How much does a Financial Representative make?

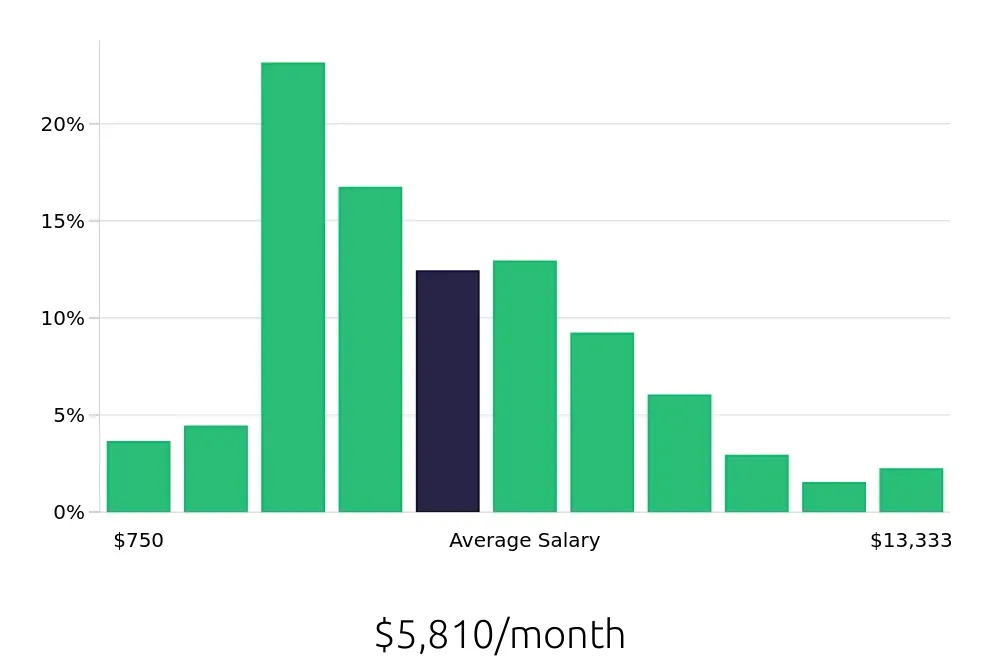

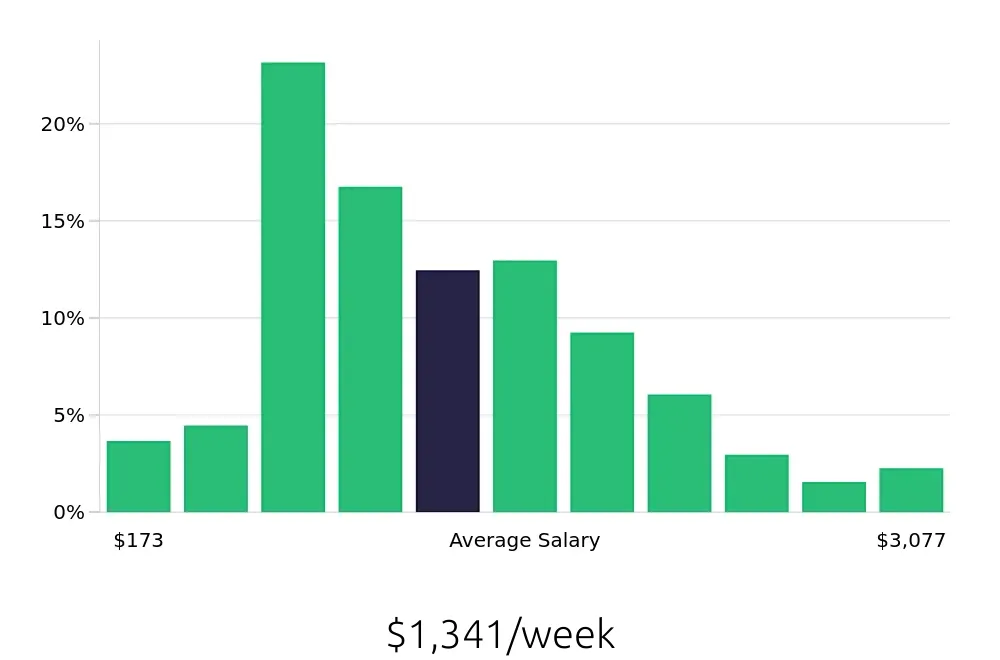

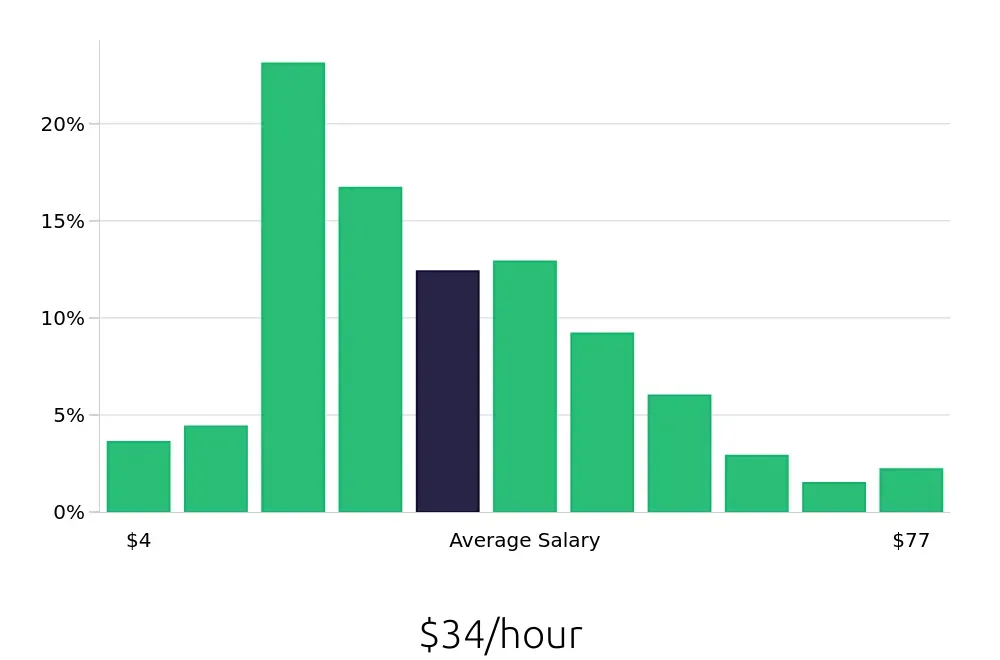

The salary for a Financial Representative can vary based on experience and location. On average, they earn about $69,722 per year. This role offers growth opportunities as experience increases. The lowest 10% earn around $22,727, while the highest 10% earn more than $146,000. Most representatives fall between $36,455 and $91,364 annually.

Factors influencing salary include years in the field, education level, and the specific company. For example, those with advanced degrees or certifications often see higher pay. Large financial firms usually offer higher salaries compared to smaller local agencies. Location also plays a role, with higher costs of living often leading to higher salaries. A Financial Representative working in a high-cost area may earn more than one in a lower-cost region.

