How much does a Claims Analyst make?

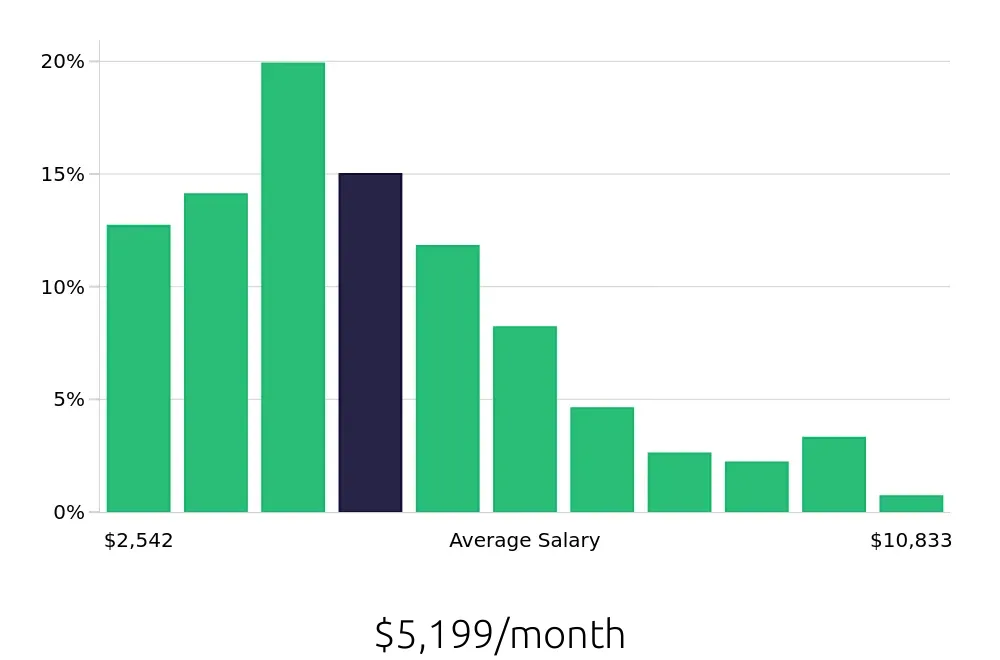

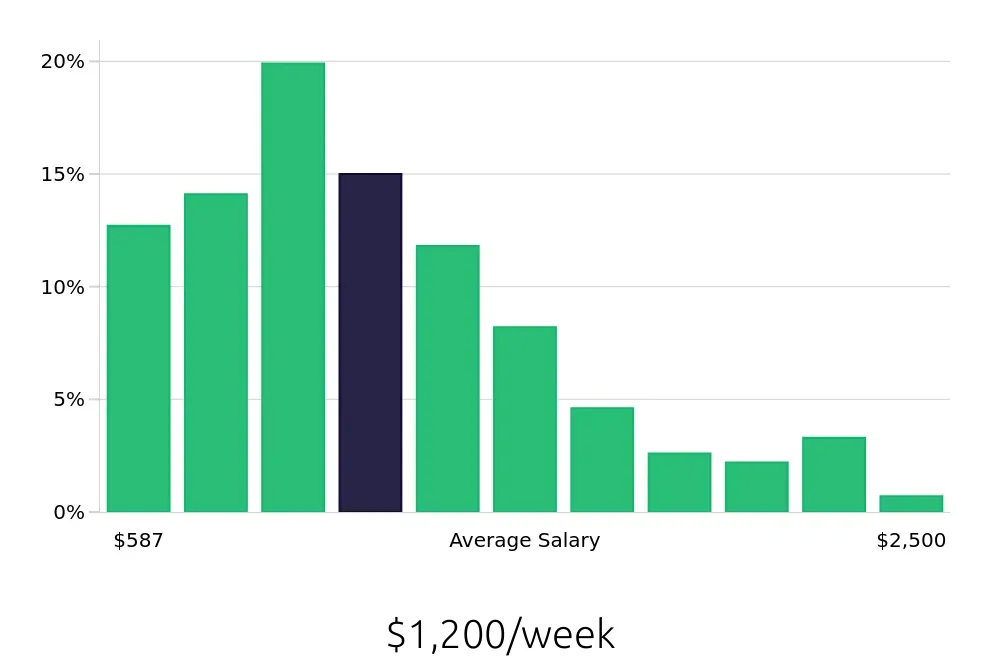

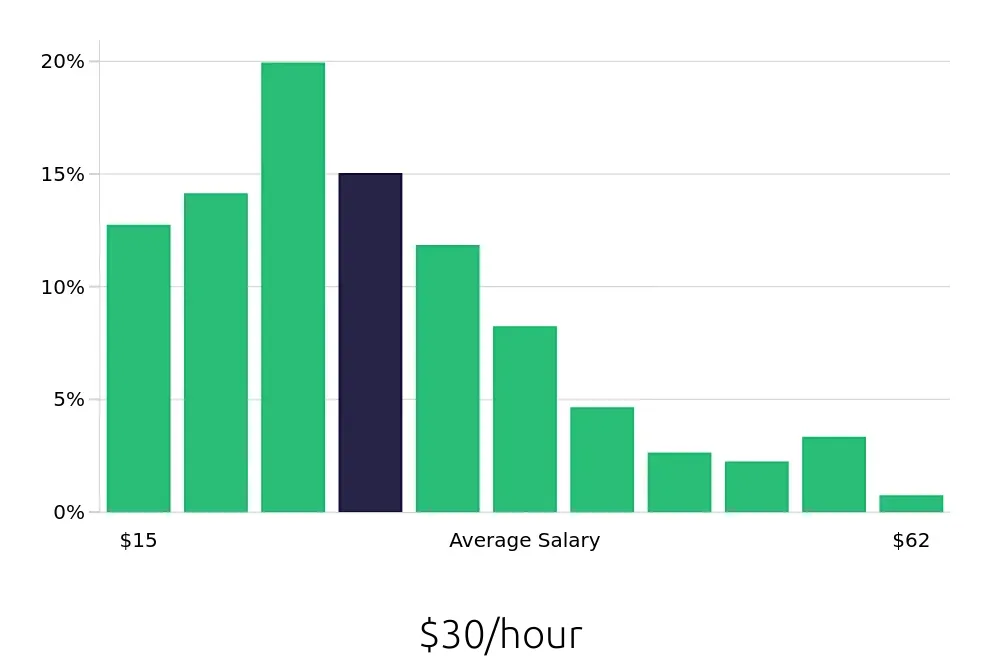

A Claims Analyst plays an important role in the insurance and finance sectors. They review and process insurance claims, assess policy coverage, and determine the payout amounts. The salary for this position varies based on experience and location. In general, the average yearly salary for a Claims Analyst stands at approximately $62,392.

To give a more detailed view, the salary range for Claims Analysts spans a broad spectrum. Starting from the entry-level positions, analysts earn around $30,500. As experience grows, salaries can climb significantly. The top earners in this field can make up to $130,000 per year. Here’s a quick look at the salary distribution:

