What does a Financial Aid Advisor do?

A Financial Aid Advisor works with students to help them understand and apply for financial assistance options for college. This person assists with navigating the complex process of financial aid, including federal and institutional grants, scholarships, loans, and work-study programs. They provide personalized guidance and support, helping students maximize their financial aid packages to cover educational expenses.

This role involves regular communication with students, explaining how to complete financial aid forms, and clarifying any questions they might have. A Financial Aid Advisor also keeps up-to-date with changes in financial aid regulations and policies to ensure they can provide accurate and relevant information. Their goal is to help students make informed decisions about funding their education, easing the financial burden and enabling them to focus on their studies.

How to become a Financial Aid Advisor?

Becoming a Financial Aid Advisor can lead to a rewarding career helping others navigate the complexities of educational funding. This role involves guiding students through the financial aid process, ensuring they receive the necessary support for their educational goals.

To start this career, one must follow several steps, each crucial in building the required expertise and credentials. Here are five essential steps to becoming a Financial Aid Advisor:

- Get an education: Begin with a high school diploma or GED. Most employers prefer candidates with at least a bachelor’s degree in a related field, such as finance, education, or business administration.

- Gain relevant experience: Look for entry-level positions in financial aid offices or related areas. This experience helps in understanding the financial aid process and the needs of students.

- Obtain certifications: Consider getting certifications such as the Certified Educational Planner (CEP) or the Financial Aid Professional (FAP) to boost your credentials and marketability.

- Develop key skills: Focus on skills like strong communication, attention to detail, and proficiency with financial software. These skills are crucial for accurately advising students and managing complex financial aid processes.

- Network and find job opportunities: Connect with professionals in the field through networking events, professional organizations, and job boards. Utilize social media platforms like LinkedIn to expand your professional network and discover job openings.

By following these steps, aspiring Financial Aid Advisors can build a solid foundation for a successful career in helping students achieve their educational dreams.

How long does it take to become a Financial Aid Advisor?

Pursuing a career as a Financial Aid Advisor can be fulfilling and rewarding. This role involves helping students and families navigate the financial aid process for higher education. The time it takes to become one depends on several factors. Most advisors start by earning a bachelor’s degree, which usually takes about four years. Some positions may require additional qualifications, such as a master’s degree or specific certifications, which can add more time to the process.

A typical path includes several steps. First, gaining a relevant degree sets the foundation. This often involves coursework in finance, economics, or education. Next, gaining experience through internships or entry-level positions in financial aid offices can be crucial. Advisors must also develop strong communication and problem-solving skills. Some professionals choose to pursue certifications, which can enhance their job prospects and earning potential. Completing these steps may take from two to five years, depending on individual circumstances and career goals.

Financial Aid Advisor Job Description Sample

The Financial Aid Advisor is responsible for assisting students and their families in understanding and accessing financial aid opportunities for higher education. This role involves guiding students through the financial aid process, ensuring compliance with federal and institutional policies, and providing personalized financial planning and counseling services.

Responsibilities:

- Advise students and families on financial aid options and opportunities.

- Assist students in completing and submitting all required financial aid documents and applications.

- Provide guidance on understanding financial aid award letters and the terms of financial aid offers.

- Assist students in developing and maintaining a budget for college expenses.

- Collaborate with academic advisors to ensure that students are aware of financial aid implications for their academic choices.

Qualifications

- Bachelor's degree in Finance, Business, Education, or a related field. A Master's degree is preferred.

- Minimum of 2 years of experience in a financial aid or student services role in a higher education setting.

- Strong understanding of federal and state financial aid policies and regulations.

- Excellent communication and interpersonal skills.

- Ability to work with diverse student populations and provide culturally responsive advice.

Is becoming a Financial Aid Advisor a good career path?

A Financial Aid Advisor helps students understand and access financial aid for education. They review applications and guide students through the financial aid process. This role involves working closely with students, parents, and financial aid offices. Advisors need to understand financial aid rules and changes to provide accurate advice.

