How much does a Claims Processor make?

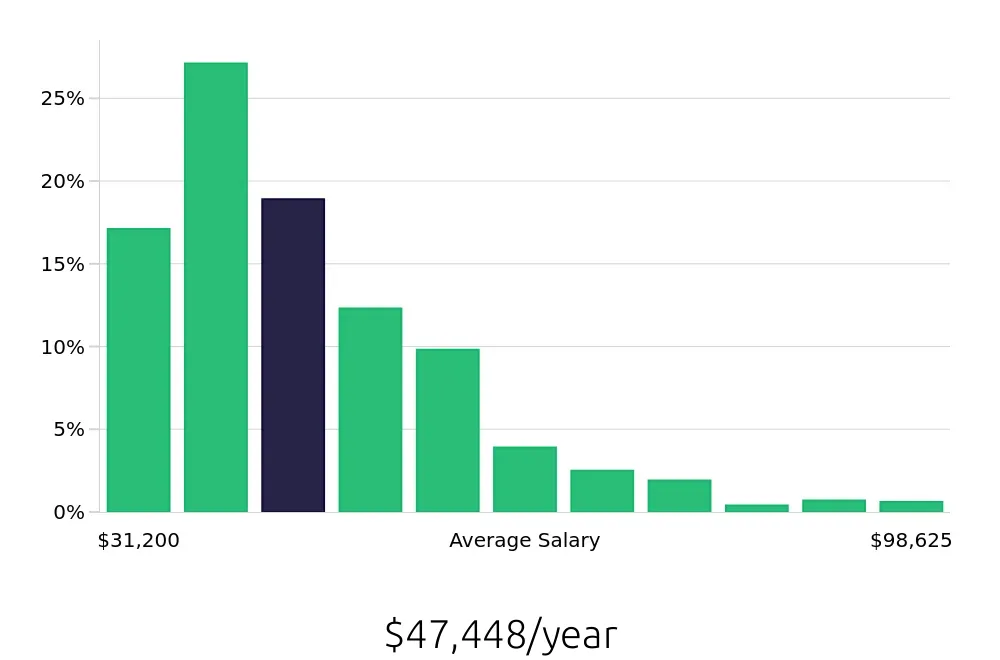

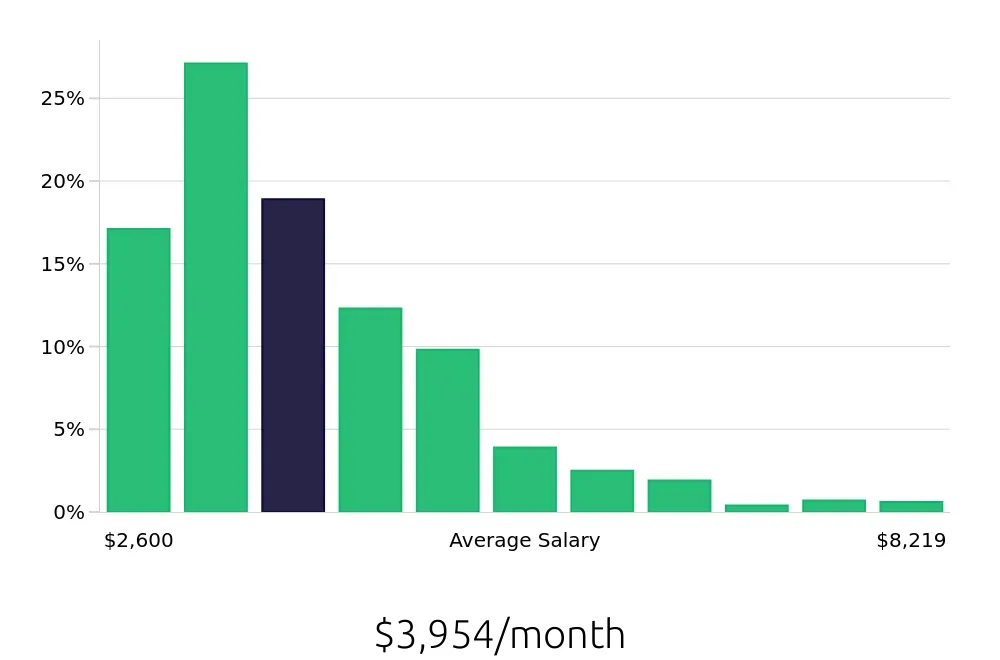

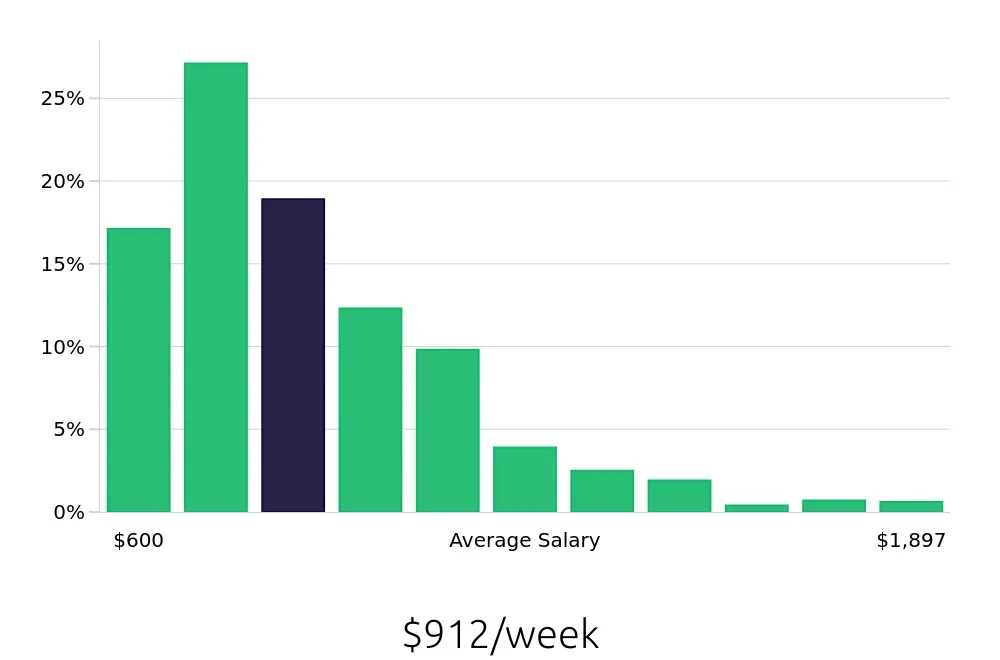

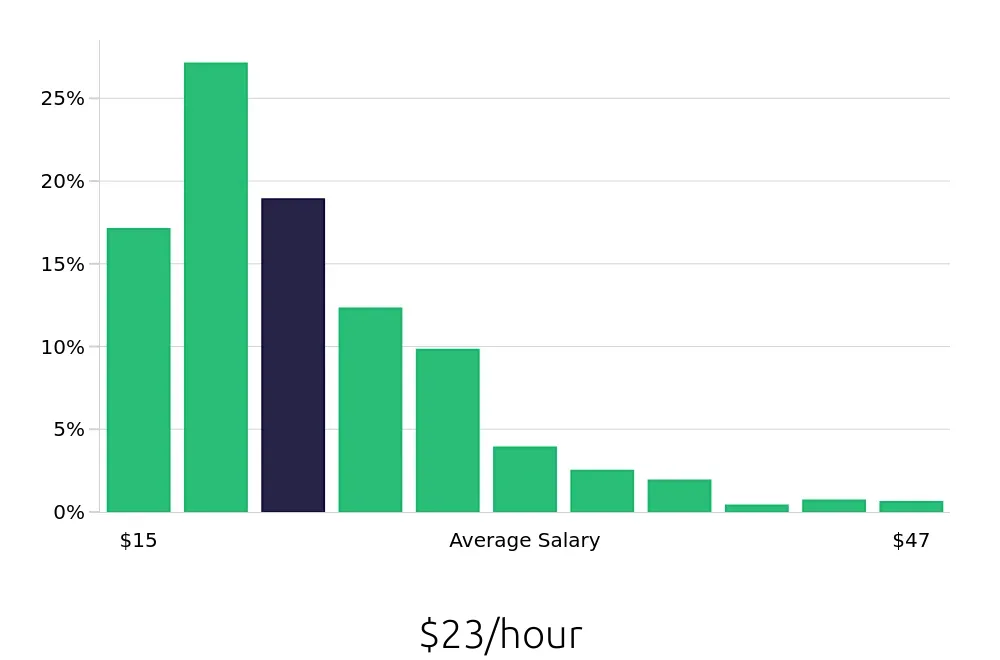

A Claims Processor handles insurance claims. They review and process claims based on policy terms. This job involves checking documents, communicating with claimants, and making decisions on settlements. The average yearly salary for a Claims Processor is around $47,448. Many start at lower wages but can earn more with experience and skills.

The salary of a Claims Processor can vary. Some make less than $31,200 a year while others earn more than $98,625. Most fall in the middle range, between $43,459 and $74,107 annually. Factors like location, company size, and industry affect earnings. Some large companies or specialized sectors may offer higher wages.

