What does a Credit Analyst do?

A Credit Analyst examines the creditworthiness of individuals or businesses. They review financial information to determine the risk of lending money. This role involves assessing credit applications and evaluating financial statements. Credit Analysts often use their findings to recommend whether a loan should be approved or denied. Their goal is to help the company manage risk and ensure they make sound financial decisions.

In this position, the Credit Analyst uses various tools and data. They analyze credit reports, income statements, and other financial documents. Attention to detail is crucial. This role requires strong analytical skills and a good understanding of financial principles. It is also important for Credit Analysts to communicate their findings clearly. They must provide recommendations that are easy to understand for decision-makers within the company. This role is vital for maintaining financial health and stability.

How to become a Credit Analyst?

Becoming a Credit Analyst involves several key steps to ensure a solid foundation in financial analysis and credit assessment. This career path requires dedication, a keen eye for detail, and an understanding of financial markets. Professionals in this field evaluate the creditworthiness of individuals and businesses, helping financial institutions make informed lending decisions. Below are the essential steps to embark on this career journey.

Start by obtaining a bachelor’s degree in finance, economics, or a related field. This education lays the groundwork for understanding financial principles and credit analysis. Pursue certifications such as the Certified Credit Analyst (CCA) to enhance your credentials and knowledge. Gaining experience through internships or entry-level positions in financial institutions can provide practical insights into the industry. Stay updated with financial news and trends to maintain a competitive edge. Finally, build a strong professional network within the finance sector to open doors to job opportunities and career growth.

To become a successful Credit Analyst, consider these steps:

- Earn a bachelor’s degree in a relevant field.

- Obtain relevant certifications like the Certified Credit Analyst (CCA).

- Gain practical experience through internships or entry-level positions.

- Stay informed about financial news and trends.

- Build and maintain a professional network.

How long does it take to become a Credit Analyst?

To become a Credit Analyst, most people need a mix of education and experience. Often, this means earning a bachelor's degree. This degree typically takes four years. Most degrees in business, economics, or finance work well. Some credit analysts might go even further with a master's degree or certifications, which can take an extra one to two years.

After finishing school, gaining experience is key. This can happen through internships or entry-level jobs in finance or banking. Many find it helpful to work in roles that deal with credit or financial analysis. This builds the skills and knowledge needed. Usually, it takes about two to four years to move from entry-level to a full Credit Analyst role. This time can vary based on the person's experience, education, and the job market.

Credit Analyst Job Description Sample

We are seeking a detail-oriented Credit Analyst to evaluate the creditworthiness of potential and existing clients. This role requires strong analytical skills, attention to detail, and the ability to assess financial information to mitigate credit risk.

Responsibilities:

- Evaluate credit applications by analyzing financial statements, credit reports, and other pertinent information.

- Assess the credit risk of clients by developing risk profiles and analyzing financial data.

- Collaborate with other departments such as sales, collections, and lending to provide credit recommendations.

- Monitor and analyze credit portfolios to identify trends, potential risks, and opportunities for improvement.

- Prepare detailed credit reports and presentations for management and clients.

Qualifications

- Bachelor's degree in Finance, Economics, Accounting, or a related field.

- Minimum of 3 years of experience in credit analysis or a related role.

- Strong understanding of credit principles, financial analysis, and risk assessment.

- Proficiency in using credit analysis software and tools.

- Excellent analytical and problem-solving skills.

Is becoming a Credit Analyst a good career path?

A Credit Analyst examines the creditworthiness of individuals and companies. They review financial statements, credit reports, and other financial data. They help businesses and financial institutions decide whether to lend money or provide credit. This role involves careful analysis and decision-making.

Working as a Credit Analyst comes with its own set of advantages and challenges. On the positive side, the job offers stability and clear career progression. Analysts often work in offices, which can provide a structured work environment. They have the chance to make decisions that impact business operations. However, the role can also be stressful due to the importance of accurate financial assessments. Analysts must manage tight deadlines and ensure compliance with regulations. Balancing these pros and cons can lead to a rewarding career for the right person.

Here are some pros and cons to consider:

- Pros:

- Stability: Many companies need credit analysts, ensuring job security.

- Clear career path: Opportunities for advancement to senior positions.

- Decision impact: Influence important business decisions regarding credit.

- Structured work environment: Typically office-based with set hours.

- Cons:

- Stress: High responsibility in making financial decisions can be stressful.

- Deadlines: Need to meet strict deadlines can create pressure.

- Regulatory compliance: Must stay updated with financial regulations.

What is the job outlook for a Credit Analyst?

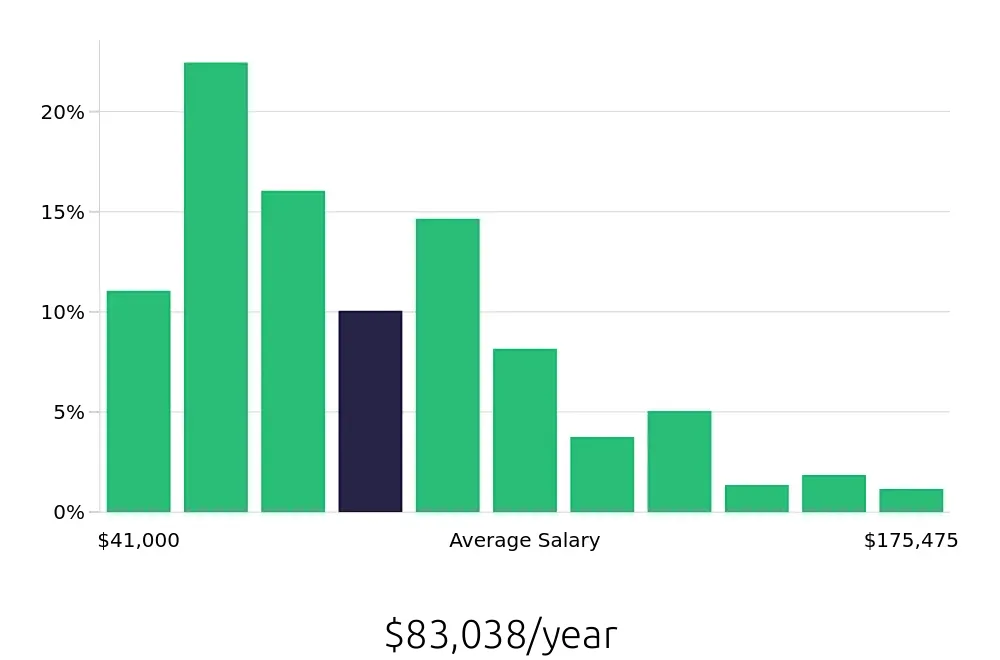

Becoming a credit analyst offers promising career prospects, with an average of 4,600 job positions available annually. Although job openings are expected to decrease by 4.3% from 2022 to 2032, the demand for skilled credit analysts remains steady. This makes the role both competitive and rewarding, with a solid national annual compensation of $94,750 and an hourly rate of $45.56.

Job seekers interested in this role should note the consistent demand across various industries. This stability ensures that qualified candidates have ample opportunities to advance in their careers. The role requires a keen eye for detail and a solid understanding of financial markets, which are valuable skills in a diverse job market.

The average compensation for credit analysts reflects the importance of their role in ensuring financial stability and risk management. With this level of pay and the steady job outlook, credit analysts can look forward to a secure and rewarding career. Aspiring analysts should focus on developing their analytical and financial skills to excel in this field.

Currently 266 Credit Analyst job openings, nationwide.

Continue to Salaries for Credit Analyst