What does a Claims Processor do?

A Claims Processor reviews and assesses insurance claims. This role involves examining the details of each claim to determine the validity and amount of compensation due. Processors gather necessary documents, analyze claim information, and communicate with claimants to clarify any uncertainties. They ensure that each claim is processed efficiently and accurately, aiming to resolve claims in a timely manner. This position often requires attention to detail and a strong understanding of insurance policies and procedures.

In this role, a Claims Processor also collaborates with other departments, such as underwriting and risk management. They may need to consult with medical experts or legal professionals to make informed decisions. Effective communication skills are essential, as processors must explain claim decisions to claimants and provide clear guidance on the next steps. Proficiency in using computer software and databases is crucial for managing and tracking claims throughout the process. Processors must stay updated on changes in insurance regulations and company policies to ensure compliance in all actions.

How to become a Claims Processor?

Becoming a claims processor is an attainable goal for those interested in the insurance industry. This role involves reviewing and processing claims to determine the appropriate payouts. Employers look for candidates who can handle this responsibility with accuracy and efficiency.

Starting this career path requires dedication and the right steps. Here are the key steps to becoming a successful claims processor:

- Obtain a high school diploma or GED. This is the foundational step in preparing for a career in claims processing.

- Gain relevant education. Pursue a certificate or degree in insurance, finance, or a related field. Some employers prefer candidates with formal education in these areas.

- Develop key skills. Learn skills like attention to detail, analytical thinking, and communication. These are crucial for handling claims effectively.

- Find entry-level positions. Apply for positions such as an insurance claims assistant. These roles provide hands-on experience and the opportunity to learn from experienced professionals.

- Advance in your career. With experience, move into more senior roles. Consider certifications to boost your resume and enhance your job prospects.

How long does it take to become a Claims Processor?

The journey to becoming a Claims Processor can vary. Typically, it takes around one to two years to gain the necessary skills and qualifications. This path often starts with obtaining a high school diploma or equivalent.

Applicants can enhance their chances by completing a postsecondary certificate program. These programs usually last about one year. Some community colleges and vocational schools offer these courses. They focus on insurance principles, claims processing, and computer skills. After completing these courses, individuals can seek entry-level positions. With experience, they can advance to higher roles within a few years.

In some cases, a bachelor’s degree in business administration or a related field can speed up the process. A degree program typically takes four years to complete. This path may also include internships or part-time work during studies. These experiences provide practical knowledge and can lead to quicker job placements.

Claims Processor Job Description Sample

The Claims Processor is responsible for processing, evaluating, and settling insurance claims in a timely and accurate manner. They will interact with claimants, policyholders, and internal departments to ensure claims are handled according to company policies and procedures.

Responsibilities:

- Evaluate and process insurance claims by reviewing documentation and determining the validity and extent of coverage.

- Communicate with claimants and policyholders to obtain additional information and provide updates on claim status.

- Conduct investigations into the circumstances surrounding claims, including interviewing claimants and witnesses, and obtaining pertinent documents.

- Collaborate with internal departments such as underwriting, legal, and medical departments to ensure accurate claim assessment and settlement.

- Ensure all claims are processed within established timelines and adhere to company policies and procedures.

Qualifications

- High school diploma or equivalent; Bachelor’s degree in Business, Insurance, or related field preferred.

- Minimum of 2-3 years of experience in claims processing or a related field.

- Knowledge of insurance policies, procedures, and regulations.

- Strong analytical and problem-solving skills.

- Excellent communication and interpersonal skills.

Is becoming a Claims Processor a good career path?

A Claims Processor plays an important role in the insurance industry. This job involves reviewing and processing claims made by policyholders. Claims Processors ensure that the claims are valid and that the policyholders receive the correct compensation. This role offers many opportunities for professional growth and skill development. It allows someone to understand insurance policies and the claims process.

