How much does a Commercial Loan Officer make?

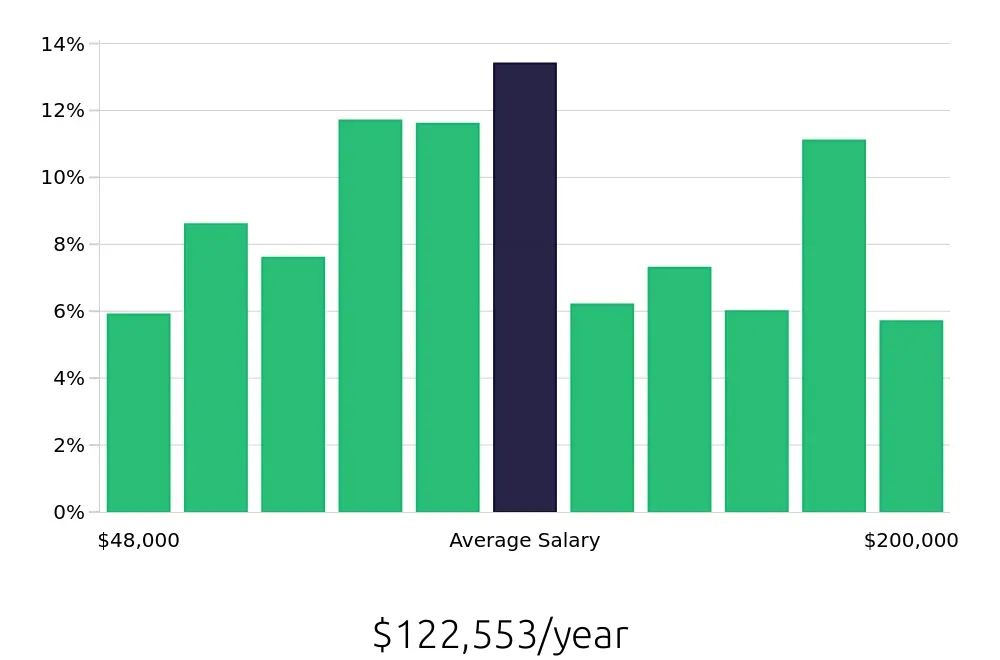

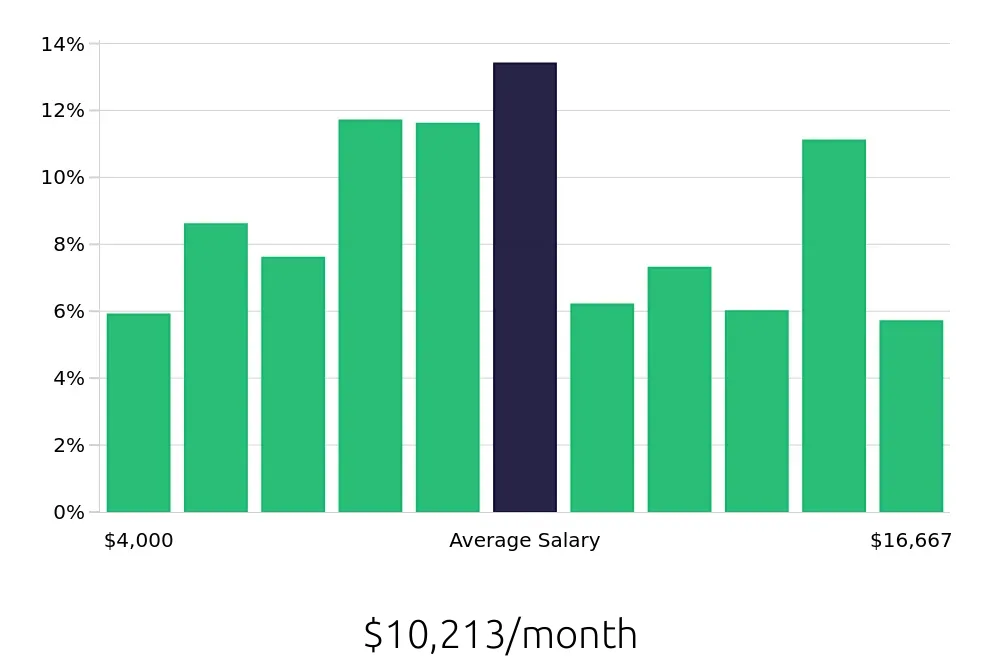

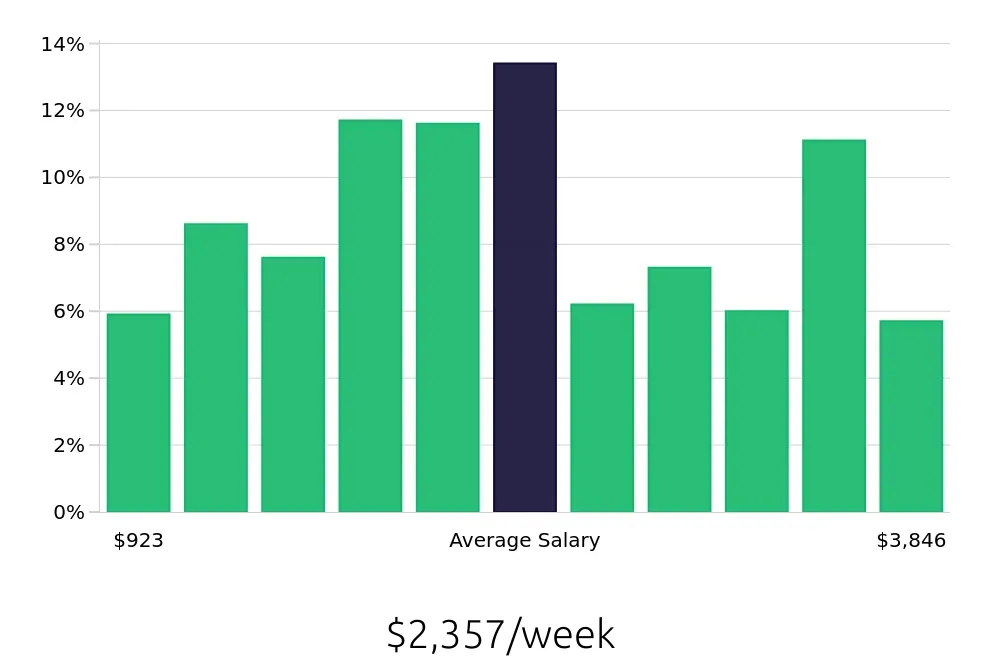

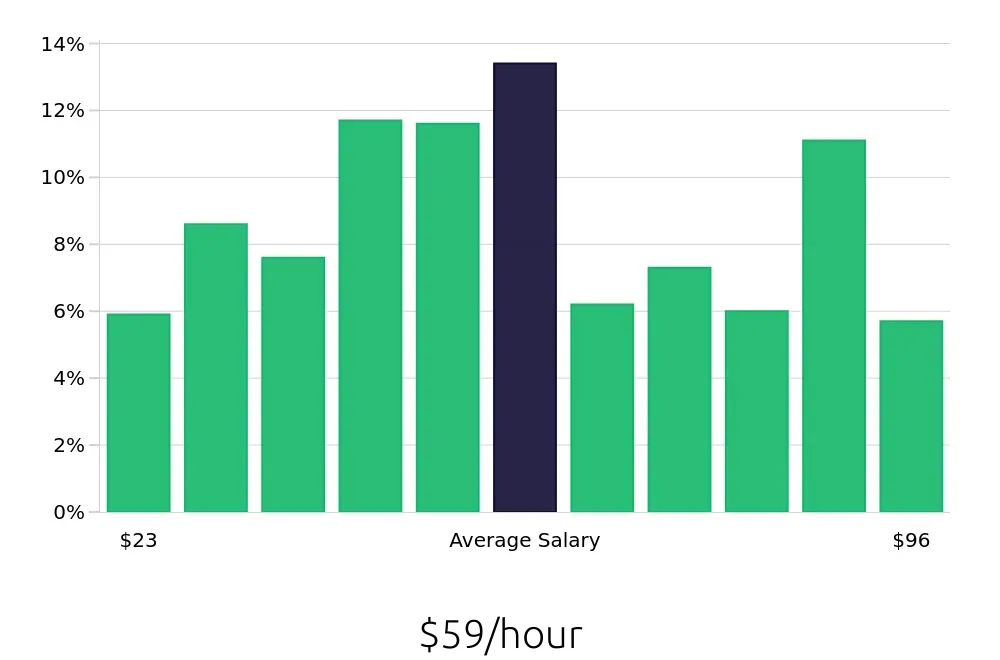

A Commercial Loan Officer helps businesses get the loans they need. This role often pays well. On average, a Commercial Loan Officer earns around $122,553 a year. This figure can vary based on experience and location. Some areas may offer higher salaries due to the cost of living and demand for loan officers.

The salary for this job can range widely. At the lower end, some officers earn around $48,000. At the higher end, top earners make over $200,000 a year. Often, those with more experience and a strong track record can expect higher pay. Bonuses and commissions can also add to their earnings. These extra incentives often depend on how many loans they successfully approve and the total amount of loans issued.

