Position

Overview

A Claims Examiner reviews insurance claims to decide if and how much an insurance company should pay. This role involves carefully examining documents and facts to assess the validity of claims. The examiner communicates with policyholders and other stakeholders to gather necessary information. They use analytical skills to interpret policies and determine the extent of the claim.

To be effective, a Claims Examiner needs a keen eye for detail and strong problem-solving skills. They must understand insurance policies thoroughly and be able to explain decisions clearly to claimants. The role requires good communication skills, both written and verbal, to interact with clients and colleagues. Additionally, they often work under tight deadlines and manage multiple cases simultaneously. This position plays a crucial role in ensuring that insurance policies are administered fairly and efficiently.

Becoming a Claims Examiner offers a rewarding career in the insurance industry. This role involves reviewing and investigating claims to decide on payment approvals. To pursue this career, follow these key steps.

First, obtain a high school diploma or GED. This is the foundational requirement for entering the field. Next, gain relevant experience. This could be through internships or entry-level jobs in insurance or related fields. Third, consider further education. While not always necessary, a degree in business, finance, or insurance can be beneficial. Fourth, develop necessary skills. These include attention to detail, strong communication, and analytical skills. Finally, seek certifications. Certifications from recognized bodies can enhance credibility and job prospects.

Each of these steps provides a solid foundation for a successful career as a Claims Examiner. By following these steps, job seekers can position themselves for opportunities in this growing field.

The path to becoming a Claims Examiner can vary. Most candidates pursue an associate's or bachelor's degree in insurance, business administration, or a related field. Some jobs may require only a high school diploma, but a degree can make candidates more competitive. This educational step often takes two to four years.

After completing education, many candidates gain experience through internships or entry-level jobs in the insurance industry. This hands-on experience helps candidates understand the claims process and industry practices. Typically, this phase lasts from six months to two years, depending on the role and available opportunities. Some positions may offer on-the-job training, which can shorten this period. Those with prior experience or specialized training in insurance may find this step quicker.

A Claims Examiner evaluates insurance claims, assesses their validity, and determines the extent of coverage and compensation. This role requires strong analytical skills, attention to detail, and the ability to communicate effectively with policyholders and internal teams.

Responsibilities:

Qualifications

A Claims Examiner plays a key role in the insurance industry. This professional reviews and evaluates insurance claims to determine coverage and settlement amounts. Working for insurance companies, government agencies, or third-party firms, they ensure policies are honored while also protecting the company’s interests.

Interested parties should know the career offers a stable job with good earning potential. However, it also comes with its own set of challenges. Understanding both sides can help individuals decide if this path fits their career goals.

Below are some pros and cons to consider.

The job outlook for Claims Examiners offers a mix of stability and growth opportunities. On average, the Bureau of Labor Statistics (BLS) reports around 21,500 job openings each year. This consistent demand points to a steady stream of opportunities for those interested in this role.

While the job openings percent change from 2022 to 2032 is projected to decline by 3.1%, this slight decrease does not indicate a lack of demand. Instead, it suggests a more controlled growth, ensuring that the job market remains competitive and rewarding for skilled professionals. Job seekers can expect a healthy environment with opportunities to grow and advance.

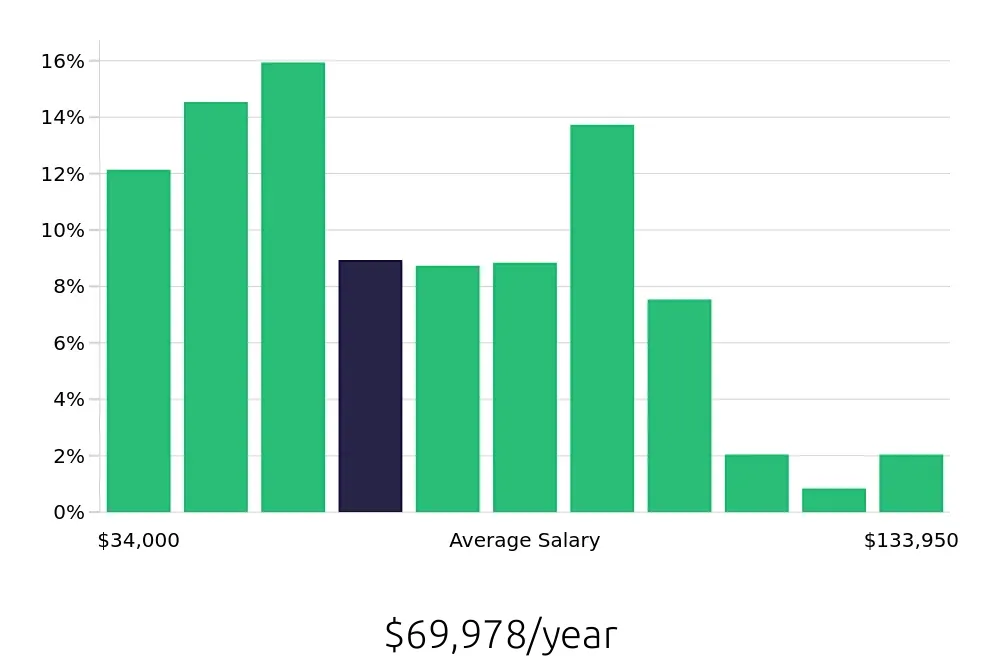

Claims Examiners enjoy a robust compensation package. BLS data indicates an average national annual salary of $75,760. Hourly rates stand at $36.43, reflecting the value placed on their expertise in evaluating and processing claims. This strong compensation makes the role appealing for those seeking both job security and financial stability.