What does a Commission Specialist do?

A Commission Specialist plays a key role in managing and processing commission payments for sales teams and other related personnel. This position involves meticulous tracking of sales data and ensuring that all commission calculations are accurate. Specialists must be detail-oriented and have strong analytical skills. They often use specialized software to monitor and report on commission performance.

The Commission Specialist works closely with various departments including sales, finance, and human resources. This role requires effective communication skills to explain commission structures and answer any queries. The Specialist also handles disputes and resolves any issues related to commission payments. Their work ensures that sales teams are fairly compensated and that the company maintains a positive relationship with its employees.

Responsibilities of a Commission Specialist include:

- Calculating commissions based on pre-established formulas

- Generating commission reports and statements

- Reviewing and auditing commission data for accuracy

- Resolving discrepancies and disputes related to commissions

- Providing support during audits and financial reviews

How to become a Commission Specialist?

Becoming a Commission Specialist involves several key steps. This role often requires a blend of sales skills, attention to detail, and familiarity with commission structures. It is a position that can lead to significant career growth and financial rewards. The journey to becoming a successful Commission Specialist includes understanding the role, gaining relevant experience, acquiring necessary skills, and continuous learning.

Firstly, understanding the role is essential. A Commission Specialist manages and tracks commissions for a company. This involves ensuring that sales staff receive the correct commission payments based on their sales performance. The role demands a solid grasp of financial principles and sales processes. Researching the job description and duties helps in preparing for this career.

- Education and Training: Start with a high school diploma. Consider further education in business, finance, or a related field. Courses in accounting and sales can be beneficial.

- Gain Experience: Seek entry-level positions in sales or finance. Experience in these areas provides a practical understanding of commission structures and sales processes.

- Develop Key Skills: Focus on developing strong analytical skills. Attention to detail is crucial for accurately calculating commissions. Good communication skills help in resolving any disputes or queries.

- Learn Software and Tools: Familiarize yourself with commission management software and spreadsheets. Proficiency in tools like Excel can enhance efficiency and accuracy in commission calculations.

- Network and Seek Opportunities: Join professional networks and attend industry events. Networking can open doors to job opportunities and provide insights into the industry.

How long does it take to become a Commission Specialist?

The journey to becoming a Commission Specialist varies based on several factors. Most Commission Specialists start with a high school diploma or equivalent. Some choose to pursue additional education, such as an associate’s or bachelor’s degree in business, finance, or a related field. This education can lead to better job opportunities and higher earnings.

Experience also plays a big role. Many Commission Specialists gain experience through internships, entry-level positions, or part-time work while in school. Gaining practical experience helps in understanding the complexities of commission calculations and related tasks. Typically, it takes 2 to 4 years to gain the necessary experience and education to become a Commission Specialist. This period can differ for individuals based on their educational paths and work experiences.

Commission Specialist Job Description Sample

The Commission Specialist is responsible for managing and processing commission payments for sales staff, ensuring accuracy and timeliness. This role involves collaborating with various departments to resolve issues, maintaining records, and implementing best practices for commission management.

Responsibilities:

- Calculate and process commission payments for sales staff accurately and on time.

- Collaborate with sales, finance, and HR departments to ensure all commission-related data is accurate and up-to-date.

- Review and audit commission reports to identify and resolve discrepancies.

- Maintain comprehensive records of all commission transactions and communications.

- Prepare and present commission reports and analyses to management.

Qualifications

- Bachelor’s degree in Finance, Accounting, or a related field.

- Proven experience in a commission specialist or similar role.

- Strong knowledge of commission structures and calculation methods.

- Proficiency in using commission management software and Microsoft Office Suite.

- Excellent analytical and problem-solving skills.

Is becoming a Commission Specialist a good career path?

A Commission Specialist plays a vital role in managing and processing commissions for a company. They work closely with sales and marketing teams to ensure accurate and timely commission payments. Commission Specialists often handle large volumes of data, requiring attention to detail and strong organizational skills. They typically work in an office setting but may also need to work remotely or travel for business purposes.

This role offers a mix of benefits and challenges. Here are some pros and cons to consider:

- Pros:

- Opportunity to work with different departments.

- Development of strong analytical skills.

- Job stability due to the constant need for commission processing.

- Potential for career growth into higher managerial roles.

- Cons:

- High pressure to meet deadlines and ensure accuracy.

- Frequent handling of sensitive financial information.

- Limited career advancement without additional qualifications.

What is the job outlook for a Commission Specialist?

Finding the right job can make a big difference in your career. Commission Specialists can look forward to a stable job market. Each year, there are around 12,500 job openings for Commission Specialists. This role is important in helping businesses manage their commissions accurately. The average salary for this job is $54,690 a year. On an hourly basis, the average pay is $26.29.

The job outlook for Commission Specialists shows some changes. The number of positions available is expected to decrease by 16.4% from 2022 to 2032. This decrease may happen because of changes in how businesses handle commissions. Despite this change, the role remains important. It requires skill and knowledge to manage commission structures effectively. With the right training and experience, job seekers can still find good opportunities in this field.

For those who want to enter this field, there are several good reasons. The average salary offers a good income for this role. Also, the skills you gain can be valuable in many different industries. Even with some job changes ahead, the demand for skilled Commission Specialists will remain. Those who are prepared can find stable and rewarding positions in this field.

Currently 39 Commission Specialist job openings, nationwide.

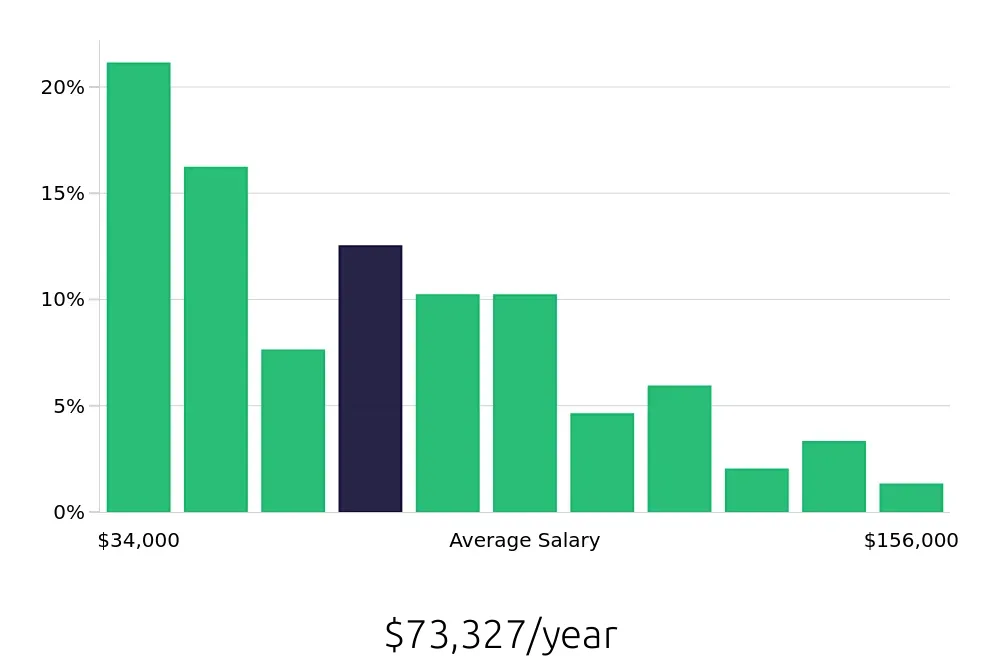

Continue to Salaries for Commission Specialist