What does a Controller do?

A Controller manages the accounting and financial aspects of an organization. They oversee financial reporting, budgeting, and compliance with financial regulations. Controllers prepare financial statements and reports for management. They also analyze financial data to support decision-making. Key tasks include monitoring cash flow, managing budgets, and ensuring financial records are accurate. Controllers work closely with other departments to support financial planning and strategy.

In this role, the Controller ensures financial accuracy and compliance with laws and regulations. They implement internal controls to safeguard assets. Controllers also lead the financial team and provide training. They work on long-term financial planning and risk management. This position requires strong analytical skills and attention to detail. A Controller plays a key role in maintaining financial health and stability.

How to become a Controller?

Becoming a Controller involves several key steps. This career focuses on overseeing financial operations within a company. It includes budgeting, accounting, and financial reporting. Those interested should follow a structured path to succeed.

Start with earning a bachelor's degree in accounting or finance. This provides a strong foundation in financial principles. Next, gain experience through internships or entry-level positions. Experience in accounting or finance helps build practical skills. Take relevant certifications, such as CPA or CMA. These credentials enhance expertise and job prospects. Seek a position as a senior accountant or financial analyst. This role offers more responsibility and skills. Finally, advance to a Controller role. This often requires several years of experience and a solid track record.

Becoming a Controller requires dedication and the right steps. Follow this path for a successful career in financial management.

- Earn a bachelor's degree in accounting or finance.

- Gain experience through internships or entry-level positions.

- Take relevant certifications, such as CPA or CMA.

- Seek a senior accountant or financial analyst role.

- Advance to a Controller position with experience and credentials.

How long does it take to become a Controller?

Starting the journey to become a Controller often involves education and experience in accounting or finance. Typically, individuals need a bachelor's degree in accounting, finance, or a related field. This degree usually takes four years to complete. During this time, students learn about financial reporting, budgeting, and accounting principles.

After earning a bachelor's degree, gaining practical experience becomes crucial. Many employers prefer candidates with at least two to four years of experience in accounting or a similar role. This experience helps individuals develop the skills needed for the Controller position. Some may choose to pursue a Master's degree or professional certifications like CPA or CMA to enhance their qualifications. These additional steps can take one to two years. Overall, the path to becoming a Controller can take anywhere from five to eight years, combining education and professional experience.

Controller Job Description Sample

The Controller is responsible for overseeing the accounting operations of a company, ensuring financial compliance, and providing strategic financial guidance to senior management. This role involves managing financial reporting, budgeting, and forecasting, as well as leading a team of accounting professionals.

Responsibilities:

- Manage the accounting operations, including the preparation of financial statements and reports.

- Oversee the budgeting process and ensure adherence to financial plans.

- Implement and maintain internal controls and accounting systems to ensure accuracy and compliance.

- Prepare and present financial forecasts and analysis to senior management.

- Lead and mentor a team of accounting staff, providing training and performance management.

Qualifications

- Bachelor’s degree in Accounting, Finance, or related field; CPA or similar certification required.

- Minimum of 5-7 years of experience in accounting or a related role, with at least 3 years in a managerial position.

- Strong knowledge of accounting principles and practices, GAAP, and financial reporting standards.

- Proven experience in budgeting, forecasting, and financial analysis.

- Excellent leadership and team management skills.

Is becoming a Controller a good career path?

A Controller plays a crucial role in any organization by managing financial reporting, budgeting, and compliance. This career path involves overseeing the accounting function and ensuring that the organization meets its financial goals. Controllers often work closely with executives to make strategic decisions. Their expertise in financial analysis and risk management makes them key players in the business world.

Being a Controller offers many benefits and some challenges. Here are some pros and cons to consider:

- Pros:

- Stability: Controllers often have stable employment and good job security.

- Leadership: This role offers opportunities to lead and influence key financial decisions.

- Compensation: The position usually comes with a competitive salary and benefits.

- Skills Development: Controllers gain valuable skills in accounting, finance, and management.

- Cons:

- Pressure: The role can be stressful, especially during budget periods and audits.

- Detail-Oriented: Controllers must be very detail-oriented and precise, which can be demanding.

- Regulatory Changes: The job requires staying up-to-date with changing laws and regulations.

- Long Hours: The workload can be heavy, with long hours, particularly during year-end closings.

What is the job outlook for a Controller?

The job outlook for controllers is strong and continues to grow. The Bureau of Labor Statistics (BLS) shows that there are around 69,600 positions available each year. The number of job openings is expected to increase by 16% from 2022 to 2032. This growth shows a stable and increasing demand for skilled controllers in various industries.

Controllers play a crucial role in financial management. They ensure that companies operate efficiently and comply with regulations. This demand for accuracy and oversight is why businesses need qualified controllers. The role requires strong analytical skills and knowledge of financial reporting. Companies value these skills highly, which helps controllers find many job opportunities.

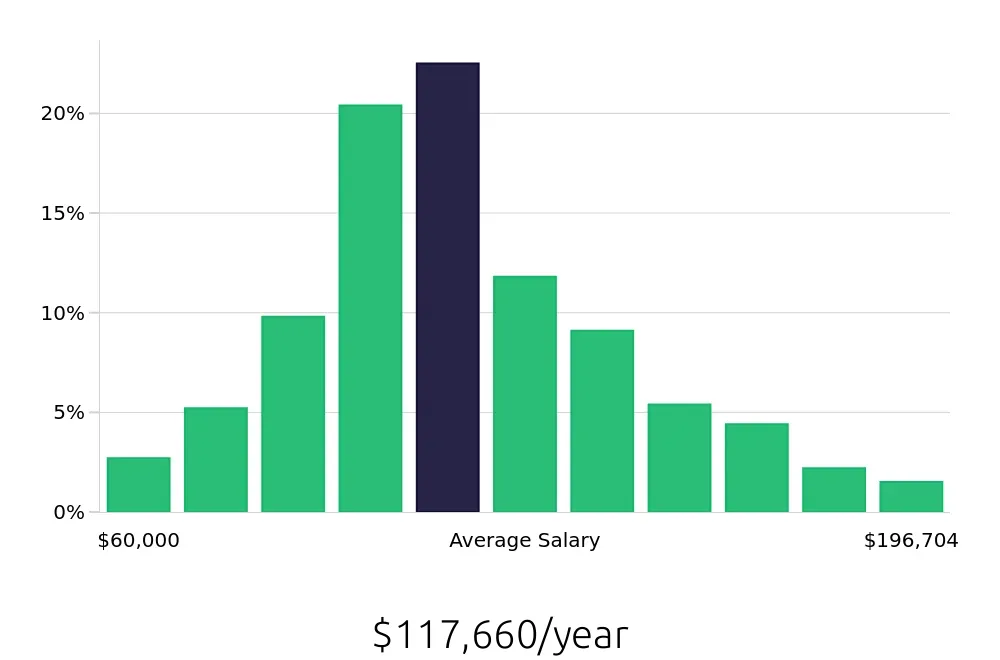

The compensation for controllers is competitive, with an average national annual salary of $174,820, according to the BLS. On an hourly basis, controllers earn about $84.05. This compensation reflects the responsibility and expertise required for the position. Job seekers can expect rewarding career paths with good pay and job stability. With a positive job outlook and attractive salary, becoming a controller is a great career choice.

Currently 1,577 Controller job openings, nationwide.

Continue to Salaries for Controller