How much does a Consumer Banker make?

Consumer bankers play a crucial role in the financial sector, focusing on lending and saving services. They help individuals and businesses manage their finances. Their work is vital for economic growth. Knowing their salary range can guide those considering this career.

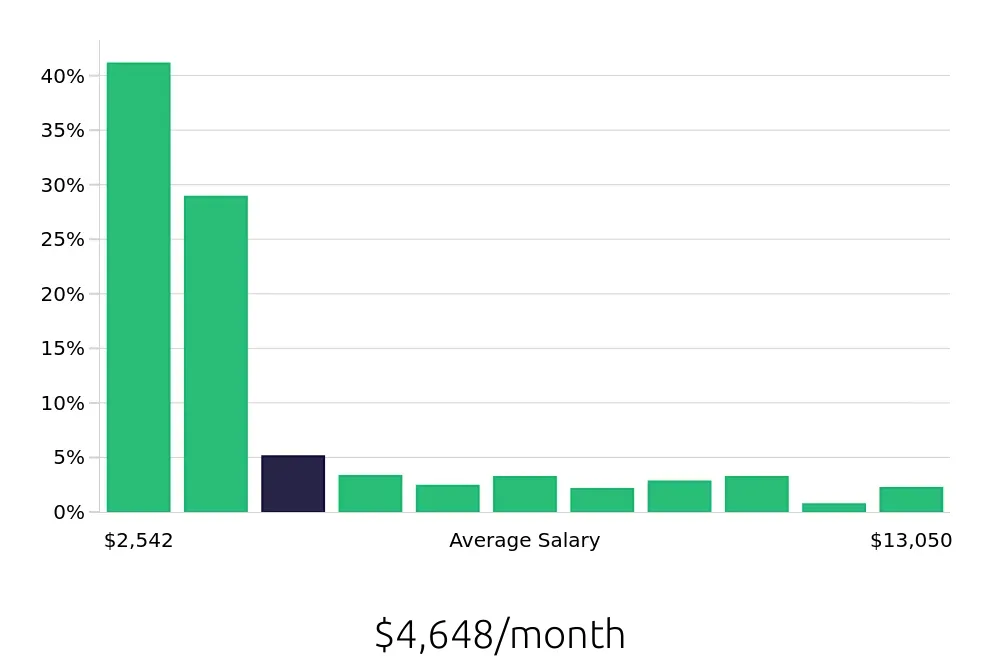

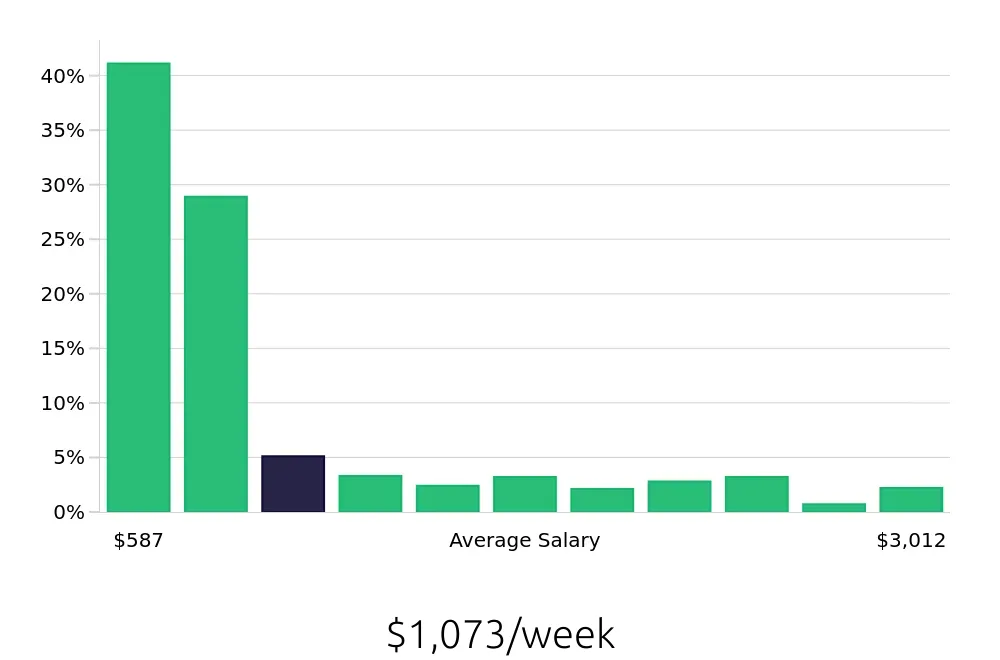

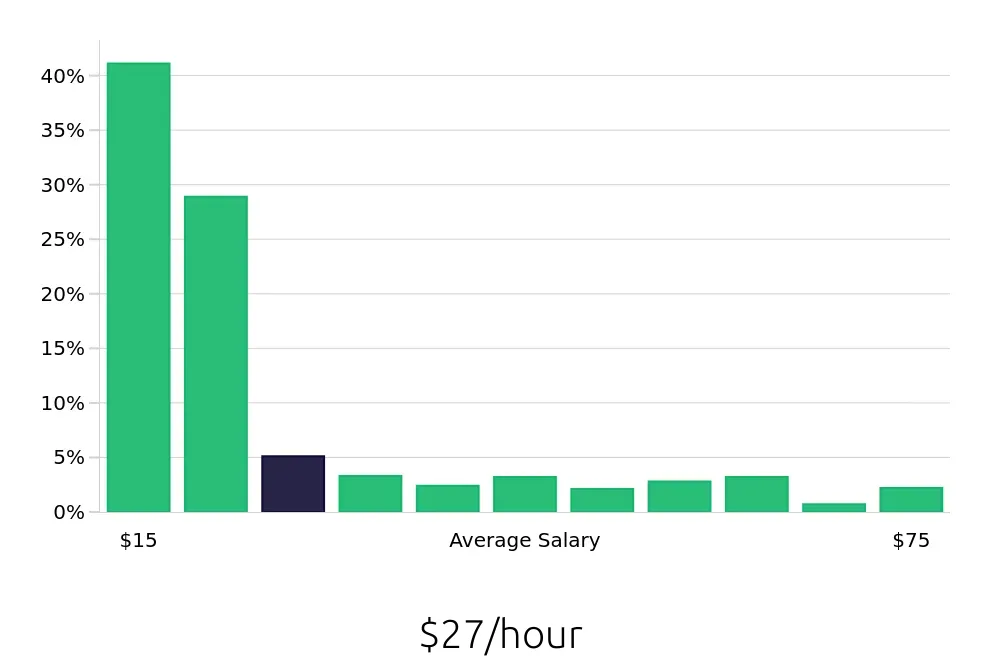

The average yearly salary for a consumer banker is $55,776. Salaries vary based on experience and location. At the entry level, consumer bankers earn around $30,500. Those with more experience can earn up to $156,602 a year. This wide range makes it a flexible career path for many.

Here are some salary milestones in this field:

- 25th percentile: $30,500

- 50th percentile: $53,428

- 75th percentile: $99,283

- 90th percentile: $122,211

- 95th percentile: $133,675

- 99th percentile: $145,139

What are the highest paying cities for a Consumer Banker?

-

Charlotte, NC

Average Salary: $135,286

Charlotte, often called the banking capital of the world, offers an excellent environment for banking professionals. The city is home to major banks like Bank of America and Wells Fargo. These institutions provide numerous opportunities for growth and development.

Find Consumer Banker jobs in Charlotte, NC

-

Minneapolis, MN

Average Salary: $90,770

In Minneapolis, the banking industry thrives, particularly at U.S. Bank and other leading financial institutions. This city values innovation and customer service, making it a great place for bankers who enjoy a dynamic work environment.

Find Consumer Banker jobs in Minneapolis, MN

-

Louisville, KY

Average Salary: $63,502

Louisville has a growing financial sector with prominent banks such as Fifth Third Bank. Here, bankers can enjoy a balance between work and the vibrant cultural scene, creating a fulfilling work experience.

