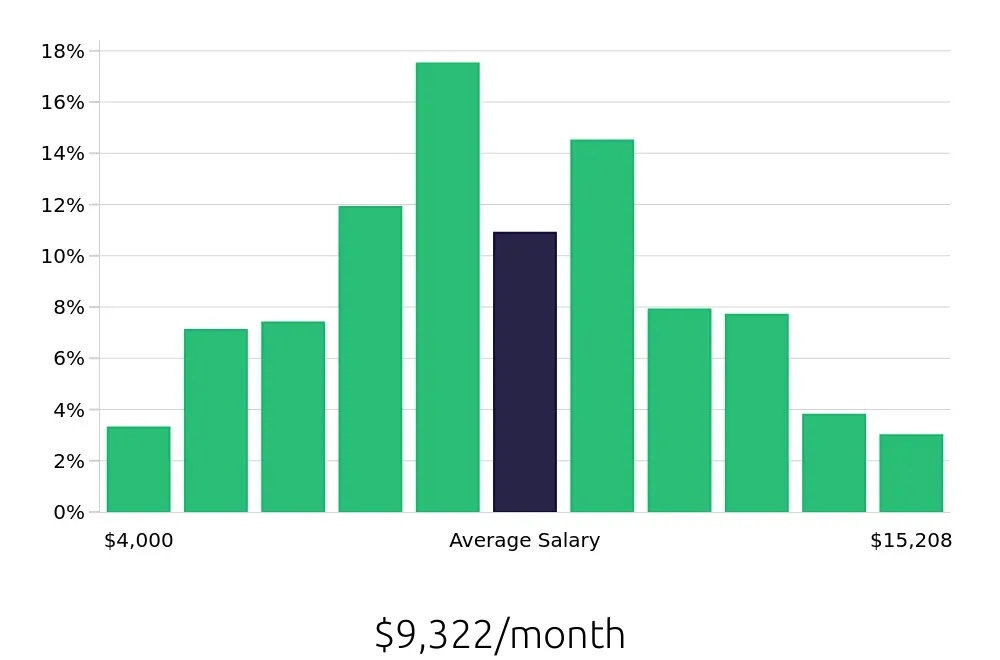

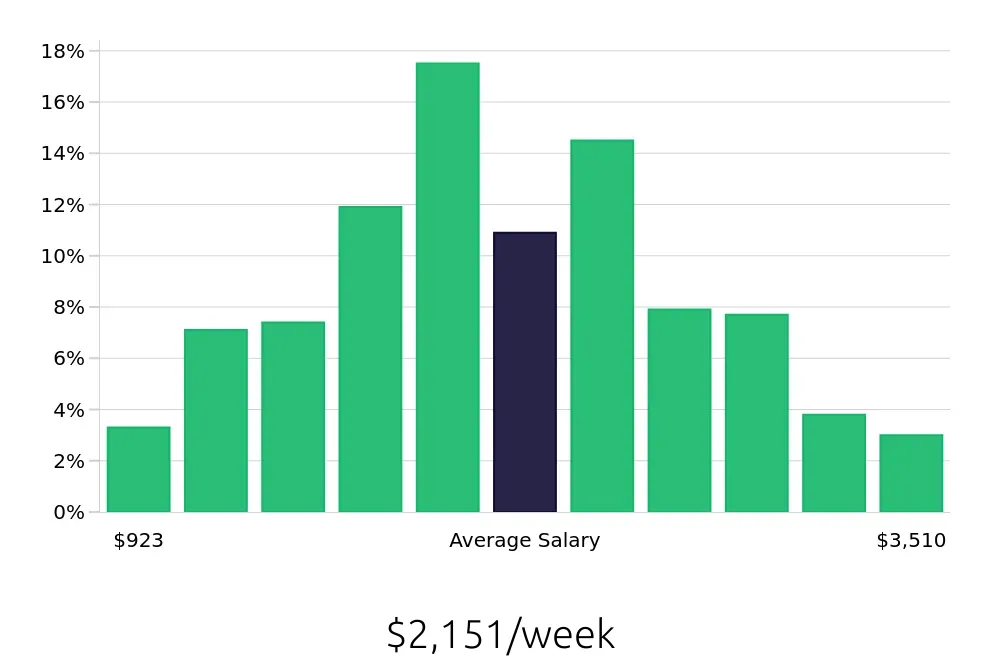

How much does a Claims Manager make?

