How much does a Insurance Agent make?

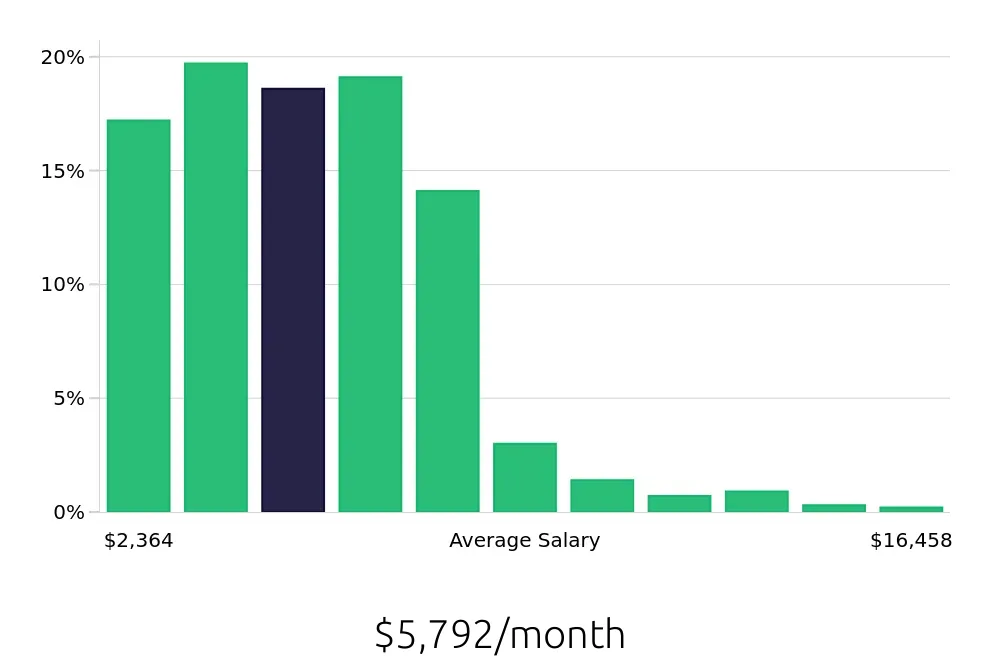

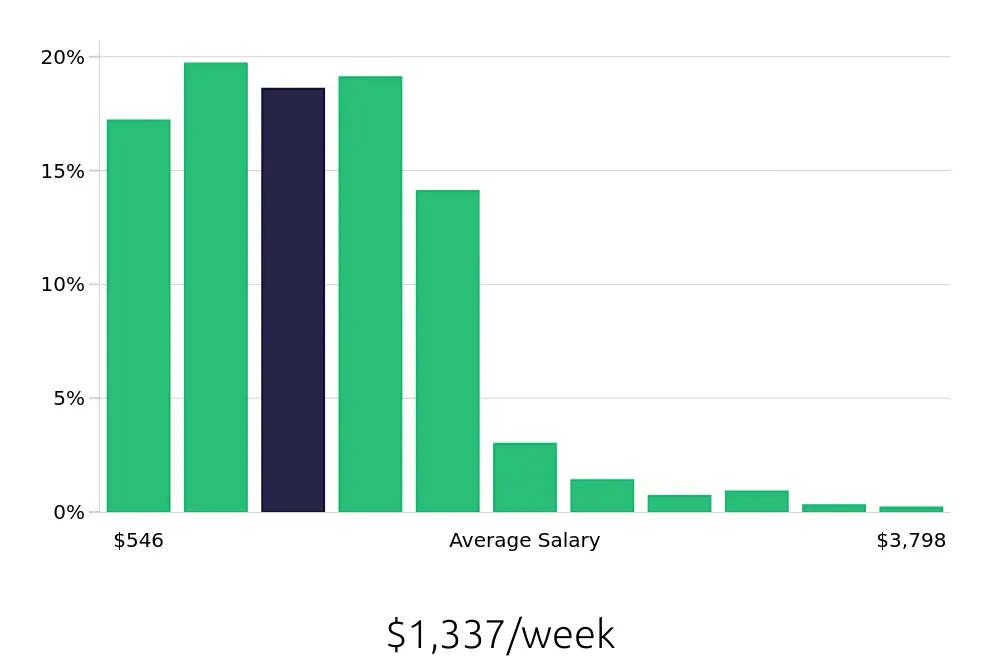

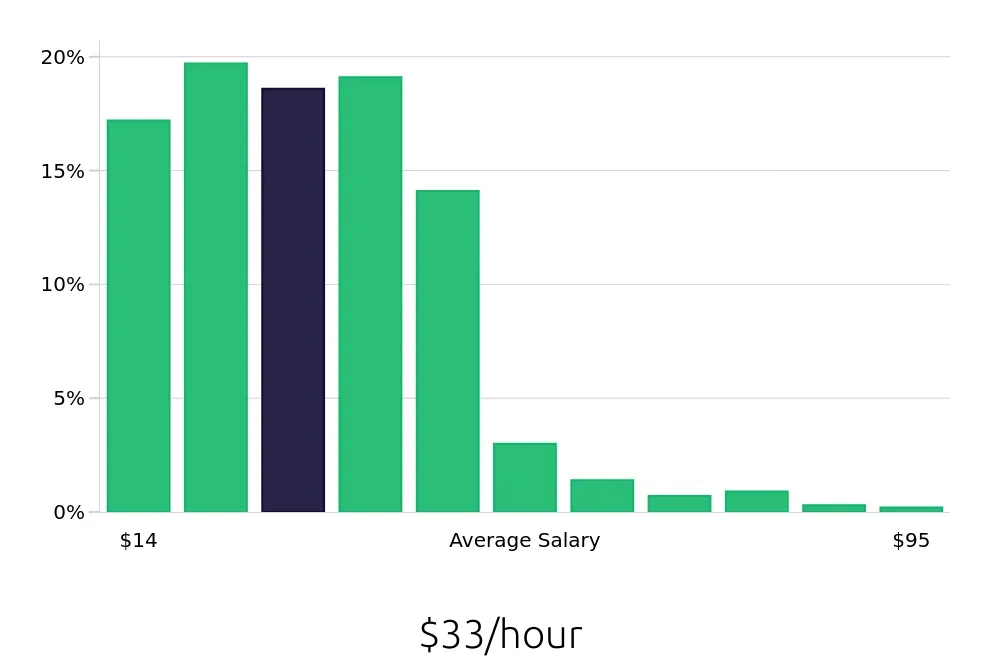

An Insurance Agent can expect to earn a range of salaries depending on experience and location. On average, Insurance Agents make about $69,503 a year. This figure can vary widely based on the agent’s expertise and the type of insurance they specialize in. Most Insurance Agents start on the lower end of the salary scale and work their way up as they gain experience and build a client base.

Insurance Agents often earn additional income through commissions and bonuses. These incentives can significantly boost an agent's annual earnings. Successful agents might earn extra compensation for meeting or exceeding sales targets. Other factors that can influence an agent's income include the region they work in and the demand for insurance services in that area. For example, agents in urban areas may see higher salaries compared to those in rural locations.

