How much does a Underwriting Assistant make?

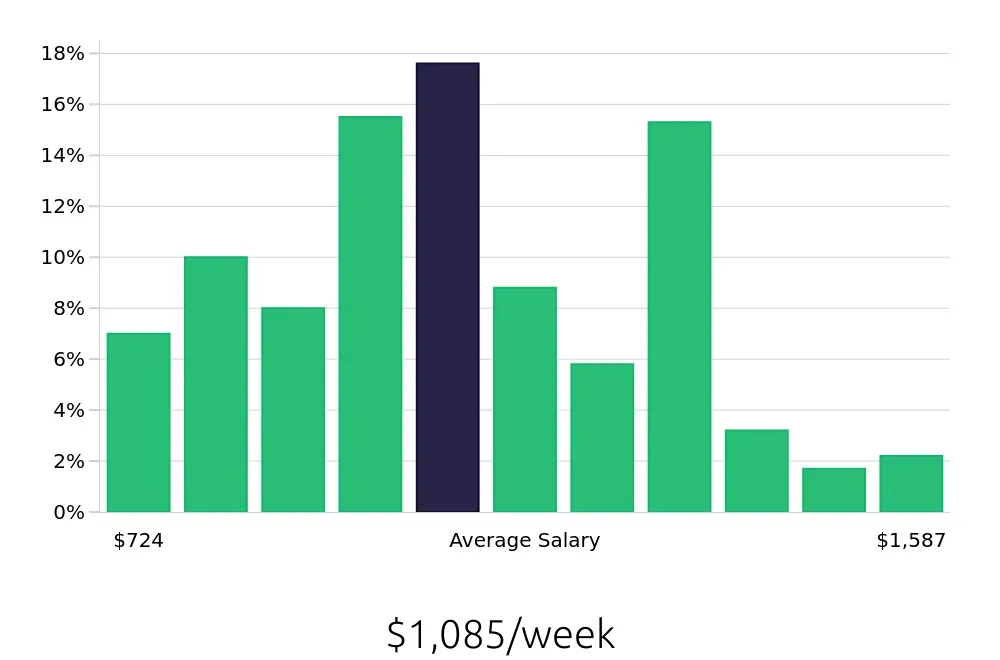

An Underwriting Assistant helps insurance companies by checking risks and approving policies. This role is vital in the financial sector. Many people find this job interesting because it pays well. The average yearly salary for an Underwriting Assistant is around $56,442. This means that, on average, people in this job earn nearly $5,500 a month.

The salary range for Underwriting Assistants can vary. Many earn between $45,813 and $62,118 per year. For those with more experience, salaries can reach up to $78,424 a year. This shows that with time, there are good chances to earn more. Working hard and learning can help increase your salary over time.

