What does a Account Clerk do?

An Account Clerk plays a vital role in managing the financial records of a company. This position involves ensuring that all financial transactions are recorded accurately and promptly. Responsibilities include processing invoices, managing accounts receivable and accounts payable, and reconciling bank statements. The Account Clerk must pay close attention to detail to avoid errors that could affect the company’s financial health.

In addition to transaction processing, the Account Clerk often assists with budgeting and forecasting. They work closely with other departments to ensure that all financial data is complete and accurate. This role requires strong organizational skills and a solid understanding of accounting principles. The Account Clerk must also maintain confidentiality and adhere to all financial regulations and company policies. This position is critical in helping a company maintain financial stability and integrity.

How to become a Account Clerk?

Becoming an account clerk involves several important steps. This role is vital in managing the financial records of a company. Account clerks handle tasks such as invoicing, data entry, and maintaining accurate records. Following these steps will guide someone through the process of becoming an account clerk.

The journey begins with gaining the necessary education and skills. Most employers look for candidates with at least a high school diploma. Some may prefer or require additional coursework in accounting or business. Taking classes in accounting, bookkeeping, or business administration can provide a solid foundation. Developing skills in computer software, such as Excel and accounting programs, is also beneficial.

Next, gaining experience is crucial. Consider starting with an internship or entry-level position in an accounting department. This hands-on experience will help someone understand the daily tasks and responsibilities of an account clerk. Volunteering or working part-time in a similar role can also be valuable.

- Education: Obtain a high school diploma or equivalent. Consider additional courses in accounting or business.

- Skills: Learn to use accounting software and develop strong computer skills.

- Experience: Gain experience through internships, part-time jobs, or volunteer work in accounting.

- Certifications: Pursue relevant certifications like the Certified Accounting Clerk (CAC) to enhance job prospects.

- Networking: Connect with professionals in the field through job fairs, industry events, and online platforms like LinkedIn.

How long does it take to become a Account Clerk?

To become an Account Clerk, one must first gain the necessary skills and education. This often involves earning a high school diploma or GED. Many employers prefer candidates with some college education, often in business, accounting, or a related field.

The journey to becoming an Account Clerk can vary. Some individuals may complete a certificate program in accounting or a similar area. This program might take about one year. Others may opt for a two-year associate degree in accounting or business. A four-year bachelor's degree can also provide a strong foundation. Each path offers different levels of depth and specialization.

Gaining practical experience can further enhance one's qualifications. Many Account Clerks start in entry-level positions and work their way up. Internships, part-time jobs, and volunteer work can all help. Most importantly, a clear dedication to the field can lead to success in this rewarding career.

Account Clerk Job Description Sample

The Account Clerk is responsible for managing accounts, ensuring accuracy in financial transactions, and supporting the accounting team in maintaining organized financial records. This role requires strong attention to detail and proficiency in accounting software.

Responsibilities:

- Process and record daily financial transactions, including accounts payable and receivable.

- Prepare and verify financial statements, reports, and documents for accuracy and compliance.

- Assist in the preparation of budgets and forecasts.

- Reconcile bank statements and resolve discrepancies.

- Maintain accurate and up-to-date financial records and documentation.

Qualifications

- High school diploma or equivalent required; Bachelor’s degree in Accounting or related field preferred.

- Proven experience as an Account Clerk or similar role.

- Proficient in accounting software and Microsoft Office Suite.

- Strong knowledge of accounting principles and practices.

- Attention to detail and accuracy in financial record-keeping.

Is becoming a Account Clerk a good career path?

An Account Clerk plays a vital role in the financial operations of a business. This role involves handling financial records, ensuring accuracy, and supporting the accounting team. Account Clerks often work in an office setting and may handle tasks such as processing payments, reconciling accounts, and preparing financial reports.

Choosing a career as an Account Clerk has several benefits. First, it provides a stable and steady income. Many businesses, from small startups to large corporations, need Account Clerks. This means there are plenty of job opportunities. Another benefit is the chance to learn and grow in the field of accounting. Account Clerks can gain valuable experience that can lead to higher positions in finance and accounting.

