How much does a Financial Advisor make?

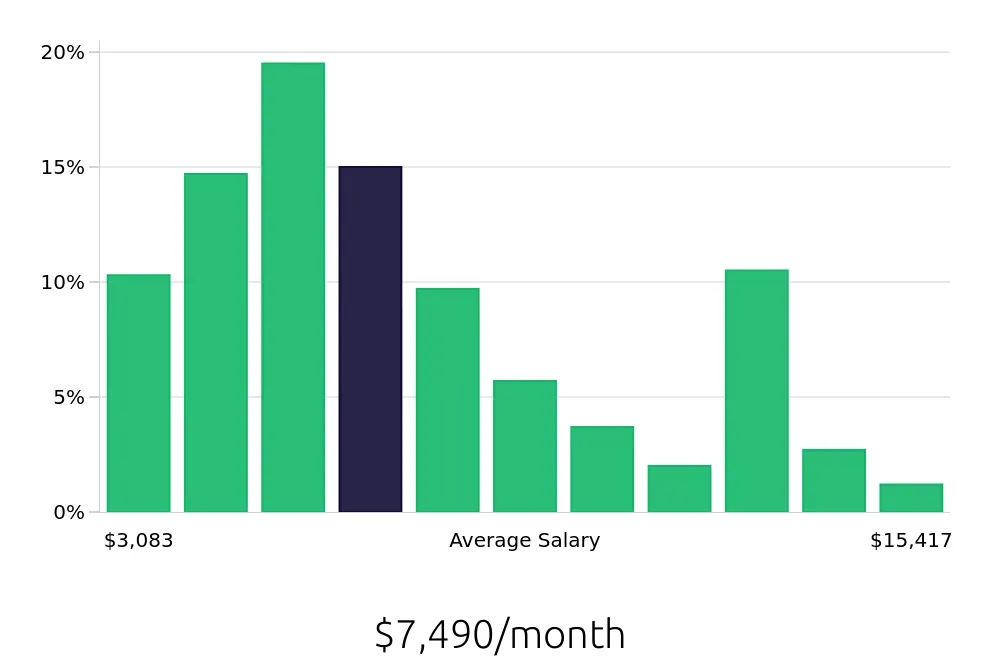

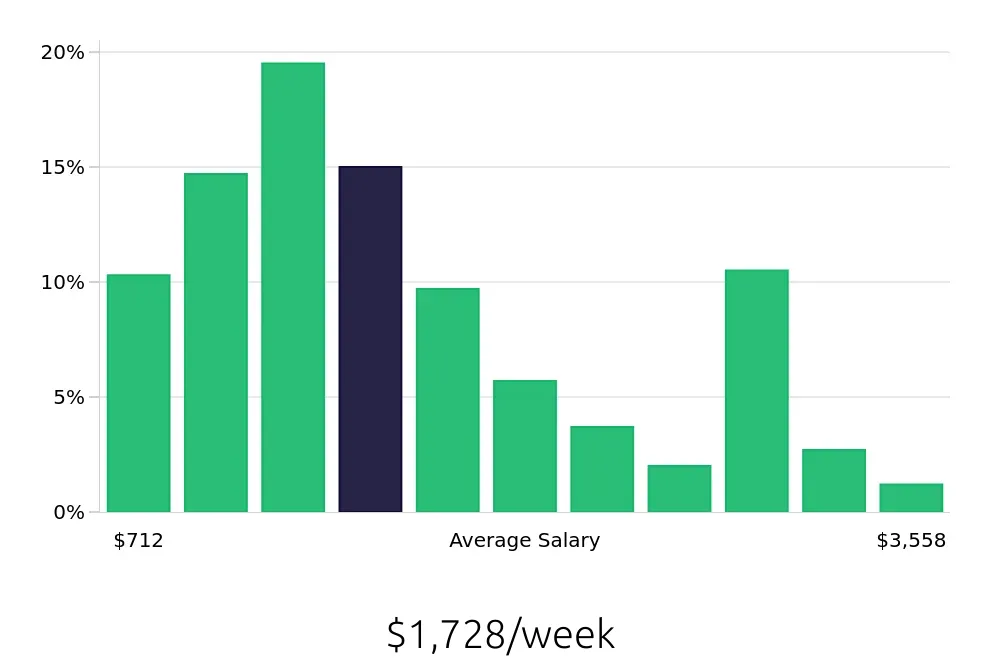

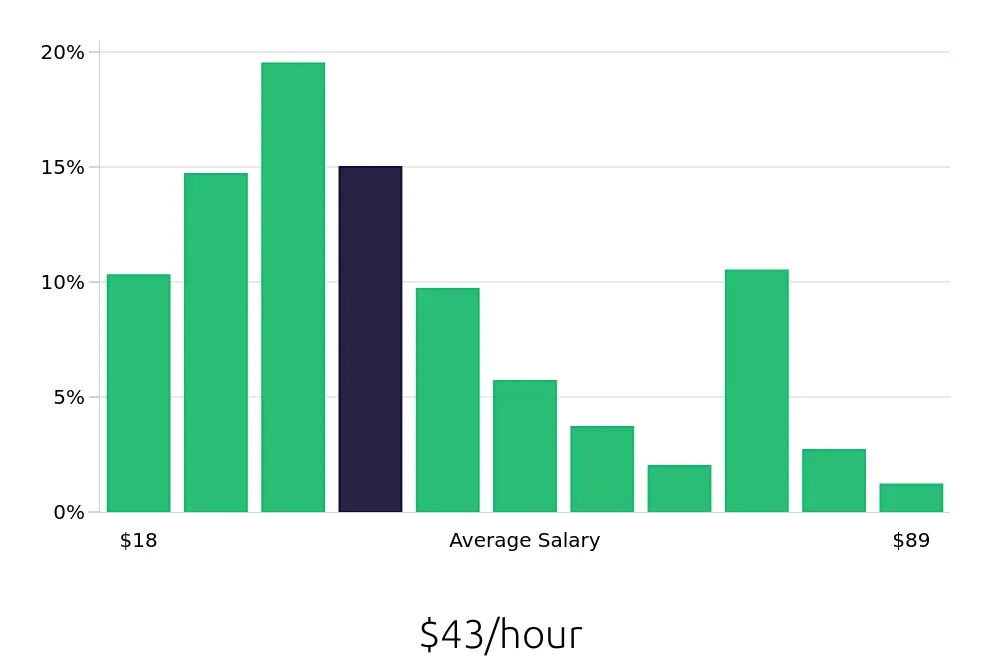

Becoming a financial advisor offers a rewarding career path with a competitive salary. The average yearly salary for a financial advisor stands at around $89,876. This figure varies based on several factors, including experience, location, and the type of employer. For those new to the profession, starting salaries are lower, but they grow significantly with experience and expertise.

The salary range for financial advisors can be quite broad. At the lower end, the bottom 10% of earners make about $37,000 annually. As advisors gain experience, the median salary increases, with the 50th percentile earning around $77,364. Highly experienced or specialized advisors can see salaries rise above $144,000. These higher figures often come with added responsibilities and a broader client base.