Find Consumer Banker jobs in Louisville, KY

-

Colorado Springs, CO

Average Salary: $58,581

Colorado Springs is a hub for banking with institutions like Security Bank. The city's strong economy and beautiful surroundings make it an attractive place for those in the banking field.

Find Consumer Banker jobs in Colorado Springs, CO

-

Indianapolis, IN

Average Salary: $56,279

In Indianapolis, you will find a mix of big banks and local credit unions. The city’s central location and growing economy offer a stable and promising environment for financial professionals.

Find Consumer Banker jobs in Indianapolis, IN

-

Syracuse, NY

Average Salary: $55,648

Syracuse offers a close-knit banking community with local and regional banks. Working here provides a chance to build strong relationships and a sense of community.

Find Consumer Banker jobs in Syracuse, NY

-

Cincinnati, OH

Average Salary: $53,828

Cincinnati is known for its rich banking history with companies like Fifth Third Bank. The city provides a supportive environment for growth and a friendly community atmosphere.

Find Consumer Banker jobs in Cincinnati, OH

-

St. Louis, MO

Average Salary: $51,379

St. Louis has a vibrant banking sector with many local and national banks. The city’s central location and rich cultural heritage offer a dynamic work environment.

Find Consumer Banker jobs in St. Louis, MO

-

Denver, CO

Average Salary: $46,353

Denver offers a high-paced banking environment with access to major financial institutions. The city's outdoor lifestyle and strong economy make it an appealing place to work.

Find Consumer Banker jobs in Denver, CO

-

Greeley, CO

Average Salary: $44,464

Greeley combines a smaller city feel with strong banking opportunities. The community's friendly nature and lower cost of living provide a unique work experience.

