What does a Actuarial Analyst do?

An Actuarial Analyst plays a key role in assessing financial risks for businesses. They use statistical methods to study past data and predict future trends. This position requires a strong foundation in mathematics and statistics. Actuarial Analysts work in insurance, finance, and pension industries. Their work helps companies make smart decisions about pricing, risk management, and investments.

These professionals create detailed reports and models. They analyze data to understand patterns and risks. They present their findings to managers and decision-makers. Actuarial Analysts often collaborate with other teams to ensure accurate and effective risk assessments. Their work is crucial for creating stable financial strategies.

Key responsibilities include:

- Analyzing financial data

- Developing risk assessment models

- Creating detailed reports

- Collaborating with other departments

- Presenting findings to stakeholders

An Actuarial Analyst must stay updated with industry trends and regulatory changes. This position demands accuracy and attention to detail. It is perfect for those who enjoy working with numbers and solving complex problems.

How to become a Actuarial Analyst?

Becoming an Actuarial Analyst involves a clear and structured process. This career path requires a mix of education, certifications, and practical experience. By following these steps, one can build a successful career in actuarial analysis.

First, a solid educational foundation is essential. This starts with earning a bachelor’s degree in a field such as mathematics, statistics, economics, or a related discipline. Coursework in these areas provides the necessary analytical and problem-solving skills.

- Earn a bachelor’s degree in a relevant field.

- Pass actuarial exams administered by professional organizations like the Society of Actuaries (SOA) or the Casualty Actuarial Society (CAS).

- Gain experience through internships or entry-level positions in insurance, consulting, or financial services.

- Obtain professional certifications by completing required exams and practical experience.

- Continue professional development with ongoing education and staying current with industry trends.

After completing the degree, the next step involves passing a series of rigorous actuarial exams. These exams cover various topics such as probability, financial mathematics, and statistics. Passing these exams is a key requirement for certification.

How long does it take to become a Actuarial Analyst?

Learning to become an Actuarial Analyst can take several years. This journey begins with a strong educational foundation. Most analysts hold at least a bachelor's degree in a related field, such as mathematics, statistics, or finance. Coursework in these areas provides the essential knowledge needed.

After earning a degree, the next step involves passing professional exams. The Actuarial Profession sets out a series of exams. Passing these exams shows that an individual has the skills needed for the job. This process can take a few years, as each exam has its own study and testing timeline. Typically, candidates spend months preparing for each exam. They also need to balance this with any job responsibilities they may have. This means that becoming fully qualified can take several years, often around 4-6 years from the start of a degree program.

Actuarial Analyst Job Description Sample

The Actuarial Analyst is responsible for analyzing data and trends to develop actuarial models and forecasts. They work closely with other analysts and actuaries to provide insights and recommendations on financial risks, insurance products, and investment strategies. This role requires strong analytical skills, attention to detail, and proficiency in statistical software.

Responsibilities:

- Analyze and interpret complex data sets to develop actuarial models and forecasts.

- Prepare and present actuarial reports and findings to senior management and stakeholders.

- Collaborate with other analysts and actuaries to gather data and insights for risk assessments.

- Develop and maintain relationships with external stakeholders, including insurance companies and regulators.

- Assist in the preparation of actuarial examinations and audits.

Qualifications

- Bachelor’s degree in Actuarial Science, Mathematics, Statistics, Economics, or a related field.

- Pass at least one Actuarial Society exam (e.g., Society of Actuaries, Casualty Actuarial Society).

- Proficient in statistical software such as R, Python, SAS, or SQL.

- Strong analytical and problem-solving skills.

- Excellent attention to detail and accuracy in data analysis.

Is becoming a Actuarial Analyst a good career path?

An Actuarial Analyst plays a key role in the insurance and finance industries. This role involves using mathematical models to analyze the financial risks of events. The analyst provides insights that help companies make informed decisions. The job often requires strong skills in statistics and problem-solving.

