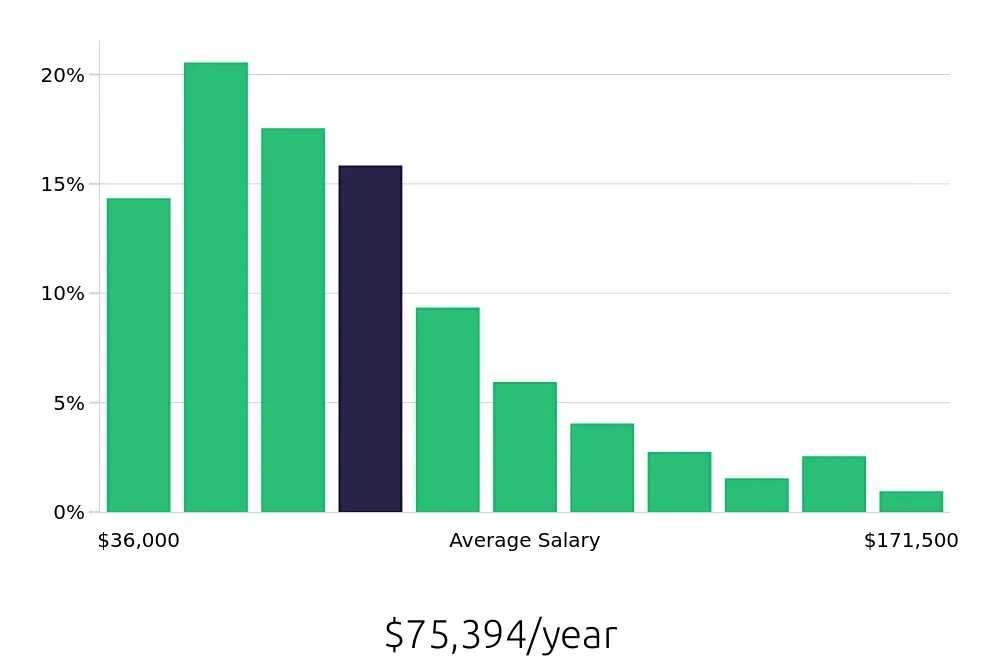

How much does a Compliance Analyst make?

