How much does a Risk Analyst make?

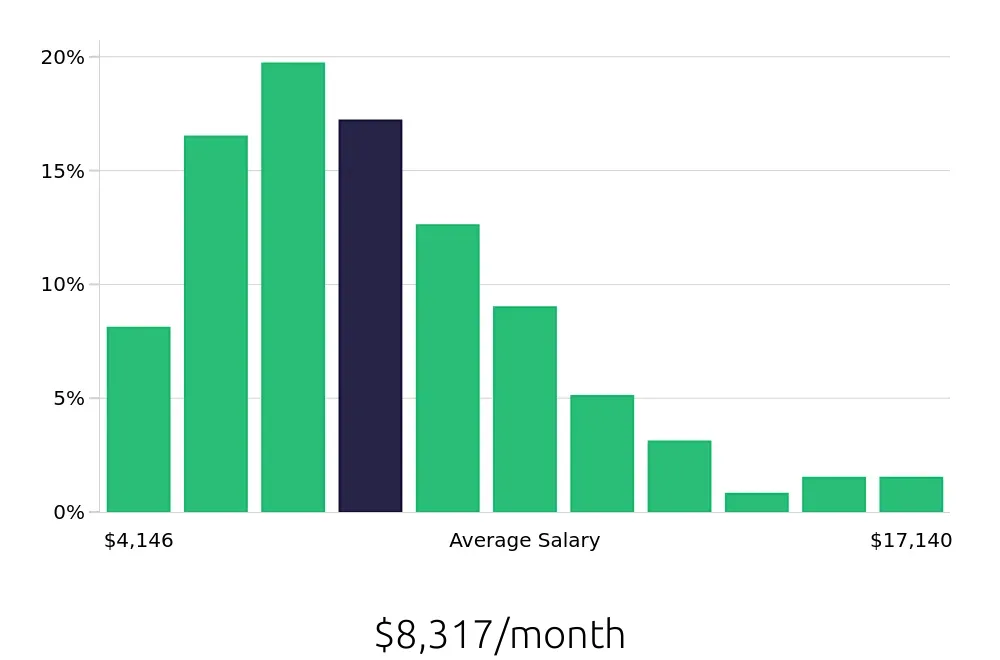

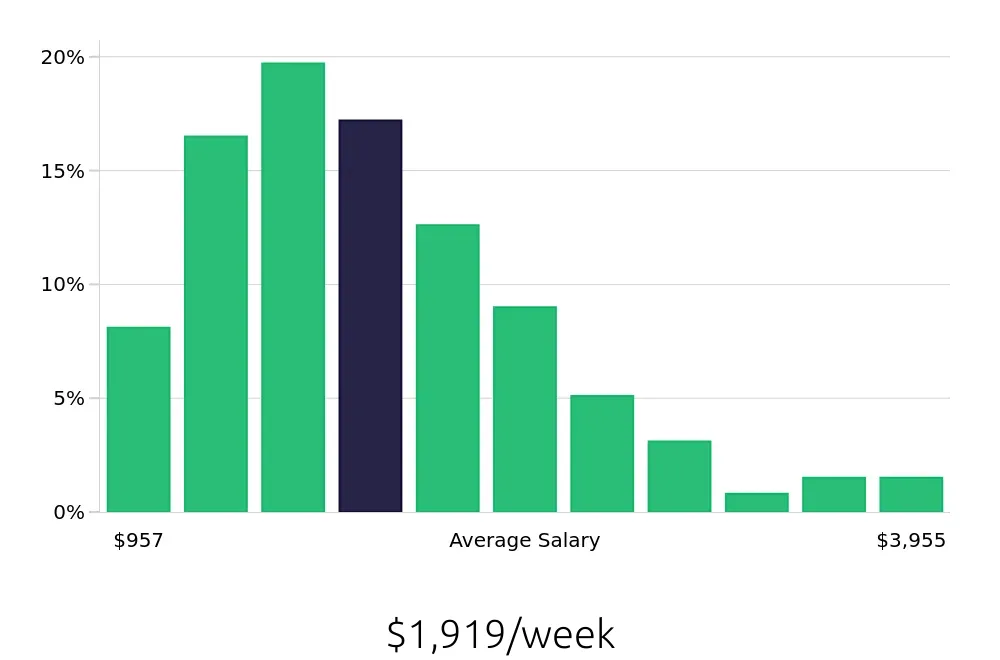

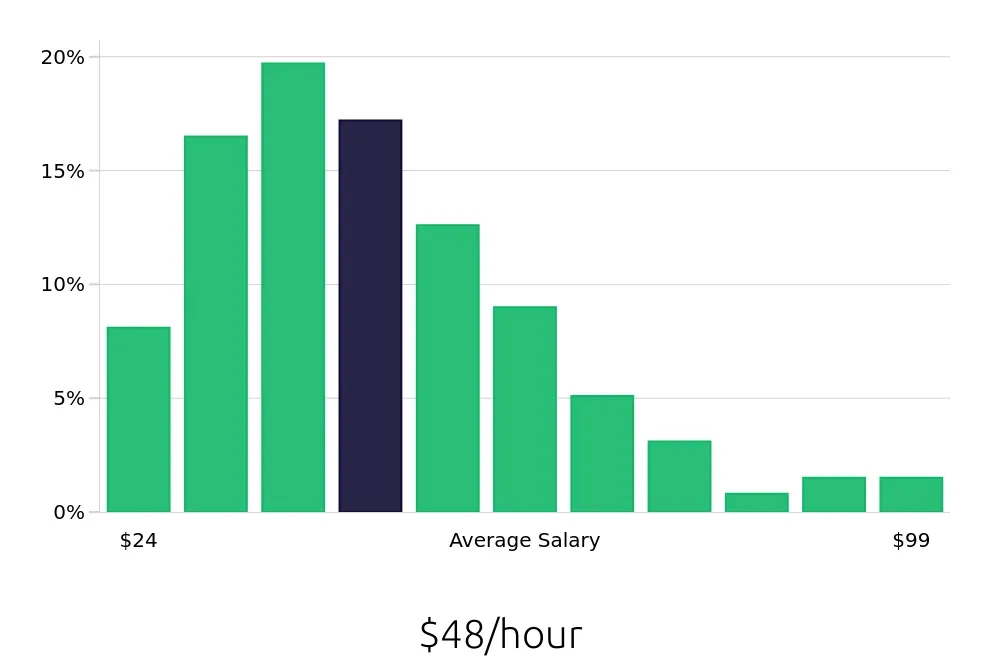

A Risk Analyst can expect to earn an average yearly salary of $99,806. This role involves assessing potential risks in various sectors and developing strategies to mitigate these risks. With experience and advanced qualifications, Risk Analysts can move up the pay scale significantly.

The salary can vary based on experience and the specific industry. For instance, those in the top 10% of earners make over $191,505 a year. A breakdown of the salary distribution shows the following range: 10% earn less than $49,750, 25% earn between $49,750 and $78,101, and the median salary is $92,277. This range provides a good overview of what to expect as you gain more experience and expertise in the field.

What are the highest paying cities for a Risk Analyst?

-

San Antonio, TX

Average Salary: $149,129

Working in San Antonio offers a dynamic environment where professionals assess and manage risks for major companies. The city's strong financial sector provides many opportunities to work with banks and insurance firms. The warm weather and affordable living make it a great place to build a career.

Find Risk Analyst jobs in San Antonio, TX

-

Charlotte, NC

Average Salary: $121,632

Charlotte is a key player in the banking industry. Professionals here focus on analyzing risks for financial institutions. The city's vibrant business scene and growing tech sector create a supportive environment for growth. The cost of living is moderate, making it a practical choice for many.

Find Risk Analyst jobs in Charlotte, NC

-

San Jose, CA

Average Salary: $120,943

In San Jose, working as a risk professional means collaborating with tech giants. The city's innovative culture provides a chance to analyze risks in cutting-edge industries. The high standard of living and excellent public transportation make it an attractive location for career development.

Find Risk Analyst jobs in San Jose, CA

-

Buffalo, NY

Average Salary: $118,913

Buffalo offers a mix of traditional and modern industries for risk professionals. The city's strong manufacturing base and emerging tech sector provide diverse opportunities. The lower cost of living and rich cultural scene make Buffalo an appealing place to work and live.

Find Risk Analyst jobs in Buffalo, NY

-

Washington, DC

Average Salary: $116,171

Washington, DC is a hub for political and international risk management. Professionals here often work with government agencies and large corporations. The city's vibrant social life and numerous networking opportunities enhance career growth. The higher cost of living is offset by a strong job market.

