Position

Overview

A Credit Assistant supports the credit and collections functions within a company. This role involves managing accounts, ensuring timely payments, and maintaining good relationships with clients. The Credit Assistant works closely with other departments, such as sales and finance, to ensure smooth operations. They review credit applications, assess credit risks, and provide valuable insights to help the company make informed decisions about extending credit to clients.

Responsibilities of a Credit Assistant include monitoring credit limits, updating credit reports, and following up on overdue accounts. They also prepare reports for management that summarize credit status and trends. The Credit Assistant often communicates with clients to resolve payment issues and negotiate payment plans. This role requires strong attention to detail, good communication skills, and a solid understanding of credit principles. Effective credit management helps businesses maintain financial stability and fosters long-term client relationships.

To become a Credit Assistant, one must follow a clear path. This career offers an opportunity to work with financial data and support the credit department. It requires attention to detail and good analytical skills. Follow these steps to begin your journey in this role.

First, obtain a high school diploma or equivalent. This is the foundation for any job. Next, consider taking courses related to finance or business. These classes provide valuable knowledge that can be beneficial in the credit field. Some people might choose to pursue an associate or bachelor's degree in finance, accounting, or a related field. This formal education can open more job opportunities.

Seek out internships or entry-level jobs in financial services. These roles help build practical skills and experience. Look for jobs in banks, credit unions, or other financial institutions. Apply to credit assistant positions that fit your skill set. Networking with professionals in the credit field can lead to job leads and advice.

Earning a certification in credit management can boost your resume. Look for programs offered by professional organizations. Keeping up with the latest trends and technologies in credit management is important. This ensures your skills stay current and relevant.

Interested in a career as a Credit Assistant? It's a role that combines skills in accounting and customer service. You'll help businesses by managing credit for clients. This job often leads to roles with more responsibility. Many people take different paths to this position.

First, some start with a high school diploma and gain experience in related roles. Others may complete a certificate or short course in finance. These courses usually last from a few weeks to a few months. Each path takes time. On average, it might take about one to two years to get the necessary skills and experience. Working in an entry-level role helps you learn the job well. Experience matters, and it makes you a stronger candidate for a Credit Assistant position.

We are looking for a detail-oriented and analytical Credit Assistant to join our finance team. The ideal candidate will be responsible for evaluating credit applications, monitoring credit risks, and ensuring compliance with credit policies.

Responsibilities:

Qualifications

The career path of a Credit Assistant offers a blend of financial oversight and customer interaction. This role involves assessing the creditworthiness of clients and businesses, ensuring they can repay loans or extend credit. A Credit Assistant examines financial statements, credit histories, and other financial data to make informed decisions. Companies rely on these assessments to manage risk and maintain financial stability.

Choosing this career path brings a mix of advantages and challenges. Here are some pros and cons to consider:

The role of a Credit Assistant offers a stable career path with a steady demand for professionals. On average, 1,200 job positions become available each year, according to the Bureau of Labor Statistics (BLS). This steady stream of opportunities provides a promising outlook for those entering or looking to transition into this field.

While the BLS projects a slight decline of 5.8% in job openings from 2022 to 2032, this decrease is relatively minor. It indicates a stable career landscape where consistent demand remains. This trend suggests that while the number of new positions may decrease slightly, existing roles will continue to offer professional growth and job security.

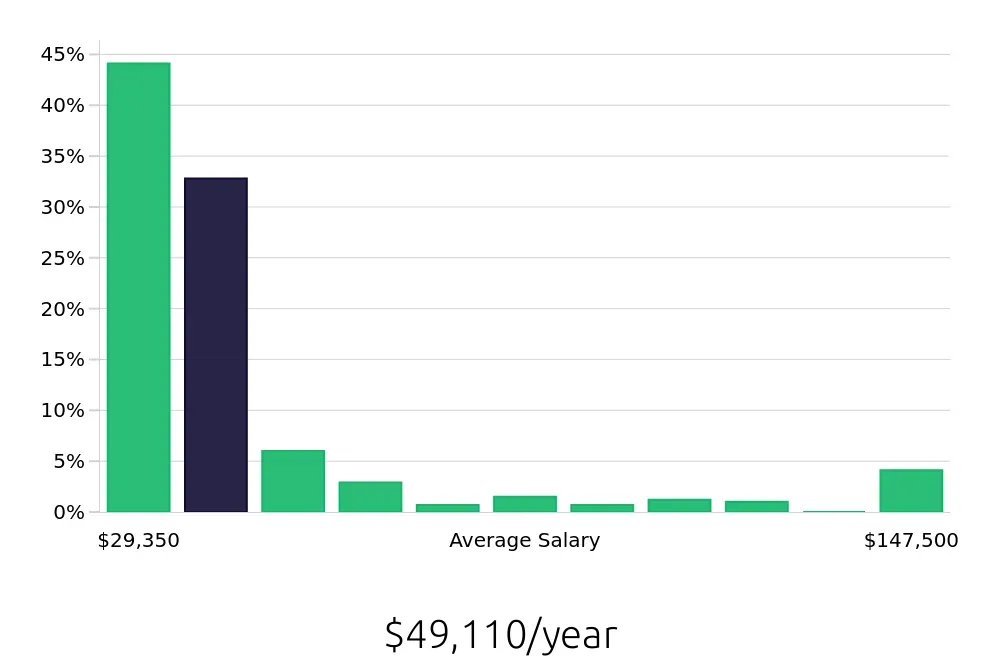

Credit Assistants can expect a competitive salary, with an average national annual compensation of $50,380 and an hourly rate of $24.22, according to BLS data. This compensation reflects the specialized skills and responsibilities required for the role. Job seekers can look forward to not only a stable job outlook but also a rewarding financial package that values their expertise and contributions.