How much does a Investment Manager make?

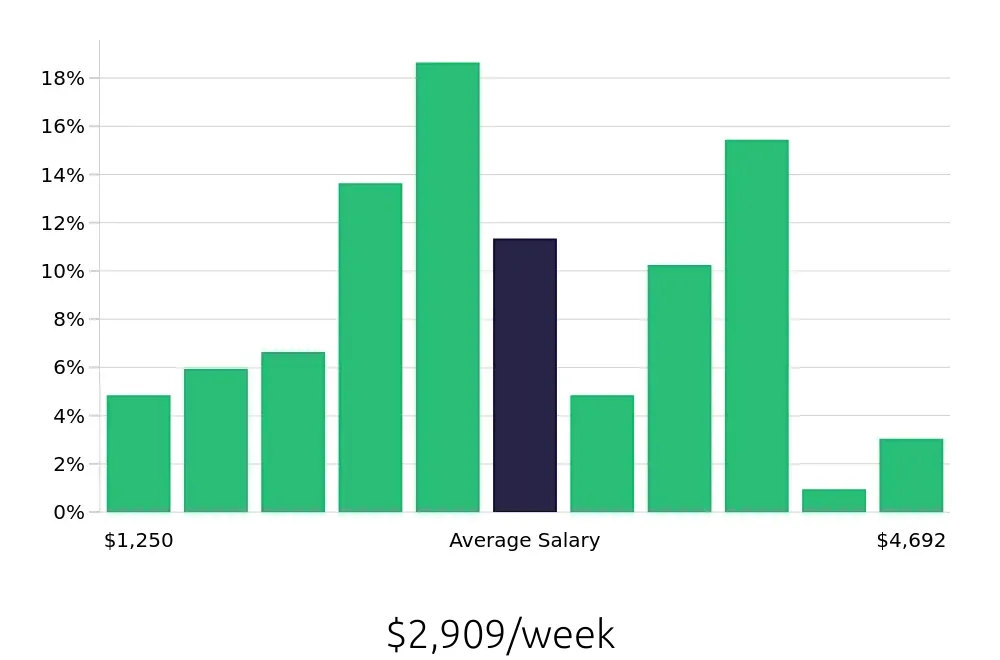

Investment Managers work hard to manage and grow the assets of their clients. On average, they earn around $151,257 each year. This means they make good money for their skills. Investment Managers handle portfolios, provide advice, and make decisions that can impact clients' finances.

Salary for Investment Managers can vary based on experience and location. Entry-level managers might earn less, while those with more experience or in big cities often earn more. The data shows that the most common salaries range from about $81,000 to $179,000. The highest earners make around $244,000 a year.

What are the highest paying cities for a Investment Manager?

-

Sacramento, CA

Average Salary: $217,219

In Sacramento, managing investments involves working with a variety of clients. You will often collaborate with tech companies and government entities. The city's growing economy offers many opportunities for growth.

Find Investment Manager jobs in Sacramento, CA

-

Los Angeles, CA

Average Salary: $178,053

Los Angeles offers a dynamic environment for those in the investment field. You will often interact with entertainment industry clients. The city's diverse economy means there's always something new to learn.

Find Investment Manager jobs in Los Angeles, CA

-

Kansas City, MO

Average Salary: $164,677

Kansas City provides a balanced approach to managing investments. Here, you will often work with financial institutions and local businesses. The city's stable economy offers steady growth opportunities.

Find Investment Manager jobs in Kansas City, MO

-

Minneapolis, MN

Average Salary: $154,439

In Minneapolis, investment managers often deal with insurance and banking sectors. The city's strong economy and thriving tech scene create a wealth of opportunities. Networking is key in this vibrant community.

Find Investment Manager jobs in Minneapolis, MN

-

San Francisco, CA

Average Salary: $152,293

San Francisco is a tech hub where managing investments can be both challenging and rewarding. You will often work with startups and established tech companies. The city's innovative spirit makes it an exciting place to be.

Find Investment Manager jobs in San Francisco, CA

-

Boston, MA

Average Salary: $149,697

Boston offers a rich environment for those in the investment field. You will often work with healthcare and education sectors. The city's history and culture provide a unique backdrop for your career.

Find Investment Manager jobs in Boston, MA

-

Tampa, FL

Average Salary: $148,377

In Tampa, managing investments involves a mix of local businesses and tourism. The city's growing economy offers many opportunities for professionals. A friendly and welcoming atmosphere makes Tampa a great place to work.

Find Investment Manager jobs in Tampa, FL

-

Seattle, WA

Average Salary: $146,007

Seattle provides a modern environment for those in the investment field. You will often work with tech giants and startups. The city's progressive culture and scenic beauty make it an appealing place to live and work.

Find Investment Manager jobs in Seattle, WA

-

Charlotte, NC

Average Salary: $145,867

Charlotte offers a well-balanced approach to managing investments. You will often deal with financial services and banking. The city's strong economy offers many growth opportunities.

