What does a Payment Processor do?

A Payment Processor manages and facilitates financial transactions between businesses and their customers. This role ensures that payments are accurately and timely processed. The Payment Processor works with various payment systems, including credit cards, bank transfers, and digital wallets.

Key responsibilities include verifying transaction details, handling disputes, and maintaining detailed records of all transactions. The Payment Processor must also ensure the security of financial data and comply with industry regulations. This position requires strong attention to detail and excellent customer service skills. The role often involves using specialized software to monitor transaction statuses and troubleshoot any issues that may arise.

How to become a Payment Processor?

Becoming a Payment Processor is a rewarding career path for those interested in the financial services industry. It requires a blend of technical skills and a solid understanding of financial transactions. This career allows one to facilitate the smooth exchange of money between businesses and their customers. Securing a position in this field can lead to an important role within many companies.

The journey to becoming a Payment Processor involves several key steps. Following these steps will help individuals gain the necessary skills and qualifications for this career. Below are the steps to take to start this career.

- Gain Relevant Education: Start with a high school diploma or GED. A degree in business, finance, or a related field can be beneficial. Some community colleges offer courses in payment processing.

- Learn Technical Skills: Understand how payment systems work. Learn about different payment methods and security protocols. Familiarity with software used in payment processing is crucial.

- Get Certified: Consider certifications such as Certified Payment Professional (CPP) or Certified Electronic Funds Specialist (CEFS). These credentials can make a resume stand out.

- Gain Experience: Look for entry-level positions in financial services or customer service. Experience in retail or banking can also be valuable. Internships or part-time jobs in payment processing are ideal.

- Network and Apply: Connect with professionals in the field through industry events and online platforms. Apply for positions that match skills and experience. Tailor each application to highlight relevant experience and skills.

How long does it take to become a Payment Processor?

The path to becoming a Payment Processor varies depending on education and experience. Those with a high school diploma can often complete a certificate program in a few months. This program usually includes courses on transaction processing and customer service.

Individuals who wish to advance may pursue a bachelor’s degree in finance, business, or a related field. This can take about four years. Some employers may prefer candidates with a degree. This degree can lead to better job opportunities and higher pay.

Experience matters. Many Payment Processors start in entry-level positions. They gain experience over time. With dedication and the right training, a person can successfully transition into this important role.

Payment Processor Job Description Sample

A Payment Processor is responsible for handling financial transactions for a company. They ensure the accuracy and security of all payment processing activities, manage accounts receivable and payable, and provide customer support regarding billing and payment issues.

Responsibilities:

- Process credit and debit card payments, electronic transfers, and checks in a timely and accurate manner.

- Maintain detailed and accurate records of all transactions.

- Resolve customer inquiries and disputes related to billing and payment.

- Monitor accounts receivable and payable to ensure timely collection and payment.

- Reconcile bank statements and other financial documents.

Qualifications

- High school diploma or equivalent; additional education in finance or accounting preferred.

- Previous experience in a similar role, preferably in a related industry.

- Proficient in using payment processing software and financial systems.

- Strong attention to detail and accuracy in handling financial transactions.

- Excellent problem-solving skills and the ability to handle customer inquiries effectively.

Is becoming a Payment Processor a good career path?

A career as a Payment Processor offers a stable path in the financial industry. Payment Processors handle transactions between businesses and customers. They ensure that payments are processed accurately and securely. This job often requires attention to detail and strong organizational skills. Most Payment Processors work in an office setting, but some may also work remotely. The role can lead to various opportunities within the financial sector.

Working as a Payment Processor has its benefits and challenges. The pros include job stability, as the demand for financial transactions remains constant. Payment Processors usually work regular hours and often benefit from health and retirement plans. However, the job can be repetitive, requiring careful attention to details. The role may involve long hours, especially during peak transaction periods. Understanding these pros and cons helps in making an informed career decision.

Consider the following points before pursuing a career as a Payment Processor:

- Pros:

- Job stability

- Regular work hours

- Potential for advancement

- Cons:

- Repetitive tasks

- High attention to detail required

- Possible long hours during peak periods

What is the job outlook for a Payment Processor?

The job outlook for Payment Processors is a promising field for job seekers. According to the Bureau of Labor Statistics (BLS), there are about 183,900 positions available each year. This shows that there are many opportunities for those looking to enter this career. Payment Processors play a vital role in the financial industry, helping businesses and individuals with their transactions. This constant need ensures that there will always be jobs available.

When looking at job growth, the BLS predicts a change of -6.2% from 2022 to 2032. Though this might seem like a decline, it is still important to understand what this means. This percentage does not indicate a decrease in demand but rather a slow change in the job market. With technology evolving, the role of Payment Processors is becoming more critical. This means that while the number of positions may not grow rapidly, the existing jobs will remain important.

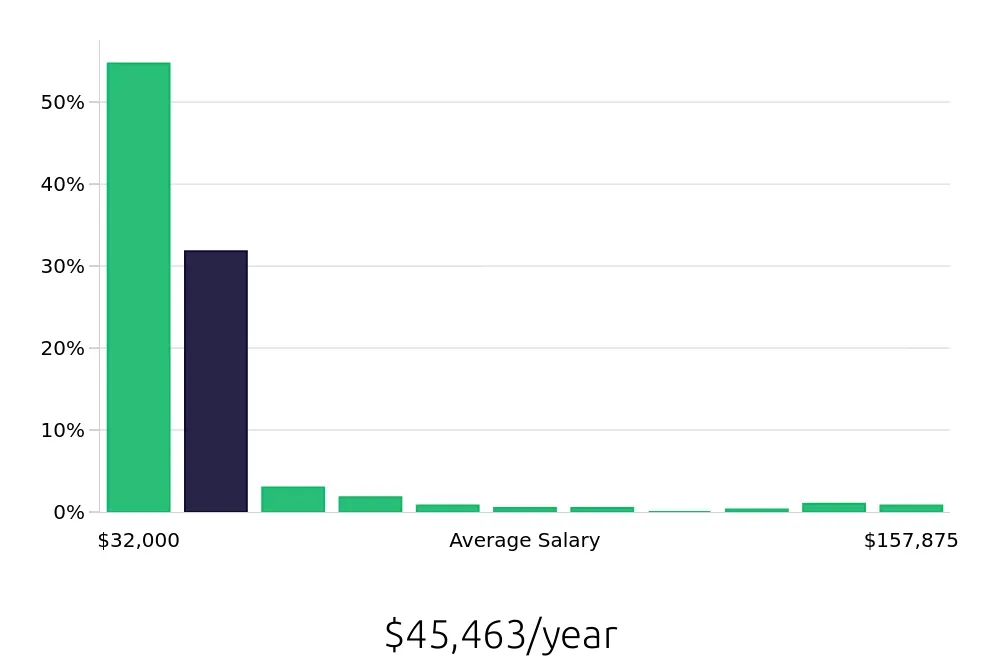

Payment Processors earn an average national annual compensation of $49,580, as reported by the BLS. Hourly, they earn about $23.84. This compensation reflects the skill and responsibility needed in this role. The financial sector values accuracy and efficiency, which Payment Processors must provide. With experience and skill, professionals in this field can look forward to competitive salaries and opportunities for advancement.

Currently 37 Payment Processor job openings, nationwide.

Continue to Salaries for Payment Processor