Position

Overview

A Commercial Loan Officer works with businesses to secure funding. They assess the creditworthiness of companies seeking loans. This involves evaluating financial statements and business plans. They also determine the loan amount and terms. This role requires strong communication skills. Commercial Loan Officers present loan options to clients and explain terms clearly. They build relationships with business owners to better understand their needs.

Commercial Loan Officers collaborate with various departments within the bank. They work with underwriters who assess risk. They also coordinate with the legal team to ensure loan agreements are in place. Meeting with clients is a big part of the job. Officers need to understand business operations and financial health. They often travel to meet clients in person. Commercial Loan Officers play a key role in helping businesses grow by providing necessary capital.

Becoming a Commercial Loan Officer involves a clear path that combines education, experience, and skill development. This profession requires individuals to assess business financials and creditworthiness to approve loans. The journey to this role is systematic and rewarding for those dedicated to financial services.

Here are the steps to embark on this career:

To work as a Commercial Loan Officer, a combination of education, experience, and specific qualifications is necessary. Typically, a bachelor's degree in finance, business, or a related field is the starting point. This education can take about four years. Gaining practical experience in banking or finance adds value. Often, new graduates start in entry-level positions to build their skills and network.

Professionals may then pursue certifications to enhance their credentials. Certifications such as the Certified Commercial Investment Member (CCIM) or Certified Banking & Credit Analyst (CBCA) can improve job prospects. These certifications usually require several months to a couple of years to complete, depending on study time and exam preparation. Networking and internships during education can also help in securing a position faster. The total time can range from four to seven years, considering all factors.

A Commercial Loan Officer is responsible for evaluating commercial loan applications, managing relationships with business clients, and ensuring that lending practices comply with industry regulations.

Responsibilities:

Qualifications

A Commercial Loan Officer plays a key role in the banking sector. They assess and approve loans for businesses. This job offers a mix of challenges and rewards. Officers interact with business owners to understand their needs. They analyze financial documents to decide the loan's approval. Working with companies helps officers understand different industries. This role combines finance, analysis, and customer service.

This career has several benefits and drawbacks. Here are some things to consider:

The job outlook for Commercial Loan Officers looks promising for job seekers aiming to enter this field. According to the Bureau of Labor Statistics (BLS), an average of 27,700 job positions are available each year. This steady demand reflects a positive trend in the financial sector's growth. Job seekers can expect a consistent stream of opportunities, making it a reliable career path.

For those looking ahead, the job openings for Commercial Loan Officers are projected to increase by 3.1% from 2022 to 2032. This modest growth suggests stability and potential for advancement in the industry. With a growing economy, more businesses will seek loans, driving demand for skilled loan officers. This positive outlook makes it an attractive career choice for those entering the job market.

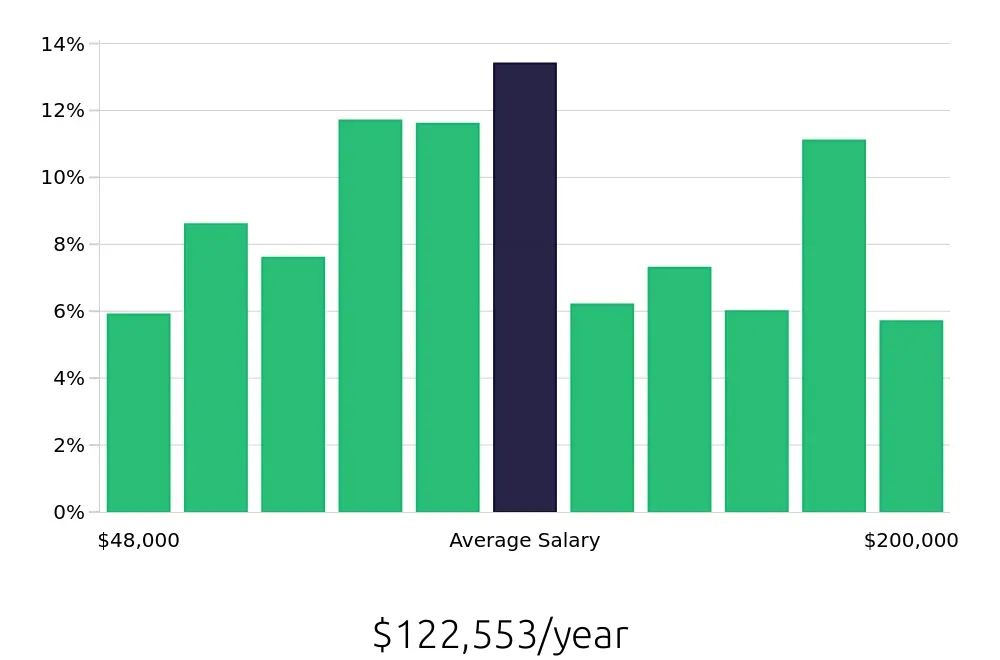

Commercial Loan Officers can also look forward to a competitive salary. The average national annual compensation is $82,000, with an hourly rate of $39.43. This reflects the skill and expertise required for the role. For job seekers, this means a rewarding career with good financial benefits. Additionally, with the right qualifications and experience, there is potential for higher earnings and career growth.