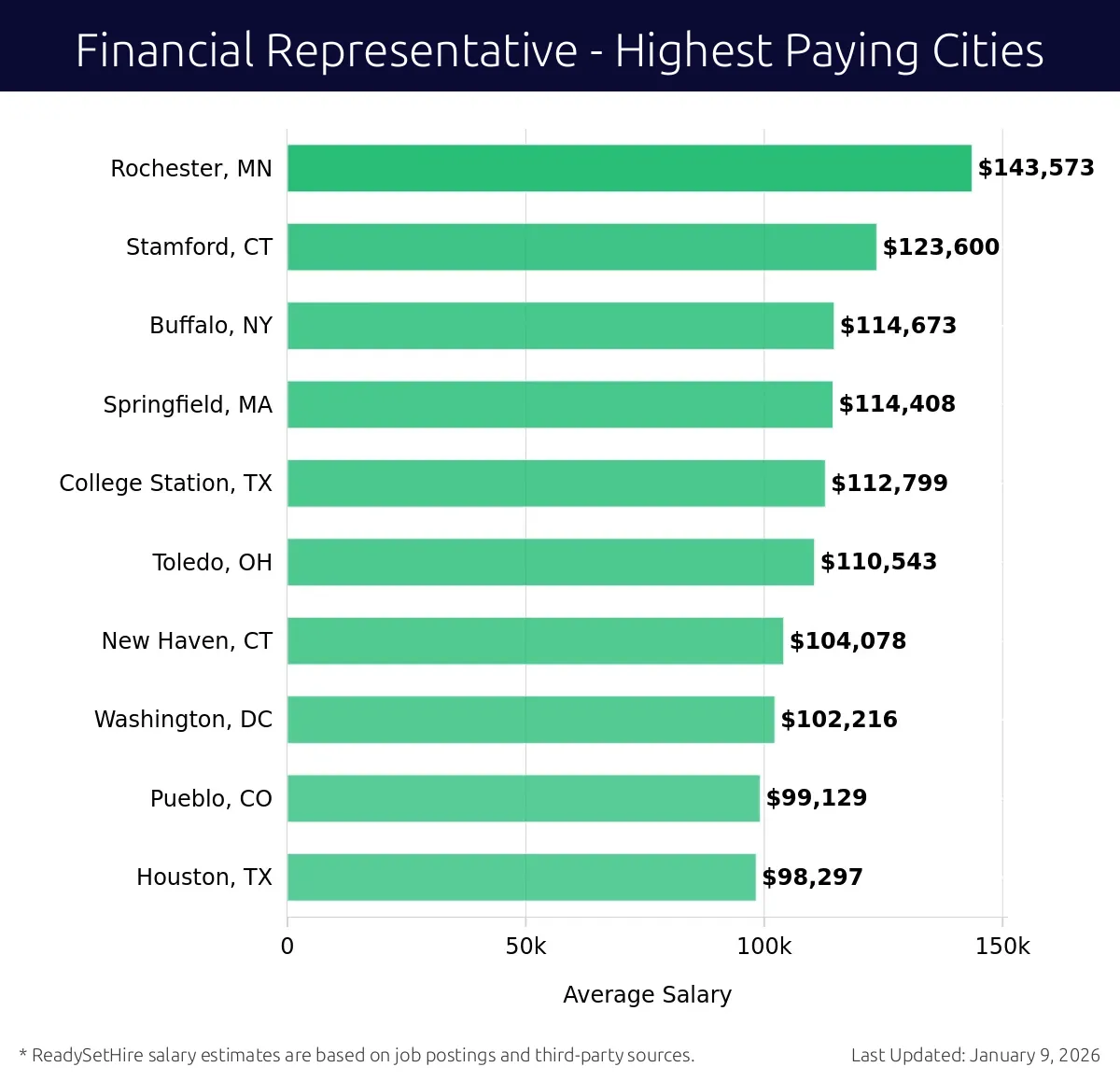

What are the highest paying cities for a Financial Representative?

-

Rochester, MN

Average Salary: $143,573

In Rochester, working as a Financial Representative involves helping clients manage their wealth. The presence of Mayo Clinic and other healthcare institutions creates a demand for financial expertise. You’ll find plenty of opportunities with local banks and investment firms.

Find Financial Representative jobs in Rochester, MN

-

Stamford, CT

Average Salary: $123,600

Stamford offers a vibrant atmosphere for financial professionals. Companies like Xerox and United Technologies Corporation create a strong demand for financial expertise. The city's business-friendly environment provides numerous growth opportunities.

Find Financial Representative jobs in Stamford, CT

-

Buffalo, NY

Average Salary: $114,673

Buffalo is known for its diverse economy, including healthcare, manufacturing, and finance. Working here offers exposure to various financial sectors. Major employers like KeyBank and M&T Bank provide robust career paths.

Find Financial Representative jobs in Buffalo, NY

-

Springfield, MA

Average Salary: $114,408

Springfield has a rich history of manufacturing and finance. Being a Financial Representative here allows you to work with both long-established companies and growing startups. The city’s supportive business community fosters career development.

Find Financial Representative jobs in Springfield, MA

-

College Station, TX

Average Salary: $112,799

College Station benefits from its proximity to Texas A&M University. This setting leads to a high demand for financial services, especially from students and faculty. Working here offers a mix of dynamic projects and community engagement.

