What does a Trader do?

A trader buys and sells goods, stocks, or other financial instruments. They aim to make a profit by predicting market trends and movements. Traders analyze market data and news to make smart decisions. They manage risks by setting limits on investments.

Traders work in various environments, including stock exchanges, banks, and financial firms. They need to be quick thinkers and able to handle pressure. Success depends on their knowledge, experience, and ability to adapt to changing market conditions. Traders must also follow strict regulations to ensure fair and ethical practices.

Key responsibilities for a trader include:

- Researching market trends

- Analyzing financial data

- Making buy and sell decisions

- Managing trading accounts

- Reporting to supervisors

A successful trader combines analytical skills with strategic thinking. They play a crucial role in financial markets, helping to keep them efficient and balanced.

How to become a Trader?

Becoming a trader can lead to a rewarding career in the financial sector. It involves buying and selling assets like stocks, bonds, or commodities. This profession requires skill and knowledge. Follow these steps to start your journey as a trader.

First, traders need to understand the market. Research different markets and their rules. Know what influences asset prices. Reading financial news and market reports helps. Understanding these basics is key.

- Get the right education. Start with a bachelor's degree in finance, economics, or business. Courses in these areas give a solid foundation.

- Gain experience. Look for internships or entry-level jobs in trading firms. This real-world experience is very valuable. It helps you learn the ins and outs of the job.

- Obtain necessary licenses. Traders often need specific licenses. These depend on the type of trading. Research what licenses are needed in your area.

- Develop a trading plan. Create a clear plan for how to trade. This plan should include goals, strategies, and risk management. Stick to this plan to succeed.

- Continue learning and networking. The market changes constantly. Stay updated with new trends and technologies. Networking with other traders can provide insights and opportunities.

How long does it take to become a Trader?

Trading can be a rewarding career path, but how long does it take to become a trader? The time varies based on the type of trading and the individual's commitment. Some traders start with a solid educational background and gain experience through internships or entry-level positions. They might spend several years learning the market and refining their skills. Others might choose to enter the field with a more practical approach, starting as a day trader or apprentice and learning on the job.

Factors affecting the timeline include the amount of time spent on education, the type of trading pursued, and the individual's ability to learn and adapt. For instance, someone with a strong background in finance or economics might enter the field faster than someone without prior knowledge. Continuous learning and keeping up with market trends are also crucial. Engaging with mentors and industry professionals can further speed up the learning process. Ultimately, dedication and hard work determine how quickly someone becomes a successful trader.

Trader Job Description Sample

A Trader is responsible for buying and selling commodities, securities, currencies, or other financial instruments to generate profits and manage risks. This role involves analyzing market trends, making informed decisions, and executing trades within the organization's trading strategies.

Responsibilities:

- Conduct market research and analysis to identify trading opportunities.

- Develop and implement trading strategies based on market conditions and financial analysis.

- Monitor and evaluate the performance of trading activities and make necessary adjustments.

- Execute trades and manage open positions to maximize returns and minimize risks.

- Collaborate with the finance and risk management teams to ensure compliance with trading policies and regulations.

Qualifications

- Bachelor's degree in Finance, Economics, Business Administration, or a related field.

- Minimum of 3-5 years of experience in trading or a related financial role.

- Strong understanding of financial markets, instruments, and trading strategies.

- Proficiency in using trading platforms, financial analysis tools, and data management systems.

- Excellent analytical and problem-solving skills with attention to detail.

Is becoming a Trader a good career path?

A career as a trader offers unique opportunities in the financial world. Traders buy and sell assets, such as stocks, bonds, and commodities. This role often requires sharp analytical skills and the ability to make quick decisions. Markets can be fast-paced and exciting, offering high rewards for those who succeed.

Traders need to stay informed about market trends and economic news. This career can be very rewarding, both financially and professionally. However, it also comes with its own set of challenges. Traders face high levels of competition and the risk of financial loss. Success often depends on experience, skill, and a bit of luck. Understanding the pros and cons can help a job seeker decide if this is the right path for them.

