How much does a Claims Representative make?

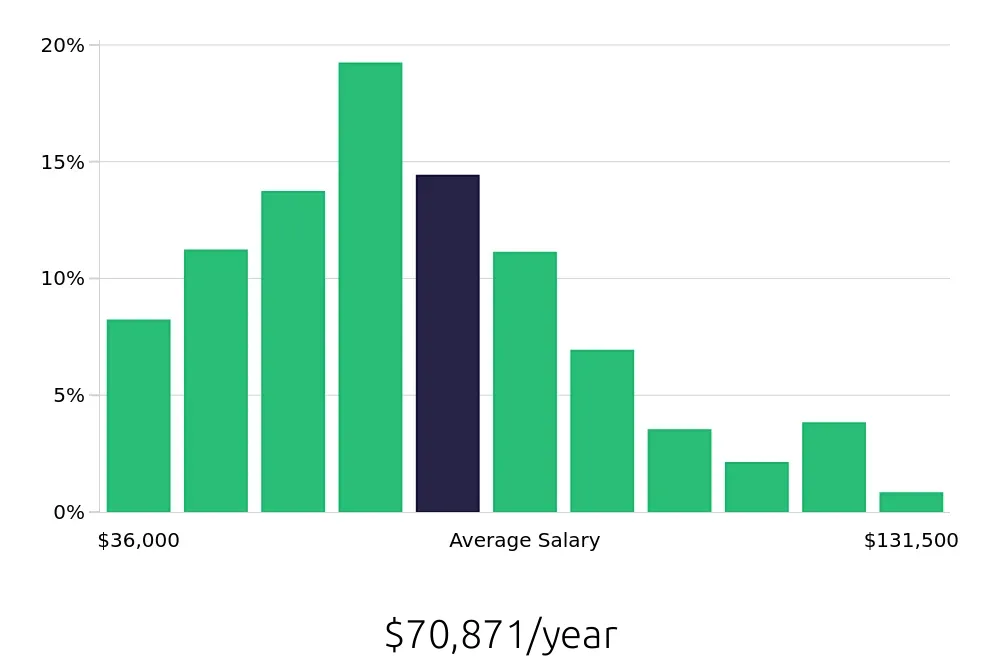

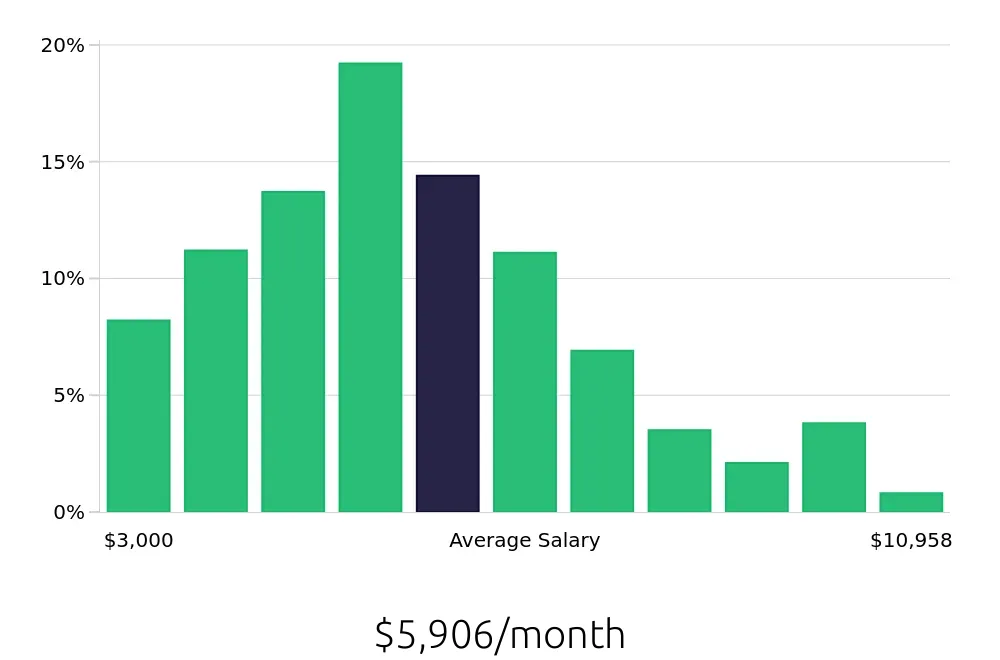

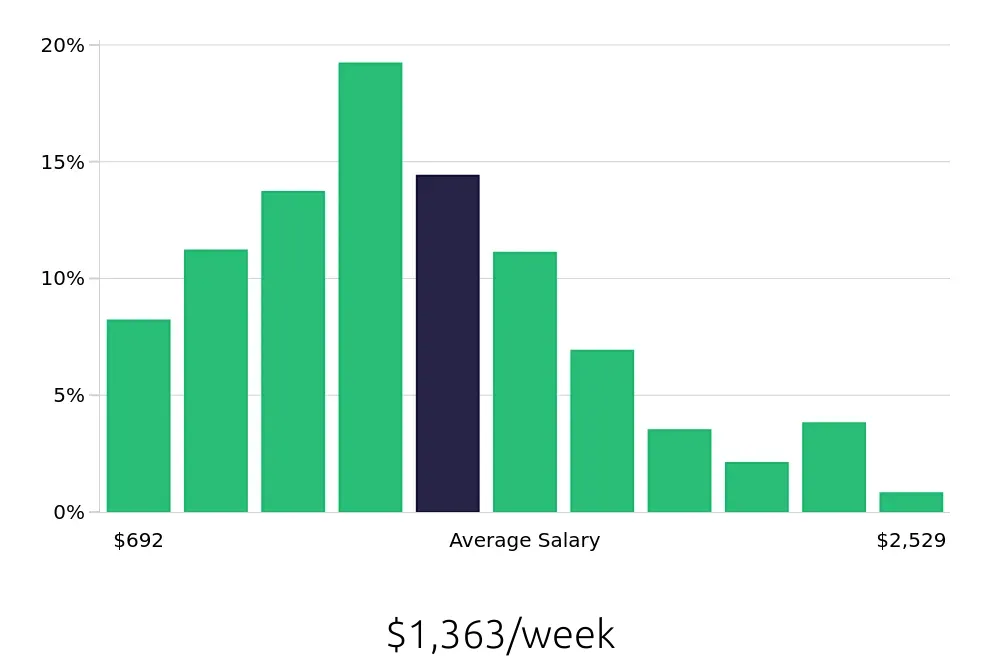

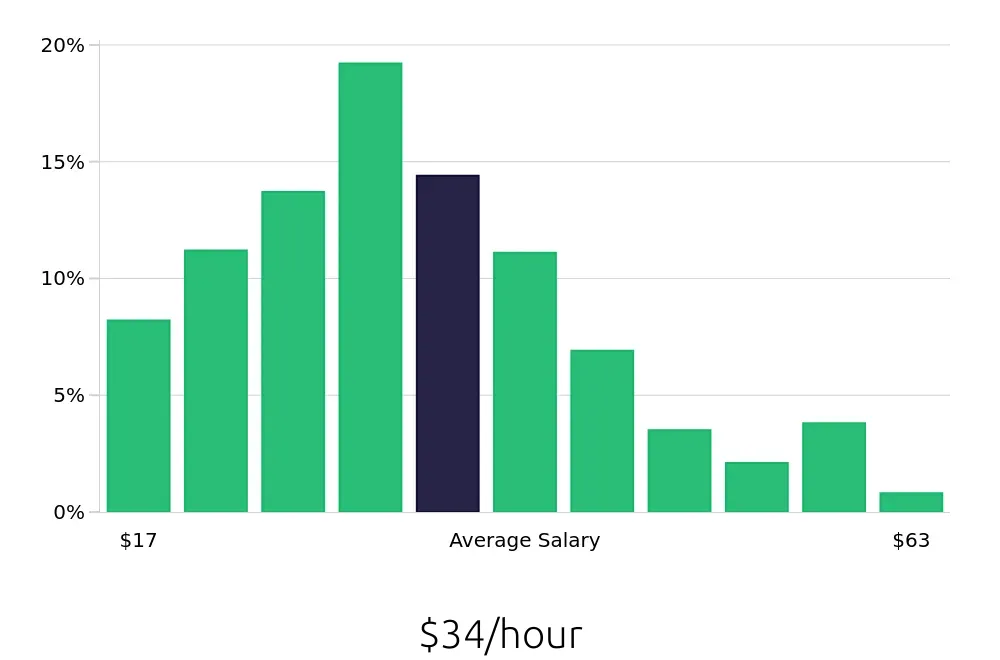

A Claims Representative plays a crucial role in reviewing and settling insurance claims. With this role, professionals can expect an average yearly salary of $70,871. This average takes into account various factors such as experience, location, and company size. For those new to the field, salaries often start lower, but they have the potential to grow as one gains more experience.

Here is a breakdown of the salary range for Claims Representatives:

- The bottom 10% earn less than $36,000.

- The next 20% earn between $36,000 and $53,000.

- The next 25% earn between $53,000 and $70,000.

- The top 25% earn between $70,000 and $131,000 or more.