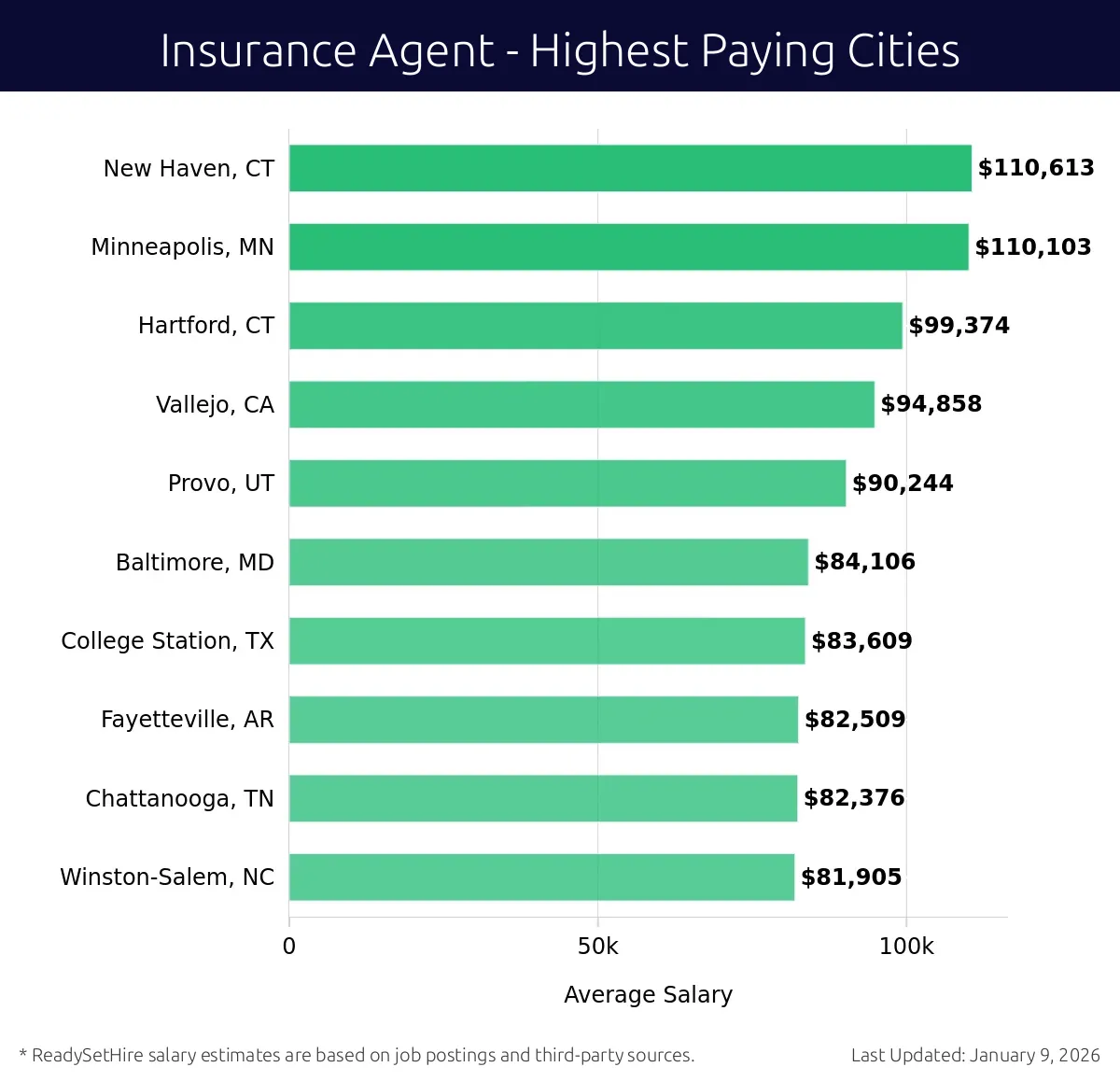

What are the highest paying cities for a Insurance Agent?

-

New Haven, CT

Average Salary: $110,613

In New Haven, you can expect a stable environment for insurance professionals. Companies like The Hartford and Travelers are well-established here. They offer excellent benefits and growth opportunities.

Find Insurance Agent jobs in New Haven, CT

-

Minneapolis, MN

Average Salary: $110,103

Minneapolis offers a dynamic market for insurance agents. With major firms like U.S. Bank and Principal Financial Group, there is a strong demand for skilled professionals. The city supports a competitive salary and robust career advancement.

Find Insurance Agent jobs in Minneapolis, MN

-

Hartford, CT

Average Salary: $99,374

Hartford is known as the insurance capital of the world. Working here means being at the heart of the industry with giants like Aetna and Travelers. The competitive salary reflects the value of your work.

Find Insurance Agent jobs in Hartford, CT

-

Vallejo, CA

Average Salary: $94,858

Vallejo provides a unique blend of coastal charm and industry opportunities. Companies like Pacific Life and Allstate are prominent here. You can enjoy a balanced work life in this vibrant community.

Find Insurance Agent jobs in Vallejo, CA

-

Provo, UT

Average Salary: $90,244

Provo offers a friendly and family-oriented environment for insurance agents. Local firms like Zions Bank provide solid opportunities. The community support makes this a great place to build a career.

Find Insurance Agent jobs in Provo, UT

-

Baltimore, MD

Average Salary: $84,106

Baltimore has a rich history and a growing market for insurance professionals. With companies like Geico and State Farm, there are plenty of chances to succeed. The city’s diverse culture enhances the work experience.

