How much does a Actuarial Analyst make?

An actuarial analyst uses math, statistics, and financial knowledge to predict future business risks. Many companies hire actuarial analysts. They want to understand the risks that could affect their business.

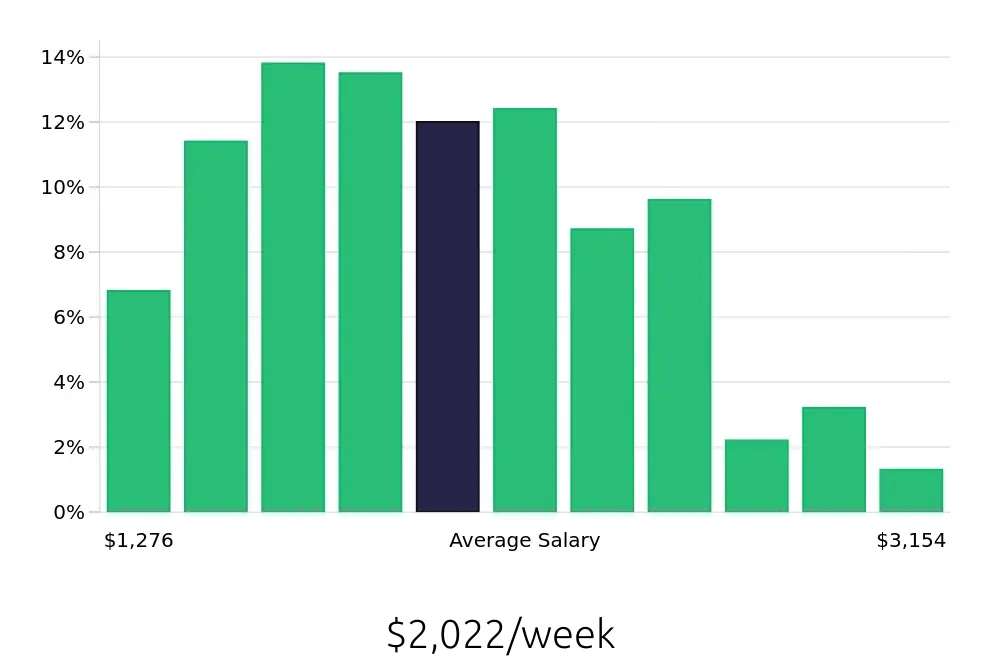

On average, an actuarial analyst earns about $105,137 per year. Salary can vary. It depends on experience, location, and the type of company. Some analysts make less than $75,208 a year. Others make more than $164,000. Most analysts fall somewhere in the middle of this range.

Factors that can affect salary include:

- Years of experience

- Certifications held

- Industry sector

- Geographic location

Experienced analysts with advanced certifications typically earn higher salaries. Those working in the finance or insurance industries may earn more than those in other sectors. Locations with a higher cost of living often offer higher salaries.