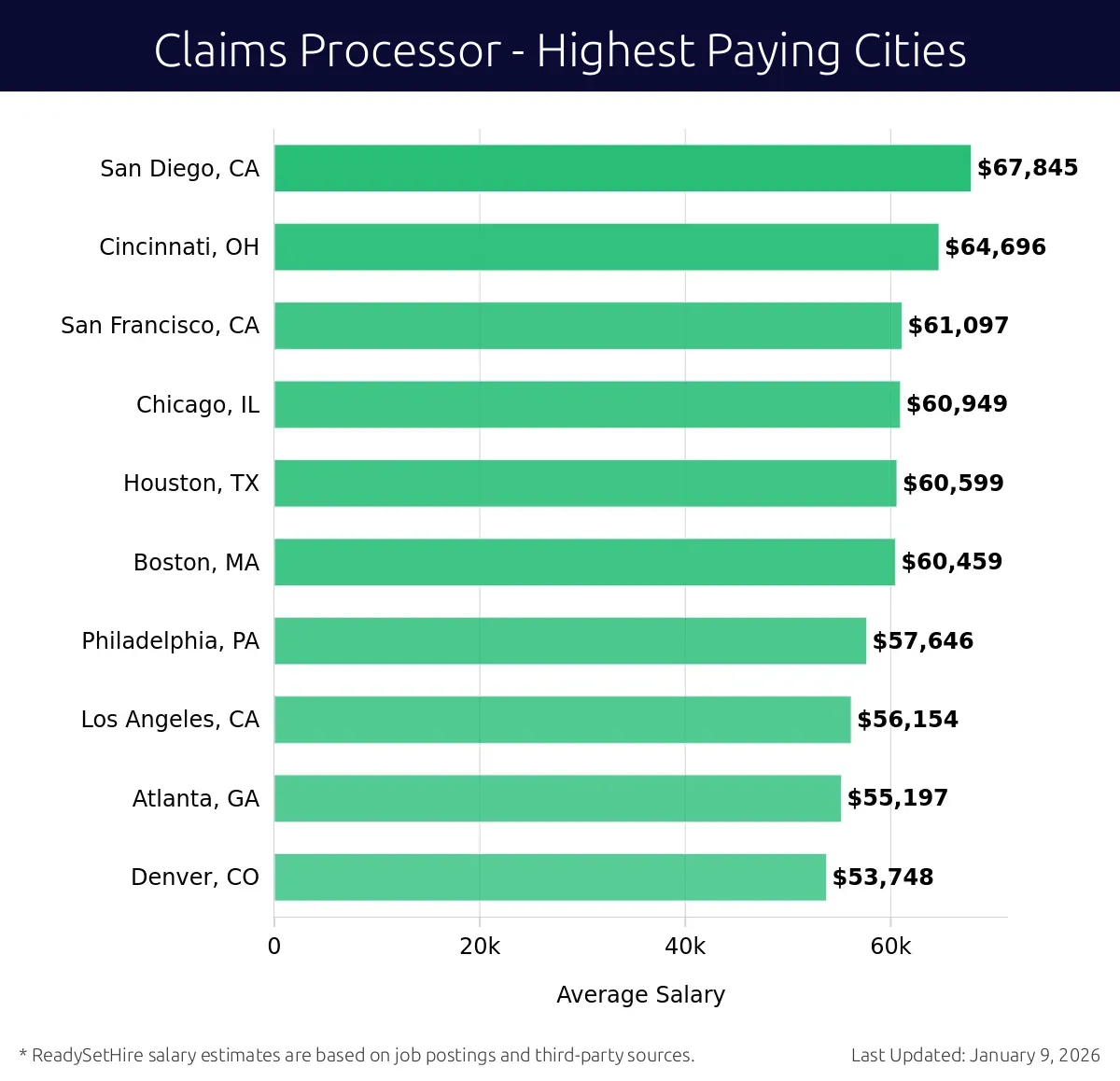

What are the highest paying cities for a Claims Processor?

-

San Diego, CA

Average Salary: $67,845

In San Diego, professionals enjoy a mild climate and beautiful coastal views. This city houses many insurance giants, including Kaiser Permanente and Farmers Insurance. Working here means you'll be part of a dynamic team focused on customer satisfaction.

Find Claims Processor jobs in San Diego, CA

-

Cincinnati, OH

Average Salary: $64,696

Cincinnati offers a mix of urban and suburban life with a rich cultural scene. Key employers like United Healthcare and American Financial Group provide a stable environment. Here, you'll handle claims efficiently, ensuring clients receive timely support.