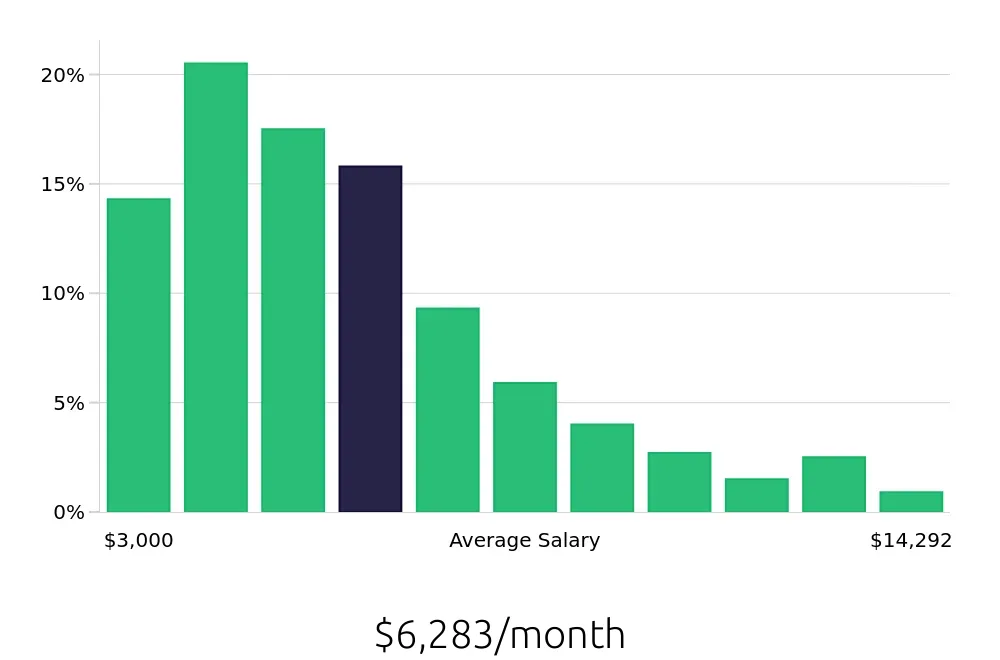

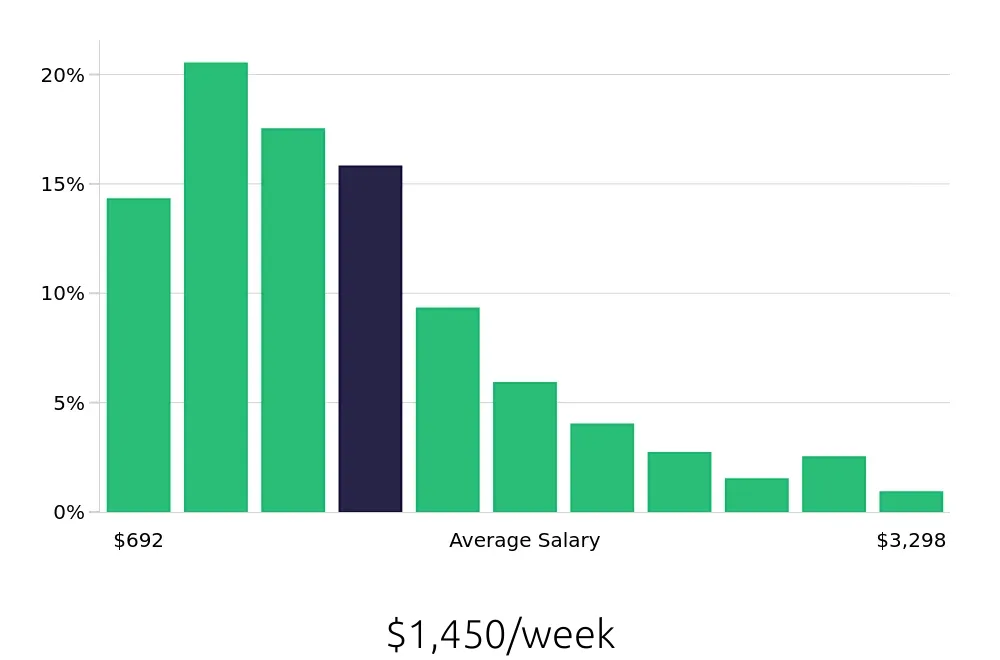

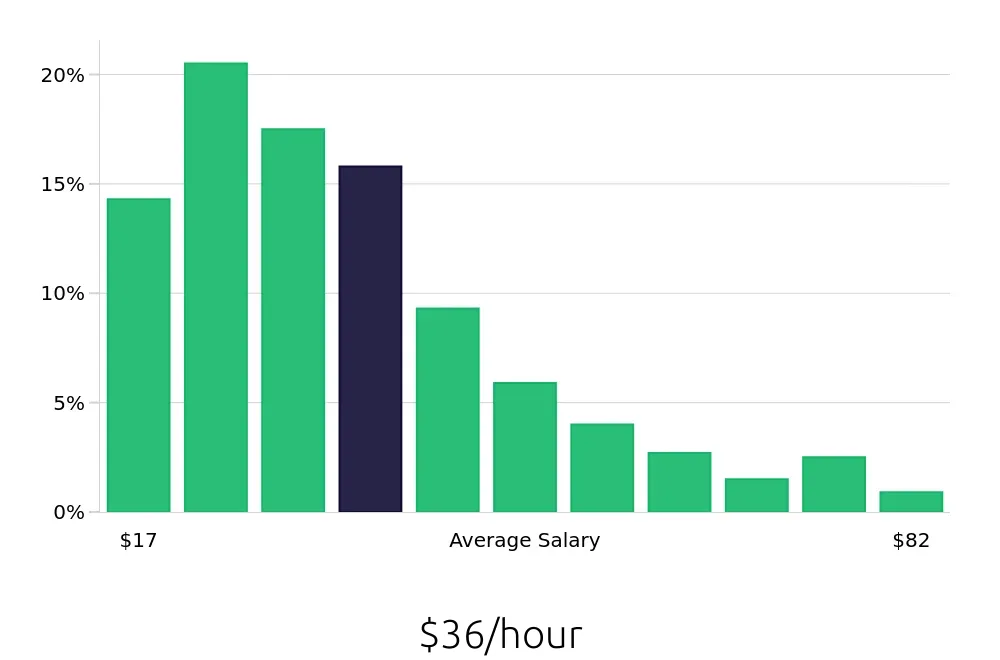

A Compliance Analyst plays a key role in ensuring that organizations follow laws and regulations. They check that everything is in order and help prevent legal issues. With this important job, Compliance Analysts often receive a fair salary. The average yearly salary for a Compliance Analyst is around $75,394. This means they earn a steady income and their work is valued.

The salary for a Compliance Analyst can vary based on experience and location. Here is a look at the salary distribution for these professionals:

- 14.32% of Compliance Analysts earn $36,000 per year.

- 20.54% earn $48,318 per year.

- 17.54% earn $60,636 per year.

- 15.79% earn $72,955 per year.

- 9.27% earn $85,273 per year.

- 5.92% earn $97,591 per year.

- 3.95% earn $109,909 per year.

- 2.74% earn $122,227 per year.

- 1.48% earn $134,545 per year.

- 2.51% earn $146,864 per year.

- 0.95% earn $159,182 per year.

This range shows how experience and skill can lead to higher earnings. With more experience, Compliance Analysts can expect to see their salaries increase. This career offers a good chance for growth and higher income over time.

