What does a Financial Planning Manager do?

The Financial Planning Manager plays a key role in guiding a company's financial strategy. This professional is responsible for creating and implementing financial plans that align with the organization's goals. They analyze financial data to identify trends and opportunities for growth. The manager works closely with other departments to ensure the company's financial health. They also prepare budgets and forecasts to support decision-making.

In this role, the Financial Planning Manager oversees a team of financial analysts. They provide leadership and support to ensure the team meets its objectives. The manager also communicates financial information to stakeholders, including executives and board members. They ensure that all financial activities comply with regulations and company policies. This position requires strong analytical skills and attention to detail. It also demands excellent communication and leadership abilities. The Financial Planning Manager helps to secure the company's financial future and drives its success.

How to become a Financial Planning Manager?

Becoming a Financial Planning Manager involves a clear path of education, experience, and professional development. This role requires a strong foundation in finance and a commitment to continuous learning. By following these steps, one can successfully navigate the journey to becoming a Financial Planning Manager.

First, obtaining a relevant degree is essential. Most employers look for candidates with a bachelor's degree in finance, economics, or a related field. This educational background provides the necessary knowledge of financial principles and practices. Next, gaining experience in the financial industry is crucial. Working in roles such as a financial analyst or investment advisor helps build practical skills and industry knowledge. Networking with professionals and attending industry events can also open doors to new opportunities.

- Earn a bachelor's degree in finance or a related field.

- Gain experience through roles like financial analyst or investment advisor.

- Obtain relevant certifications to enhance credentials.

- Network with industry professionals and attend events.

- Seek advanced roles and leadership opportunities to build management skills.

How long does it take to become a Financial Planning Manager?

The journey to becoming a Financial Planning Manager involves several steps. First, a bachelor's degree in finance, business, or a related field sets the foundation. This typically takes four years. Many employers prefer candidates with a master's degree, which adds another two years. Gaining experience in financial planning roles helps build necessary skills. This often takes three to five years, depending on the position and industry.

Professionals may also seek certifications to enhance their credentials. The Certified Financial Planner (CFP) certification is highly valued. Preparing for the CFP exam requires several months of study. Passing the exam adds another layer, taking a few weeks. Continuing education keeps skills sharp and credentials current. This ongoing process ensures a Financial Planning Manager remains knowledgeable and competitive in the job market. With dedication and the right steps, one can achieve this role in about seven to eleven years.

Financial Planning Manager Job Description Sample

The Financial Planning Manager is responsible for overseeing the financial planning and analysis functions within the organization. This role involves developing strategic financial plans, analyzing financial data, and providing insights to support decision-making processes. The Financial Planning Manager will work closely with the executive team to ensure the financial health and sustainability of the organization.

Responsibilities:

- Develop and implement comprehensive financial plans and budgets in alignment with organizational goals.

- Analyze financial data, trends, and forecasts to provide strategic insights and recommendations.

- Collaborate with department heads to understand their financial needs and develop tailored plans.

- Prepare detailed financial reports and presentations for senior management and stakeholders.

- Monitor and manage financial performance against budgets and forecasts, identifying areas for improvement.

Qualifications

- Bachelor’s degree in Finance, Accounting, Business Administration, or a related field. A Master’s degree or MBA is preferred.

- Certified Financial Planner (CFP) or other relevant professional certifications are highly desirable.

- Minimum of 7-10 years of experience in financial planning and management roles, with at least 3-5 years in a managerial position.

- Proven track record of developing and implementing successful financial plans and strategies.

- Strong analytical skills with the ability to interpret complex financial data and trends.

Is becoming a Financial Planning Manager a good career path?

A Financial Planning Manager plays a key role in helping businesses and individuals achieve their financial goals. This role involves creating and managing financial plans, analyzing financial data, and providing advice on investments and savings. The job requires strong analytical skills and a deep understanding of financial markets. Managers often work with clients to develop strategies that align with their long-term financial objectives.

