What does a Compliance Analyst do?

A Compliance Analyst plays a crucial role in ensuring an organization adheres to legal standards and internal policies. This position involves reviewing and analyzing various documents and practices to ensure they meet regulatory requirements. A Compliance Analyst often works closely with different departments to identify potential risks and suggest improvements. They also conduct training sessions to educate staff about compliance issues.

Daily tasks for a Compliance Analyst include monitoring changes in laws and regulations, performing audits, and preparing detailed reports. They need strong analytical skills and attention to detail. This role requires clear communication and the ability to explain complex regulations in simple terms. By focusing on compliance, the analyst helps protect the organization from legal issues and financial penalties. A Compliance Analyst contributes significantly to maintaining the integrity and reputation of the company.

How to become a Compliance Analyst?

Becoming a Compliance Analyst can open many doors in various industries. It requires a mix of education, skills, and experience. Follow these steps to start your journey towards a successful career in compliance analysis.

Begin with obtaining the right education. Most employers look for candidates with at least a bachelor’s degree in fields like business, finance, or law. Having specialized courses in compliance, risk management, or accounting can also be beneficial. Next, gaining relevant experience is crucial. Working in roles that involve regulatory compliance, such as in banking, finance, or healthcare, can provide valuable insight. Participate in internships or entry-level positions to build experience.

- Earn a bachelor's degree.

- Gain relevant work experience.

- Obtain necessary certifications.

- Network within the industry.

- Apply for compliance analyst positions.

Obtaining certifications can significantly boost your resume. Consider getting certifications such as the Certified Regulatory Compliance Manager (CRCM) or the Certified Compliance and Ethics Professional (CCEP). Networking with industry professionals can help you learn about job openings and gain insights into the field. Join professional associations and attend industry conferences. Finally, apply for compliance analyst positions with your education, experience, and certifications. Tailor your resume to highlight your compliance skills and relevant experience.

How long does it take to become a Compliance Analyst?

Getting into compliance analysis can be a smart move for those who enjoy working with rules and regulations. This career focuses on ensuring that companies follow laws and guidelines. Most people find it rewarding to work in this field. The journey to becoming a Compliance Analyst usually involves several steps. One can complete this path in a few months to a couple of years.

First, one needs to gain the right education. A bachelor's degree in business, finance, or a related field is common. Some may choose a degree in law, but this is less typical. Next, gaining relevant experience helps. Working in a similar role or in a related field provides valuable skills. Many professionals spend 1-2 years in these roles before moving to compliance analysis. Some employers may prefer or require a master’s degree or additional certifications. These can often be completed in another 1-2 years. With the right education and experience, one can start applying for Compliance Analyst positions.

Compliance Analyst Job Description Sample

A Compliance Analyst is responsible for ensuring that an organization adheres to laws, regulations, and internal policies. They monitor, analyze, and report on compliance activities, conduct audits, and recommend improvements to compliance programs.

Responsibilities:

- Monitor and analyze compliance activities to ensure adherence to laws and regulations.

- Conduct internal audits and assessments to identify compliance risks and issues.

- Prepare and maintain comprehensive compliance reports for management and regulatory bodies.

- Develop and implement compliance policies, procedures, and training programs.

- Collaborate with various departments to ensure consistent application of compliance standards.

Qualifications

- Bachelor’s degree in Law, Business, or a related field.

- Proven experience as a Compliance Analyst or in a similar role.

- Knowledge of relevant laws, regulations, and industry standards.

- Strong analytical and problem-solving skills.

- Attention to detail and high ethical standards.

Is becoming a Compliance Analyst a good career path?

A Compliance Analyst examines an organization’s practices and policies. They ensure everything follows laws, regulations, and internal guidelines. They identify areas for improvement and help the company avoid legal issues. This role requires attention to detail and strong analytical skills. It often involves working with legal and financial documents.

Working as a Compliance Analyst has many benefits. They often find jobs in various industries like finance, healthcare, and government. This role provides a stable career path with potential for growth. Analysts may advance to higher roles such as Compliance Manager or Risk Officer. They also contribute to the integrity and reputation of the organization.

However, the job has its challenges. Compliance Analysts may face high pressure to meet deadlines. The work can be repetitive and require long hours. Here are some pros and cons to consider:

- Pros:

- Job stability

- Opportunities for career advancement

- Contribution to an organization’s integrity

- Chances to work in various industries

- Cons:

- High-pressure deadlines

- Potential for repetitive work

- Demanding hours

What is the job outlook for a Compliance Analyst?

The job outlook for Compliance Analysts is quite promising for job seekers. The Bureau of Labor Statistics (BLS) reports that there are around 31,000 job positions available every year. This means many opportunities exist for those who want to enter this field. The BLS also predicts a 4.6% growth in job openings from 2022 to 2032. This growth shows that companies are increasingly valuing compliance roles in today's business environment.

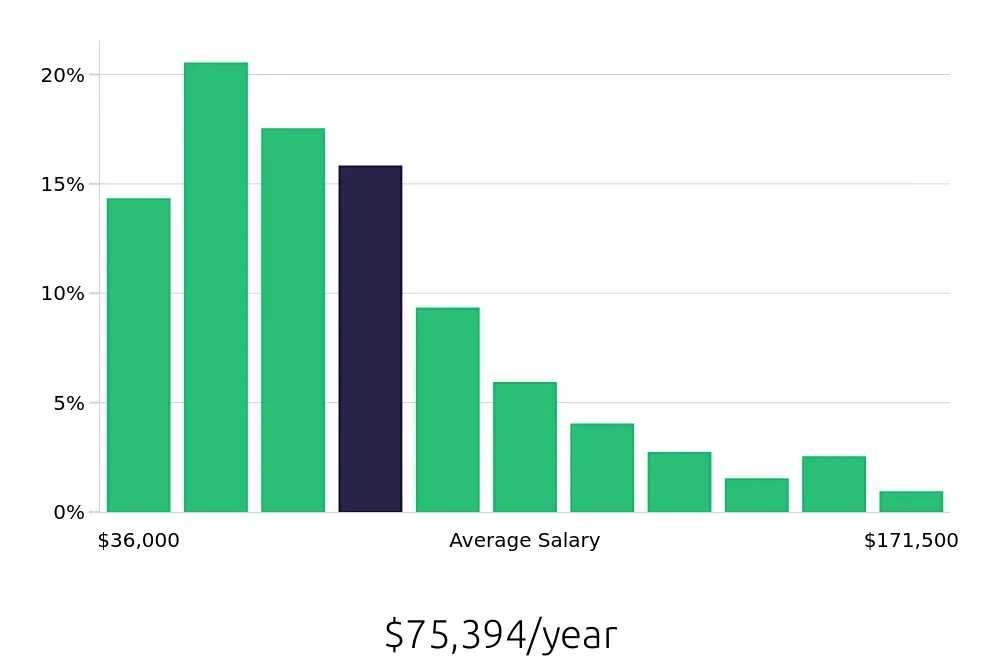

Compliance Analysts can expect competitive compensation. According to the BLS, the average annual salary for this role is $80,190. This figure highlights the importance of compliance in maintaining ethical business practices. Additionally, the hourly wage stands at $38.55, reflecting the specialized skills required for this position. These figures make a career in compliance both rewarding and financially viable.

A career as a Compliance Analyst offers stability and growth. With consistent job openings and a positive outlook for future employment, this field is attractive for job seekers. The combination of steady demand and respectable compensation makes it an excellent choice for those looking to build a long-term career.

Currently 752 Compliance Analyst job openings, nationwide.

Continue to Salaries for Compliance Analyst