Find Claims Processor jobs in Cincinnati, OH

-

San Francisco, CA

Average Salary: $61,097

San Francisco's vibrant tech hub offers opportunities at major firms like Anthem and Blue Shield. Working as a claims specialist, you'll navigate a fast-paced environment, dealing with a variety of insurance claims to ensure client needs are met.

Find Claims Processor jobs in San Francisco, CA

-

Chicago, IL

Average Salary: $60,949

Chicago is known for its rich history and diverse population. Major companies like Allstate and State Farm are present. As a claims processor, you'll work in a bustling atmosphere, ensuring claims are resolved accurately and swiftly.

Find Claims Processor jobs in Chicago, IL

-

Houston, TX

Average Salary: $60,599

In Houston, the energy industry thrives alongside insurance firms like Liberty Mutual and Travelers. This city offers a unique blend of opportunities. You will handle claims with an eye for detail, supporting clients through their insurance needs.

Find Claims Processor jobs in Houston, TX

-

Boston, MA

Average Salary: $60,459

Boston offers a mix of history and modernity with companies like Harvard Pilgrim and Blue Cross Blue Shield. Working here, you will engage with a diverse client base, handling claims with a focus on efficiency and customer care.

Find Claims Processor jobs in Boston, MA

-

Philadelphia, PA

Average Salary: $57,646

Philadelphia's historic charm meets modern opportunities. Working at companies like Independence Blue Cross and Cigna, you will manage claims in a supportive environment, helping clients navigate their insurance needs.

Find Claims Processor jobs in Philadelphia, PA

-

Los Angeles, CA

Average Salary: $56,154

Los Angeles offers a vibrant lifestyle with a plethora of opportunities at companies like Kaiser Permanente and Anthem. As a claims processor, you’ll thrive in a dynamic setting, supporting clients with their insurance claims.

Find Claims Processor jobs in Los Angeles, CA

-

Atlanta, GA

Average Salary: $55,197

Atlanta combines business growth with a friendly atmosphere. Companies like Aflac and SunTrust Bank provide diverse roles. As a claims processor, you'll work to ensure clients receive timely and accurate support.

Find Claims Processor jobs in Atlanta, GA

-

Denver, CO

Average Salary: $53,748

Denver’s scenic beauty and strong job market feature employers like HealthPartners and Farmers Insurance. Here, you’ll manage claims in a collaborative environment, ensuring clients get the help they need.