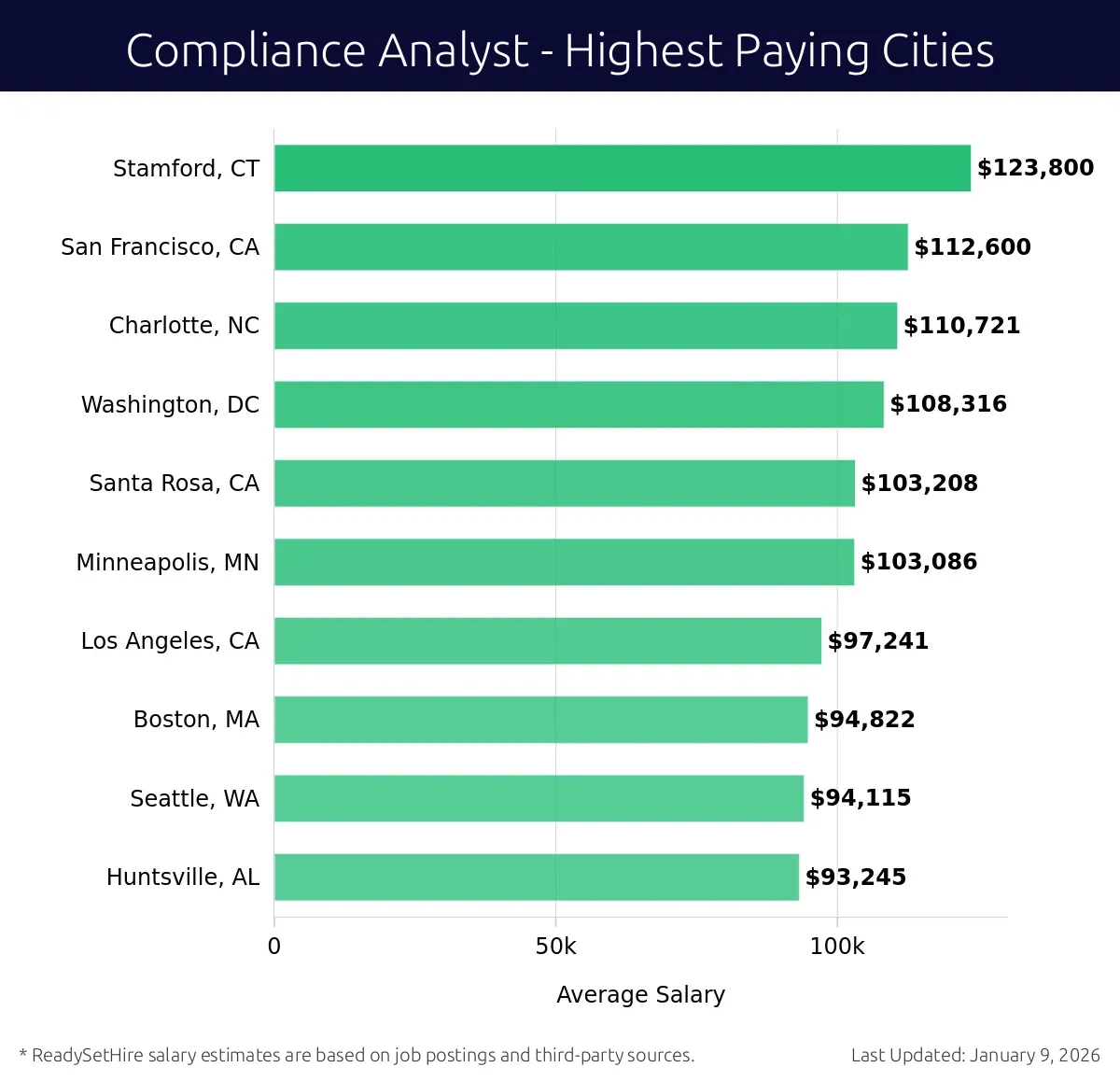

What are the highest paying cities for a Compliance Analyst?

-

Stamford, CT

Average Salary: $123,800

In Stamford, working in compliance offers a blend of finance and law. Key companies like Travelers and United Technologies provide stability. Professionals often work with diverse regulatory environments.

Find Compliance Analyst jobs in Stamford, CT

-

San Francisco, CA

Average Salary: $112,600

San Francisco presents a dynamic scene for compliance roles. Tech giants like Salesforce and Uber create exciting challenges. Professionals often deal with cutting-edge regulations in a fast-paced environment.

Find Compliance Analyst jobs in San Francisco, CA

-

Charlotte, NC

Average Salary: $110,721

Charlotte serves as a financial hub, making it ideal for compliance experts. Banks like Bank of America and Wells Fargo thrive here. This environment offers robust career growth and industry networking.

Find Compliance Analyst jobs in Charlotte, NC

-

Washington, DC

Average Salary: $108,316

Working in compliance in Washington, DC offers unique opportunities. Companies like Deloitte and PwC are prominent. Professionals often engage with federal regulations and have access to policy-making insights.

Find Compliance Analyst jobs in Washington, DC

-

Santa Rosa, CA

Average Salary: $103,208

Santa Rosa provides a relaxed yet professional atmosphere for compliance roles. Companies such as Charles Schwab and Sonoma County Water Agency are leaders. This environment balances work and lifestyle.

Find Compliance Analyst jobs in Santa Rosa, CA

-

Minneapolis, MN

Average Salary: $103,086

Minneapolis offers a vibrant market for compliance careers. Companies like Target and U.S. Bank dominate. Professionals often work in a collaborative and community-focused environment.

Find Compliance Analyst jobs in Minneapolis, MN

-

Los Angeles, CA

Average Salary: $97,241

Los Angeles presents a diverse setting for compliance roles. Entertainment companies like Warner Bros. and NBCUniversal are significant. Professionals often navigate complex regulations in a creative industry.

Find Compliance Analyst jobs in Los Angeles, CA

-

Boston, MA

Average Salary: $94,822

Boston offers a rich environment for compliance work. Key players like Fidelity Investments and MassMutual provide stability. Professionals often engage in a mix of finance and legal compliance.

