What does a Pricing Actuary do?

A Pricing Actuary evaluates risk and calculates premiums for insurance companies. This role involves analyzing statistical data to predict future trends. They use this information to set fair prices for insurance policies. The work helps ensure that the company remains profitable while offering competitive rates to customers.

Pricing Actuaries use their expertise to balance risk and reward. They gather and interpret data from various sources. This includes accident records, health statistics, and financial reports. They apply mathematical models to this data. This helps determine how much to charge for insurance. Their work supports the development of new insurance products. It also aids in adjusting existing policies to meet market demands. Their insights help maintain the financial health of the company.

How to become a Pricing Actuary?

Becoming a Pricing Actuary involves gaining specific knowledge and skills that align with the demands of the insurance industry. This career path requires a blend of education, experience, and certification. A structured approach can help professionals transition into this role effectively.

Here are the steps to becoming a Pricing Actuary:

- Earn a relevant degree. Start with a bachelor's degree in actuarial science, mathematics, statistics, or a related field.

- Gain experience. Work in roles that provide actuarial experience, such as an actuarial analyst or underwriter.

- Pass the necessary exams. Study for and pass the exams required by actuarial societies like the Society of Actuaries (SOA) or the Casualty Actuarial Society (CAS).

- Join a professional organization. Become a member of an actuarial organization to access resources and networking opportunities.

- Continue education. Stay updated with industry trends by attending seminars and workshops.

How long does it take to become a Pricing Actuary?

Pursuing a career as a Pricing Actuary offers a rewarding path in the finance sector. It involves a mix of education, exams, and practical experience. On average, it takes about four to six years to become a Pricing Actuary. This timeline includes earning a degree, passing relevant exams, and gaining industry experience.

First, a bachelor's degree in a field like mathematics, statistics, or actuarial science lays the groundwork. Then, candidates must pass a series of actuarial exams, typically through the Society of Actuaries or the Casualty Actuarial Society. These exams cover subjects such as probability, finance, and economics. Passing these exams requires study and practice, often taking several years. After passing the exams, new actuaries need to gain experience in the field, usually through a job or internship. This hands-on work is key to fully understanding actuarial pricing.

Overall, becoming a Pricing Actuary needs dedication and time. It involves mastering key skills and knowledge. The journey can be long, but it leads to a stable and lucrative career in a growing field.

Pricing Actuary Job Description Sample

The Pricing Actuary will be responsible for applying actuarial and statistical techniques to develop and maintain pricing models and methodologies for insurance products. They will analyze data, interpret results, and provide recommendations for pricing strategies to ensure the profitability and competitiveness of the company's insurance offerings.

Responsibilities:

- Develop, implement, and maintain pricing models and methodologies for insurance products.

- Analyze historical claims data and market trends to identify pricing risks and opportunities.

- Collaborate with underwriting, claims, and other relevant teams to ensure accurate and consistent application of pricing models.

- Perform actuarial analyses to support pricing decisions and evaluate the impact of changes in pricing assumptions and market conditions.

- Prepare and present pricing recommendations to senior management and stakeholders.

Qualifications

- Bachelor's degree in Actuarial Science, Mathematics, Statistics, or a related field. Advanced degree (e.g., Master's, PhD) is preferred.

- Actuarial designation (e.g., ACAS, FCAS, FCA) or in the process of obtaining one.

- Proven experience as an actuary, with a focus on pricing and rate-making.

- Strong analytical and problem-solving skills with a solid understanding of actuarial techniques and statistical methods.

- Proficiency in programming languages such as R, Python, or SAS for data analysis and model development.

Is becoming a Pricing Actuary a good career path?

A Pricing Actuary examines data to determine the cost of products or services. They work for companies that need to set fair prices, such as insurance firms, banks, and pension funds. This role combines math skills with business knowledge. It requires understanding complex data and explaining it in simple terms.

The job involves working with numbers and making financial predictions. It can lead to good career growth and opportunities to specialize. Pricing Actuaries have a chance to influence business decisions. They help ensure their company's products are competitively priced. This work can be challenging but rewarding. It offers a stable career with the chance to advance.

