What does a Field Automobile Adjuster do?

A Field Automobile Adjuster examines damage to vehicles and determines how much to pay for repairs. This position travels to different locations to inspect cars, trucks, and other vehicles. The adjuster meets with clients, takes photos of the damage, and writes detailed reports. They also talk to mechanics to understand the cost of repairs. The Field Automobile Adjuster plays a key role in helping people get the money they need to fix their vehicles.

This job requires a blend of analytical and interpersonal skills. The adjuster must carefully inspect the vehicle to assess the damage accurately. They need to understand how different parts of a vehicle work. Good communication skills are crucial as the adjuster must explain findings to clients and mechanics. They must also be detail-oriented to ensure all aspects of the damage are considered. By combining these skills, the Field Automobile Adjuster ensures fair and accurate settlements for vehicle repairs.

How to become a Field Automobile Adjuster?

Becoming a Field Automobile Adjuster offers a dynamic career in the insurance industry. This role involves assessing vehicle damage and determining insurance settlements. Achieving this position requires a clear process and dedication. Follow these steps to embark on a successful career as a Field Automobile Adjuster.

The journey starts with obtaining the necessary education. Many employers prefer candidates with a high school diploma or equivalent. Some may require additional coursework in business or insurance. A bachelor's degree in business or a related field can enhance job prospects. Completing courses in mathematics, English, and computer skills is also beneficial.

- Gain relevant experience: Employers often look for candidates with experience in the automotive or insurance industry. Consider internships, part-time jobs, or volunteer work in these fields. Experience with vehicles, whether from personal interest or previous employment, can be advantageous.

- Obtain certification: Some states require Field Automobile Adjusters to be licensed. This involves passing an examination administered by the state insurance department. Review the requirements in your state and prepare for the exam accordingly. Certification can open more job opportunities and increase earning potential.

- Apply for entry-level positions: Start with entry-level roles in the insurance industry. Positions such as claims adjuster or insurance assistant can provide valuable experience. Networking with professionals in the field can lead to job leads and recommendations.

- Pursue advanced training: Consider taking additional courses or obtaining specialized certifications. Many organizations offer training programs for automobile adjusters. Skills in estimating repair costs, understanding vehicle mechanics, and communication are crucial. Staying updated with industry trends can set you apart.

- Seek advancement opportunities: With experience and training, apply for positions as a Field Automobile Adjuster. Demonstrate your skills and knowledge in interviews. Continuously improve your abilities and seek feedback from supervisors to advance your career.

How long does it take to become a Field Automobile Adjuster?

The journey to becoming a Field Automobile Adjuster involves several key steps. The length of time can vary based on individual circumstances and educational paths. Most people need at least a high school diploma. After that, taking courses in auto mechanics or insurance can help. These courses may last from a few months to a couple of years. Some may choose to get a degree in business, insurance, or a related field. This usually takes about four years.

Experience is important as well. Many start as an intern or assistant. This hands-on work can last from several months to a few years. Some get certified through professional organizations. Certification requirements can take additional time, often including passing exams. Gaining experience under a seasoned adjuster often adds value. This practical learning helps prepare for the field. The total time can range from one to five years or more. Each step builds the skills and knowledge needed for success in this career.

Field Automobile Adjuster Job Description Sample

The Field Automobile Adjuster is responsible for assessing vehicle damage and evaluating claims made by policyholders. This role involves inspecting damaged vehicles, gathering evidence, and determining the extent of the damage to authorize appropriate compensation.

Responsibilities:

- Inspect vehicles at the scene of an accident or damage to assess the extent of the damages.

- Evaluate repair costs based on inspection findings and provide detailed estimates.

- Interview policyholders and witnesses to gather relevant information regarding the incident.

- Communicate with auto repair shops and vendors to coordinate repairs and assess repair costs.

- Prepare detailed reports including photographs, sketches, and a summary of the findings.

Qualifications

- High school diploma or equivalent; additional education in auto mechanics or a related field is a plus.

- State-specific adjuster license required.

- Proven experience as an automobile adjuster or a similar role.

- Strong knowledge of vehicle mechanics, repair processes, and automotive technology.

- Excellent analytical and problem-solving skills.

Is becoming a Field Automobile Adjuster a good career path?

A career as a Field Automobile Adjuster involves inspecting and evaluating vehicles after accidents. This role requires traveling to accident sites and working with insurance companies to determine the extent of vehicle damage. Adjusters assess repair costs and decide on compensation for policyholders. This job provides hands-on experience with vehicle mechanics and a direct impact on customer satisfaction.

