What does a Financial Assistant do?

A Financial Assistant plays a vital role in managing an organization’s finances. This professional ensures that financial records are accurate and up-to-date. They handle tasks like recording transactions, preparing financial reports, and maintaining the general ledger. Accuracy is key, as the Financial Assistant must ensure all financial data is correct. This position also involves collaborating with other departments to support budgeting and financial planning.

The Financial Assistant often works with various software and tools to streamline financial processes. They may use accounting software to input data and generate financial reports. This position requires attention to detail and strong organizational skills. The Financial Assistant ensures that financial operations run smoothly. They may also assist in audits and ensure compliance with financial regulations. This role is essential for maintaining the financial health of an organization.

How to become a Financial Assistant?

To become a Financial Assistant, follow this clear process. It includes gaining the right skills, education, and experience. This role helps manage financial operations for businesses, non-profits, and other organizations. Below are the steps to pursue this career.

Start by getting the right education. Most employers look for candidates with at least a high school diploma. Some may prefer a college degree in finance, accounting, or a related field. Attend courses that cover basic financial principles, bookkeeping, and office software.

- Earn a diploma or degree: Obtain a high school diploma or college degree in finance, accounting, or a related field.

- Learn essential skills: Gain proficiency in Microsoft Excel, QuickBooks, and other accounting software.

- Seek internships or entry-level jobs: Apply for internships or entry-level positions in accounting or finance departments to gain practical experience.

- Consider certification: Obtain certifications such as Certified Financial Assistant (CFA) or Certified Bookkeeper (CB) to enhance your credentials.

- Build professional experience: Work under experienced financial professionals to understand financial processes and improve your skills.

Get hands-on experience. Look for internships or entry-level jobs in accounting or finance departments. This experience teaches you how financial operations work in real-world settings. Gain proficiency in tools and software used in the industry, like Microsoft Excel and QuickBooks. Certification can also set you apart in the job market.

How long does it take to become a Financial Assistant?

Pursuing a career as a financial assistant involves completing the right education and training. Most financial assistants have at least a high school diploma. Some employers prefer candidates with an associate degree or a certificate in accounting or business administration. These programs often take two years to complete.

In addition to formal education, gaining relevant experience enhances job prospects. Many financial assistants start with entry-level positions in accounting or administrative roles. These positions provide valuable experience and often lead to promotions. On average, it takes about one to three years to gain enough experience to qualify for a financial assistant role. Many professionals pursue additional certifications to boost their qualifications. The Certified Bookkeeper (CB) credential from the National Association of Legal Assistants (NALA) is popular among financial assistants.

Financial Assistant Job Description Sample

We are seeking a highly organized and detail-oriented Financial Assistant to join our dynamic finance team. The ideal candidate will have strong analytical skills and experience in financial reporting, accounts reconciliation, and general accounting tasks.

Responsibilities:

- Assist in the preparation of financial statements, budgets, and reports.

- Perform accounts reconciliation for various accounts and ensure accuracy.

- Support the accounts payable and accounts receivable functions.

- Assist in the preparation and processing of payments and invoices.

- Maintain and update financial records and databases.

Qualifications

- Bachelor’s degree in Finance, Accounting, or a related field.

- Proven experience as a Financial Assistant or similar role.

- Strong understanding of accounting principles and practices.

- Proficiency in Microsoft Excel and accounting software.

- Attention to detail and high level of accuracy.

Is becoming a Financial Assistant a good career path?

A career as a Financial Assistant offers valuable experience in handling financial transactions. This role involves tasks such as managing accounts, processing payments, and ensuring financial records are accurate. Companies in finance, retail, and manufacturing often seek Financial Assistants to support their financial operations.

Working as a Financial Assistant provides the opportunity to gain practical financial skills and understand the inner workings of financial management. However, this role has its pros and cons. Consider these factors to determine if it suits your career goals.

- Pros:

- Gain hands-on experience in financial operations.

- Opportunities for career growth into higher financial roles.

- Work in various industries, including finance, retail, and manufacturing.

- Develop strong organizational and attention to detail skills.

- Cons:

- May require long hours during busy financial periods.

- Job can be repetitive and require strong accuracy.

- Limited opportunities for advancement without additional education.

- Work environment may be stressful, especially during audits or fiscal year-ends.

What is the job outlook for a Financial Assistant?

Job seekers interested in a role as a Financial Assistant can look forward to a positive job outlook. The U.S. Bureau of Labor Statistics (BLS) reports around 61,300 job openings per year. This indicates a steady demand for skilled professionals in this field. The outlook extends into the next decade, with a projected job opening percent change of 8.2% from 2022 to 2032. This growth highlights the increasing need for financial assistants in various industries.

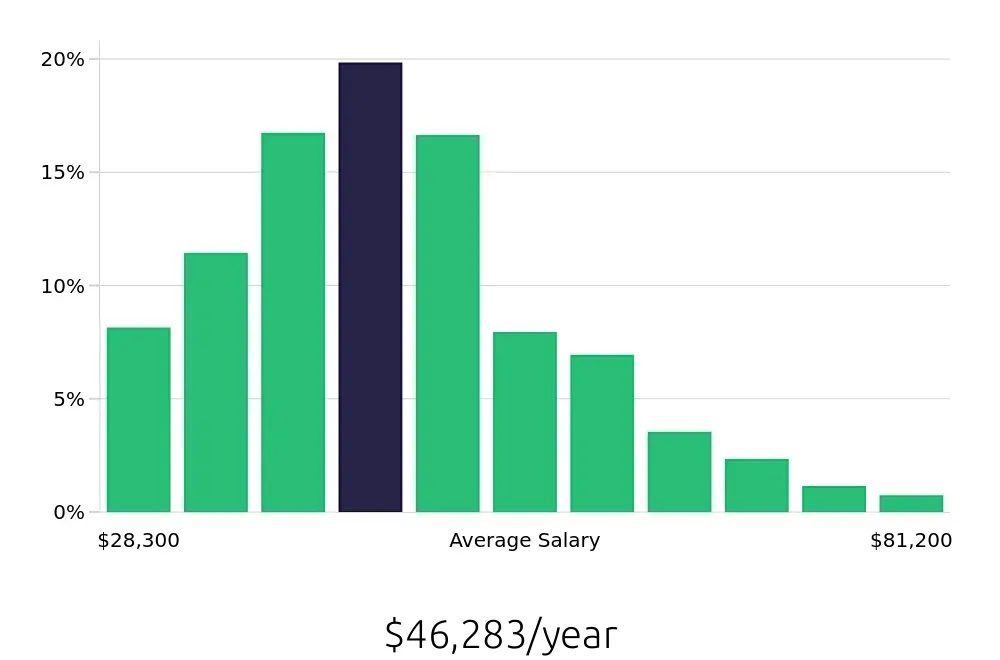

One significant aspect for potential job seekers is the average national compensation for Financial Assistants. According to the BLS, the average national annual compensation stands at $123,330. This figure reflects the rewarding nature of the career, making it an attractive option for those entering the field. Additionally, the average national hourly compensation is $59.29, providing a clear picture of the earning potential for this role. These financial incentives, combined with job stability, make it a compelling career path.

In conclusion, the Financial Assistant role presents a promising opportunity for job seekers. With consistent job openings and a positive growth trajectory, it is a field with stable and lucrative prospects. The competitive salary and hourly rates further enhance the appeal of this career. Job seekers with an interest in finance and numbers should consider this role for a rewarding professional journey.

Currently 35 Financial Assistant job openings, nationwide.

Continue to Salaries for Financial Assistant