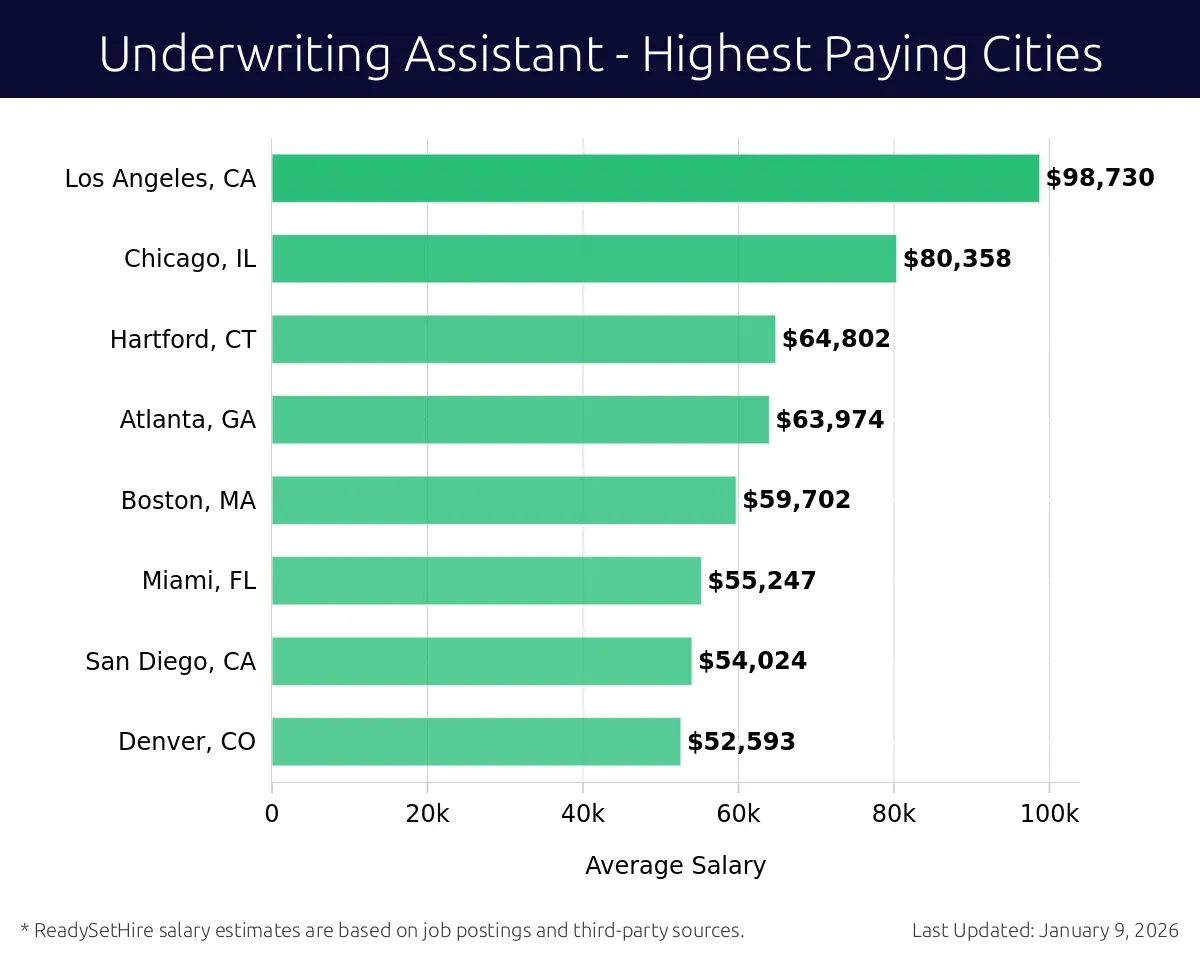

What are the highest paying cities for a Underwriting Assistant?

-

Los Angeles, CA

Average Salary: $98,730

In Los Angeles, working in underwriting offers dynamic opportunities. Companies like Allstate and Farmers Insurance lead the market. Fast-paced and diverse, it’s a city where underwriting skills make a difference.

Find Underwriting Assistant jobs in Los Angeles, CA

-

Chicago, IL

Average Salary: $80,358

Chicago’s underwriting scene thrives with major players like Allstate and State Farm. This vibrant city rewards proactive and detail-oriented professionals. The finance sector here provides a solid foundation for underwriting careers.

Find Underwriting Assistant jobs in Chicago, IL

-

Hartford, CT

Average Salary: $64,802

Hartford, known as the insurance capital, presents unique underwriting opportunities. The presence of Aetna and Travelers makes it an attractive place. Working here means being part of a historic industry hub, contributing to financial stability.

Find Underwriting Assistant jobs in Hartford, CT

-

Atlanta, GA

Average Salary: $63,974

Atlanta’s underwriting jobs are growing, supported by companies like Aflac and Allstate. The city's booming economy offers promising career paths. Here, underwriting plays a crucial role in business success.

Find Underwriting Assistant jobs in Atlanta, GA

-

Boston, MA

Average Salary: $59,702

Boston's underwriting positions are ideal for those wanting to join prestigious firms. Companies like Liberty Mutual are based here. The city's rich history in finance provides a robust environment for underwriting careers.