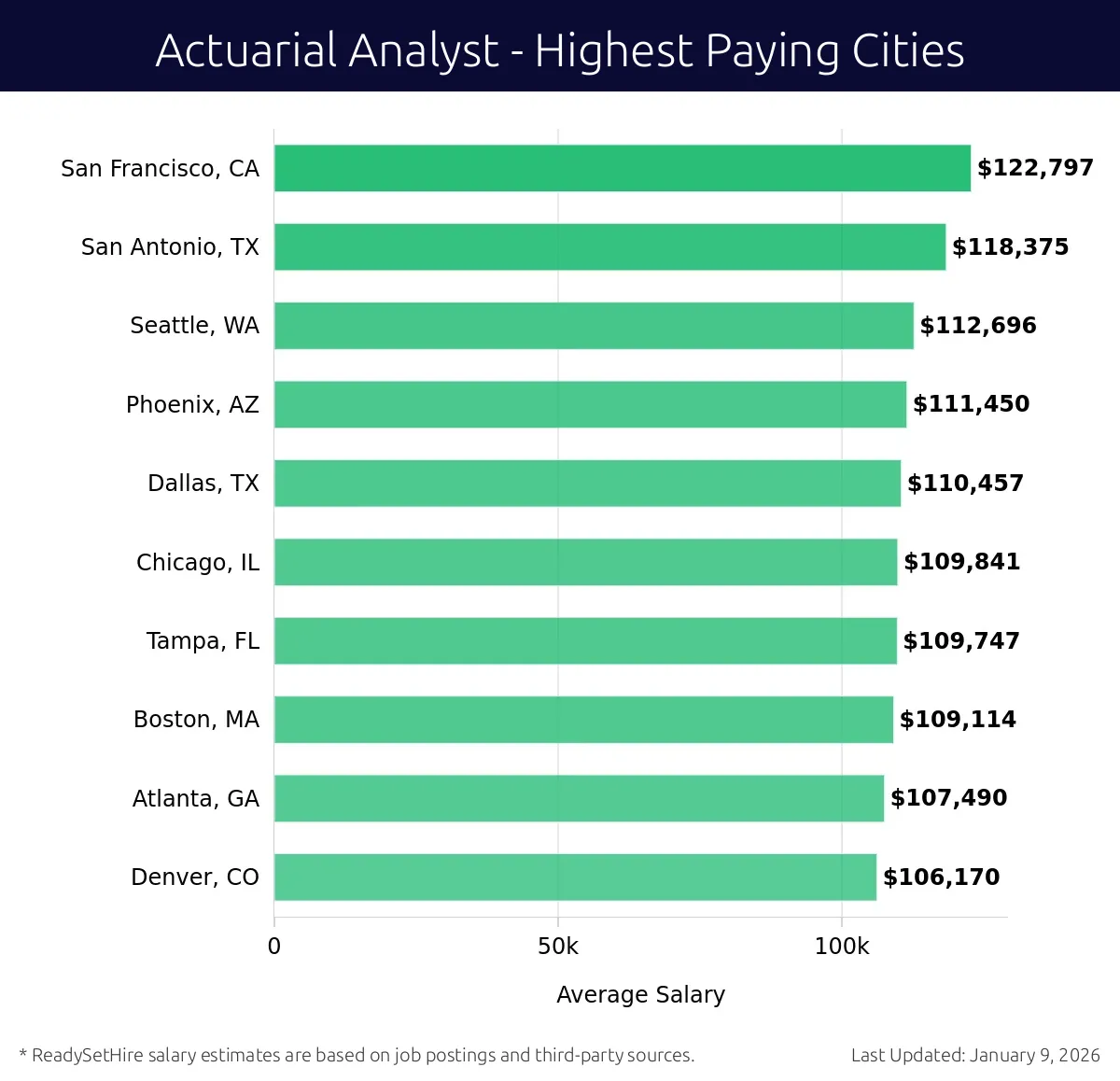

What are the highest paying cities for a Actuarial Analyst?

-

San Francisco, CA

Average Salary: $122,797

In San Francisco, professionals analyze data and create models for risk assessment. Companies like Goldman Sachs and Facebook offer great opportunities for growth.

Find Actuarial Analyst jobs in San Francisco, CA

-

San Antonio, TX

Average Salary: $118,375

San Antonio provides a vibrant environment for analyzing insurance risks. Firms such as USAA and Frost Bank are leaders in the field.

Find Actuarial Analyst jobs in San Antonio, TX

-

Seattle, WA

Average Salary: $112,696

Seattle is known for its tech-savvy atmosphere. Here, analysts work with major firms like Amazon and Microsoft to develop predictive models.

Find Actuarial Analyst jobs in Seattle, WA

-

Phoenix, AZ

Average Salary: $111,450

In Phoenix, the focus is on creating accurate forecasts for various industries. Companies such as State Farm and Nationwide are prominent employers.

Find Actuarial Analyst jobs in Phoenix, AZ

-

Dallas, TX

Average Salary: $110,457

Dallas offers a dynamic market for risk management. Firms such as American Airlines and AT&T provide diverse projects for analysts.

Find Actuarial Analyst jobs in Dallas, TX

-

Chicago, IL

Average Salary: $109,841

Chicago is a hub for financial services. Analysts here work with giants like Allstate and Moody's to drive business decisions.