A Claims Manager plays an important role in the insurance industry. They handle claims, make sure claims are processed fairly, and work to reduce costs. This job is in high demand, and it often pays well. On average, a Claims Manager makes $111,868 per year.

The salary for a Claims Manager can vary based on experience and location. Entry-level Claims Managers might earn around $48,000 per year. As they gain more experience, their salary can rise. Those with many years in the field might earn between $145,818 and $170,273 per year. Some top earners can make even more. The industry offers good opportunities for growth and higher pay as one gains more skills and experience.

What are the highest paying cities for a Claims Manager?

-

Colorado Springs, CO

Average Salary: $135,113

In Colorado Springs, a Claims Manager plays a vital role in handling insurance claims for various companies. The city's insurance sector is robust, with prominent firms like Liberty Mutual and New York Life offering many opportunities. The work is dynamic, demanding strong analytical skills and attention to detail.

Find Claims Manager jobs in Colorado Springs, CO

-

Philadelphia, PA

Average Salary: $133,836

Philadelphia boasts a thriving insurance market with companies like Comcast and Independence Blue Cross. As a Claims Manager, you will ensure smooth processing of insurance claims, providing essential support to policyholders. The role combines problem-solving with customer service, making it a rewarding career choice.

Find Claims Manager jobs in Philadelphia, PA

-

Hartford, CT

Average Salary: $129,660

Hartford, known as the insurance capital, offers diverse opportunities for a Claims Manager. Companies like Aetna and The Hartford are major employers. The role involves managing claims efficiently, supporting clients, and maintaining company policies. The city's rich insurance heritage provides a solid foundation for career growth.

Find Claims Manager jobs in Hartford, CT

-

Chicago, IL

Average Salary: $128,781

Chicago is a hub for insurance, with giants like Allstate and State Farm. A Claims Manager here works with a broad range of policies and clients. The fast-paced environment requires quick decision-making and excellent negotiation skills. The city's dynamic insurance landscape offers numerous career advancement opportunities.

Find Claims Manager jobs in Chicago, IL

-

Phoenix, AZ

Average Salary: $125,543

In Phoenix, a Claims Manager supports a growing insurance sector with companies like Farmers Insurance and Allstate. The role focuses on handling claims, assisting clients, and ensuring claims are processed accurately. The city's expanding market provides a good chance for professional development and growth.

Find Claims Manager jobs in Phoenix, AZ

-

San Diego, CA

Average Salary: $125,108

San Diego's insurance industry features key players like Geico and Farmers Insurance. As a Claims Manager, you will manage claims, assist policyholders, and maintain company standards. The city's favorable climate and growing market make it an appealing place to build a career in claims management.

Find Claims Manager jobs in San Diego, CA

-

Sacramento, CA

Average Salary: $123,009

Sacramento is home to major insurers like Blue Shield and Farmers Insurance. A Claims Manager here ensures claims are handled promptly and accurately. The role is crucial for maintaining client satisfaction and company efficiency. The city's insurance sector offers many opportunities for career advancement.

Find Claims Manager jobs in Sacramento, CA

-

Boston, MA

Average Salary: $121,078

Boston’s insurance scene includes prominent companies such as MassMutual and Liberty Mutual. A Claims Manager supports clients and handles claims efficiently. The city's rich insurance history provides a stable and supportive environment for professional growth. The role demands strong communication and analytical skills.

Find Claims Manager jobs in Boston, MA

-

San Antonio, TX

Average Salary: $116,898

In San Antonio, a Claims Manager works with leading insurance companies like USAA and Frost Bank. The role involves processing claims, assisting clients, and ensuring compliance with company policies. The city’s growing insurance sector offers ample opportunities for career development and stability.