Find Investment Manager jobs in Charlotte, NC

-

Denver, CO

Average Salary: $145,146

In Denver, managing investments means working in a vibrant and growing economy. You will often interact with energy and tech companies. The city's outdoor lifestyle and welcoming community add to the appeal.

Find Investment Manager jobs in Denver, CO

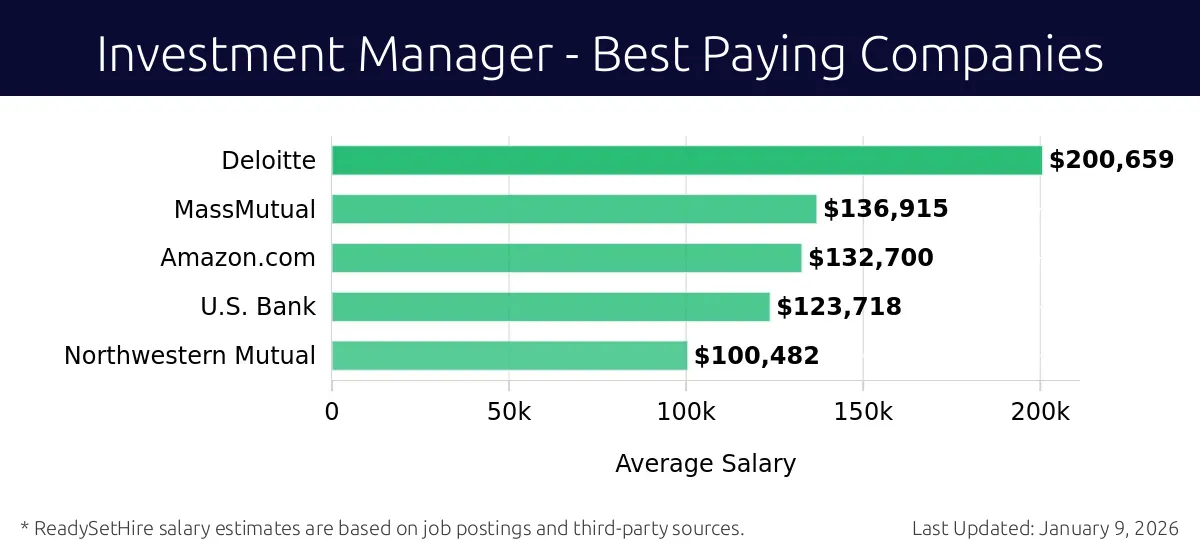

What are the best companies a Investment Manager can work for?

-

Deloitte

Average Salary: $200,659

Deloitte offers a dynamic environment for Investment Managers. They work across various sectors, including financial services and technology. Deloitte operates globally with offices in many major cities.

-

MassMutual

Average Salary: $136,915

MassMutual provides a strong platform for Investment Managers. They focus on long-term growth and client success. The company operates mainly in the U.S., with offices in Springfield, Massachusetts, and other key locations.

-

Amazon.com

Average Salary: $132,700

Amazon offers exciting opportunities for Investment Managers. They handle large-scale investments and innovation. Amazon's headquarters is in Seattle, Washington, with many offices around the world.

-

U.S. Bank

Average Salary: $123,718

U.S. Bank provides a solid foundation for Investment Managers. They work on a wide range of investment strategies. The bank operates in many U.S. states with its main office in Minneapolis, Minnesota.

-

Northwestern Mutual

Average Salary: $100,482

Northwestern Mutual is known for its family-friendly culture. Investment Managers here focus on financial planning and client relationships. The company has offices throughout the U.S., with its main office in Milwaukee, Wisconsin.

How to earn more as a Investment Manager?

Investment Managers have the chance to earn a substantial income. Their earnings depend on various factors, and focusing on these can lead to higher compensation. Understanding these key areas allows a professional to strategically enhance their earnings potential. Aspiring Investment Managers should consider these factors to maximize their income effectively.

First, expertise in specialized investment sectors can significantly boost earnings. Managers who master areas like technology, healthcare, or real estate attract high-value clients. Expertise allows them to provide tailored advice and solutions, often commanding higher fees. Second, building a strong client base increases earning potential. A larger, more loyal client base not only brings in more assets but also leads to referrals and retained earnings. Third, obtaining advanced certifications like the CFA can enhance credibility and salary. Certifications show a deep understanding of investment principles and dedication to the field. Fourth, developing a solid reputation through successful investment outcomes and client satisfaction leads to higher trust and demand. Lastly, networking within the industry opens up new opportunities and partnerships. Engaging with other professionals can lead to new client referrals and collaborative projects.

Here are five factors that can help an Investment Manager earn more:

- Specialized Expertise: Mastering specific sectors can attract high-value clients.

- Strong Client Base: A larger client base leads to higher assets under management.

- Advanced Certifications: Certifications like the CFA enhance credibility.

- Solid Reputation: Successful outcomes and client satisfaction build trust.

- Effective Networking: Connections lead to new opportunities and referrals.