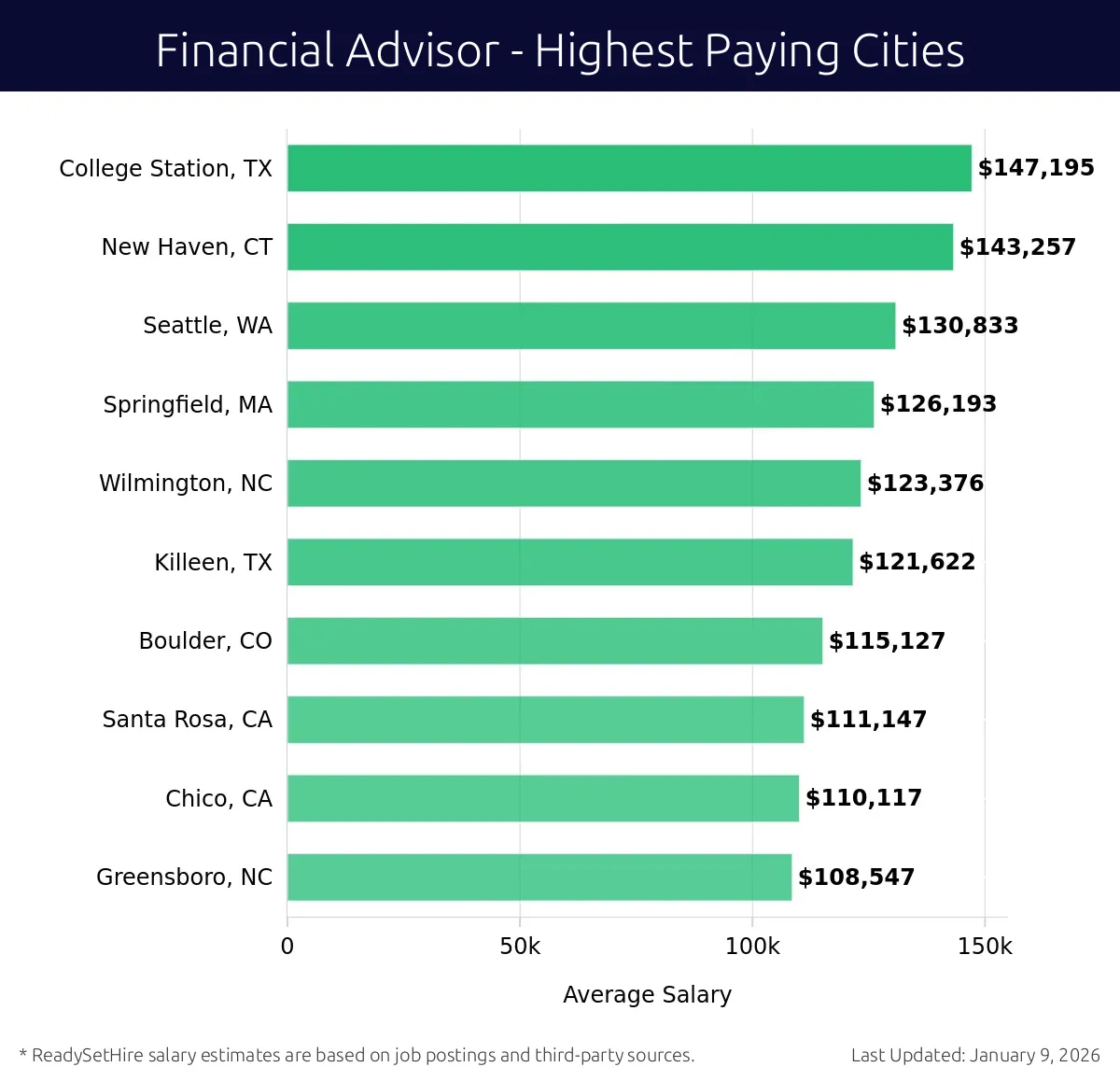

What are the highest paying cities for a Financial Advisor?

-

College Station, TX

Average Salary: $147,195

In College Station, financial professionals thrive in a close-knit community. Many work with local banks and financial firms, helping clients manage their wealth. The proximity to Texas A&M University adds a unique dynamic to the field.

Find Financial Advisor jobs in College Station, TX

-

New Haven, CT

Average Salary: $143,257

New Haven offers a mix of traditional and modern financial services. Financial experts here often collaborate with both historical financial institutions and newer fintech companies. The city's academic institutions provide a steady stream of clients.

Find Financial Advisor jobs in New Haven, CT

-

Seattle, WA

Average Salary: $130,833

Seattle's financial sector is booming, with many advisors working for major banks and tech companies. The city's vibrant economy offers diverse opportunities. Advisors often work with high-earning tech professionals.

Find Financial Advisor jobs in Seattle, WA

-

Springfield, MA

Average Salary: $126,193

Springfield provides a balanced financial environment. Here, advisors often focus on local businesses and families. The city's stability makes it a good place for long-term career growth.

Find Financial Advisor jobs in Springfield, MA

-

Wilmington, NC

Average Salary: $123,376

In Wilmington, financial advisors benefit from a growing job market. Many work with both local enterprises and larger firms. The city's coastal location brings a unique mix of industries.

Find Financial Advisor jobs in Wilmington, NC

-

Killeen, TX

Average Salary: $121,622

Killeen's financial scene is influenced by its military presence. Advisors often serve members of the armed forces and their families. The city's growth provides ample opportunities for career advancement.

