How much does a Claims Examiner make?

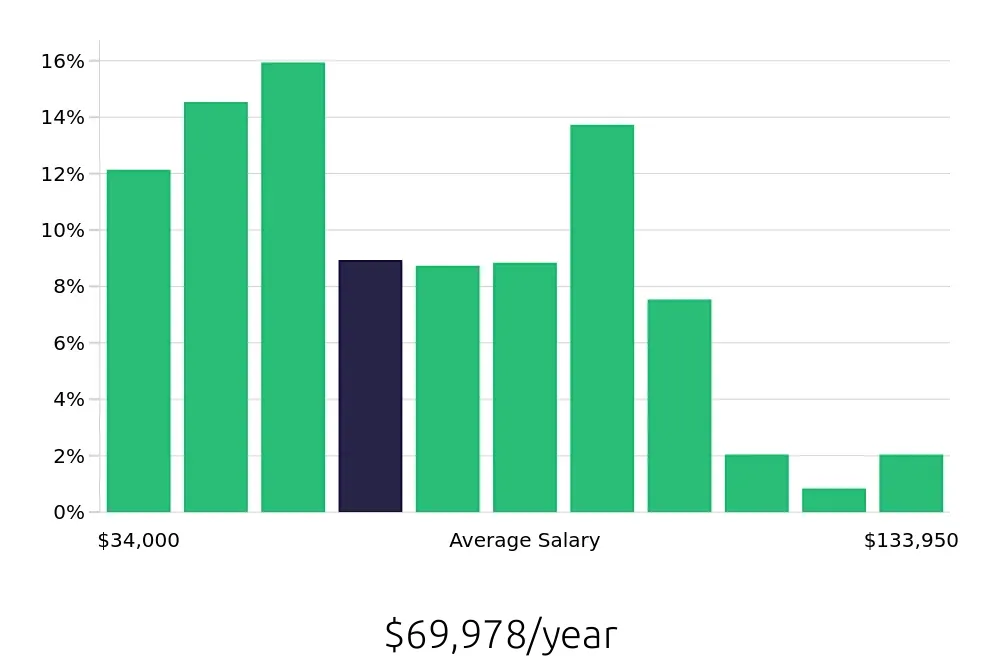

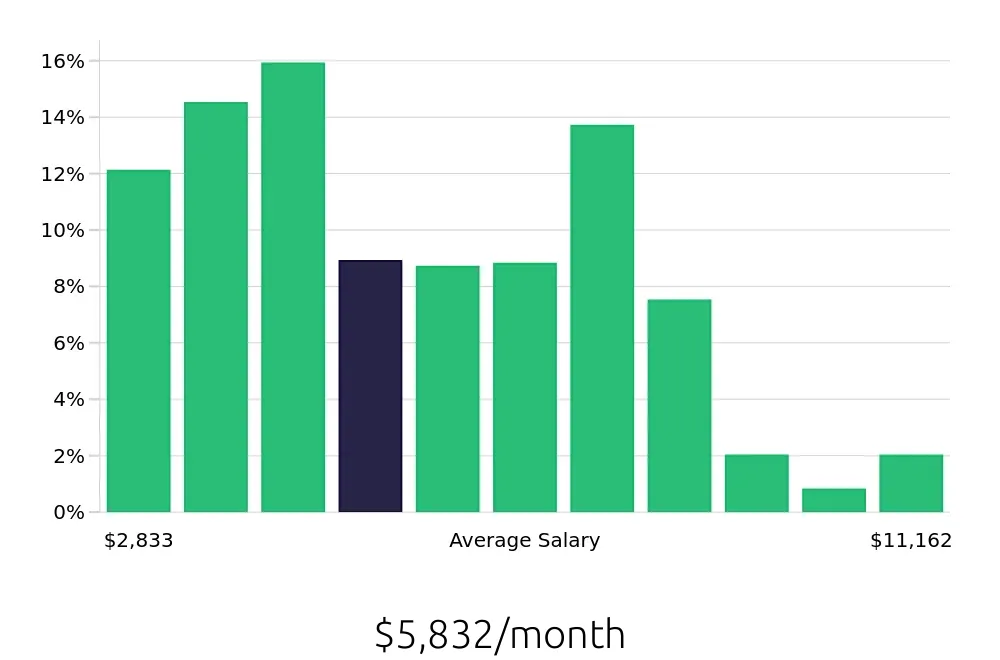

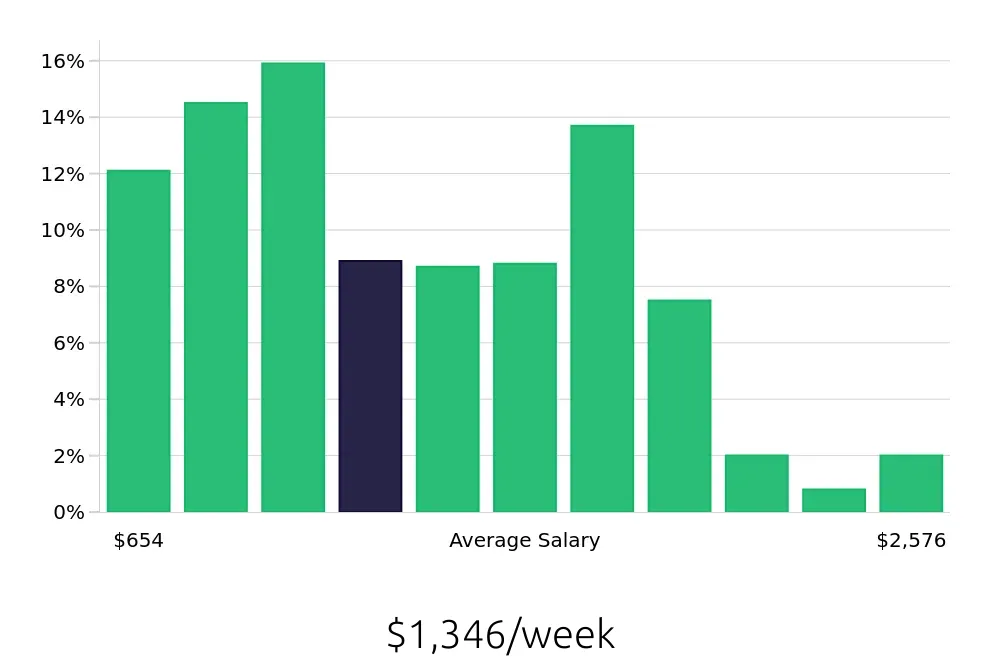

Claims examiners play a key role in the insurance industry. They investigate claims from policyholders to decide what benefits to pay out. These professionals earn a respectable income, with an average yearly salary of around $69,978. This is a rewarding job for those interested in both the insurance world and helping others.

The salary of a claims examiner can vary widely. Some factors that influence this include location, years of experience, and the specific insurance company. For instance, those in urban areas or with more experience often earn higher salaries. Here’s a look at some salary figures: 12.12% of claims examiners earn less than $34,000, while 1.99% earn over $124,000 annually. Most fall somewhere in between, earning between $43,086 and $115,777 per year.