Find Financial Representative jobs in College Station, TX

-

Toledo, OH

Average Salary: $110,543

Toledo boasts a strong manufacturing base, particularly in automotive and glass industries. As a Financial Representative, you'll find ample opportunities with local financial institutions. The city’s emphasis on industry creates a steady flow of professional prospects.

Find Financial Representative jobs in Toledo, OH

-

New Haven, CT

Average Salary: $104,078

New Haven is home to Yale University, which boosts the demand for financial services. Working here means you’ll engage with a diverse client base, from students to faculty. Major financial institutions in the area provide excellent career advancement.

Find Financial Representative jobs in New Haven, CT

-

Washington, DC

Average Salary: $102,216

The nation’s capital offers a unique blend of opportunities in finance and government. Working as a Financial Representative here means you’ll interact with clients from various sectors, from political campaigns to corporate giants. The dynamic environment fosters continuous learning.

Find Financial Representative jobs in Washington, DC

-

Pueblo, CO

Average Salary: $99,129

Pueblo has a strong economy with a mix of manufacturing and retail. Financial Representatives here benefit from a supportive community and steady demand for financial services. Working in Pueblo means you’ll contribute to a thriving local economy.

Find Financial Representative jobs in Pueblo, CO

-

Houston, TX

Average Salary: $98,297

Houston’s diverse economy, particularly in energy and healthcare, creates a high demand for financial expertise. As a Financial Representative, you’ll work with major corporations and enjoy a dynamic work environment. The city’s growth offers numerous opportunities for career advancement.