Find Financial Advisor jobs in Killeen, TX

-

Boulder, CO

Average Salary: $115,127

Boulder offers a unique blend of outdoor lifestyle and financial services. Advisors here often cater to a well-educated, environmentally-conscious clientele. The city’s economy is diverse and growing.

Find Financial Advisor jobs in Boulder, CO

-

Santa Rosa, CA

Average Salary: $111,147

Santa Rosa provides a relaxed environment for financial advisors. Many work with local businesses and residents. The city's strong wine industry offers unique financial planning opportunities.

Find Financial Advisor jobs in Santa Rosa, CA

-

Chico, CA

Average Salary: $110,117

Chico is home to a strong agricultural economy. Financial experts here often help farmers and local businesses. The city's small-town feel provides a welcoming work environment.

Find Financial Advisor jobs in Chico, CA

-

Greensboro, NC

Average Salary: $108,547

Greensboro offers a vibrant job market for financial advisors. Many work with both local companies and national firms. The city’s diverse economy provides various opportunities for growth.

Find Financial Advisor jobs in Greensboro, NC

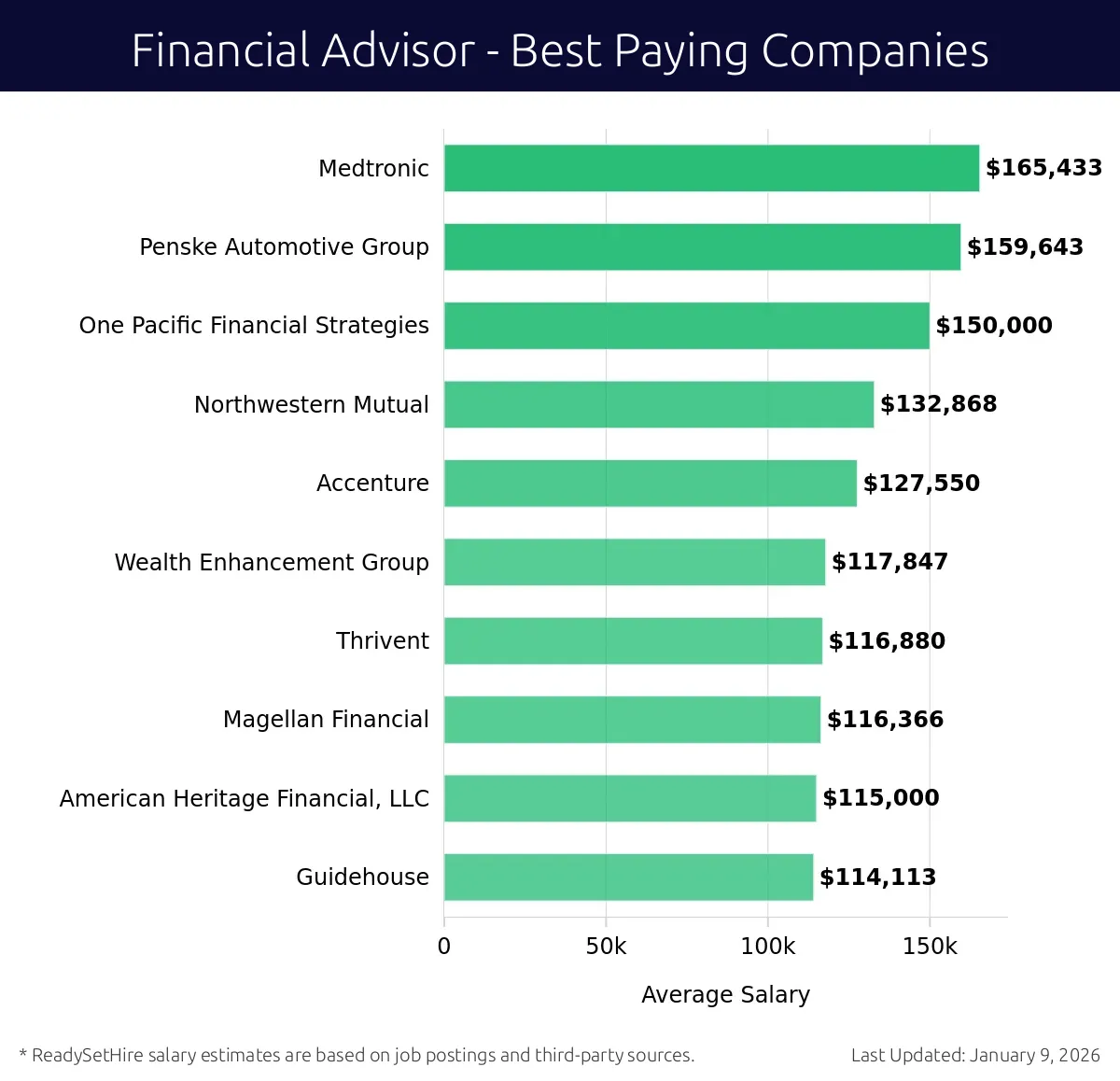

What are the best companies a Financial Advisor can work for?

-

Medtronic

Average Salary: $165,433

Medtronic offers rewarding Financial Advisor positions. They provide health solutions globally. Locations include the USA, Europe, and Asia. Financial Advisors at Medtronic enjoy competitive salaries and comprehensive benefits.

-

Penske Automotive Group

Average Salary: $159,643

Penske Automotive Group is a top choice for Financial Advisors. They have dealerships across the USA. Financial Advisors here work on a team, helping clients with financial planning. The company values teamwork and offers good benefits.

-

One Pacific Financial Strategies

Average Salary: $150,000

At One Pacific Financial Strategies, Financial Advisors have excellent opportunities. They serve clients in California. The company focuses on personalized financial plans. Advisors here benefit from a strong team environment and a culture of growth.

-

Northwestern Mutual

Average Salary: $132,868

Northwestern Mutual is a well-respected firm for Financial Advisors. They have offices nationwide in the USA. Financial Advisors help clients with life insurance and retirement plans. The company offers excellent training and advancement opportunities.

-

Accenture

Average Salary: $127,550

Accenture offers Financial Advisor jobs with a strong focus on technology. They operate globally, with offices in many countries. Financial Advisors here work on innovative projects, offering a blend of finance and tech skills.