Here are some pros and cons to think about:

- Pros:

- Stability: This job is in demand and often comes with job security.

- Competitive Pay: Pricing Actuaries usually earn a good salary.

- Advancement: There are opportunities to move up to senior roles.

- Job Satisfaction: Many find this role rewarding due to its impact on business decisions.

- Cons:

- Long Hours: This job can be demanding and require long hours, especially during peak periods.

- High Pressure: Pricing decisions can have significant financial impacts.

- Stress: Balancing accuracy with tight deadlines can be stressful.

- Continuous Learning: The field is always changing, requiring ongoing education.

What is the job outlook for a Pricing Actuary?

Job seekers interested in becoming a Pricing Actuary can look forward to a growing job market. The Bureau of Labor Statistics (BLS) reports that there are about 2,300 job openings each year. This field provides a promising outlook for professionals with the right skills and training. The BLS also projects a 23.2% increase in job openings from 2022 to 2032. This growth indicates a strong demand for expertise in pricing and risk assessment.

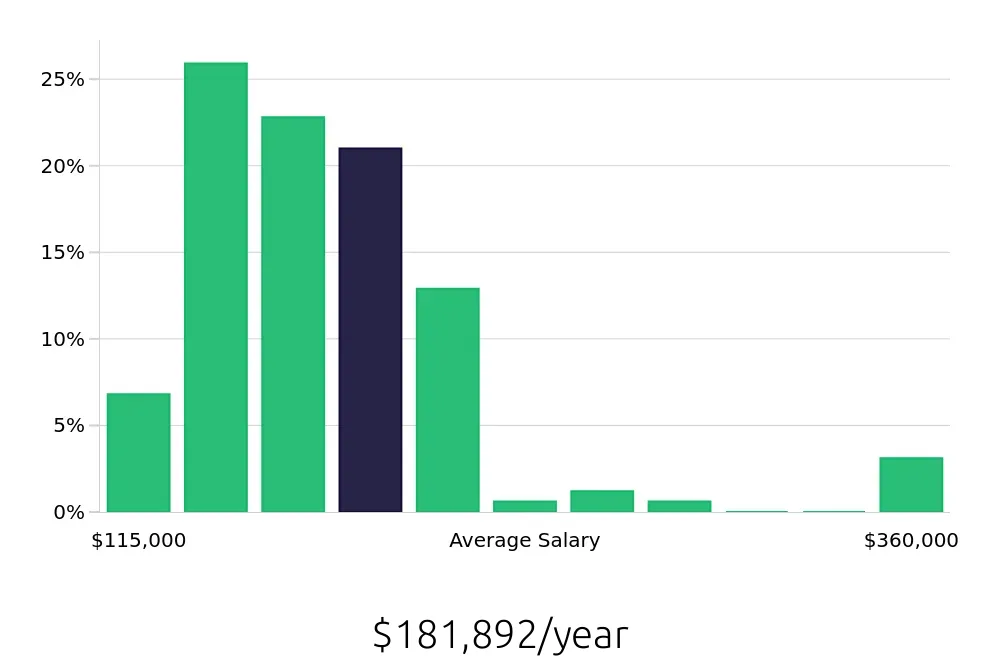

A career as a Pricing Actuary offers competitive compensation. The BLS reports an average national annual salary of $132,500. This figure reflects the value companies place on skilled actuaries who can accurately assess risks and price financial products. Hourly compensation averages $63.7, which adds up to a substantial annual income for those in this profession. This salary level makes it an attractive career choice for many job seekers.

The role of a Pricing Actuary involves using statistical models to price insurance policies and assess risks. This job requires strong analytical skills and a solid understanding of mathematics and finance. Companies in the insurance and finance sectors actively seek professionals who can perform these tasks. With the growing demand for these skills, job seekers can expect a stable and potentially lucrative career path ahead.

Currently 84 Pricing Actuary job openings, nationwide.

Continue to Salaries for Pricing Actuary