Find Financial Representative jobs in Houston, TX

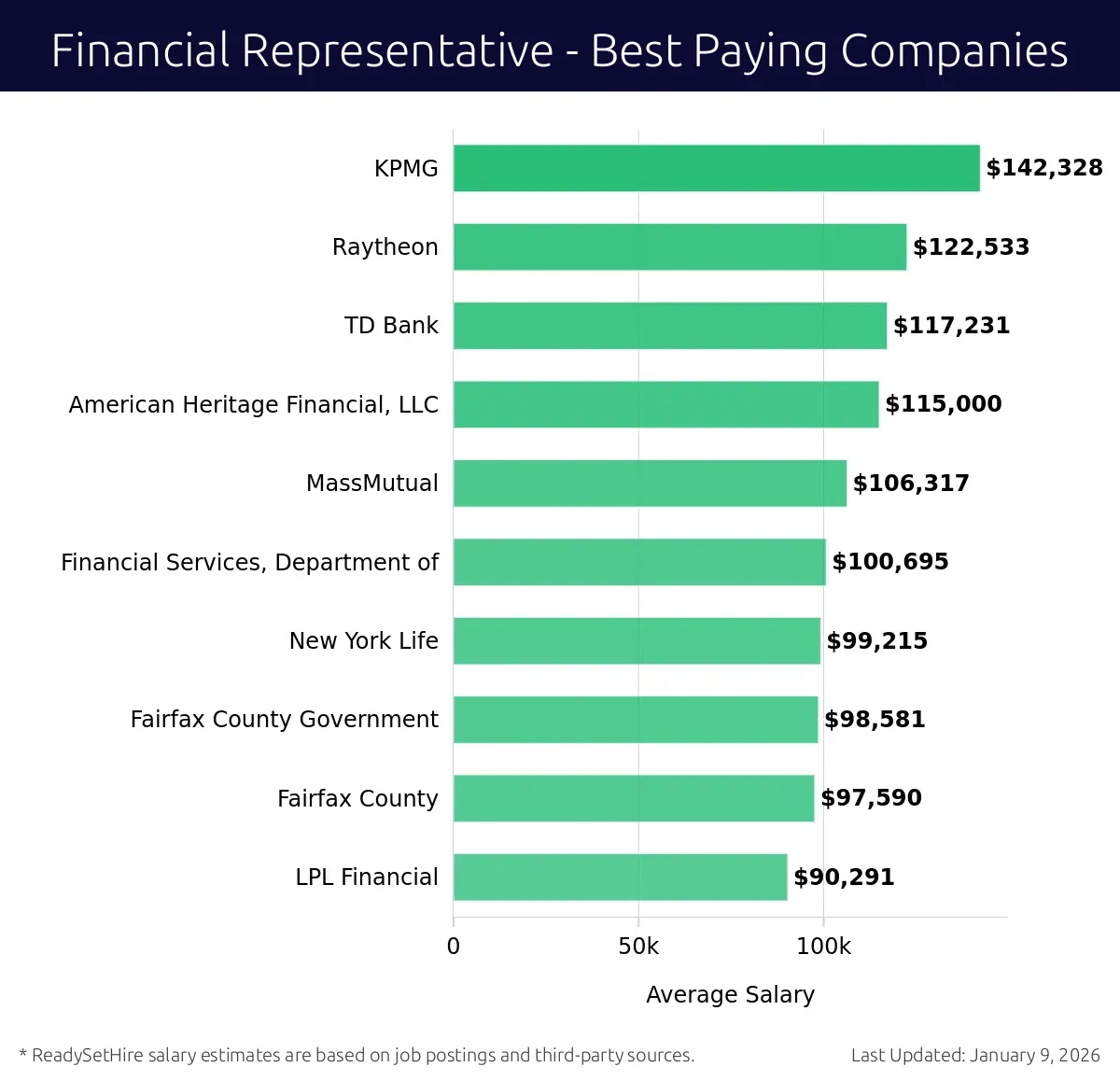

What are the best companies a Financial Representative can work for?

-

KPMG

Average Salary: $142,328

KPMG provides audit, tax, and advisory services. Financial Representatives work in various sectors, including banking and insurance. KPMG operates globally, with offices in major cities.

-

Raytheon

Average Salary: $122,533

Raytheon focuses on defense, security, and civil markets. Financial Representatives support the company's financial strategies and investments. Raytheon has offices worldwide, including the U.S. and Europe.

-

TD Bank

Average Salary: $117,231

TD Bank offers banking and financial services across the U.S. and Canada. Financial Representatives help clients with investment planning and financial management. The bank has branches across these regions.

-

American Heritage Financial, LLC

Average Salary: $115,000

American Heritage Financial provides investment and insurance services. Financial Representatives assist clients with retirement planning and investment strategies. The company operates in the U.S.

-

MassMutual

Average Salary: $106,317

MassMutual is an insurance company that offers life insurance, annuities, and investment products. Financial Representatives work with clients to create personalized financial plans. The company has offices across the U.S.

-

Financial Services, Department of

Average Salary: $100,695

This department oversees the financial sector and economic policy. Financial Representatives support various projects and initiatives. The department operates nationally, with offices in Washington, D.C.

-

New York Life

Average Salary: $99,215

New York Life provides life insurance and investment products. Financial Representatives help clients with financial planning and investments. The company operates across the U.S.

-

Fairfax County Government

Average Salary: $98,581

Fairfax County Government offers various public services. Financial Representatives manage the county's financial operations and budgets. The county is located in Virginia, U.S.

-

Fairfax County

Average Salary: $97,590

Fairfax County is a local government entity providing public services. Financial Representatives manage the county's finances and budgets. The county is located in Virginia, U.S.

-

LPL Financial

Average Salary: $90,291

LPL Financial provides investment advisory and brokerage services. Financial Representatives help clients with investment planning. The company operates across the U.S.

How to earn more as a Financial Representative?

Earning more as a Financial Representative involves understanding key areas for improvement and growth. Focus on these areas to boost income and job satisfaction. Achieving higher earnings often requires dedication, continuous learning, and strategic planning.

Here are five essential factors to consider for increasing earnings:

- Education and Certifications: Completing relevant courses and earning certifications can make a representative more knowledgeable and competitive. Employers often value these credentials and may offer higher pay for skilled professionals.

- Experience: Gaining experience in the financial industry leads to a deeper understanding of market trends and client needs. More experienced representatives can often secure higher positions with better pay.

- Client Relationships: Building strong relationships with clients can lead to repeat business and referrals. Happy clients often lead to more business, which can increase earnings.

- Sales Skills: Improving sales techniques can lead to better performance and higher commissions. Representatives who can effectively sell financial products typically earn more.

- Network and Connections: Having a strong professional network can lead to new opportunities and higher-paying positions. Networking with other industry professionals can open doors to better job offers.