Find Consumer Banker jobs in Greeley, CO

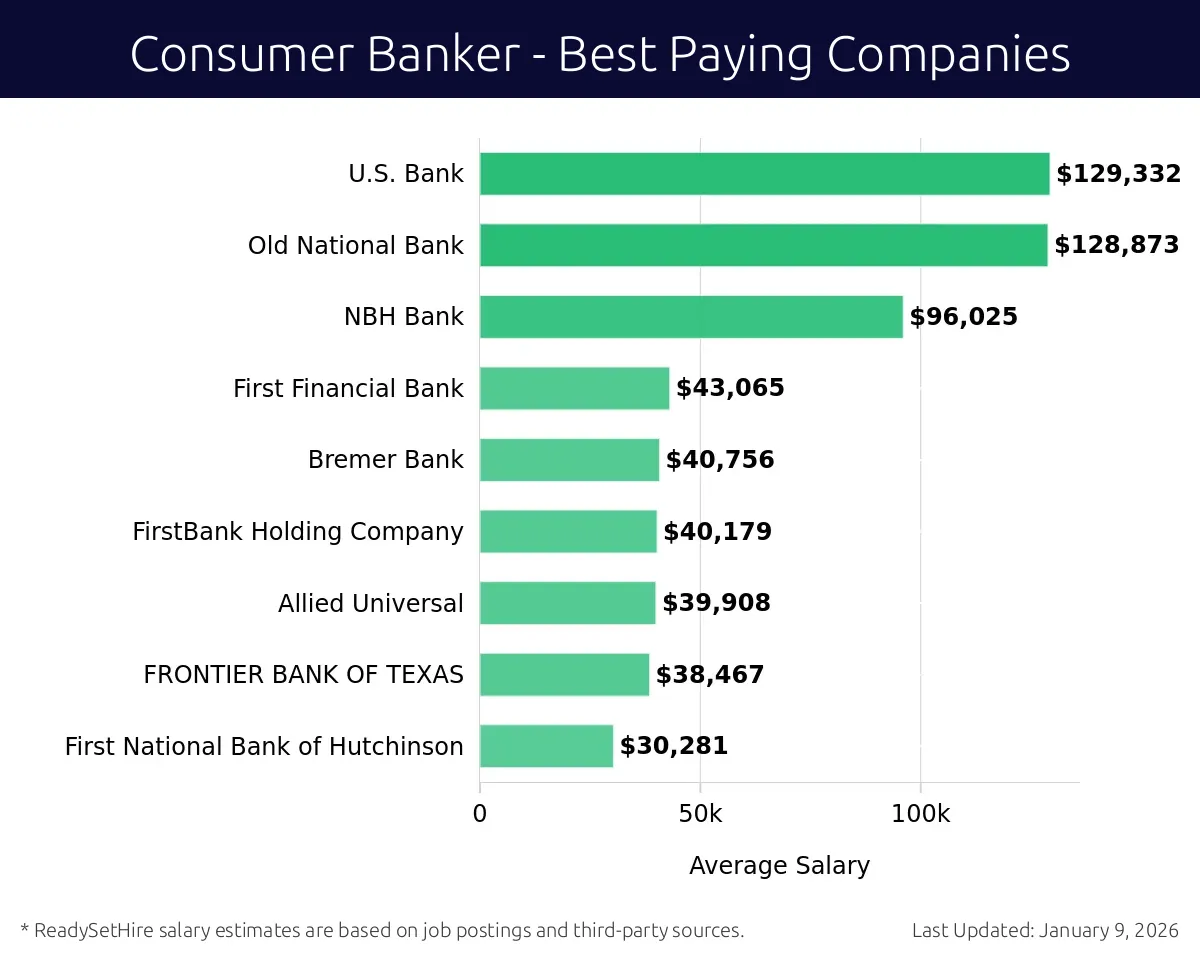

What are the best companies a Consumer Banker can work for?

-

U.S. Bank

Average Salary: $129,332

U.S. Bank offers competitive salaries for Consumer Bankers. They operate in all 50 states and provide various banking services. Locations include major cities like New York, Los Angeles, and Chicago, as well as smaller towns.

-

Old National Bank

Average Salary: $128,873

Old National Bank provides excellent benefits and salaries for Consumer Bankers. They are present in Indiana, Kentucky, and Ohio. They focus on community banking and offer many opportunities for growth.

-

NBH Bank

Average Salary: $96,025

NBH Bank offers attractive pay for Consumer Bankers. They serve customers in Michigan and California. They value customer service and support professional development.

-

First Financial Bank

Average Salary: $43,065

First Financial Bank provides a good salary for Consumer Bankers. They serve clients in Texas and New Mexico. They focus on a family-oriented work environment.

-

Bremer Bank

Average Salary: $40,756

Bremer Bank offers a decent salary for Consumer Bankers. They operate in Wisconsin and Illinois. They emphasize community banking and personal service.

-

FirstBank Holding Company

Average Salary: $40,179

FirstBank Holding Company provides good compensation for Consumer Bankers. They serve customers in Missouri. They focus on local banking and community involvement.

-

Allied Universal

Average Salary: $39,908

Allied Universal offers reasonable salaries for Consumer Bankers. They operate nationwide. They focus on security and provide a supportive work environment.

-

FRONTIER BANK OF TEXAS

Average Salary: $38,467

FRONTIER BANK OF TEXAS provides fair compensation for Consumer Bankers. They serve customers in Texas. They focus on personal banking and community support.

-

First National Bank of Hutchinson

Average Salary: $30,281

First National Bank of Hutchinson offers modest salaries for Consumer Bankers. They serve clients in Kansas. They emphasize community banking and customer service.

How to earn more as a Consumer Banker?

Working as a Consumer Banker offers many opportunities for growth and increased earnings. This career path can lead to higher pay through various methods. Bankers who focus on their career development can see significant financial benefits. Understanding these factors can help a banker maximize their earnings.

Here are some key factors for increasing your income as a Consumer Banker:

- Experience: Gaining more experience in banking leads to higher positions and better pay.

- Education: Higher degrees or specialized certifications can open doors to higher-paying roles.

- Skills: Developing strong sales and customer service skills can improve job performance and lead to bonuses.

- Networking: Building a strong professional network can lead to new job opportunities and higher salaries.

- Location: Working in areas with a higher cost of living often means higher pay to attract talent.