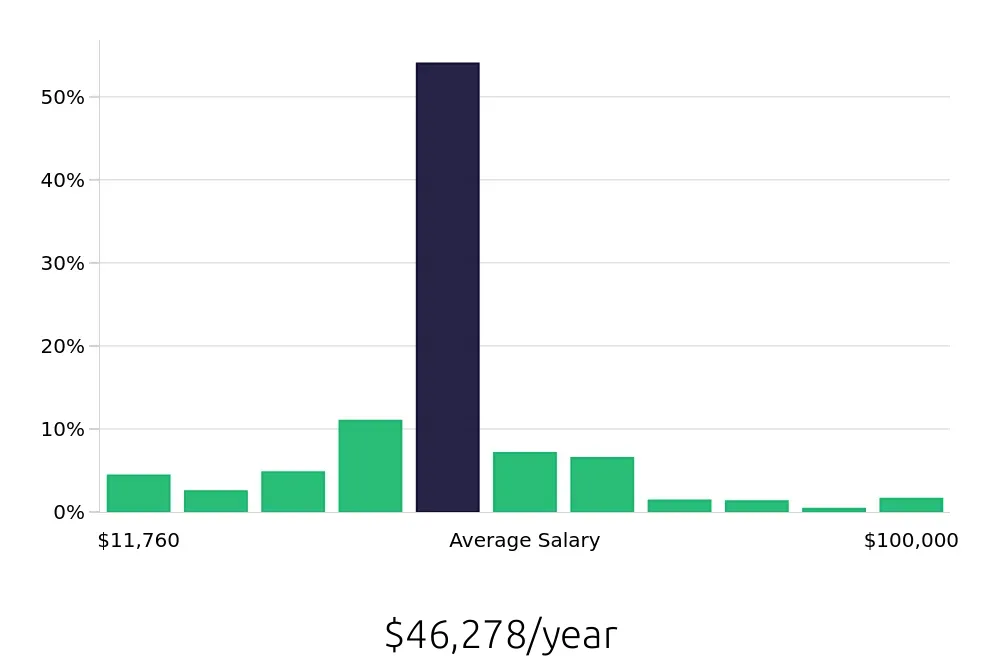

Commercial insurance inspectors earn a strong income, with an average annual salary of $75,760. Hourly, they make around $36.43. These figures highlight the value placed on their skills and expertise. Job seekers can expect competitive pay, making this field attractive. Remuneration reflects the critical nature of their work in assessing risks and preventing losses.

The role of commercial insurance inspectors is essential in managing risk. They evaluate properties and businesses to determine insurance coverage needs. This responsibility ensures both insurers and policyholders understand potential risks. The steady demand for this expertise guarantees a steady flow of job opportunities. Job seekers in this field can look forward to a rewarding and stable career.

Currently 153 Commercial Insurance Inspector job openings, nationwide.

Continue to Salaries for Commercial Insurance Inspector