Find Actuarial Analyst jobs in Chicago, IL

-

Tampa, FL

Average Salary: $109,747

Tampa boasts a growing finance sector. Companies like Raymond James and Wells Fargo need skilled professionals to analyze data.

Find Actuarial Analyst jobs in Tampa, FL

-

Boston, MA

Average Salary: $109,114

Boston's rich academic environment supports actuarial work. Leading firms such as State Street and Liberty Mutual offer rewarding positions.

Find Actuarial Analyst jobs in Boston, MA

-

Atlanta, GA

Average Salary: $107,490

Atlanta provides a mix of industries for risk analysis. Key employers include Aflac and SunTrust, offering varied projects.

Find Actuarial Analyst jobs in Atlanta, GA

-

Denver, CO

Average Salary: $106,170

Denver's growing tech and finance sectors create ample opportunities. Firms like Colorado National Bank and Rocky Mountain Insurance Group need analysts.

Find Actuarial Analyst jobs in Denver, CO

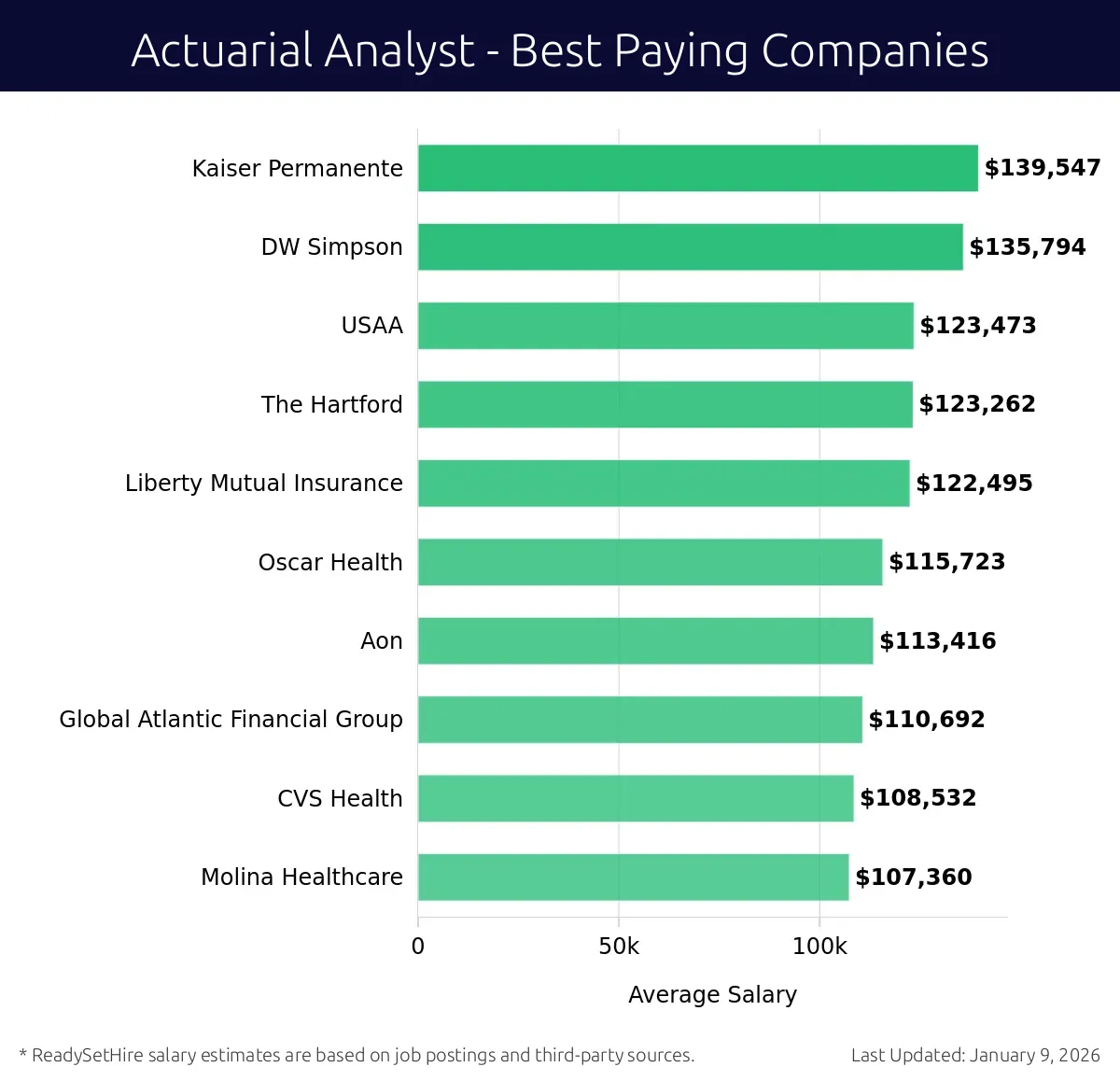

What are the best companies a Actuarial Analyst can work for?

-

Kaiser Permanente

Average Salary: $139,547

Kaiser Permanente offers Actuarial Analyst positions in many of its locations. Employees work in a team-oriented setting. They focus on risk assessment and financial modeling. The company has hospitals and medical offices in several states.

-

DW Simpson

Average Salary: $135,794

DW Simpson provides Actuarial Analyst jobs in different parts of the country. Employees analyze data to help make important business decisions. The company offers a dynamic work environment with many growth opportunities.

-

USAA

Average Salary: $123,473

USAA has Actuarial Analyst positions available. Employees work on projects that affect financial strategies. The company operates in the U.S. and focuses on serving military personnel and their families.

-

The Hartford

Average Salary: $123,262

The Hartford offers Actuarial Analyst jobs to those who want to make a difference. Employees do risk assessment and help in setting insurance rates. The company works across many states.

-

Liberty Mutual Insurance

Average Salary: $122,495

Liberty Mutual Insurance has many Actuarial Analyst positions. Employees analyze data to help with insurance policies. The company is large and operates throughout the U.S.

-

Oscar Health

Average Salary: $115,723

Oscar Health offers Actuarial Analyst jobs with a focus on innovation. Employees help shape the company’s financial future. They work in several locations across the U.S.

-

Aon

Average Salary: $113,416