Find Underwriting Assistant jobs in Boston, MA

-

Miami, FL

Average Salary: $55,247

Miami’s underwriting field is on the rise with notable employers such as Allstate and Farmers. The city’s diverse economy offers varied opportunities. Working here means being part of a fast-growing, vibrant market.

Find Underwriting Assistant jobs in Miami, FL

-

San Diego, CA

Average Salary: $54,024

San Diego’s underwriting jobs thrive alongside tech and marine industries. Companies like Farmers Insurance are prominent. This coastal city offers a balanced, professional environment for underwriting roles.

Find Underwriting Assistant jobs in San Diego, CA

-

Denver, CO

Average Salary: $52,593

In Denver, underwriting roles are supported by strong companies like State Farm. The city’s thriving business scene offers diverse opportunities. Working here means being part of a dynamic, forward-thinking industry.

Find Underwriting Assistant jobs in Denver, CO

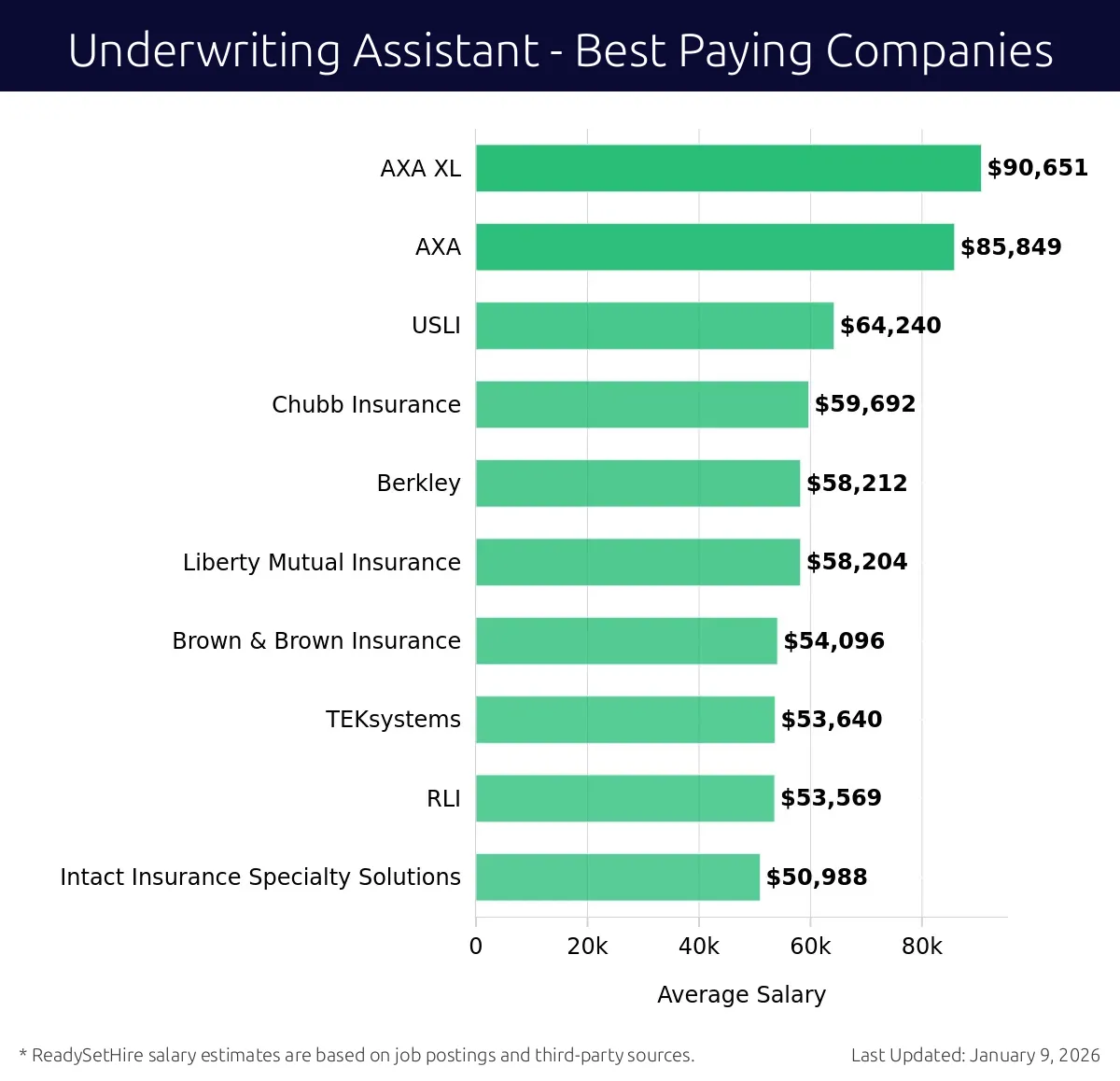

What are the best companies a Underwriting Assistant can work for?

-

AXA XL

Average Salary: $90,651

AXA XL offers competitive salaries for Underwriting Assistant roles. They provide exciting opportunities in underwriting, working across locations in New York, London, and Singapore.

-

AXA

Average Salary: $85,849

At AXA, Underwriting Assistants can expect a solid salary. They contribute to underwriting decisions across offices in Paris, Madrid, and Milan, making it a global opportunity.

-

USLI

Average Salary: $64,240

USLI provides a stable salary for Underwriting Assistants. They work in underwriting departments in major cities like Boston, Chicago, and San Francisco.

-

Chubb Insurance

Average Salary: $59,692

Chubb Insurance offers a good salary package for Underwriting Assistants. They work in underwriting teams in New York, London, and Zurich, offering diverse career paths.

-

Berkley

Average Salary: $58,212

Berkley provides an average salary for Underwriting Assistants. They work across underwriting departments in major cities such as New York, London, and Hong Kong.

-

Liberty Mutual Insurance

Average Salary: $58,204

Liberty Mutual Insurance offers a decent salary for Underwriting Assistants. They work in underwriting roles in major cities like Boston, New York, and Toronto.