-

Wealth Enhancement Group

Average Salary: $117,847

Wealth Enhancement Group provides rewarding Financial Advisor positions. They serve clients in the USA. Financial Advisors here focus on long-term wealth management. The company values collaboration and professional development.

-

Thrivent

Average Salary: $116,880

Thrivent offers Financial Advisor positions with a focus on financial well-being. They serve clients in the USA. Financial Advisors help clients with their financial goals. The company offers a supportive work environment and excellent benefits.

-

Magellan Financial

Average Salary: $116,366

Magellan Financial has excellent opportunities for Financial Advisors. They operate in Australia. Financial Advisors here focus on providing tailored financial solutions. The company offers a dynamic work environment with growth opportunities.

-

American Heritage Financial, LLC

Average Salary: $115,000

American Heritage Financial, LLC offers Financial Advisor positions with a focus on client service. They serve clients in the USA. Financial Advisors here help with wealth management and investment planning. The company values integrity and client satisfaction.

-

Guidehouse

Average Salary: $114,113

Guidehouse offers Financial Advisor jobs with a focus on public sector clients. They have offices in the USA. Financial Advisors here help clients with financial management. The company values innovation and professional development.

How to earn more as a Financial Advisor?

Becoming a top-earning Financial Advisor involves more than just managing numbers. It requires a strategic approach and dedication to continuous improvement. Building a solid client base and enhancing your expertise are key steps in this journey.

First, consider focusing on high-value clients. These are individuals or businesses with substantial assets. Serving them can lead to higher earnings. Second, develop strong relationships with clients. Trust and loyalty often result in long-term engagements and referrals. Third, invest in ongoing education. Staying updated on financial trends and regulations can make you more valuable. Fourth, expand your service offerings. Diversification can attract more clients and increase revenue. Lastly, leverage technology. Tools that streamline processes and enhance client experience can lead to better outcomes and higher pay.

By prioritizing these factors, a Financial Advisor can significantly increase their earnings and career satisfaction.

- Focus on high-value clients.

- Develop strong client relationships.

- Invest in ongoing education.

- Expand service offerings.

- Leverage technology.