Find Compliance Analyst jobs in Boston, MA

-

Seattle, WA

Average Salary: $94,115

Seattle is known for its tech-driven market. Companies like Amazon and Microsoft dominate. Compliance professionals often deal with innovative regulations in a growing tech industry.

Find Compliance Analyst jobs in Seattle, WA

-

Huntsville, AL

Average Salary: $93,245

Huntsville offers a unique blend of aerospace and defense. Companies like NASA and Lockheed Martin are prominent. Compliance professionals often work on specialized regulations in a cutting-edge field.

Find Compliance Analyst jobs in Huntsville, AL

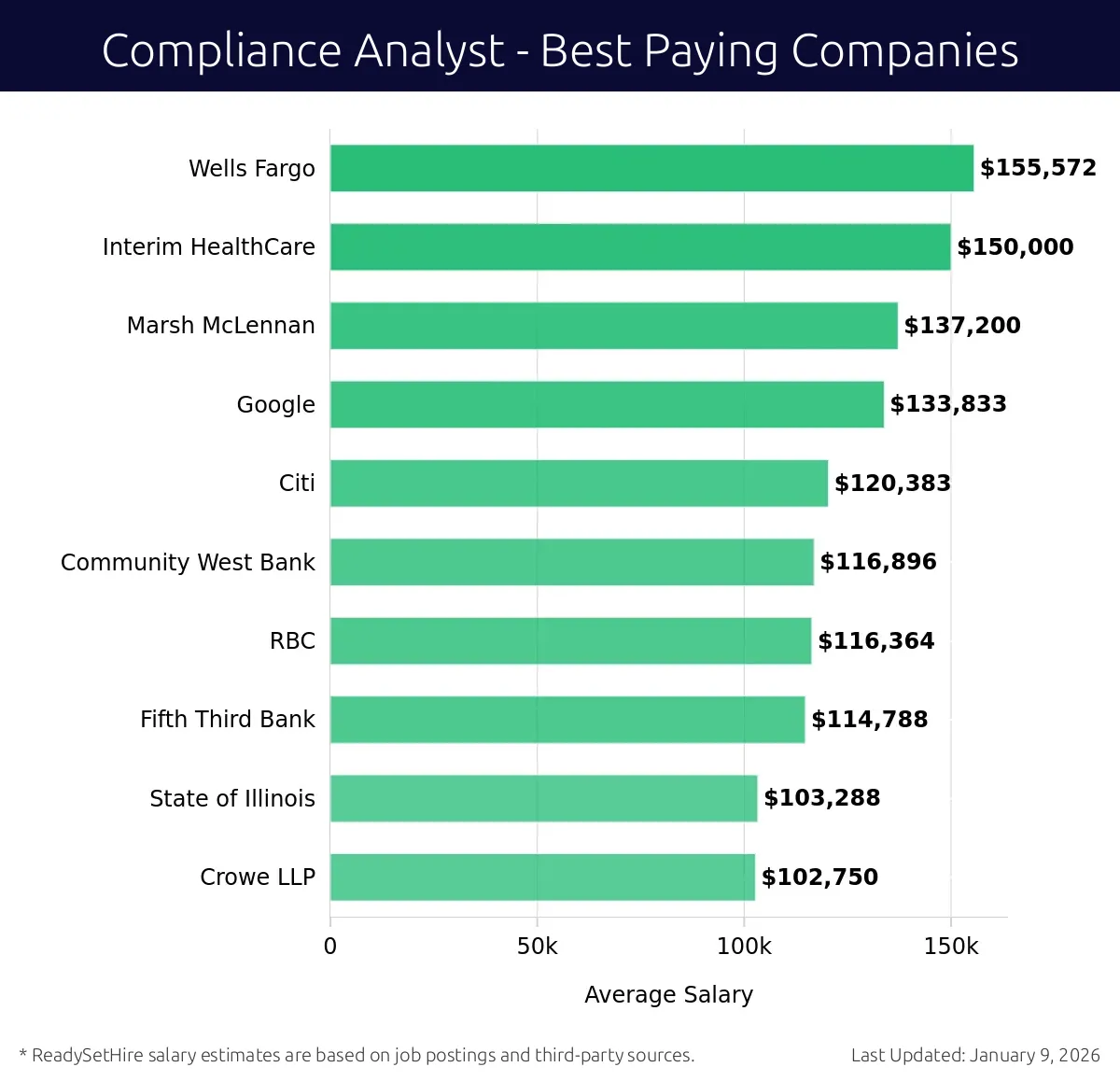

What are the best companies a Compliance Analyst can work for?