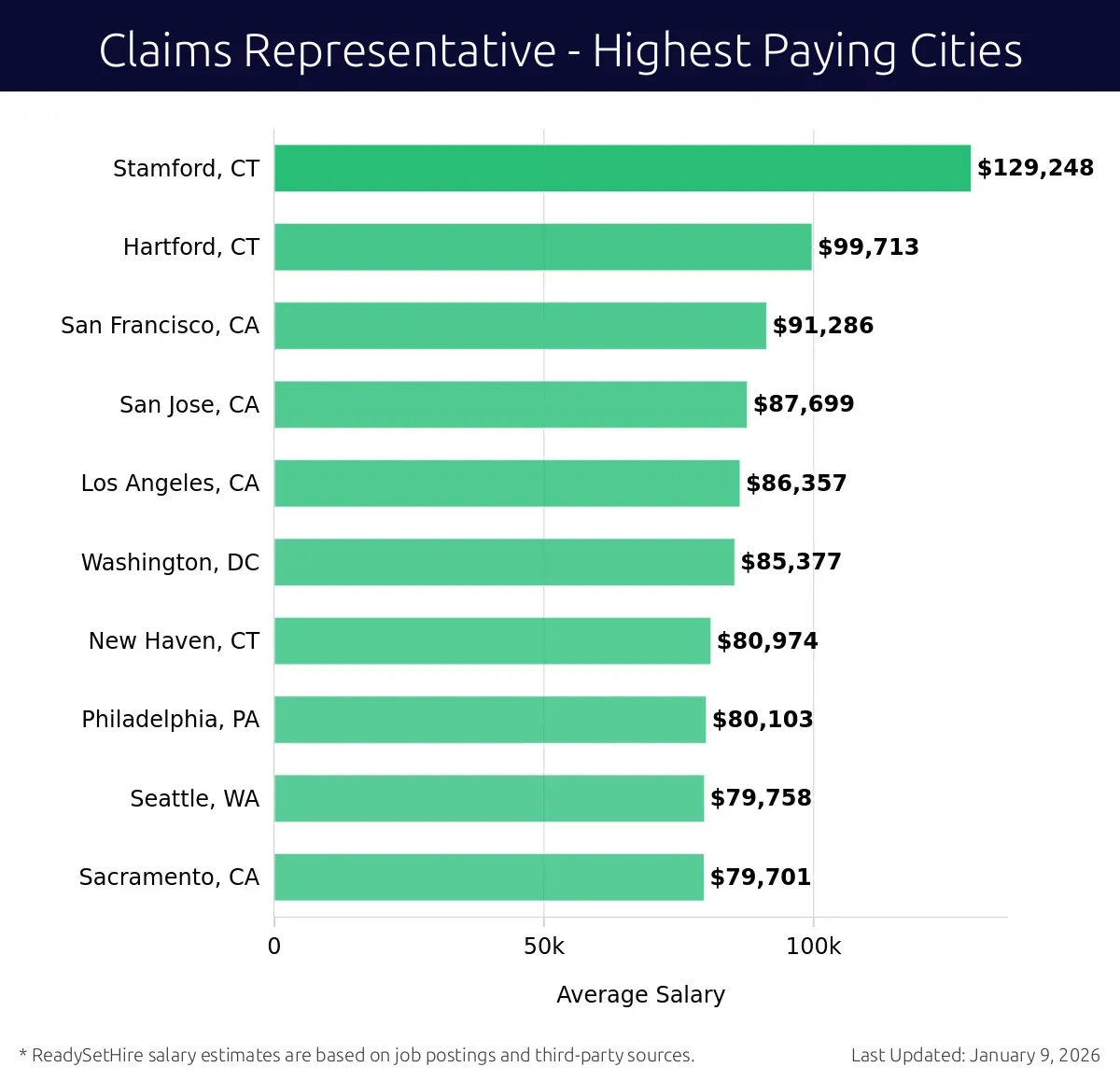

What are the highest paying cities for a Claims Representative?

-

Stamford, CT

Average Salary: $129,248

In Stamford, a Claims Representative can find work with well-known insurance companies. This city offers a mix of urban and suburban living, making it an appealing place for professionals. Companies like The Hartford and Travelers provide excellent career opportunities.

Find Claims Representative jobs in Stamford, CT

-

Hartford, CT

Average Salary: $99,713

Hartford is home to some of the largest insurance companies in the world. Working here offers stability and growth. Notable employers include Aetna and ConnectiCare. The city's central location makes commuting easy.

Find Claims Representative jobs in Hartford, CT

-

San Francisco, CA

Average Salary: $91,286

San Francisco is a dynamic city with many opportunities for a Claims Representative. Working in this area often means collaborating with tech-savvy teams. Companies like Anthem Blue Cross and Kaiser Permanente offer competitive benefits and a modern workplace.

Find Claims Representative jobs in San Francisco, CA

-

San Jose, CA

Average Salary: $87,699

San Jose offers a vibrant job market for Claims Representatives. This city is known for its tech industry, providing unique challenges. Companies such as Cisco Systems and Fidelity Investments are leaders in this field.

Find Claims Representative jobs in San Jose, CA

-

Los Angeles, CA

Average Salary: $86,357