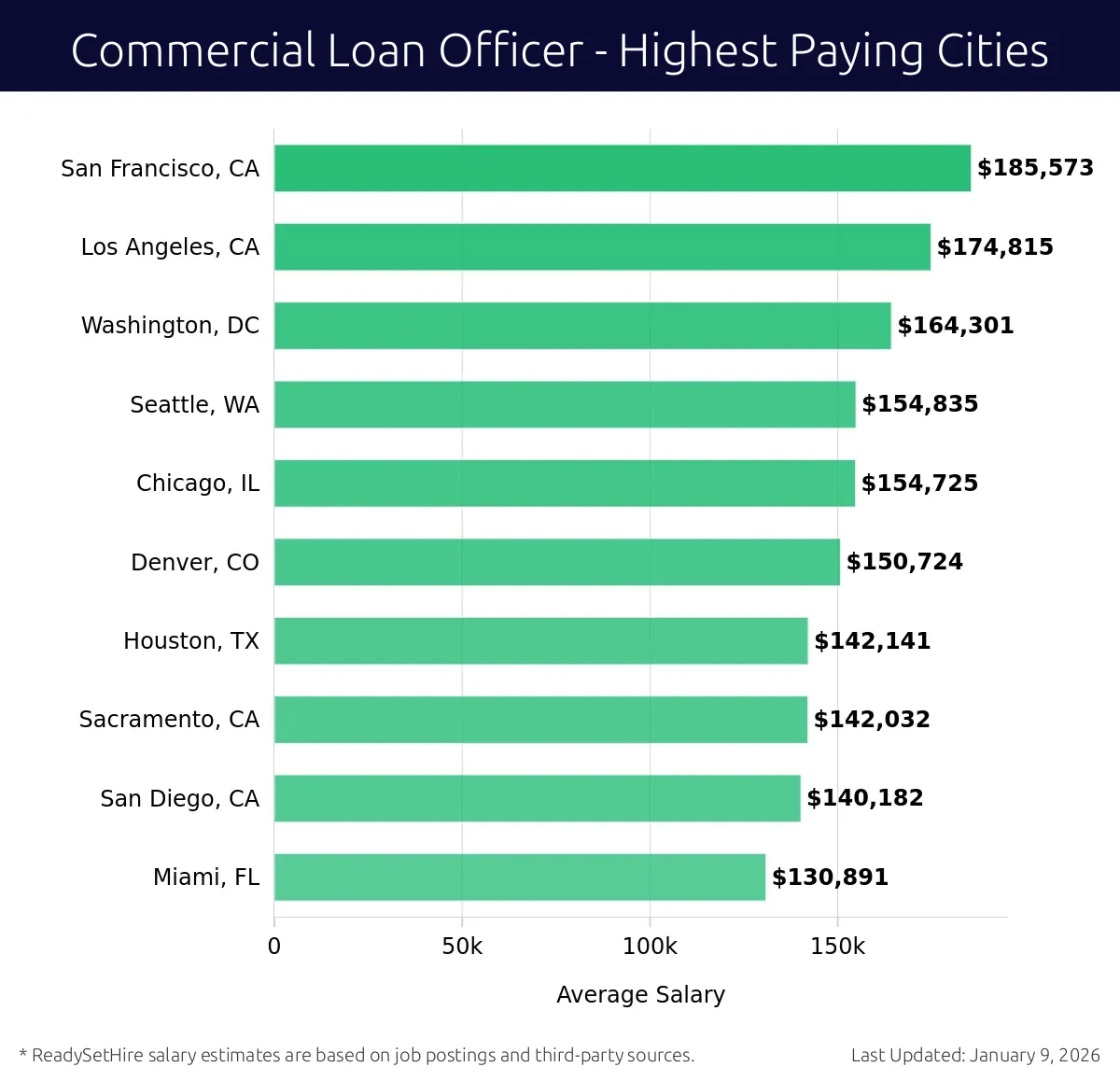

What are the highest paying cities for a Commercial Loan Officer?

-

San Francisco, CA

Average Salary: $185,573

In San Francisco, working as a Loan Officer involves a dynamic environment with diverse businesses. The tech industry and startups provide ample opportunities. Companies like Bank of America and Wells Fargo are prominent players.

Find Commercial Loan Officer jobs in San Francisco, CA

-

Los Angeles, CA

Average Salary: $174,815

Los Angeles offers a bustling atmosphere for Loan Officers. The entertainment industry and real estate sector are key players. Firms like JPMorgan Chase and U.S. Bank are major employers.

Find Commercial Loan Officer jobs in Los Angeles, CA

-

Washington, DC

Average Salary: $164,301

In Washington, DC, a Loan Officer will navigate a city rich in government and international business. Firms like Capital One and government-backed institutions offer great opportunities.

Find Commercial Loan Officer jobs in Washington, DC

-

Seattle, WA

Average Salary: $154,835

Seattle presents a unique market for Loan Officers with a strong tech presence. Companies like Amazon and Boeing offer diverse loan opportunities. The city’s growing economy is a big plus.

