What does a Financial Services Officer do?

A Financial Services Officer plays a key role in managing the financial activities of an organization. This role involves ensuring the smooth flow of financial operations. Tasks often include budgeting, financial reporting, and compliance with financial regulations. The officer works to maximize the organization's financial performance while minimizing risks.

The responsibilities of a Financial Services Officer cover a wide range of financial activities. They prepare detailed financial reports, which provide insights into the organization's financial health. They also monitor cash flow and ensure that the company has enough funds to meet its obligations. This officer collaborates with other departments to provide financial advice and support. They play a crucial role in making strategic financial decisions that help the organization achieve its goals.

How to become a Financial Services Officer?

Becoming a Financial Services Officer involves a clear and strategic path. This role is crucial in managing financial operations and ensuring compliance with financial regulations. Follow these steps to start a rewarding career in financial services.

The journey to becoming a Financial Services Officer begins with education and relevant experience. Secure a bachelor's degree in finance, accounting, or a related field. Look for internships or entry-level positions in financial services to gain practical experience. These steps lay a solid foundation for future career growth.

Next, build a strong skill set. Develop proficiency in financial analysis, risk management, and investment strategies. Gaining certifications, such as the Chartered Financial Analyst (CFA) designation, can enhance credibility and career prospects. Networking with professionals in the field also opens up new opportunities for career advancement.

- Earn a bachelor's degree in finance or a related field.

- Gain experience through internships or entry-level jobs.

- Develop essential skills in financial analysis and risk management.

- Obtain relevant certifications to boost your credentials.

- Network with industry professionals to find career opportunities.

Finally, consider pursuing advanced degrees or specialized training. A master's degree in finance or an MBA can provide deeper insights and open higher-level positions. Continuous learning and staying updated with industry trends will ensure long-term success in the financial services sector.

How long does it take to become a Financial Services Officer?

To work as a Financial Services Officer, the journey involves a blend of education and experience. Typically, an individual needs a bachelor's degree in finance, accounting, or a related field. This academic path generally takes four years to complete. Following this, gaining relevant experience is essential.

Most employers prefer candidates with a few years of experience in financial roles. Some positions may require a master's degree or professional certifications, such as the Chartered Financial Analyst (CFA) designation. This additional education can take another one to two years. Experience levels and specific qualifications can affect how long the entire process takes. However, the combination of education and practical experience provides a solid foundation for a career in financial services.

Financial Services Officer Job Description Sample

The Financial Services Officer will be responsible for managing and overseeing financial operations, ensuring compliance with financial regulations, and developing strategies to enhance financial performance. This role requires a detailed understanding of financial markets, risk management, and strategic financial planning.

Responsibilities:

- Develop and implement financial policies and procedures.

- Prepare and manage the organization's annual budget.

- Conduct financial analysis and provide recommendations for cost reduction and revenue enhancement.

- Monitor and report on financial performance, including budget variances.

- Ensure compliance with financial regulations and internal control systems.

Qualifications

- Bachelor's degree in Finance, Accounting, or a related field.

- Professional certification such as CFA, CPA, or ACCA is preferred.

- Minimum of 5 years of experience in a financial services role.

- Strong knowledge of financial markets, investment products, and risk management.

- Excellent analytical and problem-solving skills.

Is becoming a Financial Services Officer a good career path?

A Financial Services Officer plays a crucial role in managing and overseeing financial activities within a company or organization. This career offers a variety of opportunities and responsibilities. Duties can include analyzing financial data, creating budgets, and advising on investments. The role demands strong analytical skills and an understanding of financial markets.

This career path has several benefits. It often leads to good job security and a competitive salary. Financial Services Officers also have chances for advancement. However, this field can be stressful due to high expectations and tight deadlines. Additionally, it requires ongoing education to stay current with financial laws and trends.

Here are some pros and cons to consider:

- Pros:

- Job security

- Competitive salary

- Opportunities for advancement

- Cons:

- High stress levels

- Tight deadlines

- Need for ongoing education

What is the job outlook for a Financial Services Officer?

If you're considering a career as a Financial Services Officer, you're in luck. According to the Bureau of Labor Statistics (BLS), there are typically around 3,600 job positions available each year. This steady demand shows a solid job outlook. The BLS also predicts a 3.3% increase in job openings from 2022 to 2032. This growth highlights the continued importance of financial services in our economy. Securing a position as a Financial Services Officer can lead to a rewarding and stable career.

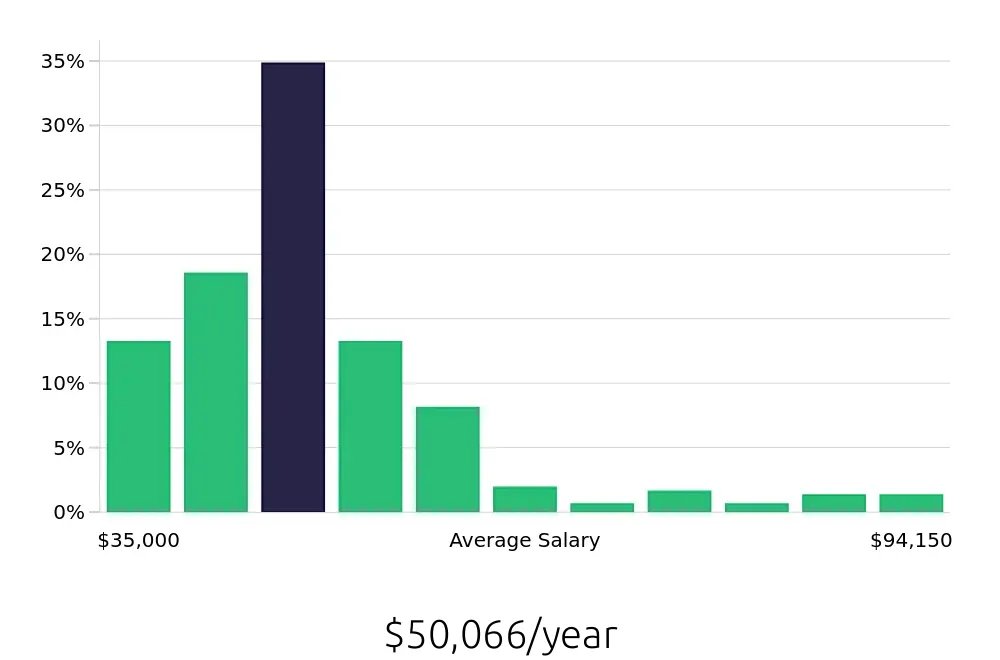

Financial Services Officers earn a competitive salary. The BLS reports an average national annual compensation of $90,880. This figure reflects the expertise and responsibility that comes with the role. On an hourly basis, the average compensation is $43.69. These numbers provide a clear picture of the financial rewards that come with this career path. Job seekers can expect fair compensation for their skills and contributions.

For those looking to enter this field, the job outlook is promising. With an average of 3,600 positions opening annually and a projected growth of 3.3%, the field remains vibrant. The attractive salary, averaging $90,880 per year, adds to the appeal. Averaging $43.69 per hour further underscores the value placed on this role. This combination of steady demand and good compensation makes it an excellent choice for job seekers.

Currently 36 Financial Services Officer job openings, nationwide.

Continue to Salaries for Financial Services Officer