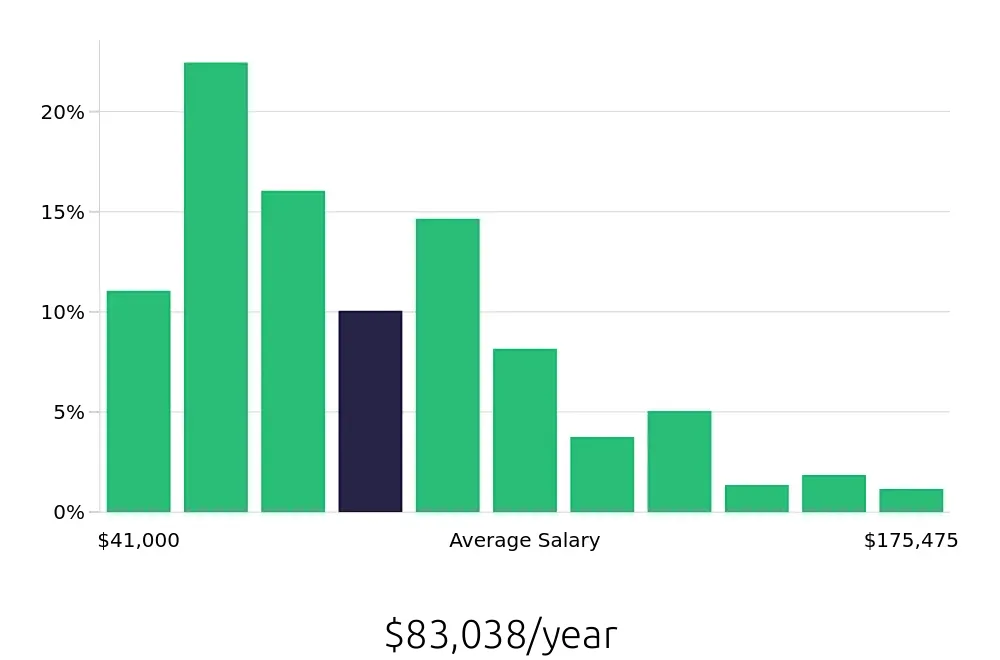

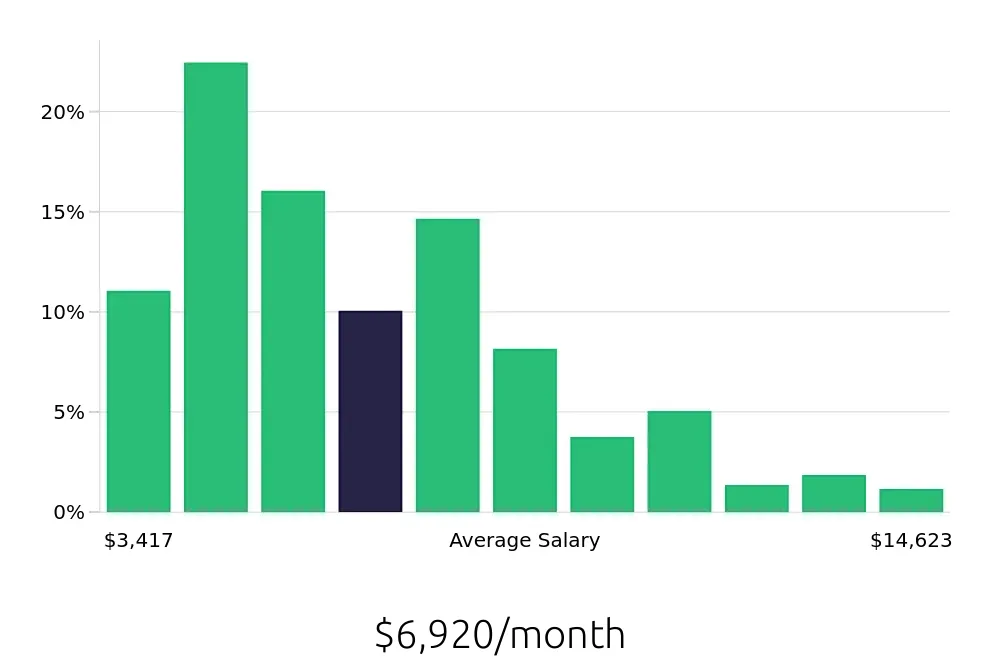

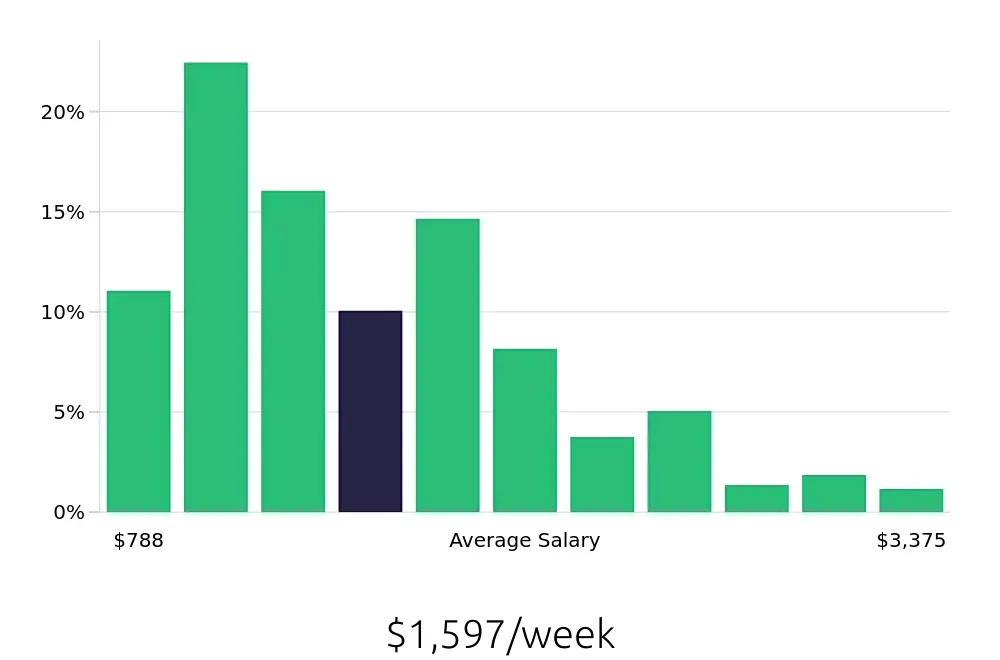

How much does a Credit Analyst make?

Becoming a Credit Analyst can bring a rewarding salary. On average, Credit Analysts earn $83,038 each year. This job is often rewarding because it involves analyzing the financial health of companies or individuals. It helps lenders decide how much risk they are taking on.

The salary for a Credit Analyst can change based on experience and location. Here are some averages:

- The first 10% of analysts earn about $41,000.

- The next 20% make between $53,225 and $65,450.

- About 30% earn from $65,450 to $89,900.

- The middle 20% make from $89,900 to $114,350.

- Top-earning analysts, about 10%, make over $126,575 a year.