-

Brown & Brown Insurance

Average Salary: $54,096

Brown & Brown Insurance provides a good compensation package for Underwriting Assistants. They work across underwriting departments in cities such as Orlando, Nashville, and Austin.

-

TEKsystems

Average Salary: $53,640

TEKsystems offers competitive salaries for Underwriting Assistants. They provide opportunities to work in underwriting across offices in New York, Chicago, and Dallas.

-

RLI

Average Salary: $53,569

RLI provides a good salary for Underwriting Assistants. They work in underwriting departments across locations like Chicago, Philadelphia, and Detroit.

-

Intact Insurance Specialty Solutions

Average Salary: $50,988

Intact Insurance Specialty Solutions offers an average salary for Underwriting Assistants. They provide opportunities in underwriting roles in Toronto, Montreal, and Vancouver.

How to earn more as a Underwriting Assistant?

Becoming an Underwriting Assistant can lead to a stable career, but earning more requires dedication and the right skills. By focusing on key areas, professionals can increase their earning potential. One important factor is gaining experience. More experienced assistants often receive higher pay due to their proven track record.

Continuous learning and certification also play a crucial role. Specializing in areas like life insurance or property underwriting can make an assistant more valuable. Building a strong network within the industry helps in discovering new opportunities. Effective communication skills are essential for interacting with clients and colleagues. Lastly, maintaining a positive attitude and strong work ethic can lead to promotions and salary increases. These strategies can significantly enhance an Underwriting Assistant's earnings.

Here are five factors to consider for earning more as an Underwriting Assistant:

- Experience: Gaining more experience leads to higher pay.

- Certification: Special certifications can increase your value.

- Specialization: Focus on specific areas like life or property underwriting.

- Networking: Building a strong industry network can lead to better opportunities.

- Skills: Develop strong communication and work ethic skills.