Working as a Claims Processor has its advantages and challenges. It is a job that requires attention to detail and good communication skills. The role demands someone who can handle sensitive information with integrity. Below are some pros and cons to consider for this career path.

- Pros:

- The job offers a clear career path with opportunities for advancement.

- It provides a stable and predictable income.

- Skills gained can transfer to other roles in the insurance industry.

- Cons:

- The work can be repetitive and may require long hours.

- It involves handling difficult situations with policyholders.

- Stress can come from meeting deadlines and processing claims efficiently.

What is the job outlook for a Claims Processor?

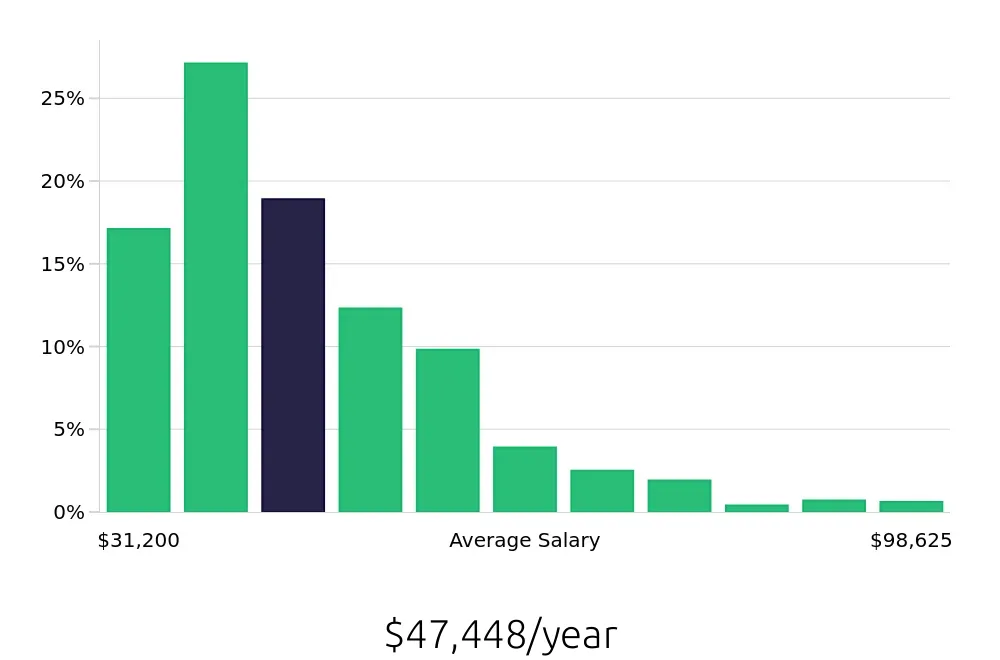

The role of a Claims Processor is an integral part of the insurance industry. This profession involves reviewing and processing claims from policyholders. This job is essential to ensure that insured individuals receive the benefits they are entitled to. The Bureau of Labor Statistics (BLS) indicates that an average of 22,100 job positions are available each year. This number represents a stable career path for those entering this field. The BLS also reports an average national annual compensation of $49,530. This compensation highlights the earning potential within this profession.

Job seekers should consider the outlook for this role. According to the BLS, job openings for Claims Processors are expected to decline by 3.2% from 2022 to 2032. Despite this decrease, the role remains crucial within the insurance sector. The decline may be due to technological advancements and automation. However, demand will continue in areas where manual review and personal interaction are necessary. The average national hourly compensation stands at $23.81, offering competitive wages. This figure is attractive for those seeking a stable and rewarding career.

In summary, becoming a Claims Processor offers a reliable career path with steady job opportunities. The BLS data shows a consistent demand for these professionals. Although job openings may decrease slightly, the role's importance remains unchanged. The average salary provides a good financial incentive. Job seekers can expect a stable and potentially rewarding career in this field.

Currently 129 Claims Processor job openings, nationwide.

Continue to Salaries for Claims Processor