Find Insurance Agent jobs in Baltimore, MD

-

College Station, TX

Average Salary: $83,609

In College Station, the insurance field thrives with local and national companies. Firms like State Farm and Nationwide offer excellent benefits. The strong educational institutions also provide a skilled workforce.

Find Insurance Agent jobs in College Station, TX

-

Fayetteville, AR

Average Salary: $82,509

Fayetteville offers a supportive community for insurance professionals. With companies like Farmers Insurance and Aflac, there are solid job opportunities. The city’s cost of living is also relatively low.

Find Insurance Agent jobs in Fayetteville, AR

-

Chattanooga, TN

Average Salary: $82,376

Chattanooga provides a growing market with a mix of local and national firms. Companies like Allstate and State Farm are active here. The scenic beauty and affordable living add to the appeal of working in this city.

Find Insurance Agent jobs in Chattanooga, TN

-

Winston-Salem, NC

Average Salary: $81,905

Winston-Salem is a thriving hub for insurance agents. With major companies like Prudential and MetLife, there are excellent career opportunities. The city’s historical charm makes it a pleasant place to work.

Find Insurance Agent jobs in Winston-Salem, NC

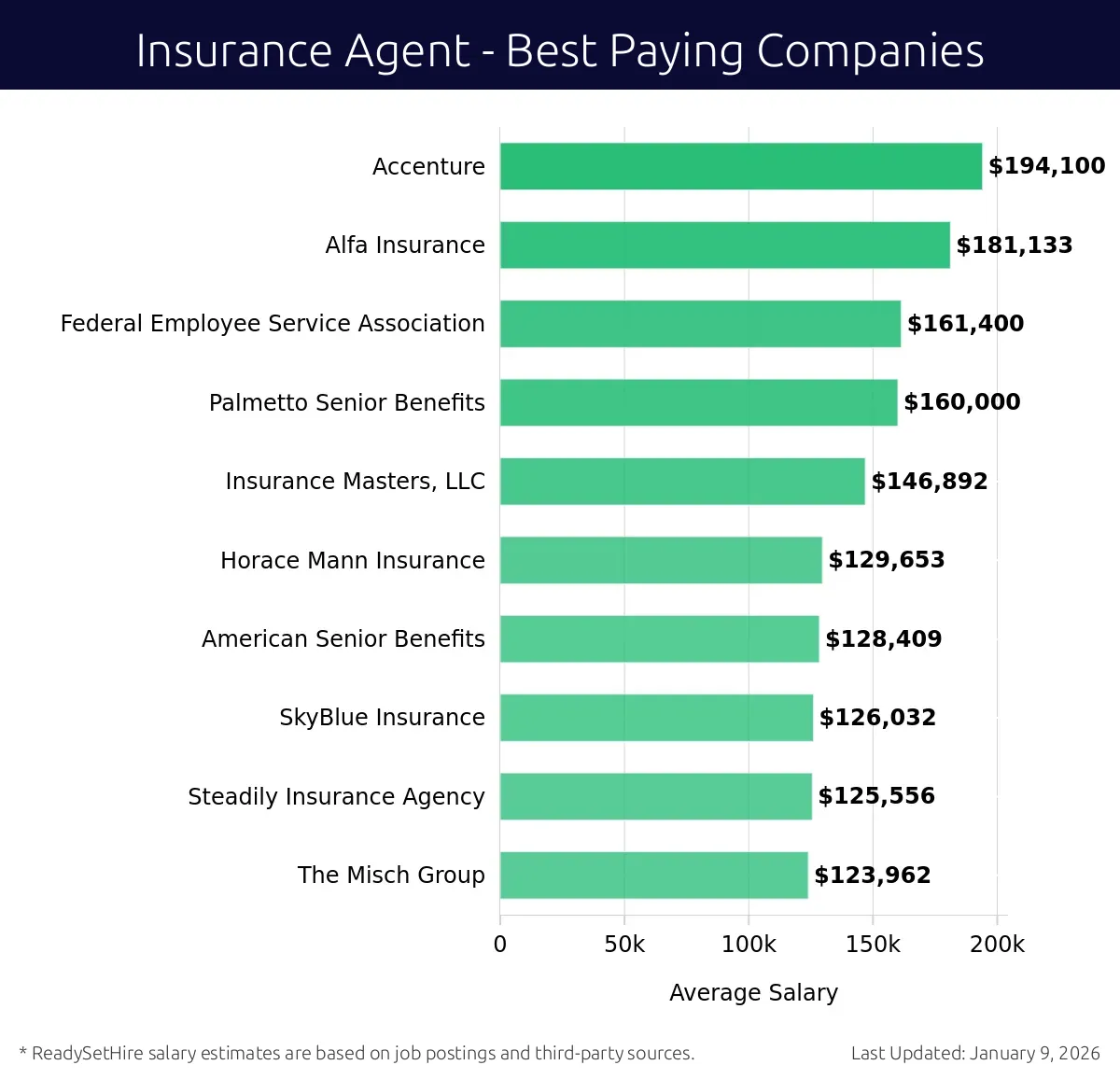

What are the best companies a Insurance Agent can work for?

-

Accenture

Average Salary: $194,100

Accenture offers Insurance Agent jobs with a focus on innovative technologies. They operate globally with major offices in the United States, Europe, and Asia. Agents at Accenture enjoy competitive benefits and opportunities for career growth.

-

Alfa Insurance

Average Salary: $181,133

Alfa Insurance is a leading insurance company known for its personalized service. They have offices across the United States. Insurance Agents at Alfa Insurance work on a variety of insurance products to meet client needs.

-

Federal Employee Service Association

Average Salary: $161,400

Federal Employee Service Association provides Insurance Agent positions focused on public sector insurance needs. They operate nationally with a strong presence in Washington, D.C., and other key cities. Agents benefit from a stable work environment.

-

Palmetto Senior Benefits

Average Salary: $160,000

Palmetto Senior Benefits specializes in insurance for senior citizens. They serve clients across multiple states. Insurance Agents enjoy working with a dedicated team and helping seniors find the best coverage options.

-

Insurance Masters, LLC

Average Salary: $146,892

Insurance Masters, LLC offers Insurance Agent jobs with a strong emphasis on customer service. They operate throughout the United States. Agents at this company work on a range of insurance products and enjoy a supportive work culture.