Find Risk Analyst jobs in Washington, DC

-

St. Louis, MO

Average Salary: $116,100

St. Louis provides a balanced environment for risk professionals, with both manufacturing and financial sectors. The city's affordable cost of living and central location make it a practical choice. The diverse job market offers stability and growth potential.

Find Risk Analyst jobs in St. Louis, MO

-

Phoenix, AZ

Average Salary: $114,878

Phoenix offers a warm climate and a growing economy for risk professionals. The city's diverse industries include finance, healthcare, and technology. The lower cost of living and excellent outdoor activities create a desirable place to work and live.

Find Risk Analyst jobs in Phoenix, AZ

-

San Francisco, CA

Average Salary: $112,026

San Francisco is a tech and finance powerhouse, offering many opportunities for risk professionals. The city's innovative culture and high demand for risk management skills create a competitive job market. The higher cost of living is matched by abundant job prospects and a vibrant social scene.

Find Risk Analyst jobs in San Francisco, CA

-

Seattle, WA

Average Salary: $111,928

Seattle offers a mix of tech and maritime industries for risk professionals. The city's strong tech sector provides many opportunities in risk management. The mild climate and outdoor activities make it a great place to live. The cost of living is higher, but the job market and quality of life are excellent.

Find Risk Analyst jobs in Seattle, WA

-

Boston, MA

Average Salary: $108,879

Boston offers a rich history and a strong job market for risk professionals. The city's diverse industries include finance, healthcare, and education. The higher cost of living is offset by a dynamic social scene and numerous networking opportunities. Boston is an excellent place to build a career.

Find Risk Analyst jobs in Boston, MA

What are the best companies a Risk Analyst can work for?

-

Synchrony

Average Salary: $151,250

Synchrony offers exciting opportunities for Risk Analysts. They assess and manage financial risks. Synchrony operates in many locations, including major cities across the U.S.

-

USAA

Average Salary: $139,944

USAA provides Risk Analyst roles focused on financial services. They operate nationwide and value employee development.

-

Citi

Average Salary: $137,744

Citi has top-paying Risk Analyst positions. They work on global financial risk strategies. Citi's offices are in major financial hubs.

-

PayPal

Average Salary: $122,032

PayPal offers Risk Analyst jobs with a focus on fintech risks. They operate worldwide and innovate continuously.

-

Fannie Mae

Average Salary: $120,429

Fannie Mae has Risk Analyst positions that deal with mortgage risks. They have offices in major U.S. cities.

-

M&T Bank

Average Salary: $119,211

M&T Bank offers Risk Analyst roles focused on banking risks. They operate in several U.S. states.

-

U.S. Bank

Average Salary: $117,594

U.S. Bank provides Risk Analyst jobs with a focus on banking and financial risks. They have a nationwide presence.

-

Booz Allen Hamilton

Average Salary: $116,731

Booz Allen Hamilton offers Risk Analyst positions with a focus on government and defense. They operate across the U.S.

-

Fidelity Investments

Average Salary: $115,546

Fidelity Investments has Risk Analyst roles focused on investment risks. They operate in major financial centers.

-

SoFi

Average Salary: $110,400

SoFi provides Risk Analyst positions focused on financial technology risks. They operate online and in major cities.

How to earn more as a Risk Analyst?

Becoming a Risk Analyst offers many paths to increase earnings. Success in this field often depends on a combination of skills, certifications, and experience. A Risk Analyst can earn more by continuously learning and improving their skill set. Specializing in high-demand areas like financial risk or cybersecurity risk can also open doors to higher-paying opportunities.

Experience matters significantly in this role. Job seekers can earn more by gaining experience in different industries. Each industry has unique risks, and the ability to navigate them can be very valuable. Networking with other professionals and joining industry groups can provide job seekers with insights into higher-paying roles. Additionally, moving to a role with more responsibility or taking on leadership positions can lead to higher earnings. Lastly, obtaining advanced certifications in risk management can make a job seeker more attractive to potential employers.

Here are some factors to consider to increase earnings as a Risk Analyst:

- Obtain relevant certifications

- Specialize in a high-demand area

- Gain experience in multiple industries

- Network and join industry groups

- Take on leadership roles