Aon provides Actuarial Analyst positions for those who want a global perspective. Employees analyze risk and help develop strategies. The company operates in many countries.

-

Global Atlantic Financial Group

Average Salary: $110,692

Global Atlantic Financial Group has Actuarial Analyst jobs for those who want to work in the financial services industry. Employees focus on risk assessment and financial planning. The company operates in multiple locations.

-

CVS Health

Average Salary: $108,532

CVS Health offers Actuarial Analyst positions with a focus on health care. Employees analyze data to help with financial decisions. The company has many locations across the U.S.

-

Molina Healthcare

Average Salary: $107,360

Molina Healthcare provides Actuarial Analyst jobs with an emphasis on health care. Employees work on projects that affect insurance policies. The company operates in multiple states.

How to earn more as a Actuarial Analyst?

To earn more as an Actuarial Analyst, consider these key factors to enhance your value in the job market. One way is to specialize in a high-demand area, such as healthcare or pensions. Specialization can lead to higher-paying positions and open more career advancement opportunities. Networking with professionals in your chosen field also plays a critical role. Building relationships with industry leaders and attending relevant conferences can lead to job offers and salary increases. Gaining relevant certifications like the Associate of the Society of Actuaries (ASA) or the Fellow of the Society of Actuaries (FSA) can further boost earning potential. Continuous education in data analysis and risk management skills keeps an analyst's expertise sharp. Finally, taking on leadership roles or projects that demonstrate a strong ability to manage teams can lead to higher positions and increased compensation.

Additionally, experience and tenure within a company often lead to higher salaries. Employers value tenured employees who have proven their reliability and skills over time. Those who pursue advanced degrees, such as a Master’s in Actuarial Science or an MBA, also see better earning potential. Pursuing certifications from recognized bodies and gaining experience with leading software tools in the actuarial field enhances marketability and earning power. By focusing on these factors, an Actuarial Analyst can effectively increase their income and career prospects.

- Specialize in high-demand areas

- Network with industry professionals

- Obtain relevant certifications

- Pursue continuous education

- Take on leadership roles or projects