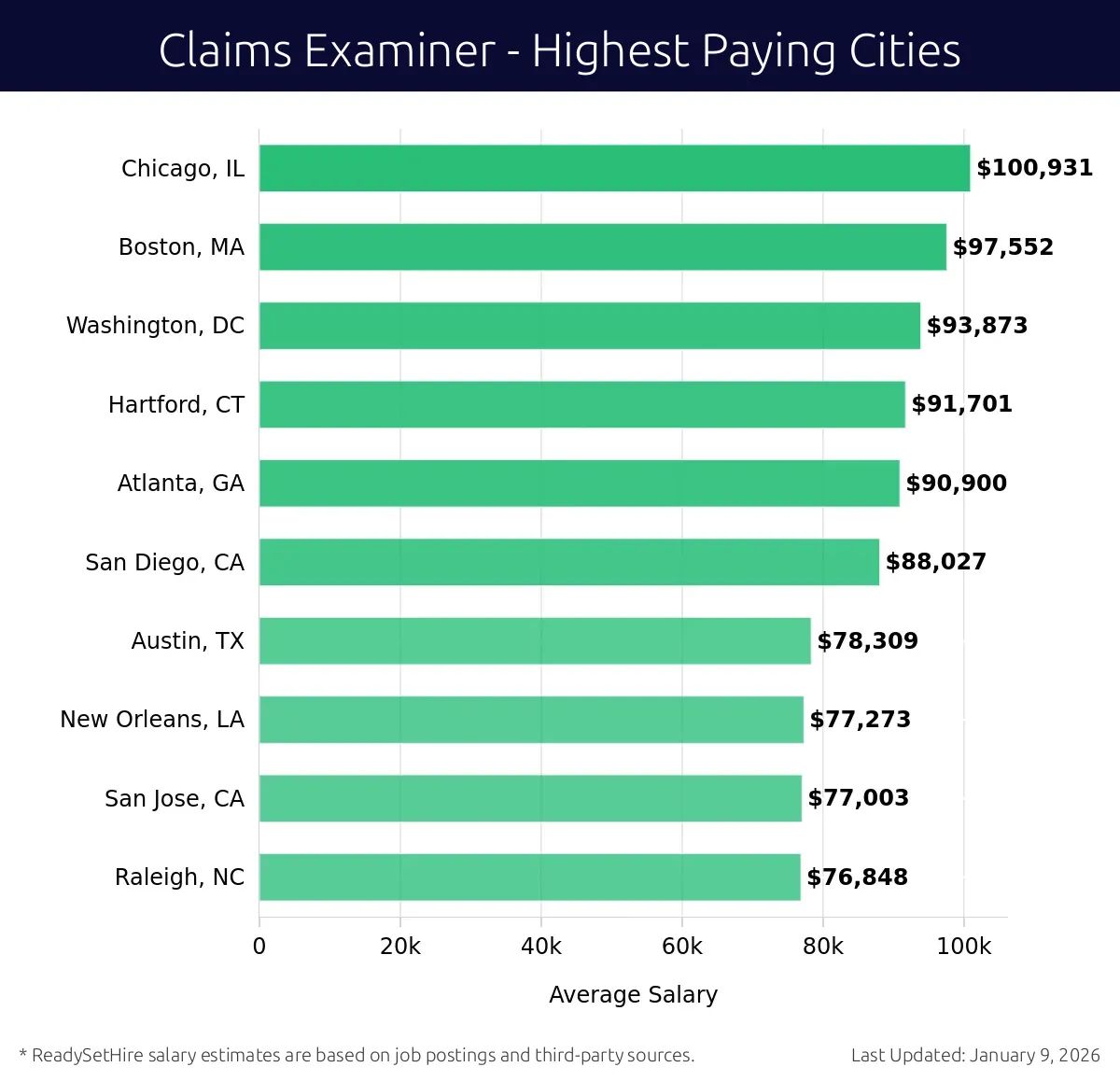

What are the highest paying cities for a Claims Examiner?

-

Chicago, IL

Average Salary: $100,931

In Chicago, working as an examiner involves reviewing insurance claims for validity. Companies like Allstate and Aon have a strong presence. The city's diverse businesses offer varied claims to process.

Find Claims Examiner jobs in Chicago, IL

-

Boston, MA

Average Salary: $97,552

Boston offers a dynamic environment for claims examiners, working for companies such as Liberty Mutual and State Street. The city's rich history brings a unique business culture to claims examination.

Find Claims Examiner jobs in Boston, MA

-

Washington, DC

Average Salary: $93,873

In Washington, DC, professionals analyze claims while surrounded by a significant number of insurance firms. Companies such as USAA and UnitedHealth Group are notable. The city's political environment adds a layer of complexity to claims.

Find Claims Examiner jobs in Washington, DC

-

Hartford, CT

Average Salary: $91,701

Hartford, known as the insurance capital, provides a robust setting for examiners. Working for giants like The Hartford and Aetna, professionals here enjoy a supportive insurance community.

Find Claims Examiner jobs in Hartford, CT

-

Atlanta, GA

Average Salary: $90,900

Atlanta offers a growing field for claims examiners with companies like Aflac and SunTrust Bank. The city's fast-paced atmosphere challenges professionals to stay sharp and efficient.

Find Claims Examiner jobs in Atlanta, GA

-

San Diego, CA

Average Salary: $88,027

San Diego provides a coastal setting for claims examiners, with a focus on diverse claims. Companies like Farmers Insurance and SDCCU offer a competitive environment to grow in.

Find Claims Examiner jobs in San Diego, CA

-

Austin, TX

Average Salary: $78,309

Austin's tech-savvy environment benefits claims examiners, with firms like Austin Energy and Whole Foods offering innovative challenges. The city's growth attracts a diverse array of claims.

Find Claims Examiner jobs in Austin, TX

-

New Orleans, LA

Average Salary: $77,273

In New Orleans, examiners work in a city rich in culture and history, dealing with claims from companies like Allstate and State Farm. The unique local flavor adds interest to the work.