Working in this field offers many opportunities. Advisors can make a real difference in students’ lives by helping them fund their education. They often work in schools, community colleges, and universities. This career provides a stable income and can be rewarding for those who enjoy helping others. Advisors also have the chance to grow professionally by taking on more responsibility or specializing in certain types of financial aid.

Choosing a career as a Financial Aid Advisor has its pros and cons. Consider the following:

- Pros:

- Helping students achieve their education goals

- Stable job opportunities in educational institutions

- Potential for career advancement and specialization

- Variety of work environments, including schools and financial aid offices

- Cons:

- Dealing with complex financial aid regulations can be challenging

- May involve long hours, especially during application periods

- Requires continuous learning to stay updated on financial aid changes

- Stress from helping students with limited aid options

What is the job outlook for a Financial Aid Advisor?

The job outlook for a Financial Aid Advisor is promising for those entering the field. The Bureau of Labor Statistics (BLS) shows that there are about 27,700 job positions available each year. This consistent demand highlights a stable career path. The BLS also projects a job openings percent change of 3.1% from 2022 to 2032. This modest increase indicates a steady need for qualified professionals. Job seekers should find ample opportunities in this field.

Financial Aid Advisors play a crucial role in helping students afford higher education. Advisors guide students through the complex process of financial aid applications. This includes FAFSA forms and scholarship opportunities. With the rising cost of college, the need for these professionals continues to grow. Advisors help ensure that more students can access higher education. This role is both rewarding and essential in today's educational landscape.

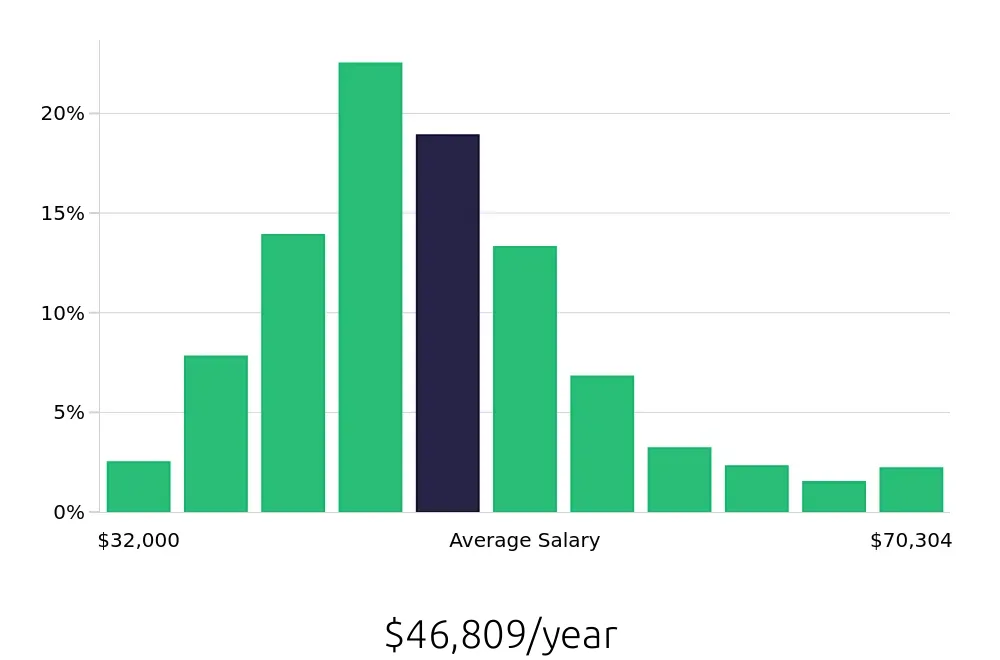

Financial Aid Advisors earn a competitive salary, making this a lucrative career choice. According to the BLS, the average national annual compensation is $82,000. Additionally, the average national hourly compensation stands at $39.43. These figures reflect the value placed on the skills and knowledge of these professionals. Job seekers can expect fair compensation for their efforts in assisting students with financial planning. This adds to the overall attractiveness of the profession.

Currently 117 Financial Aid Advisor job openings, nationwide.

Continue to Salaries for Financial Aid Advisor