Here are some pros of being a trader:

- High Earning Potential: Successful traders can make significant income, especially with commissions and bonuses.

- Dynamic Work Environment: The market is always changing, providing a stimulating and engaging work environment.

- Opportunities for Growth: Traders can advance to higher positions, such as portfolio managers or financial analysts.

- Independence: Many traders have the flexibility to work from home or set their own hours.

Here are some cons to consider:

- High Risk: Traders often deal with significant financial risks. Losses can be substantial.

- Stressful: The fast-paced nature of trading can lead to high stress and long hours.

- Competitive: The field is highly competitive, with many skilled professionals vying for the same positions.

- Constant Learning: Traders must continuously update their knowledge to stay ahead of the curve.

What is the job outlook for a Trader?

Trading in the financial markets offers a dynamic career path with substantial opportunities. On average, around 39,000 job positions open each year. This role is in demand due to the constant need for market analysis and strategic investment decisions. Job seekers entering this field can expect a competitive environment that rewards analytical skills and market knowledge.

The outlook for traders shows a slight decline in job openings, with a projected change of -7.7% from 2022 to 2032, according to the Bureau of Labor Statistics (BLS). Despite this decrease, the role remains vital in financial sectors. Candidates should focus on continuous learning and skill development to stay competitive. Networking and staying updated with market trends are essential for long-term success.

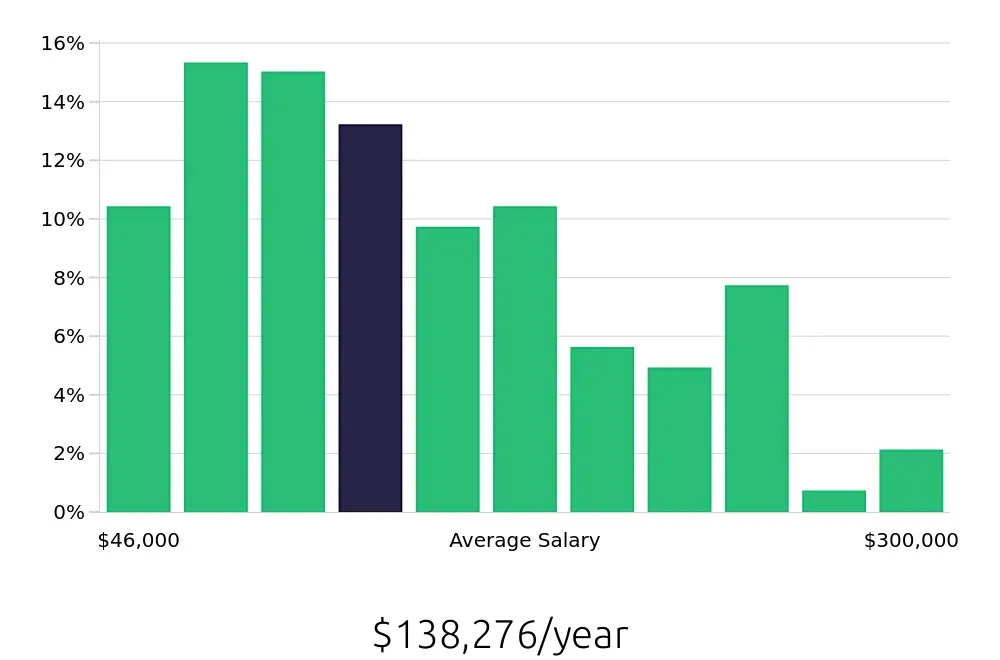

Traders can expect a solid financial reward for their work. The average national annual compensation stands at $77,850, with hourly rates averaging around $37.43. This compensation reflects the importance of skill and expertise in trading. Job seekers should consider the potential for growth and stability in this career, even with slight changes in job availability. The compensation and role significance make trading a promising choice for those interested in finance.

Currently 26 Trader job openings, nationwide.

Continue to Salaries for Trader