Find Commercial Loan Officer jobs in Seattle, WA

-

Chicago, IL

Average Salary: $154,725

Chicago offers a vibrant job market for Loan Officers. The city’s diverse industries include finance and manufacturing. Major banks like Citibank and Bank of America are key employers.

Find Commercial Loan Officer jobs in Chicago, IL

-

Denver, CO

Average Salary: $150,724

In Denver, Loan Officers enjoy a mix of energy and technology sectors. Companies like Wells Fargo and local banks provide excellent opportunities. The city’s growing economy is a big advantage.

Find Commercial Loan Officer jobs in Denver, CO

-

Houston, TX

Average Salary: $142,141

Houston’s Loan Officers work in an energy-rich environment. The oil and gas sector are major players. Firms like Chase and local banks offer diverse loan opportunities.

Find Commercial Loan Officer jobs in Houston, TX

-

Sacramento, CA

Average Salary: $142,032

Sacramento provides a balanced job market for Loan Officers. The city’s government and agriculture sectors are key. Local banks and financial institutions offer solid opportunities.

Find Commercial Loan Officer jobs in Sacramento, CA

-

San Diego, CA

Average Salary: $140,182

San Diego offers a mix of defense, biotech, and tourism sectors for Loan Officers. Firms like U.S. Bank and local lenders provide diverse loan opportunities. The city’s stable economy is a big plus.

Find Commercial Loan Officer jobs in San Diego, CA

-

Miami, FL

Average Salary: $130,891

In Miami, Loan Officers benefit from a diverse economy. The tourism and real estate sectors are major players. Companies like Bank of America and local lenders offer excellent opportunities.

Find Commercial Loan Officer jobs in Miami, FL

What are the best companies a Commercial Loan Officer can work for?

-

Citi

Average Salary: $167,229

Citi offers top-notch positions for Commercial Loan Officers. They provide competitive salaries and opportunities to work in major financial centers across the world, including New York, London, and Hong Kong.

-

California Bank & Trust

Average Salary: $155,208

California Bank & Trust provides rewarding roles for Commercial Loan Officers. They have branches in multiple locations across California, offering a chance to work in vibrant urban areas and communities.

-

Truist

Average Salary: $126,111

Truist is a leading financial institution with many openings for Commercial Loan Officers. They have a presence in the southeastern U.S. and offer a dynamic work environment.

-

gpac

Average Salary: $126,034

gpac connects job seekers with some of the best companies for Commercial Loan Officers. They have a range of opportunities across various locations, providing diverse career paths.

-

Wintrust Financial Corporation

Average Salary: $121,269

Wintrust Financial Corporation offers lucrative positions for Commercial Loan Officers. They focus on community banking, with branches in Illinois, Arizona, and Florida.

-

Greenstate Credit Union

Average Salary: $119,718

Greenstate Credit Union provides competitive salaries for Commercial Loan Officers. They serve members in various locations, with a focus on providing personalized service.

-

Arvest Bank

Average Salary: $116,042

Arvest Bank offers rewarding career opportunities for Commercial Loan Officers. They operate in the Midwest, providing a chance to work in dynamic regional markets.

-

Merchants Bank

Average Salary: $94,955

Merchants Bank provides solid positions for Commercial Loan Officers. They serve clients in several states, offering a stable and supportive work environment.

-

Bank OZK

Average Salary: $93,691

Bank OZK offers good career opportunities for Commercial Loan Officers. They focus on community banking with branches in multiple states, including Arkansas, Kansas, and Missouri.

-

PointBank

Average Salary: $68,676

PointBank provides positions for Commercial Loan Officers with a focus on community banking. They operate in several locations, offering a supportive and growth-oriented environment.

How to earn more as a Commercial Loan Officer?

A Commercial Loan Officer can make more by focusing on certain key areas. These efforts can lead to higher earnings and better job satisfaction. By concentrating on these strategies, a Commercial Loan Officer can stand out and improve their financial rewards.

First, gaining relevant experience makes a big difference. Working with different types of clients and projects helps build expertise. This experience can lead to better job offers and higher salaries. Second, obtaining professional certifications is beneficial. Certifications show dedication to the field and can lead to more trust from clients. Third, networking within the industry opens up more opportunities. Building relationships with other professionals can lead to referrals and new clients. Fourth, staying updated with market trends keeps skills sharp. Understanding the latest trends helps in making better decisions. Finally, taking on leadership roles can increase earnings. Managing teams or projects can lead to higher positions and salaries.

An officer can use these factors to boost their career and income. Focusing on these areas can create a path to greater success.

Here are the top five factors for earning more:

- Gain relevant experience.

- Obtain professional certifications.

- Network within the industry.

- Stay updated with market trends.

- Take on leadership roles.