Find Claims Processor jobs in Denver, CO

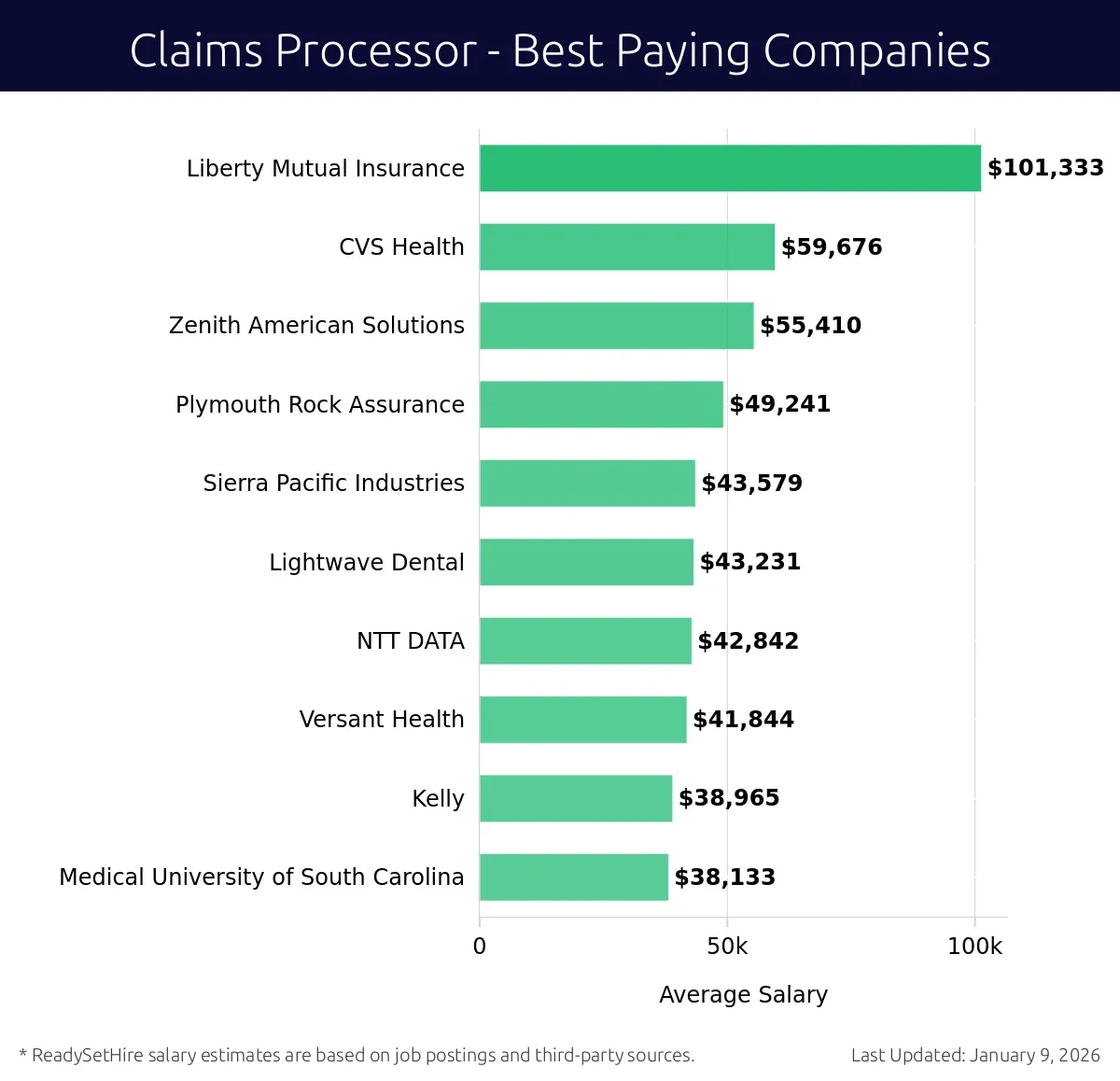

What are the best companies a Claims Processor can work for?

-

Liberty Mutual Insurance

Average Salary: $101,333

Liberty Mutual Insurance offers competitive salaries for Claims Processors. They operate nationwide and provide opportunities in various locations. The company values teamwork and offers a supportive work environment.

-

CVS Health

Average Salary: $59,676

CVS Health is known for its comprehensive benefits and supports Claims Processors in multiple locations. They prioritize professional growth and offer diverse career paths.

-

Zenith American Solutions

Average Salary: $55,410

Zenith American Solutions provides good salaries for Claims Processors. They operate in various locations and focus on employee development. The company emphasizes quality service and innovation.

-

Plymouth Rock Assurance

Average Salary: $49,241

Plymouth Rock Assurance offers attractive compensation for Claims Processors. They have a strong presence in multiple regions and focus on a collaborative work culture.

-

Sierra Pacific Industries

Average Salary: $43,579

Sierra Pacific Industries provides a decent salary for Claims Processors. They operate in diverse locations and promote a positive workplace environment.

-

Lightwave Dental

Average Salary: $43,231

Lightwave Dental offers competitive pay for Claims Processors. They have offices in several locations and focus on team support and professional development.

-

NTT DATA

Average Salary: $42,842

NTT DATA offers good salaries for Claims Processors. They operate in various regions and emphasize a collaborative work atmosphere.

-

Versant Health

Average Salary: $41,844

Versant Health provides good compensation for Claims Processors. They have multiple locations and focus on employee satisfaction and growth.

-

Kelly

Average Salary: $38,965

Kelly offers a decent salary for Claims Processors. They have offices in several locations and emphasize a supportive work environment.

-

Medical University of South Carolina

Average Salary: $38,133

The Medical University of South Carolina offers reasonable pay for Claims Processors. They operate in various locations and prioritize employee well-being and professional development.

How to earn more as a Claims Processor?

In the role of a Claims Processor, individuals can enhance their earning potential through various strategic approaches. One way to achieve this is by gaining more experience in the field. Experienced claims processors often command higher salaries due to their knowledge and efficiency in handling complex cases. Another factor includes obtaining relevant certifications, such as the Certified Claims Professional (CCP) credential, which can boost credibility and salary prospects.

Additionally, specialization in a particular type of claims, such as property damage or health insurance, can lead to higher earning opportunities. Employers often value specialized skills and may offer higher wages for such expertise. Networking within the industry also plays a crucial role. Building relationships with other professionals can lead to job opportunities that offer better pay. Finally, seeking out employers who offer competitive salaries and benefits can result in higher earnings. Researching and applying to companies known for fair compensation can make a significant difference.

Considering these factors can help claims processors increase their earning potential:

- Gain more experience in the field.

- Obtain relevant certifications.

- Specialize in a particular type of claims.

- Network with other industry professionals.

- Seek out employers with competitive salaries.