Find Claims Manager jobs in San Antonio, TX

-

Atlanta, GA

Average Salary: $116,341

Atlanta’s insurance market features major players such as Aflac and Humana. A Claims Manager here manages claims, assists clients, and ensures efficient claim processing. The city's strong insurance presence offers a solid foundation for career growth and stability in the claims management field.

Find Claims Manager jobs in Atlanta, GA

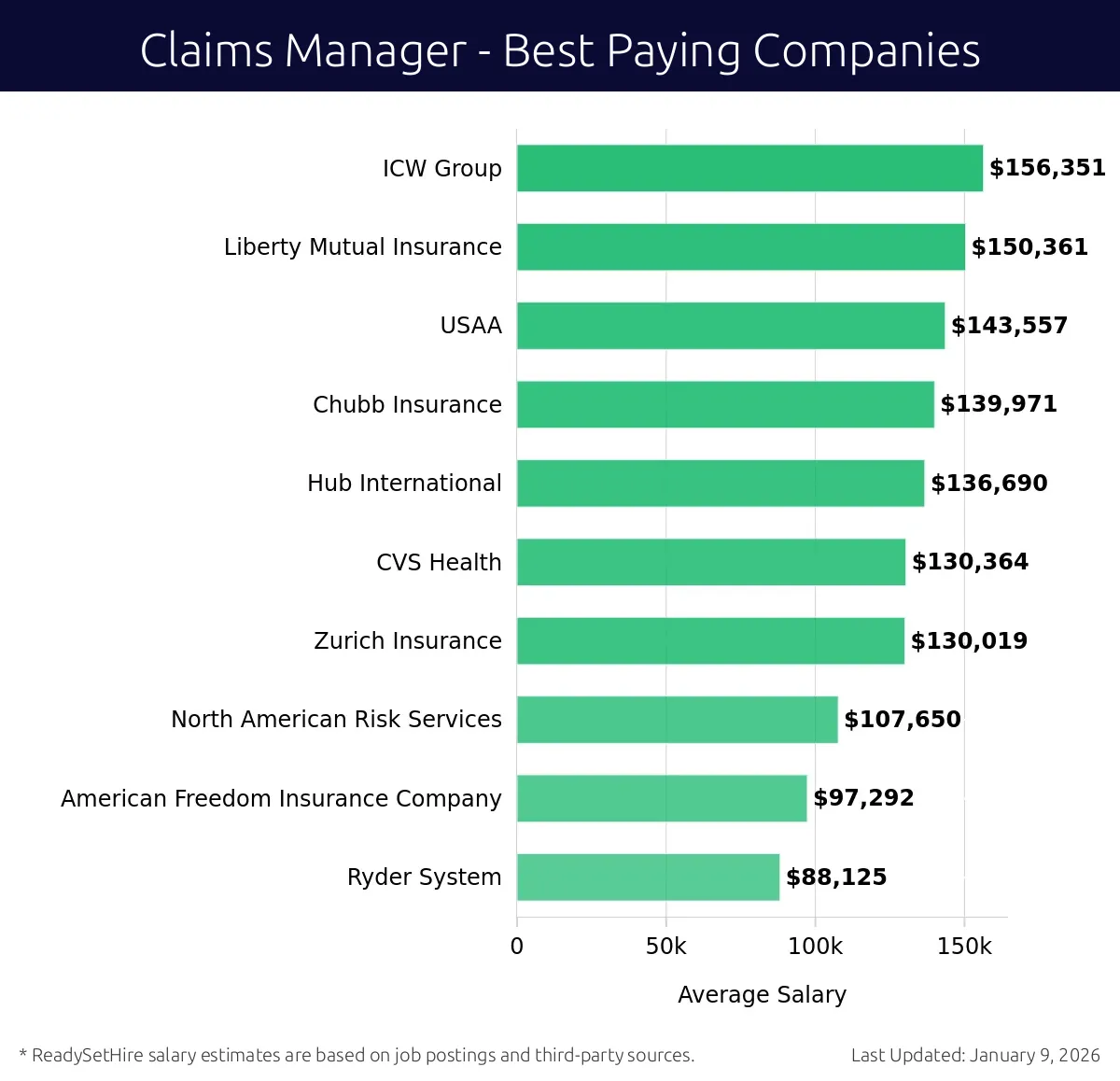

What are the best companies a Claims Manager can work for?

