What does a Collection Specialist do?

A Collection Specialist plays a crucial role in ensuring that businesses receive the payments they are owed. This role involves contacting customers who have outstanding debts and negotiating payment plans. Collection Specialists aim to recover the owed amounts while maintaining a positive relationship with the customers. They meticulously track accounts and follow up on overdue payments. By doing so, they help the company maintain cash flow and financial stability.

The job requires excellent communication and negotiation skills. Collection Specialists must be patient and empathetic when dealing with customers who may be in difficult financial situations. They often work in a fast-paced environment, managing multiple accounts at once. Key responsibilities include reviewing account details, making contact through phone calls or emails, and setting up payment agreements. They also update account records and report on collection efforts. This role demands attention to detail and the ability to remain professional in challenging situations.

How to become a Collection Specialist?

Becoming a Collection Specialist can open doors to a stable career in the financial industry. This role involves contacting clients to recover unpaid debts. It requires a mix of skills like communication, problem-solving, and attention to detail. Here is a clear path to take in achieving this role.

Start with the following steps to embark on a successful journey to becoming a Collection Specialist:

- Earn a High School Diploma or GED: This is the first step. A high school education provides the basic knowledge needed.

- Gain Relevant Experience: Work in customer service, sales, or any role that involves communication. This experience is valuable.

- Consider Further Education: Some employers prefer a college degree or a certificate in business, finance, or a related field.

- Learn About Collection Laws: Understand the laws governing debt collection. This knowledge is important for legal compliance.

- Apply for Jobs: Look for positions at banks, finance companies, or collection agencies. Tailor your resume to highlight relevant skills and experiences.

How long does it take to become a Collection Specialist?

Choosing a career as a Collection Specialist can lead to a rewarding position in the financial services sector. The time it takes to become one often depends on the individual’s background and the specific requirements of the employer. Most Collection Specialists have a high school diploma or GED and complete a specialized training program.

These training programs can last from a few weeks to several months. Some community colleges and vocational schools offer certificate courses that provide essential skills in debt collection and communication. Additional experience or a related degree can shorten the path. Gaining experience through internships or entry-level positions in finance or customer service can be beneficial. Understanding credit laws and customer service skills enhances one's qualifications and can lead to faster job placement.

Collection Specialist Job Description Sample

We are seeking a dedicated and detail-oriented Collection Specialist to join our team. The ideal candidate will be responsible for managing and collecting accounts, ensuring timely payment of outstanding balances, and maintaining positive relationships with clients.

Responsibilities:

- Contact customers to collect outstanding balances in a professional and timely manner.

- Utilize various communication channels, including phone, email, and mail, to engage with clients and resolve payment issues.

- Maintain accurate records of all collection activities and transactions in the company's database.

- Identify and address potential collection issues and escalate cases to the appropriate department when necessary.

- Negotiate payment plans and settlements with clients to ensure timely payment of invoices.

Qualifications

- Bachelor’s degree in Finance, Business, or a related field (preferred).

- Proven experience in collections, credit, or a similar role.

- Strong understanding of collection laws and regulations.

- Excellent communication, negotiation, and interpersonal skills.

- Proficiency in MS Office and collection software.

Is becoming a Collection Specialist a good career path?

A Collection Specialist focuses on recovering money owed to companies. They work with customers and clients who owe money due to late payments or outstanding debts. The role involves communication, negotiation, and understanding financial policies. This career offers various benefits and challenges. It provides opportunities to improve communication skills and gain experience in customer service. It also offers potential for advancement and a stable income.

Starting as a Collection Specialist can lead to various career paths. This job teaches valuable skills in problem-solving, conflict resolution, and financial management. With experience, one can move into senior roles, such as a Senior Collection Specialist, or switch to related fields like credit management or financial advising. The experience gained can open doors to better opportunities in finance and customer service sectors.

Here are some pros and cons to consider:

- Pros:

- Job stability: There is often a demand for collection specialists.

- Skill development: This role helps in enhancing communication and negotiation skills.

- Career advancement: Experience can lead to higher positions in the company.

- Cons:

- Stressful environment: Dealing with late payments and upset customers can be stressful.

- Possible rejection: Not all collections result in success.

- Repetitive work: The job can be routine and require persistence.

What is the job outlook for a Collection Specialist?

The job outlook for Collection Specialists shows steady demand in the financial industry. Each year, around 19,200 new positions open up. This provides ample opportunity for job seekers to find a role. While job openings are projected to decrease by 9.6% from 2022 to 2032, according to the Bureau of Labor Statistics (BLS), this trend does not suggest a lack of opportunities. Instead, it indicates a shift in hiring needs, which means opportunities will still be available.

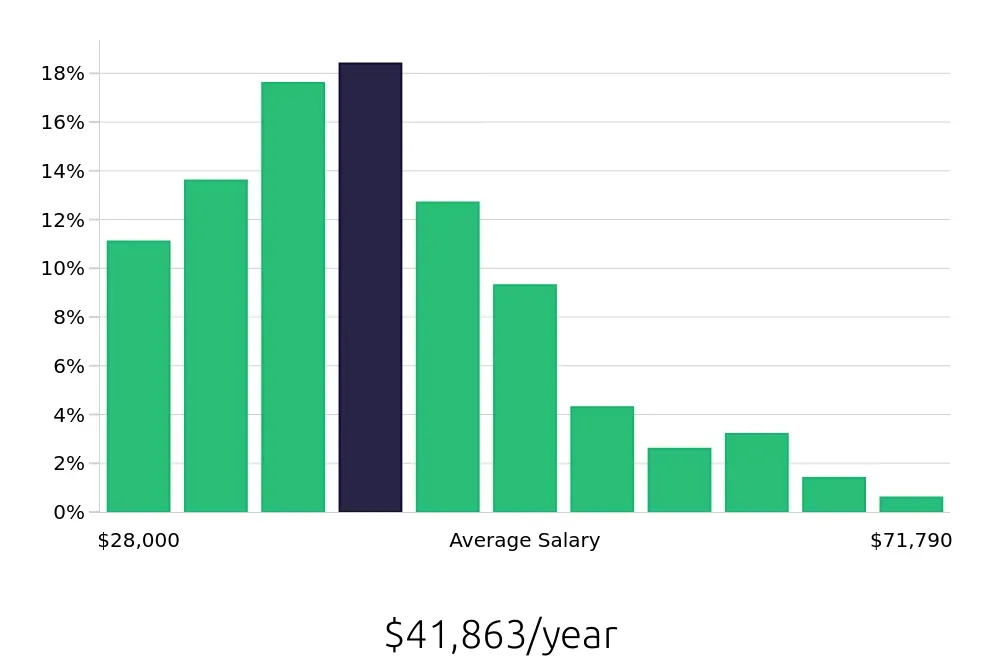

Collection Specialists earn a competitive salary, with an average annual compensation of $46,020. This figure highlights the value of the skills and responsibilities held by these professionals. On an hourly basis, the average compensation stands at $22.12, reflecting the importance of efficiency and effectiveness in this role. These figures show that Collection Specialists can expect a stable and rewarding income, making this career path attractive for many.

For job seekers entering this field, the combination of steady demand and competitive compensation makes Collection Specialist a viable career choice. The average number of job positions available each year ensures that there are plenty of openings for new candidates. The solid annual salary offers financial stability and potential for growth. With the right skills and dedication, Collection Specialists can find lasting opportunities and a rewarding career.

Currently 233 Collection Specialist job openings, nationwide.

Continue to Salaries for Collection Specialist