Find Claims Examiner jobs in New Orleans, LA

-

San Jose, CA

Average Salary: $77,003

San Jose offers a tech-focused environment, with claims examiners working for giants like Cisco and Intel. The city's innovation drives a dynamic approach to claims handling.

Find Claims Examiner jobs in San Jose, CA

-

Raleigh, NC

Average Salary: $76,848

Raleigh provides a supportive environment for claims examiners, with companies like RBC and Progress Energy offering stability. The city's growth creates a steady flow of claims to manage.

Find Claims Examiner jobs in Raleigh, NC

What are the best companies a Claims Examiner can work for?

-

General Placement Service

Average Salary: $137,361

General Placement Service offers competitive salaries for Claims Examiners. This company has locations across the United States. They focus on providing exceptional service and support to their clients, making it a great place for claims professionals.

-

Berkley

Average Salary: $122,346

Berkley has a strong reputation for its Claims Examiner positions. They have offices in major cities like New York and London. Berkley emphasizes teamwork and career growth, providing a dynamic environment for claims professionals.

-

Berkshire Hathaway Specialty Insurance

Average Salary: $114,773

At Berkshire Hathaway Specialty Insurance, Claims Examiners benefit from high average salaries. The company operates globally, with significant locations in the U.S. and Europe. They offer excellent opportunities for professional development and career advancement.

-

Amazon.com

Average Salary: $104,800

Amazon.com provides solid compensation for Claims Examiners. With numerous locations worldwide, Amazon offers a diverse and innovative work environment. They are committed to supporting their employees' growth and success in the claims field.

-

Intercare Holdings Insurance Services

Average Salary: $104,292

Intercare Holdings Insurance Services has a robust pay scale for Claims Examiners. They have offices in major U.S. cities such as Miami and Chicago. The company values its employees and provides a supportive and growth-oriented workplace.

-

Markel Corporation

Average Salary: $93,867

Markel Corporation offers competitive salaries for Claims Examiners. They have locations across the United States, including Virginia and Massachusetts. The company is known for its collaborative culture and commitment to employee development.

-

ICW Group

Average Salary: $84,976

ICW Group provides attractive compensation for Claims Examiners. They have offices in key cities like New York and Denver. The company is focused on delivering quality service and fostering a supportive work environment.

-

Athens Administrators

Average Salary: $83,556

Athens Administrators offers a solid salary for Claims Examiners. They operate in major cities such as Los Angeles and New York. The company emphasizes a team-oriented approach and provides opportunities for career growth.

-

USLI

Average Salary: $83,137

USLI provides a competitive salary for Claims Examiners. They have locations across the U.S., including Houston and San Francisco. The company is dedicated to employee success and offers a collaborative work environment.

-

TRISTAR

Average Salary: $82,649

TRISTAR offers an attractive salary package for Claims Examiners. They have offices in cities like Phoenix and Seattle. The company focuses on providing a supportive and rewarding work experience for its employees.

How to earn more as a Claims Examiner?

Becoming a top-performing Claims Examiner can lead to earning more in this rewarding career. It involves understanding the intricacies of claims processing and delivering accurate, timely evaluations. Certain strategies can help Claims Examiners advance their skills and potentially increase their earnings.

Investing in professional development is a key factor. Gaining certifications, such as the Certified Claims Professional (CCP) designation, showcases expertise and dedication. These certifications often lead to higher-paying positions. Additionally, staying current with industry trends through workshops and online courses ensures a deep understanding of evolving practices.

Building a strong professional network also helps. Attending industry conferences, joining professional associations, and connecting with peers provide insights into better opportunities. Networking can lead to job offers that come with higher salaries. Collaborating with colleagues fosters a better work environment and can lead to recommendations for promotions.

Experience plays a crucial role in earning more as a Claims Examiner. Working in different areas of claims management broadens skill sets. Taking on challenging cases and successfully resolving them demonstrates competence and reliability. More experienced Claims Examiners often earn higher salaries due to their proven track record.

Excelling in communication and negotiation skills can also lead to higher earnings. Claims Examiners who can clearly explain decisions and negotiate favorable settlements for both parties often stand out. These skills can result in more complex and lucrative assignments. Effective communication helps in building trust with clients and employers, opening doors to better-paying roles.

Lastly, seeking continuous feedback and setting personal goals for improvement ensures ongoing growth. Regularly reviewing performance with supervisors and aiming to exceed expectations can lead to promotions and salary increases. Being proactive in seeking better opportunities and enhancing skills ensures long-term success and higher earnings in this field.