- 10th percentile: $30,500

- 25th percentile: $39,545

- 50th percentile: $48,591

- 75th percentile: $75,727

- 90th percentile: $111,909

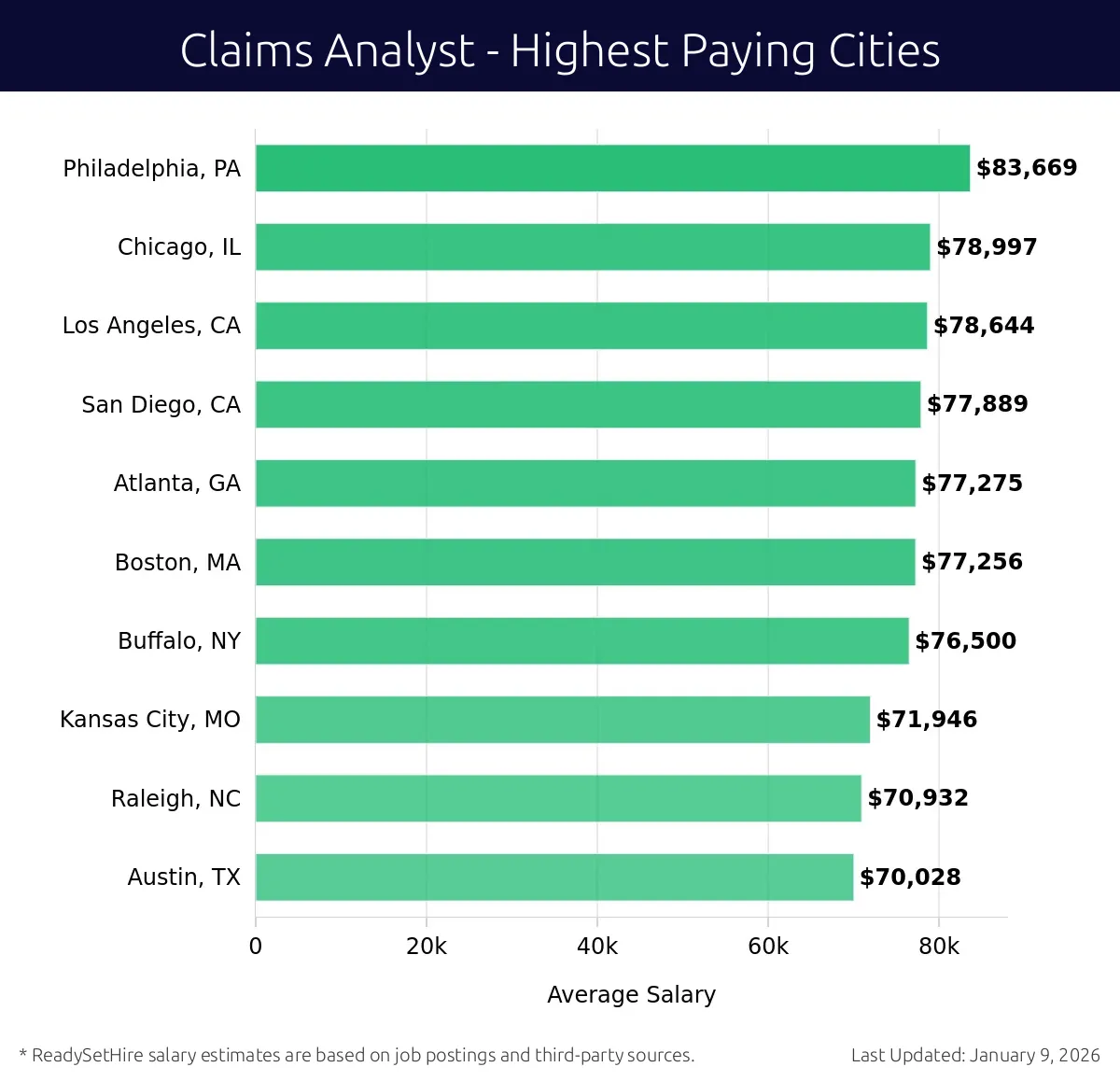

What are the highest paying cities for a Claims Analyst?

-

Philadelphia, PA

Average Salary: $83,669

In Philadelphia, working as an analyst involves processing claims for well-known insurance firms. The city’s vibrant job market provides various opportunities. Philadelphia’s blend of urban and historic charm makes it a unique place to work.

Find Claims Analyst jobs in Philadelphia, PA

-

Chicago, IL

Average Salary: $78,997

Chicago offers a bustling environment for those in the claims industry. The city boasts major insurance companies, offering robust career growth. Working here means dealing with a dynamic range of claims, keeping professionals engaged.

Find Claims Analyst jobs in Chicago, IL

-

Los Angeles, CA

Average Salary: $78,644

Los Angeles provides a vibrant setting for claims analysts. The city’s insurance sector is robust, with numerous companies seeking skilled professionals. The diverse workforce and lively atmosphere enhance the job experience.

Find Claims Analyst jobs in Los Angeles, CA

-

San Diego, CA

Average Salary: $77,889

San Diego presents a serene environment for handling claims. The city’s growing tech and insurance industries offer many job opportunities. Working here means enjoying a balanced lifestyle with a stable career.

Find Claims Analyst jobs in San Diego, CA

-

Atlanta, GA

Average Salary: $77,275

Atlanta is a hub for claims professionals, with several prominent insurance firms present. The city offers a lively job market and a chance to work with cutting-edge technology. The warm climate adds to the appeal.

Find Claims Analyst jobs in Atlanta, GA

-

Boston, MA

Average Salary: $77,256

Boston offers a rich environment for those in the claims field. The city’s historic charm meets modern career opportunities in insurance. Working here means being part of a thriving industry with many learning chances.

Find Claims Analyst jobs in Boston, MA

-

Buffalo, NY

Average Salary: $76,500

Buffalo provides a supportive environment for claims analysts. The city’s strong insurance sector offers numerous job opportunities. The affordable cost of living and community feel make it a great place to work.

Find Claims Analyst jobs in Buffalo, NY

-

Kansas City, MO

Average Salary: $71,946

Kansas City offers a welcoming atmosphere for claims professionals. The city’s insurance companies provide a stable career path. The blend of urban and rural charm makes it an enjoyable place to live and work.

Find Claims Analyst jobs in Kansas City, MO

-

Raleigh, NC

Average Salary: $70,932

Raleigh presents a growing market for claims analysts. The city’s expanding tech and insurance sectors offer many job opportunities. The pleasant climate and friendly community add to the appeal.

Find Claims Analyst jobs in Raleigh, NC

-

Austin, TX

Average Salary: $70,028

Austin offers a dynamic environment for claims professionals. The city’s booming tech and insurance industries provide diverse job opportunities. Working here means being part of a vibrant community with a strong job market.