-

Wells Fargo

Average Salary: $155,572

Wells Fargo offers Compliance Analyst positions in various locations across the U.S. These roles focus on ensuring adherence to laws and regulations. Employees work to protect the company from legal issues and financial loss. They analyze compliance programs and monitor transactions.

-

Interim HealthCare

Average Salary: $150,000

Interim HealthCare provides high-paying Compliance Analyst jobs in many cities. Their compliance team ensures that all healthcare services meet federal and state regulations. Analysts at Interim HealthCare also help staff understand compliance requirements.

-

Marsh McLennan

Average Salary: $137,200

Marsh McLennan offers Compliance Analyst roles with competitive salaries. These jobs focus on risk management and regulatory compliance in insurance. Compliance Analysts here work in offices located in major cities, helping to mitigate risks and ensure compliance.

-

Google

Average Salary: $133,833

Google's Compliance Analysts earn a high average salary. They focus on data privacy and regulatory compliance in tech. These professionals work in offices worldwide, ensuring Google's practices meet international standards.

-

Citi

Average Salary: $120,383

Citi offers Compliance Analyst jobs with a solid salary. They focus on financial regulations and risk management. Citi's Compliance Analysts work in offices around the globe, ensuring the bank's operations are compliant.

-

Community West Bank

Average Salary: $116,896

Community West Bank provides a competitive salary for Compliance Analysts. These roles focus on banking regulations and customer protection. Employees work in offices across several states, ensuring the bank follows all laws and regulations.

-

RBC

Average Salary: $116,364

Royal Bank of Canada (RBC) offers Compliance Analyst jobs with a strong salary. Their analysts ensure adherence to financial regulations. Employees work in offices across Canada and the U.S., focusing on risk management.

-

Fifth Third Bank

Average Salary: $114,788

Fifth Third Bank offers Compliance Analyst roles with a good salary. They focus on financial regulations and risk management. Analysts work in offices throughout the Midwest, ensuring the bank operates within legal boundaries.

-

State of Illinois

Average Salary: $103,288

The State of Illinois provides Compliance Analyst jobs with a respectable salary. These roles focus on state regulations and public sector compliance. Employees work in various locations across Illinois, ensuring all state operations follow legal standards.

-

Crowe LLP

Average Salary: $102,750

Crowe LLP offers Compliance Analyst positions with a competitive salary. Their analysts focus on auditing and compliance in accounting. Employees work in offices nationwide, helping companies meet compliance requirements.

How to earn more as a Compliance Analyst?

A Compliance Analyst can find several ways to increase earnings. These professionals ensure that organizations follow laws and regulations. Higher earnings often come with gaining more experience and skills. Stepping into senior roles or specialized areas can open up more earning potential.

Here are key factors that can help a Compliance Analyst earn more:

- Gain more experience: Working in the field for several years helps build a solid reputation. Experience often leads to higher positions and pay.

- Obtain advanced certifications: Certifications like the Certified Regulatory Compliance Manager (CRCM) or Certified Compliance and Ethics Professional (CCEP) can boost earning potential. These certifications show a deep understanding of compliance issues.

- Seek advanced education: A bachelor’s or master’s degree in business, law, or a related field can increase job opportunities and salary. Advanced degrees often lead to higher-paying roles.

- Specialize in high-demand areas: Areas like data protection, financial compliance, and healthcare compliance often pay more. Specializing can make a Compliance Analyst more valuable to employers.

- Move to larger companies or industries: Large corporations and high-risk industries, such as finance or healthcare, often offer higher salaries. Working in these sectors can lead to better pay.