What does a Day Trader do?

A Day Trader buys and sells securities within the same trading day. This job requires a deep understanding of market trends and the ability to make quick, informed decisions. Day Traders analyze market data and use strategies to maximize profit. They must stay updated with news that could affect the market.

Day Traders often work in a fast-paced environment, using trading platforms to execute trades. They need to manage risks and control their emotions to avoid making impulsive decisions. Success in this role comes from discipline, focus, and a solid trading plan. Being a Day Trader can be rewarding, but it requires constant learning and adaptability.

How to become a Day Trader?

Becoming a day trader can open the door to a dynamic and potentially profitable career. To succeed, one must follow a structured process that combines education, practice, and strategy. This journey requires discipline, risk management, and continuous learning.

Here are five essential steps for aspiring day traders to consider:

- Learn the Basics: Understand how financial markets operate. Study stock, forex, and futures markets. Learn about market trends, technical analysis, and financial instruments. Many online courses and books can provide this knowledge.

- Develop a Trading Plan: Create a detailed trading plan. This plan should outline your goals, risk tolerance, and the strategies you will use. Stick to this plan to avoid impulsive decisions.

- Practice with a Demo Account: Use a demo trading account to practice without risking real money. This allows you to test strategies and get familiar with the trading platform.

- Start with a Small Investment: Begin trading with a small amount of money. This minimizes the risk while you gain experience. Monitor your trades closely and learn from your successes and mistakes.

- Continuously Improve: Stay updated with market news and trends. Attend webinars, read financial news, and analyze your trades to improve your strategies. Successful traders never stop learning.

How long does it take to become a Day Trader?

Day trading is an exciting and dynamic career path that offers opportunities for those who are keen to engage actively in financial markets. This role often involves trading securities within a single trading day. The timeline to become a successful day trader can vary greatly.

First, aspiring traders usually begin with significant study and education. Many start with online courses or self-study, learning the fundamentals of trading. This can take several months. After gaining the necessary knowledge, individuals often move on to paper trading. This practice allows traders to simulate trades without risking real money. This stage can last from a few months to over a year. Once comfortable, traders transition to live trading, which usually involves a mentorship period under an experienced trader. This phase can take another few months to a year. Throughout this journey, continuous learning and adaptation are essential.

In summary, becoming a proficient day trader typically involves several phases. This process starts with education, moves to paper trading, and ends with live trading. While the exact timeline varies, dedication and persistence are key to achieving success in this fast-paced field.

Day Trader Job Description Sample

We are seeking a highly skilled and experienced Day Trader to join our dynamic trading team. The ideal candidate will be responsible for executing trades on behalf of clients in various financial markets, with a focus on generating short-term profits. This role requires a strong understanding of market trends, excellent analytical skills, and the ability to make quick, informed decisions under pressure.

Responsibilities:

- Execute trades on behalf of clients in various financial markets, including stocks, options, futures, and forex.

- Conduct thorough market analysis to identify trading opportunities and market trends.

- Monitor market movements and economic news to make informed trading decisions.

- Develop and implement trading strategies to maximize profits and minimize risks.

- Maintain accurate and up-to-date records of all trades and transactions.

Qualifications

- Proven experience as a Day Trader or in a similar trading role.

- Strong understanding of financial markets, trading strategies, and risk management.

- Excellent analytical and problem-solving skills.

- Ability to make quick, informed decisions under pressure.

- Proficient in using trading platforms and financial analysis tools.

Is becoming a Day Trader a good career path?

Day trading stands out as a dynamic and high-energy career in the financial sector. It involves buying and selling securities within the same trading day. This job demands sharp analytical skills and quick decision-making. Traders often monitor markets closely, analyzing trends and making trades based on real-time data.

This career path presents both exciting opportunities and significant challenges. On the plus side, day traders can work from anywhere with an internet connection. They also have the potential to earn substantial income, especially those who perform well. However, this profession is not without its drawbacks. The risk of financial loss is high, and the stress levels can be intense. Moreover, the job requires a deep understanding of market movements and the ability to remain calm under pressure.

Consider these pros and cons before pursuing a career in day trading:

- Pros:

- Flexibility in work location

- Potential for high earnings

- Immediate feedback on trades

- Cons:

- High risk of financial loss

- Intense pressure and stress

- Requires continuous learning and adaptation

What is the job outlook for a Day Trader?

Day traders have an exciting job that involves buying and selling securities within a single trading day. According to the Bureau of Labor Statistics (BLS), there are approximately 40,100 job positions available for day traders each year. This offers a promising outlook for those seeking to enter this dynamic field. The job openings for day traders are expected to increase by 7.4% from 2022 to 2032, indicating steady growth in the industry.

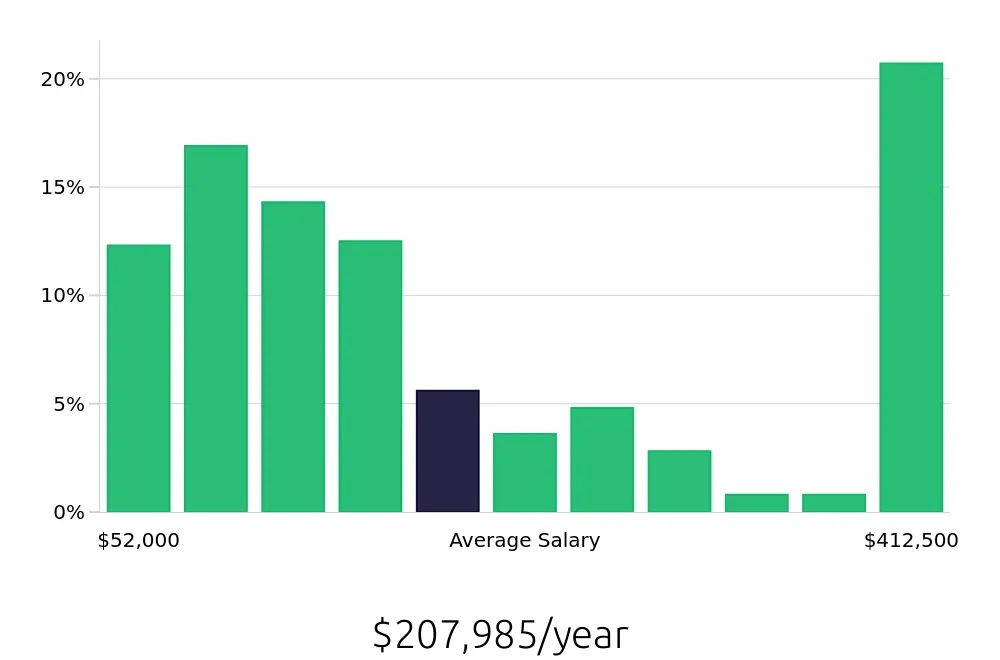

The financial markets are always evolving, and day traders play a crucial role in this fast-paced environment. With an average national annual compensation of $109,710, day traders can earn a competitive salary. This compensation reflects the skill and expertise required to succeed in this challenging yet rewarding profession. The average national hourly compensation for day traders stands at $52.75, further highlighting the potential for significant earnings in this field.

For job seekers interested in pursuing a career as a day trader, the job outlook is positive. The increasing demand for skilled traders and the potential for lucrative compensation make this a viable career path. Aspiring day traders should leverage the job growth data and salary information provided by the BLS to make informed decisions about their career in trading.

Currently 207 Day Trader job openings, nationwide.

Continue to Salaries for Day Trader