What does a Finance Manager do?

A Finance Manager oversees the financial health of an organization. This person plans, directs, and coordinates financial activities. Key tasks include managing budgets, analyzing financial data, and reporting to stakeholders. They help set financial goals and develop strategies to achieve them. This role also involves risk management, ensuring compliance with financial regulations, and providing financial guidance to other departments.

A Finance Manager needs strong analytical skills and attention to detail. They must understand financial reports, balance sheets, and income statements. This position requires excellent communication skills, as they often present financial information to non-finance staff. It involves problem-solving and making informed decisions that impact the organization's financial future. This role demands reliability, integrity, and the ability to work under pressure.

How to become a Finance Manager?

Becoming a Finance Manager requires a mix of education, experience, and the right skills. It is a rewarding path for those interested in overseeing the financial health of a company. To achieve this, one must follow a clear process that ensures the necessary knowledge and competencies are acquired.

Here are five key steps to becoming a Finance Manager:

- Earn a Degree: Begin with a bachelor’s degree in finance, accounting, or a related field. This provides a solid foundation in financial principles.

- Gain Experience: Work in entry-level finance roles, such as an accountant or financial analyst. This experience helps build practical skills and knowledge.

- Get Certified: Consider obtaining certifications like the Certified Public Accountant (CPA) or Chartered Financial Analyst (CFA). These add value to your resume and demonstrate expertise.

- Advance Your Career: Move into senior finance roles, such as a Financial Controller or Director of Finance. This step shows leadership and advanced skills.

- Network and Apply: Connect with professionals in the finance industry. Look for job openings and apply for Finance Manager positions.

How long does it take to become a Finance Manager?

To step into the role of a Finance Manager, one typically needs a blend of education and experience. Most companies look for a bachelor's degree in finance, accounting, or a related field. This degree usually takes four years to complete. After graduation, gaining practical experience in the finance sector often requires an additional 2-4 years. Some positions may require a master’s degree, such as an MBA, which adds another 1-2 years.

Career paths to becoming a Finance Manager often involve roles such as financial analyst, accounting clerk, or budget analyst. Moving up to senior analyst or assistant finance manager can take another 2-3 years. Progression to a Finance Manager position varies by company and industry. Networking, certifications like the CFA or CPA, and staying current with industry trends can speed up this journey. In total, expect to spend between 6 to 8 years to reach this level of a career in finance.

Finance Manager Job Description Sample

We are seeking a dynamic and experienced Finance Manager to lead our financial operations, ensuring accuracy, efficiency, and compliance with financial regulations. The ideal candidate will be responsible for budgeting, forecasting, and providing financial insights that support strategic decision-making.

Responsibilities:

- Develop and manage the annual budget and financial forecasts.

- Analyze financial data and prepare financial reports for management.

- Oversee accounting operations, ensuring accurate and timely financial reporting.

- Manage and optimize cash flow, including bank relationships and investments.

- Ensure compliance with financial policies, procedures, and regulations.

Qualifications

- Bachelor's degree in Finance, Accounting, or related field; MBA preferred.

- CPA or CMA certification is highly desirable.

- Minimum of 5-7 years of experience in finance management, with at least 3 years in a leadership role.

- Proven track record of managing budgets, financial planning, and analysis.

- Strong knowledge of financial regulations and compliance.

Is becoming a Finance Manager a good career path?

The role of a Finance Manager is vital in any organization. This position requires overseeing financial activities, managing budgets, and providing insights to support business decisions. A Finance Manager ensures the financial health of a company by analyzing financial data and reporting to top executives. The job often involves forecasting, risk management, and investment strategies. This career path demands strong analytical skills, a deep understanding of financial markets, and the ability to communicate complex financial information clearly.

Working as a Finance Manager offers many advantages. It provides the opportunity to influence company strategies and make key financial decisions. The job often comes with a competitive salary and benefits. Finance Managers also enjoy a degree of autonomy and the chance to work closely with senior management. This role can lead to various opportunities for advancement, including executive positions. However, the job comes with its own set of challenges. Finance Managers often face high pressure and tight deadlines, especially during budget seasons or financial reporting periods. The job may also require long hours and the need to stay updated with the latest financial regulations and trends.

When considering a career as a Finance Manager, it is essential to weigh both the pros and cons. Below are some important points to reflect on:

- Pros:

- High earning potential

- Opportunity for career growth

- Influence on strategic decisions

- Diverse industry opportunities

- Cons:

- High stress and pressure

- Long working hours

- Need for constant learning

- Complex regulatory environment

What is the job outlook for a Finance Manager?

The job outlook for finance managers looks strong and promising. The Bureau of Labor Statistics (BLS) shows an average of 69,600 job openings annually. This is a solid number for professionals seeking stability and growth in their careers. The BLS also projects a 16% increase in job openings from 2022 to 2032. This growth suggests a growing need for skilled finance managers across various industries.

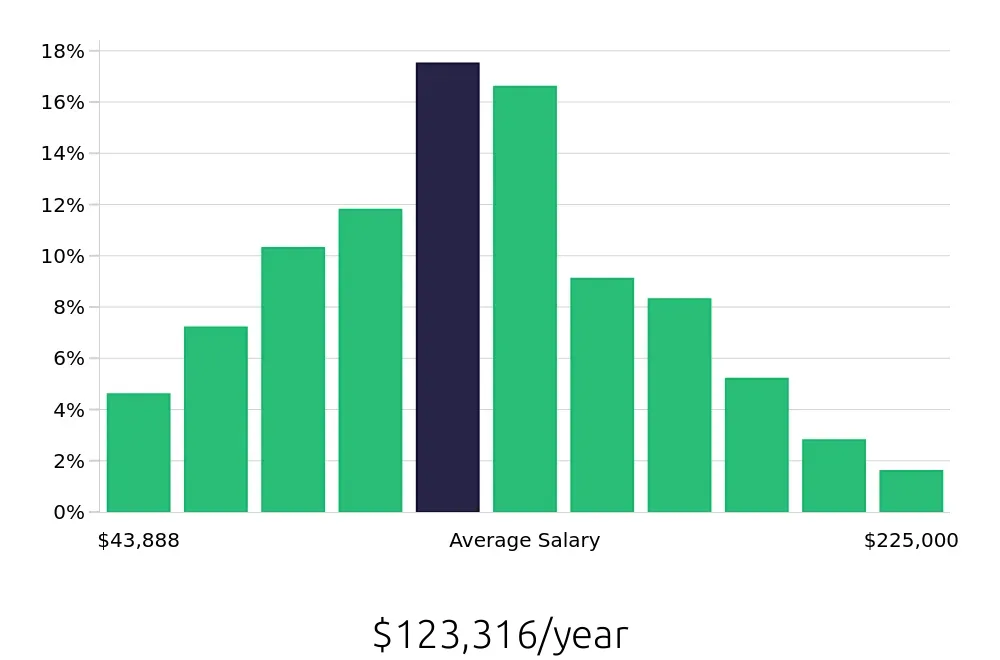

Compensation for finance managers is also attractive. The average annual salary stands at $174,820, according to the BLS. This figure highlights the value companies place on financial expertise and strategic management. Additionally, the average hourly rate is $84.05, reflecting the high demand for experienced professionals in this role. For job seekers, these numbers indicate both financial rewards and career stability.

In summary, the finance manager role offers a blend of job security, growth potential, and competitive pay. Job seekers can look forward to a robust job market and attractive compensation packages. The BLS data underscores the importance and value of this profession, making it a worthwhile career path for many.

Currently 1,306 Finance Manager job openings, nationwide.

Continue to Salaries for Finance Manager