Los Angeles provides a diverse work environment for Claims Representatives. This city’s large population means a high demand for insurance services. Major employers include Blue Shield of California and Health Net, offering diverse career paths.

Find Claims Representative jobs in Los Angeles, CA

-

Washington, DC

Average Salary: $85,377

Washington, DC is a hub for political and financial activities, which creates a strong demand for insurance professionals. Working here can offer unique insights into government policies. Companies like UnitedHealth Group and MetLife provide solid career opportunities.

Find Claims Representative jobs in Washington, DC

-

New Haven, CT

Average Salary: $80,974

New Haven is known for its educational institutions, which also create job opportunities for Claims Representatives. The cost of living is moderate, making it an attractive place to work. Yale-New Haven Hospital is a prominent employer in this field.

Find Claims Representative jobs in New Haven, CT

-

Philadelphia, PA

Average Salary: $80,103

Philadelphia offers a rich job market with well-established insurance firms. Working here can lead to a rewarding career with companies like Independence Blue Cross and Jefferson Health Plans.

Find Claims Representative jobs in Philadelphia, PA

-

Seattle, WA

Average Salary: $79,758

Seattle's job market for Claims Representatives is thriving, especially with tech companies needing insurance services. The city’s progressive environment offers many growth opportunities. Employers like Regence BlueShield and Premera Blue Cross are notable in this area.