-

Horace Mann Insurance

Average Salary: $129,653

Horace Mann Insurance provides Insurance Agent positions with a focus on educators and institutions. They have a strong presence in the Midwest and West Coast. Agents benefit from a collaborative environment and competitive pay.

-

American Senior Benefits

Average Salary: $128,409

American Senior Benefits focuses on insurance for senior citizens. They operate in multiple states with a strong presence in the Southeast. Insurance Agents enjoy working with a dedicated team and helping seniors find the best coverage options.

-

SkyBlue Insurance

Average Salary: $126,032

SkyBlue Insurance offers Insurance Agent jobs with a variety of coverage options. They have offices across the United States. Agents benefit from flexible work hours and a supportive work environment.

-

Steadily Insurance Agency

Average Salary: $125,556

Steadily Insurance Agency provides Insurance Agent positions with a focus on personalized service. They operate in the Midwest and Northeast. Agents enjoy working with a close-knit team and helping clients find the best coverage.

-

The Misch Group

Average Salary: $123,962

The Misch Group offers Insurance Agent jobs with a strong emphasis on client satisfaction. They have offices in several states. Agents benefit from a supportive work culture and opportunities for professional development.

How to earn more as a Insurance Agent?

Insurance agents have the chance to earn more by focusing on a few key areas. By improving certain skills and adopting effective strategies, an agent can significantly boost their income. Networking plays a big role in growing an agency’s client base, which in turn can lead to higher commissions and bonuses. Building strong relationships with clients and other professionals in the industry can open up new opportunities for business.

Continuous education is another important factor. Staying updated on the latest insurance trends and regulations helps agents offer the best advice to clients. Many companies offer bonuses and promotions for agents who complete additional training or achieve higher certifications. This not only increases knowledge but also boosts earning potential. Agents who keep learning often find themselves in higher-paying positions.

Here are some steps an insurance agent can take to earn more:

- Expand Client Base: Building a strong network can lead to more clients and higher income.

- Attend Workshops: Participate in training sessions to learn new skills and get certified.

- Use Technology: Adopt digital tools to manage clients and paperwork more efficiently.

- Set Goals: Create clear, achievable targets to track progress and stay motivated.

- Offer Value: Always provide excellent service to keep clients happy and encourage referrals.