Find Claims Analyst jobs in Austin, TX

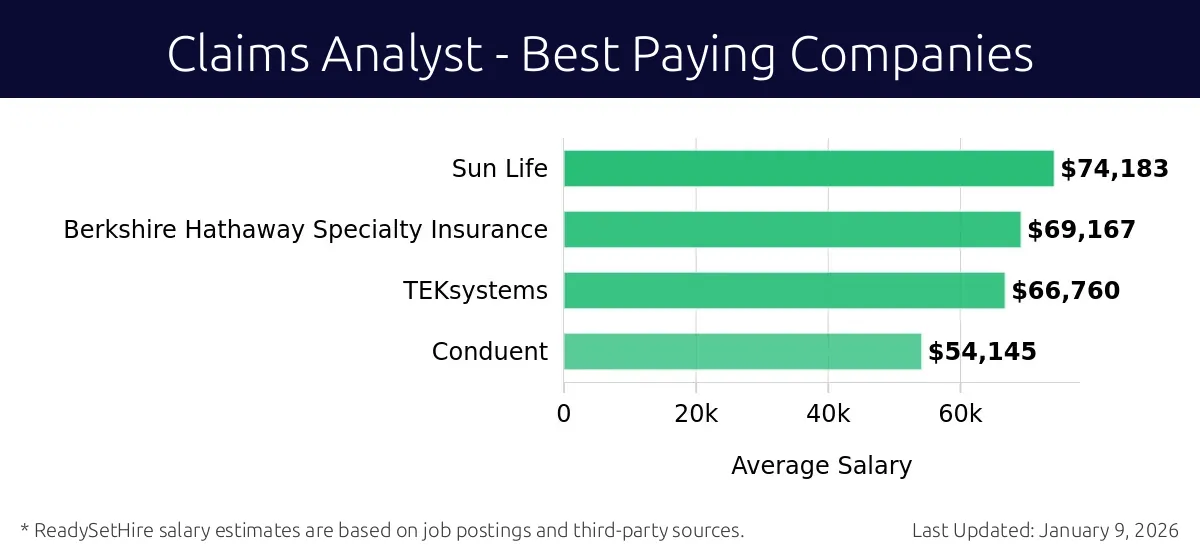

What are the best companies a Claims Analyst can work for?

-

Sun Life

Average Salary: $74,183

Sun Life offers competitive salaries for Claims Analysts. They have offices in major cities across North America and globally. Employees work on processing insurance claims, ensuring accurate information and quick responses. This company values experienced professionals.

-

Berkshire Hathaway Specialty Insurance

Average Salary: $69,167

Berkshire Hathaway Specialty Insurance provides a good salary for Claims Analysts. They operate in various locations, including the U.S. and internationally. Claims Analysts here manage complex insurance claims, working closely with clients to find solutions. The company is known for its supportive work environment.

-

TEKsystems

Average Salary: $66,760

TEKsystems offers a solid salary for Claims Analysts. With offices around the world, they hire professionals for different roles. At TEKsystems, Claims Analysts handle insurance claims, ensuring they are processed correctly. They focus on technology solutions to improve the claims process.

-

Conduent

Average Salary: $54,145

Conduent provides a fair salary for Claims Analysts. They have offices in many cities in the U.S. and abroad. Here, Claims Analysts review and process claims efficiently. The company emphasizes customer service and looks for dedicated professionals to join their team.

How to earn more as a Claims Analyst?

A Claims Analyst plays a crucial role in processing and evaluating insurance claims. To excel in this role, focus on enhancing your skills and gaining experience. By doing so, you can increase your earning potential. Here are some strategies to consider.

Firstly, gaining additional certifications can boost your resume. Certifications in insurance or claims management demonstrate your commitment to the field. They also make you more attractive to employers. Secondly, gaining experience in different areas of claims processing can make you more valuable. This includes working with various types of claims, such as auto, health, or property. Broadening your knowledge increases your ability to handle complex cases, which can lead to higher pay.

Building a strong network within the insurance industry can open doors to higher-paying opportunities. Attending industry conferences and joining professional associations can connect you with potential employers and colleagues. Networking can lead to job openings that pay more. Continuing education is another key factor. Taking courses in areas like risk management or financial analysis can enhance your skill set. These courses can make you a more versatile and valuable employee.

Lastly, seeking out leadership roles within your current position can set you apart. Taking on responsibilities like training new analysts or managing a team shows initiative and leadership. These roles often come with higher salaries. By focusing on these strategies, you can earn more as a Claims Analyst.

Consider these factors as part of your career plan. Certifications, varied experience, networking, education, and leadership roles can all lead to higher earnings.