Being an Actuarial Analyst offers several advantages. It provides a stable career with good job security. The demand for actuarial professionals remains high. This role also offers opportunities for career advancement. Many analysts can move into senior positions or specialize in areas like pension funds or healthcare.

However, there are some challenges to consider. The work can be highly competitive. A strong background in mathematics and a solid academic record are often needed to secure a position. The job can also be demanding. Analysts face tight deadlines and high expectations. Balancing the workload can sometimes be tough.

Here are some pros and cons of a career as an Actuarial Analyst:

- Pros:

- Strong job security

- Good earning potential

- Career advancement opportunities

- In-demand skills

- Cons:

- Highly competitive field

- Demanding workload

- Need for strong mathematical skills

- Possibly stressful work environment

What is the job outlook for a Actuarial Analyst?

Actuarial Analysts have a promising career outlook, with the Bureau of Labor Statistics (BLS) reporting an average of 2,300 job positions opening each year. This consistent demand highlights a stable job market, making it a favorable field for job seekers looking for opportunities. The BLS also projects a 23.2% increase in job openings from 2022 to 2032, signaling a strong growth potential for those entering or advancing in this career.

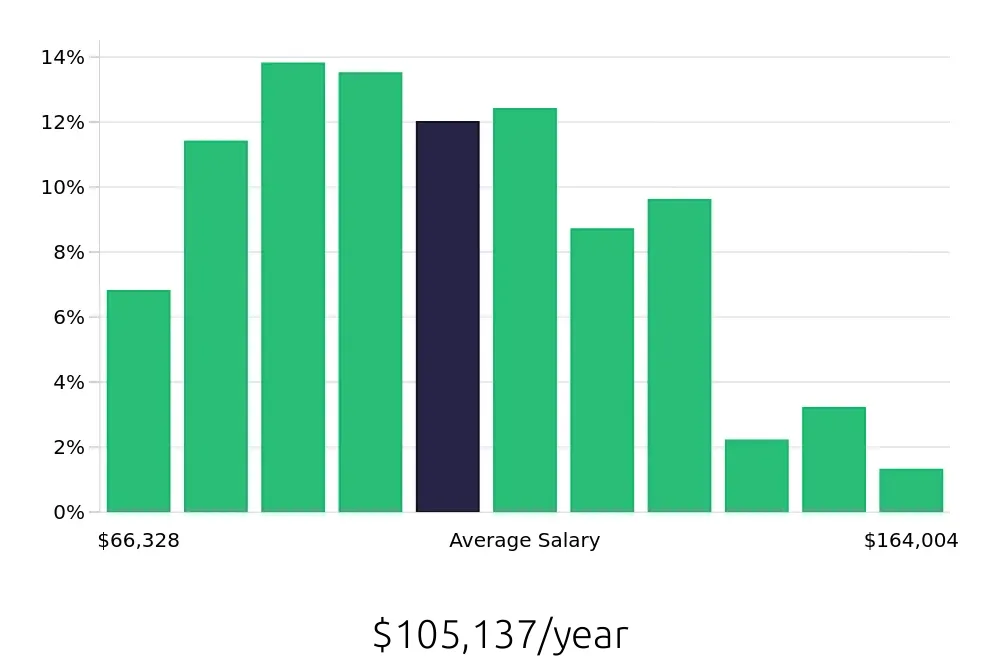

For professionals in this role, the financial rewards are significant. The average national annual compensation for Actuarial Analysts stands at $132,500, reflecting the value of their expertise in the field. Additionally, the average hourly compensation is $63.7, indicating that actuarial work is well-compensated. These figures make a strong case for the financial benefits of pursuing a career as an Actuarial Analyst.

The combination of steady job availability and attractive compensation makes the Actuarial Analyst role an appealing choice for job seekers. With a growing need for skilled professionals in this area, the industry presents numerous opportunities for career growth and financial success. For those considering this career path, the outlook is not just positive but also promising for long-term stability and advancement.

Currently 127 Actuarial Analyst job openings, nationwide.

Continue to Salaries for Actuarial Analyst