Working as a Field Automobile Adjuster offers several benefits. First, the job provides a good mix of office work and fieldwork. Adjusters spend time in an office reviewing documents and also travel to inspect damaged vehicles. Second, the role offers the chance to work independently. Adjusters often work alone, making their own schedules. Third, it can be a rewarding career, helping people in need after accidents. However, this job also comes with challenges. Adjusters need to handle difficult situations with empathy while making fair decisions. Long hours and travel can also be demanding, requiring good time management and stamina.

Here are some pros and cons to consider:

- Pros:

- Flexibility in scheduling

- Opportunity to work independently

- Direct impact on customer satisfaction

- Cons:

- Long hours and travel can be tiring

- Dealing with difficult situations

- Requires a combination of office and fieldwork

What is the job outlook for a Field Automobile Adjuster?

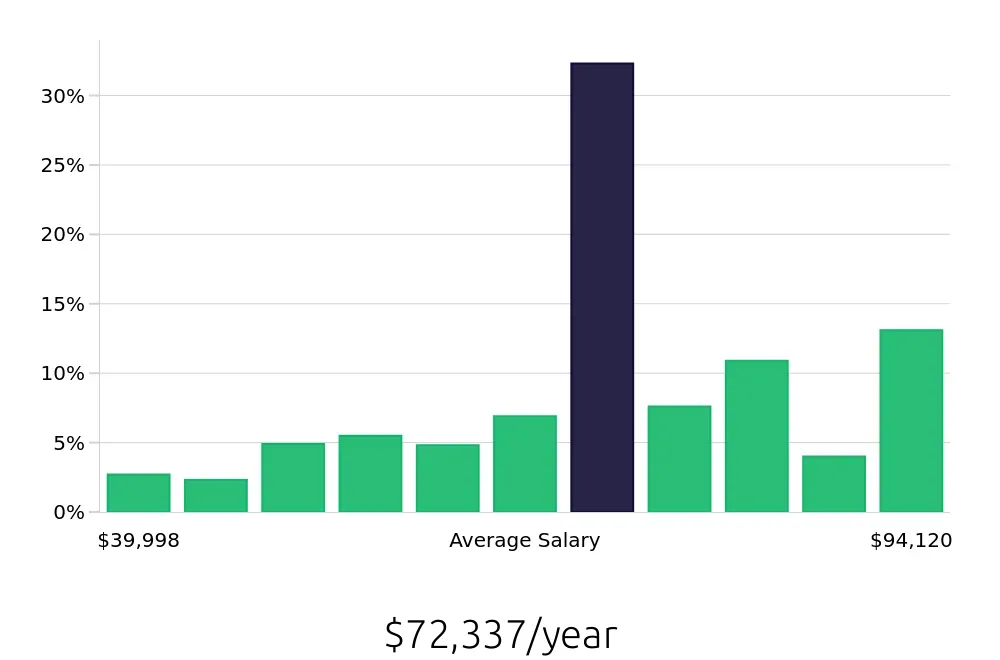

Job seekers looking to enter the field of automobile insurance will find that becoming a Field Automobile Adjuster is a stable and rewarding career choice. According to the Bureau of Labor Statistics (BLS), the average number of job positions per year for Field Automobile Adjusters is 21,500. This statistic highlights the steady demand for professionals in this role, ensuring consistent job opportunities. With an average national annual compensation of $75,760, this career offers a competitive salary that can provide a comfortable living for many families.

While job openings are expected to decrease by 3.1% from 2022 to 2032, the role of a Field Automobile Adjuster remains vital in the insurance industry. This role involves evaluating and assessing vehicle damage, which is crucial for processing insurance claims efficiently. The expertise required for this job ensures that professionals will always be needed, even if the number of positions slightly declines. The average hourly compensation of $36.43 further underscores the value of this role, making it an attractive option for those looking to secure their financial future.

Prospective Field Automobile Adjusters should be aware that this career path offers a blend of outdoor work and analytical tasks. It requires strong attention to detail and the ability to communicate effectively with clients and insurance representatives. Given the average compensation figures from the BLS, this profession not only provides a stable job outlook but also offers the potential for career growth and higher earnings through experience and specialization. For job seekers, these factors make the Field Automobile Adjuster role a solid career choice.

Currently 153 Field Automobile Adjuster job openings, nationwide.

Continue to Salaries for Field Automobile Adjuster