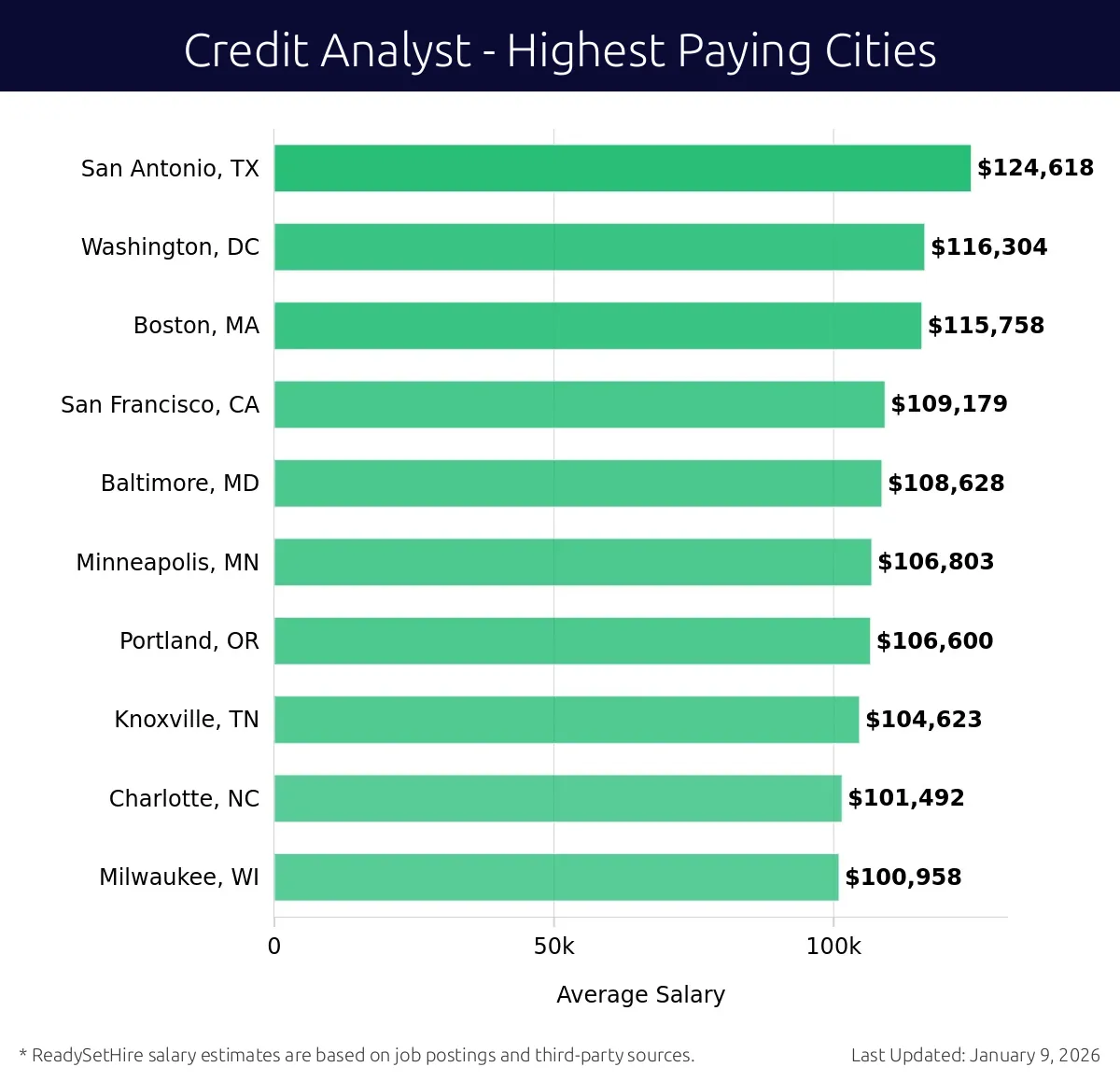

What are the highest paying cities for a Credit Analyst?

-

San Antonio, TX

Average Salary: $124,618

In San Antonio, financial experts evaluate credit risks with a focus on local businesses. Companies like Wells Fargo and USAA provide strong opportunities for growth.

Find Credit Analyst jobs in San Antonio, TX

-

Washington, DC

Average Salary: $116,304

Washington, DC, offers credit professionals a dynamic environment with many financial institutions. Working here allows for impactful analysis with global firms such as JPMorgan Chase.

Find Credit Analyst jobs in Washington, DC

-

Boston, MA

Average Salary: $115,758

In Boston, analysts enjoy a vibrant market. The presence of companies like Fidelity and State Street gives access to cutting-edge financial trends.

Find Credit Analyst jobs in Boston, MA

-

San Francisco, CA

Average Salary: $109,179

San Francisco provides a tech-driven atmosphere for credit experts. Here, professionals work alongside giants such as Goldman Sachs and fintech startups.

Find Credit Analyst jobs in San Francisco, CA

-

Baltimore, MD

Average Salary: $108,628

Baltimore offers a blend of finance and community. Credit analysts here find opportunities with organizations like T. Rowe Price and Under Armour.

Find Credit Analyst jobs in Baltimore, MD

-

Minneapolis, MN

Average Salary: $106,803

Minneapolis stands out with its strong financial sector. Analysts often find roles with U.S. Bank and Thrivent, enjoying a supportive work culture.