Working as a Financial Planning Manager offers several benefits. This role provides the opportunity to make a significant impact on people's financial well-being. Managers often enjoy a stable and rewarding career with good earning potential. The job also offers the chance to work with a diverse range of clients, from individuals to large corporations. However, it is important to consider some challenges. The role can be demanding, with long hours and high stress, especially during busy periods. Financial markets can be unpredictable, and managers must stay updated with the latest trends and regulations. Balancing client expectations with market realities can also be a complex task.

Here are some pros and cons to consider:

- Pros:

- Opportunity to help clients achieve financial goals

- Potential for high earnings and career growth

- Variety of clients and industries to work with

- Job stability and demand in the financial sector

- Cons:

- High stress and long working hours

- Need to stay updated with financial markets and regulations

- Balancing client expectations with market realities

- Potential for job insecurity during economic downturns

What is the job outlook for a Financial Planning Manager?

The job outlook for Financial Planning Managers is strong and promising. The Bureau of Labor Statistics (BLS) reports an average of 69,600 job positions available each year. This steady demand highlights the importance of financial planning in today's economy. Job seekers can expect a stable career path with numerous opportunities for growth and advancement.

Looking ahead, the BLS predicts a 16% increase in job openings from 2022 to 2032. This growth reflects the rising need for financial expertise in both personal and corporate sectors. As businesses and individuals seek to manage their finances more effectively, the demand for skilled Financial Planning Managers will continue to rise. This trend makes it an excellent time for job seekers to enter this field.

Financial Planning Managers enjoy a competitive salary, with an average annual compensation of $174,820, according to the BLS. This figure underscores the value placed on their expertise and the significant impact they have on financial success. With a solid job outlook and attractive compensation, this career path is a smart choice for those looking to build a stable and rewarding career.

Currently 129 Financial Planning Manager job openings, nationwide.

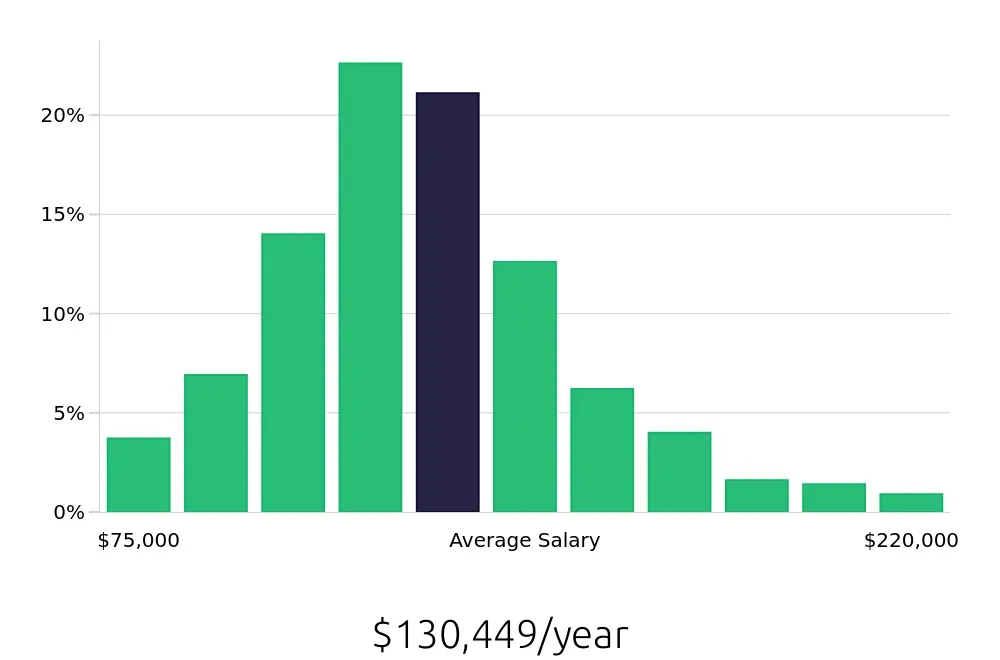

Continue to Salaries for Financial Planning Manager