However, there are some challenges to consider. One is the need for accuracy and attention to detail. Mistakes in accounting can lead to serious financial problems for a business. Account Clerks must always be precise in their work. Another challenge is the repetitive nature of some tasks. While this can be easy and straightforward, it may become monotonous over time. The job can also involve working under pressure, especially during busy periods like tax season.

In summary, being an Account Clerk offers both rewarding opportunities and some challenges. It is a role that requires dedication and precision but also provides a solid foundation for a career in finance.

- Pros:

- Stable job opportunities

- Opportunities for growth and advancement

- Skills in financial management and reporting

- Cons:

- Need for high accuracy and attention to detail

- Repetitive tasks

- Potential for high-pressure work periods

What is the job outlook for a Account Clerk?

Becoming an Account Clerk offers a stable career path with solid job prospects. The Bureau of Labor Statistics (BLS) reports an average of 183,900 job openings per year for this role. These positions are found in various industries, from retail to finance. The demand for skilled account clerks remains strong, providing job seekers with multiple opportunities.

Despite the overall stability, the job outlook for Account Clerks shows a projected decline. The BLS predicts a decrease of 6.2% in job openings from 2022 to 2032. This trend is due to advancements in technology and automation. However, the job market still offers many positions, especially for those with strong skills and experience. Opportunities will continue to arise, particularly for clerks who adapt to new tools and practices.

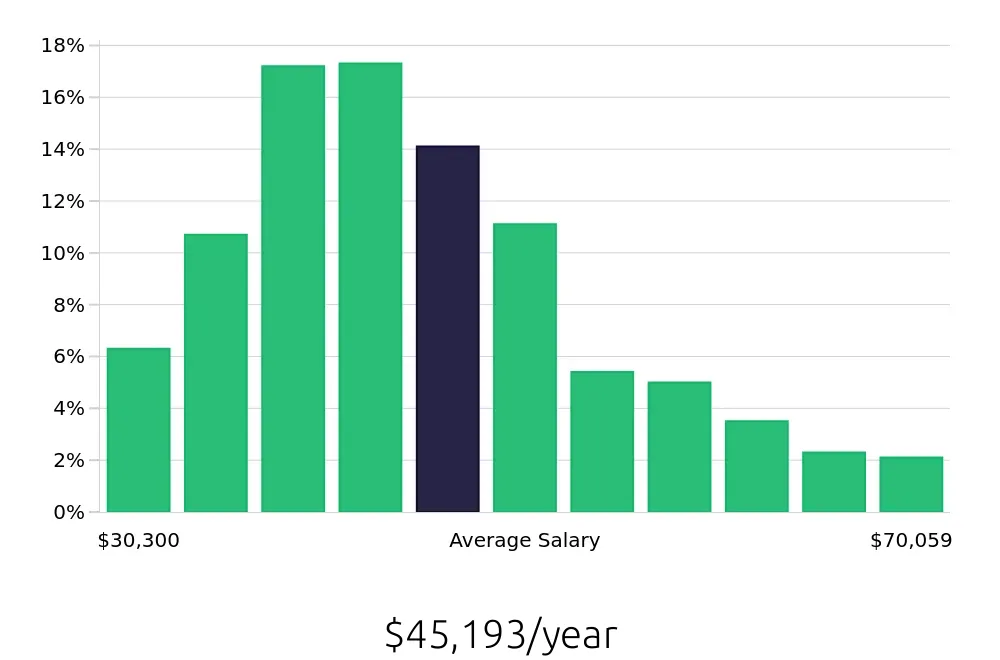

The compensation for Account Clerks is competitive, reflecting the importance of their work. According to the BLS, the average annual salary stands at $49,580. This translates to an hourly wage of $23.84. These figures provide a clear picture of the financial rewards for those who pursue this career. Job seekers can expect to earn a good income, making this a worthwhile profession to consider.

Currently 81 Account Clerk job openings, nationwide.

Continue to Salaries for Account Clerk