Find Claims Representative jobs in Seattle, WA

-

Sacramento, CA

Average Salary: $79,701

Sacramento provides a balanced lifestyle with good career opportunities for Claims Representatives. The city is home to several insurance giants, including Blue Shield of California and Health Net. The cost of living is reasonable, offering a good work-life balance.

Find Claims Representative jobs in Sacramento, CA

What are the best companies a Claims Representative can work for?

-

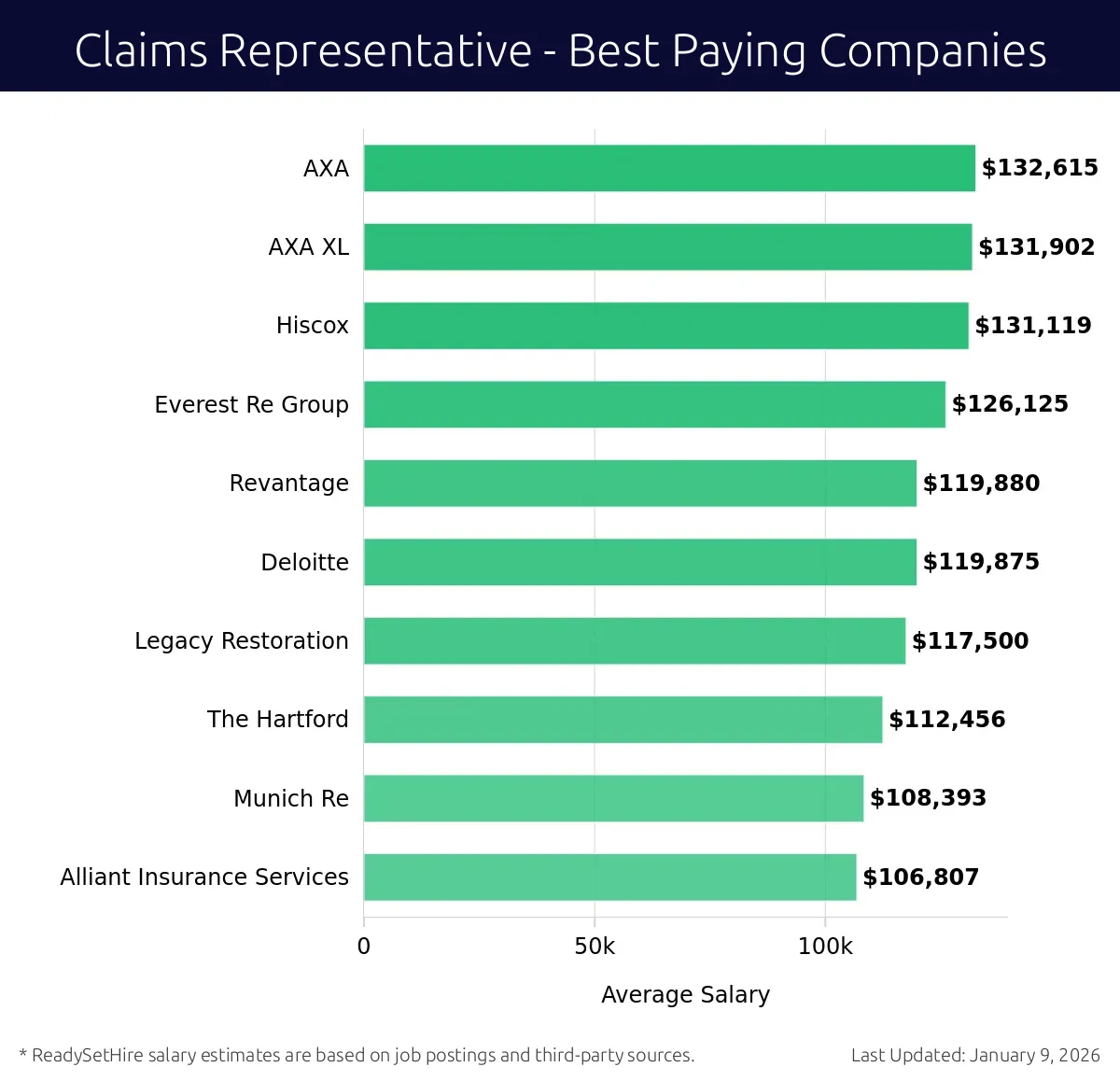

AXA

Average Salary: $132,615

AXA offers robust career opportunities for Claims Representatives across the globe. AXA operates in over 64 countries and territories, providing a diverse and dynamic work environment. Their roles often involve evaluating claims, handling customer inquiries, and ensuring a smooth claims process.

-

AXA XL

Average Salary: $131,902

AXA XL provides competitive salaries for Claims Representatives. With a presence in over 85 countries, AXA XL allows professionals to work in various locations, from London to New York. They focus on offering excellent customer service and efficient claims handling.

-

Hiscox

Average Salary: $131,119

Hiscox is known for offering attractive salaries for Claims Representatives. This company operates in more than 40 countries, providing a wide range of opportunities. They aim to deliver excellent service and support to policyholders, making it a rewarding place to work.

-

Everest Re Group

Average Salary: $126,125

Everest Re Group offers competitive pay for Claims Representatives. They have a global presence, including major offices in the U.S., Bermuda, and Singapore. The company values innovation and efficiency, offering a dynamic environment for growth.

-

Revantage

Average Salary: $119,880

Revantage provides a good salary for Claims Representatives. Operating in major cities across the U.S., they focus on delivering top-notch service. Their work involves assessing claims and ensuring smooth processing, with a focus on customer satisfaction.

-

Deloitte

Average Salary: $119,875

Deloitte offers a solid salary for Claims Representatives. They have offices in over 150 countries, providing a global reach. Deloitte values professionalism and offers opportunities to work on complex claims and projects.

-

Legacy Restoration

Average Salary: $117,500