Find Credit Analyst jobs in Minneapolis, MN

-

Portland, OR

Average Salary: $106,600

Portland's progressive environment nurtures financial expertise. Companies like Oregon Health & Science University provide diverse credit analysis opportunities.

Find Credit Analyst jobs in Portland, OR

-

Knoxville, TN

Average Salary: $104,623

Knoxville offers a balanced lifestyle with a focus on finance. Analysts here often work with regional banks and credit unions, promoting local business growth.

Find Credit Analyst jobs in Knoxville, TN

-

Charlotte, NC

Average Salary: $101,492

Charlotte is a financial hub, ideal for credit professionals. The city is home to Bank of America and Wells Fargo, offering extensive career advancement.

Find Credit Analyst jobs in Charlotte, NC

-

Milwaukee, WI

Average Salary: $100,958

In Milwaukee, credit experts benefit from a robust financial sector. Working with companies like Northwestern Mutual and Milwaukee Tool provides stable career paths.

Find Credit Analyst jobs in Milwaukee, WI

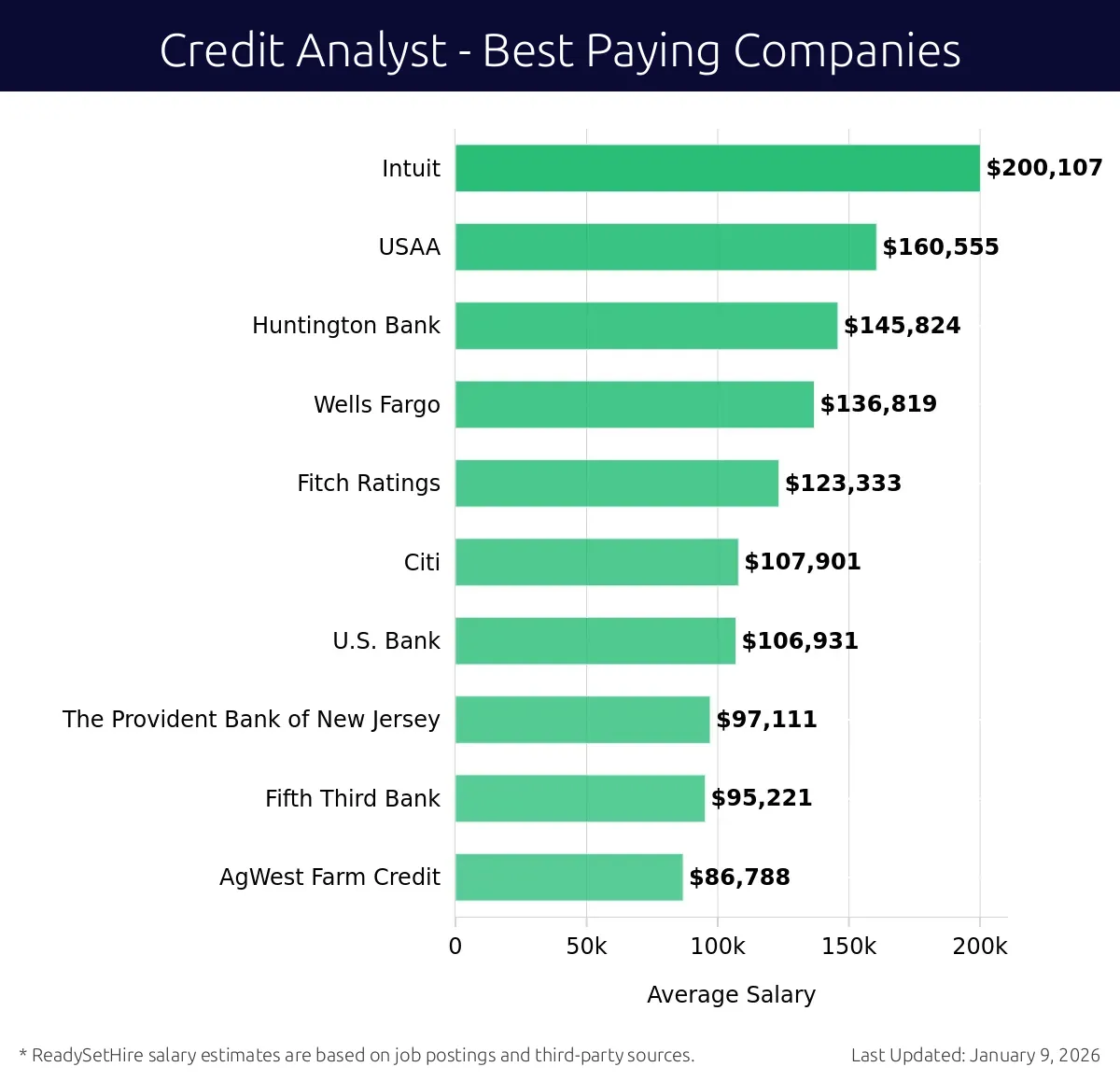

What are the best companies a Credit Analyst can work for?

-

Intuit

Average Salary: $200,107

Intuit is known for its innovative approach to financial software. Credit Analysts at Intuit work in cities like Mountain View, San Diego, and Austin. They play a key role in developing software that helps small businesses manage their finances.

-

USAA

Average Salary: $160,555

USAA offers financial services to military members and their families. Credit Analysts at USAA work in San Antonio and other locations. They focus on assessing credit risk and supporting the company’s financial health.

-

Huntington Bank

Average Salary: $145,824

Huntington Bank operates in several states, including Ohio and Indiana. Credit Analysts at Huntington Bank evaluate credit risks and help clients manage their finances. The company values community service and financial stability.

-

Wells Fargo

Average Salary: $136,819

Wells Fargo is a national bank with locations across the country. Credit Analysts at Wells Fargo work in cities like San Francisco and Charlotte. They analyze credit data and help maintain the bank's financial integrity.

-

Fitch Ratings

Average Salary: $123,333

Fitch Ratings provides credit ratings for businesses and governments. Credit Analysts at Fitch Ratings work in New York and other locations. They assess credit risks and provide ratings that inform investors and businesses.

-

Citi

Average Salary: $107,901