-

ICW Group

Average Salary: $156,351

ICW Group is a top company for Claims Manager roles, offering strong salaries and career growth. They operate in several states, including Illinois and Florida. At ICW Group, you will handle claims from start to finish, making decisions that impact policyholders. Their team values expertise and teamwork.

-

Liberty Mutual Insurance

Average Salary: $150,361

Liberty Mutual Insurance offers competitive salaries for Claims Managers. They have offices across the U.S., including Massachusetts and Texas. In this role, you will work with a diverse team, making sure claims are handled fairly and efficiently. Liberty Mutual values innovation and customer service.

-

USAA

Average Salary: $143,557

USAA is known for its high compensation for Claims Managers. They are headquartered in Texas but serve members nationwide. Here, you will manage claims for military members and their families. USAA emphasizes teamwork and a supportive work environment.

-

Chubb Insurance

Average Salary: $139,971

Chubb Insurance provides attractive salaries for Claims Managers. They operate globally, with a strong presence in the U.S. In this role, you will handle complex claims and ensure policyholders receive fair settlements. Chubb values integrity and a client-focused approach.

-

Hub International

Average Salary: $136,690

Hub International offers competitive pay for Claims Managers. They have offices in many states, including California and New York. You will work with clients to manage claims and minimize losses. Hub International encourages professional development and work-life balance.

-

CVS Health

Average Salary: $130,364

CVS Health provides good salaries for Claims Managers. They operate nationwide, with headquarters in Massachusetts. In this role, you will manage health insurance claims and ensure timely resolutions. CVS Health promotes a collaborative and inclusive work environment.

-

Zurich Insurance

Average Salary: $130,019

Zurich Insurance offers attractive compensation for Claims Managers. They have offices across the U.S., including Illinois and New York. Here, you will handle various types of insurance claims, working closely with clients. Zurich values innovation and a positive work culture.

-

North American Risk Services

Average Salary: $107,650

North American Risk Services provides reasonable pay for Claims Managers. They operate in several states, including California and Florida. In this role, you will manage claims for businesses, ensuring quick and fair resolutions. They focus on teamwork and client service.

-

American Freedom Insurance Company

Average Salary: $97,292

American Freedom Insurance Company offers decent pay for Claims Managers. They are headquartered in Florida but serve clients nationwide. Here, you will handle claims and ensure timely settlements. They value integrity and a supportive work environment.

-

Ryder System

Average Salary: $88,125

Ryder System provides fair compensation for Claims Managers. They operate across the U.S., with locations in Florida and California. In this role, you will manage claims for commercial clients, ensuring efficient service. Ryder System emphasizes teamwork and customer focus.

How to earn more as a Claims Manager?

Becoming a successful Claims Manager means not only managing insurance claims but also earning a competitive salary. With the right approach, job seekers can increase their earning potential in this role. One key factor is gaining experience. The more claims a manager handles, the better they understand the nuances of various claims, which can lead to more efficient and faster claim settlements. Another factor is obtaining relevant certifications. Certifications in claims management can make a manager more knowledgeable and credible, often leading to higher-paying positions.

Networking also plays a vital role in increasing earnings. Building strong relationships with other professionals in the industry can lead to better job opportunities and salary negotiations. Continuing education is another important factor. Attending workshops, seminars, and courses can keep a manager updated on the latest trends and best practices, making them more valuable to their employer. Lastly, effective communication skills are crucial. A manager who can clearly explain claims processes and outcomes to clients can improve customer satisfaction and potentially earn more through bonuses or promotions.

Here are some factors to consider for increasing earnings as a Claims Manager:

- Gain experience in managing various types of insurance claims.

- Obtain relevant certifications in claims management.

- Network with other industry professionals to discover better job opportunities.

- Continue education through workshops, seminars, and courses.

- Develop strong communication skills to improve customer satisfaction.