Legacy Restoration offers a good salary for Claims Representatives. They focus on property damage restoration and operate in several states across the U.S. Their roles involve detailed assessment and management of claims, with a focus on customer service.

-

The Hartford

Average Salary: $112,456

The Hartford offers competitive pay for Claims Representatives. With a presence in the U.S. and Canada, they focus on delivering excellent service. Their work involves evaluating claims and ensuring a smooth claims process, with a focus on customer satisfaction.

-

Munich Re

Average Salary: $108,393

Munich Re offers a good salary for Claims Representatives. They operate in over 50 countries, providing diverse opportunities. Their roles involve assessing and managing claims, with a focus on efficiency and customer service.

-

Alliant Insurance Services

Average Salary: $106,807

Alliant Insurance Services offers a competitive salary for Claims Representatives. They have a strong presence in the U.S., with offices in multiple states. Their work involves handling claims and providing excellent service to clients.

How to earn more as a Claims Representative?

Looking to earn more as a Claims Representative? Consider these key factors to boost your income potential in this field.

Firstly, gaining relevant certifications can significantly enhance your qualifications. For instance, obtaining the Certified Claims Specialist (CCS) designation demonstrates a deep understanding of claims processes and can lead to higher-paying positions. Additionally, specialized knowledge in areas such as auto, health, or property claims can make you more valuable to employers. Continuing education also helps keep your skills current and competitive. Investing in certifications and ongoing training is a smart way to increase your earning potential.

Another important factor is accumulating experience. The more years you spend working as a Claims Representative, the more you know about handling different types of claims. Experienced professionals often earn more due to their proven track record and expertise. Working with various claim types and in different insurance sectors can also broaden your skills and make you more attractive to potential employers. Networking with colleagues and attending industry events can provide opportunities to gain experience and learn from others in the field.

- Obtain relevant certifications

- Gain more experience

- Specialize in specific claim types

- Seek out leadership roles

- Network and build professional relationships