Citi is a global bank with a strong presence in New York and other major cities. Credit Analysts at Citi evaluate credit risks for businesses and individuals. They help the bank manage its financial risks effectively.

-

U.S. Bank

Average Salary: $106,931

U.S. Bank operates in many states, especially in the Midwest. Credit Analysts at U.S. Bank work in Minneapolis and other locations. They analyze credit data to support the bank’s lending practices.

-

The Provident Bank of New Jersey

Average Salary: $97,111

The Provident Bank of New Jersey focuses on personal and commercial banking. Credit Analysts at this bank work in New Jersey. They help assess credit risks and support the bank's lending efforts.

-

Fifth Third Bank

Average Salary: $95,221

Fifth Third Bank operates in several states, including Ohio and Michigan. Credit Analysts at Fifth Third Bank work in Cincinnati and other locations. They evaluate credit risks and help clients manage their finances.

-

AgWest Farm Credit

Average Salary: $86,788

AgWest Farm Credit provides financial services to agricultural businesses. Credit Analysts at AgWest Farm Credit work in locations across the western United States. They assess credit risks for farms and agricultural businesses.

How to earn more as a Credit Analyst?

A Credit Analyst looks at financial details to see how reliable a person or company is. This job pays well, but there are ways to make even more. Increasing your salary can make your work more rewarding. Here are some steps to help you earn more.

First, gaining more experience can lead to higher pay. Companies often value the skills that come with years on the job. Second, getting more certifications can boost your salary. Certifications show you have specialized knowledge. Third, working in a big city can offer higher wages. Large cities often pay more for living expenses. Fourth, moving to a different company can lead to better pay. Companies compete for top talent. Fifth, taking on more responsibility can increase your salary. Leading projects or teams often gets you a raise.

Increasing your earnings as a Credit Analyst means being smart about your career choices. Focus on gaining experience, getting certified, working in high-cost areas, switching jobs, and taking on leadership roles. These steps can help you earn more and have a more fulfilling career.

- Gain more experience in the field.

- Get more certifications to show specialized skills.

- Work in a big city where living costs are higher.

- Switch to a company that offers better pay.

- Take on more responsibility to lead projects or teams.