What does a Claims Representative do?

A Claims Representative reviews and processes insurance claims. This role requires a careful examination of claim information to determine the extent of coverage and the amount of payment to be issued. The Claims Representative communicates with policyholders to gather additional information when needed. They assess the validity of claims by comparing them against the policy terms and conditions.

Responsibilities of a Claims Representative include investigating claims, negotiating settlements, and ensuring timely payments. They must have strong analytical skills to accurately assess the claims. Effective communication is key, as they need to interact with policyholders, insurance adjusters, and other team members. The role involves using specialized software to manage claims and maintain accurate records. A Claims Representative works to resolve issues fairly and efficiently, helping clients through the claims process.

How to become a Claims Representative?

Becoming a Claims Representative offers a stable career path in the insurance industry. This role involves evaluating insurance claims to decide on payment amounts. Here is a clear process to start a career in this field.

First, gain relevant education and skills. Most employers require at least a high school diploma. Some may prefer candidates with an associate or bachelor's degree in business or a related field. Courses in accounting, computer skills, and business communication can be helpful. Developing strong written and verbal communication skills is also important.

- Complete relevant education and training.

- Gain experience through internships or entry-level jobs.

- Learn about insurance and claims processes.

- Apply for entry-level claims representative positions.

- Seek opportunities for professional development.

Second, gain experience through internships or entry-level jobs in the insurance industry. This hands-on experience can help build a solid foundation for a career in claims. Third, learn about insurance and claims processes. Understanding the basics of insurance and how claims are handled will prepare someone for this role. Fourth, apply for entry-level claims representative positions. Look for job openings at insurance companies, and apply with a well-crafted resume and cover letter. Networking can also lead to job opportunities. Finally, seek opportunities for professional development. Continuing education and certifications can advance a career in claims.

How long does it take to become a Claims Representative?

The path to becoming a Claims Representative often starts with a high school diploma. Many people enter this field by getting a relevant certificate or an associate degree. Some jobs may require a bachelor's degree, but this is less common.

On average, it takes about two to four years to complete the necessary education or training. This can vary based on the path taken. Some people may find entry-level jobs with a certificate, while others may need an associate degree. A bachelor’s degree can open up more opportunities and roles. Continuous education and training also help in advancing within the field.

Claims Representative Job Description Sample

A Claims Representative is responsible for evaluating and processing insurance claims, communicating with claimants, and ensuring accurate and timely resolution of claims. They play a crucial role in customer satisfaction and risk management within the organization.

Responsibilities:

- Evaluate claims by reviewing and analyzing policy information, medical records, and other relevant documents.

- Communicate with claimants, policyholders, and medical providers to gather necessary information for claim evaluation.

- Investigate claims to determine the validity and extent of coverage, ensuring compliance with company policies and procedures.

- Process payments and settlements for approved claims, ensuring accuracy and timeliness.

- Maintain detailed and organized records of all claim activities and decisions.

Qualifications

- Bachelor’s degree in Business, Finance, or a related field preferred.

- Previous experience in claims processing or a related field is highly desirable.

- Strong understanding of insurance policies, procedures, and regulatory requirements.

- Excellent analytical and problem-solving skills with attention to detail.

- Proficient in using computer software and claim management systems.

Is becoming a Claims Representative a good career path?

Working as a Claims Representative involves evaluating insurance claims and deciding on the amount to be paid. This role requires strong communication skills and a good understanding of insurance policies. Claims Representatives often work in an office setting, interacting with clients, insurance agents, and company supervisors. They need to analyze information, make decisions, and sometimes travel to inspect the damage or property involved in the claim.

This career offers opportunities to help people during difficult times, and it can be quite rewarding. It allows someone to use their analytical skills and attention to detail to solve problems. Being a Claims Representative can lead to career growth and the chance to specialize in different types of insurance claims. However, it can also be stressful, as the job often involves handling complaints and difficult decisions. The job might require long hours, especially when dealing with large claims or during peak claim periods.

Pros of being a Claims Representative include:

- Helping people in need.

- Using analytical skills to solve problems.

- Opportunities for career advancement.

- Potential for specialization in various types of claims.

Cons of this career include:

- Handling complaints and difficult decisions can be stressful.

- Long hours, especially during peak claim periods.

- The need to balance multiple claims at once.

What is the job outlook for a Claims Representative?

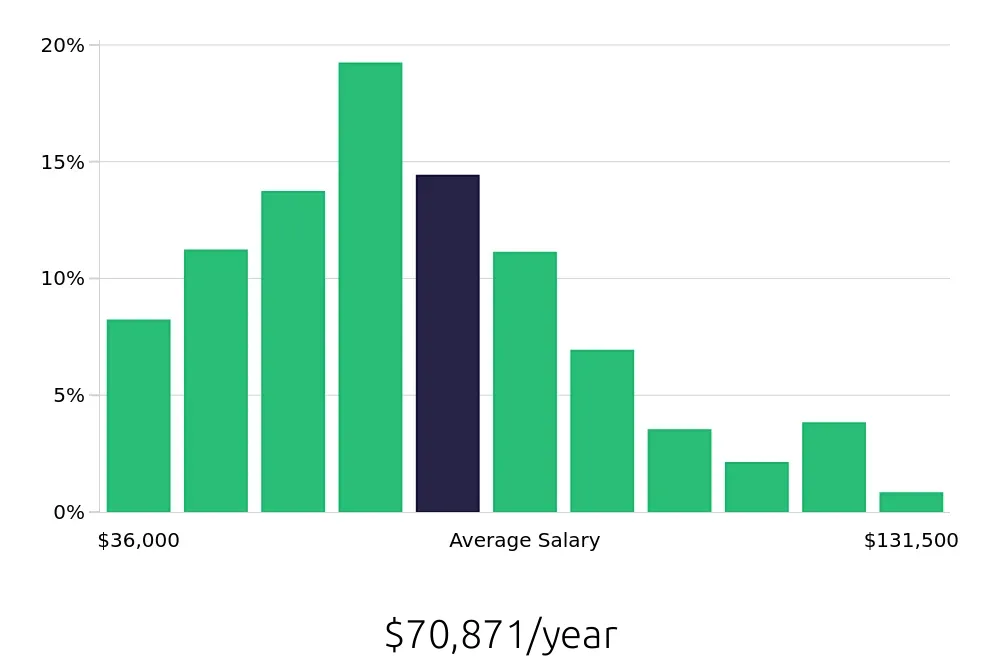

The job outlook for Claims Representatives remains stable, with the Bureau of Labor Statistics (BLS) reporting an average of 21,500 job positions available each year. Despite a projected percent change of -3.1 from 2022 to 2032, this role remains important within the industry. The average national annual compensation for this position is $75,760, providing a stable income for those in the field.

A Claims Representative plays a critical role in the insurance industry. This role involves evaluating and processing insurance claims, interacting with policyholders, and ensuring that claims are settled efficiently. With an average national hourly compensation of $36.43, this profession offers competitive pay, reflecting the value of the skills and responsibilities that these professionals bring to their employers. The BLS data underscores the steady demand for these professionals, despite the slight projected decrease in job openings over the next decade.

For those seeking a career in claims, this outlook presents a balanced view. While the number of job openings may decrease slightly, the consistent demand and strong compensation suggest a viable career path. The skills developed in this role, such as attention to detail and strong communication, are transferable and valuable across various industries. Job seekers should consider these factors when evaluating opportunities in claims representation.

Currently 1,114 Claims Representative job openings, nationwide.

Continue to Salaries for Claims Representative