What does a Credit Manager do?

A Credit Manager plays a critical role in ensuring a company’s financial stability. This professional assesses the creditworthiness of potential clients. They analyze financial data and credit reports to determine the risk of extending credit. By managing the credit policies, they help maintain healthy cash flow and reduce bad debt. Their job involves working closely with the sales and accounting teams. They ensure that credit decisions align with company policies and legal regulations.

In their daily tasks, a Credit Manager reviews and updates credit limits for customers. They monitor accounts receivables and follow up on overdue payments. This role requires strong analytical skills to identify trends and make informed decisions. They also communicate with customers to negotiate payment terms and resolve any credit issues. This position demands excellent communication and negotiation skills. It also requires attention to detail and the ability to work under pressure. With a focus on risk management, a Credit Manager helps the company avoid financial pitfalls and supports its growth.

How to become a Credit Manager?

Becoming a Credit Manager is a rewarding path for those with a knack for finance and risk assessment. This role involves overseeing the credit policies of a company and ensuring that customers can pay their debts. A Credit Manager must have excellent analytical skills and a strong understanding of financial regulations. Here are five essential steps to embark on this career.

First, obtaining a relevant degree is crucial. Many Credit Managers hold a degree in finance, accounting, or business administration. This education provides the necessary foundation in financial principles and business practices. Second, gaining experience in credit or finance roles helps build practical skills. Working in areas like accounts receivable or collections is beneficial. Third, developing strong analytical skills is vital. Credit Managers must assess the creditworthiness of clients and predict future financial trends. Fourth, mastering credit management software is essential. Proficiency in these tools helps manage credit accounts efficiently. Lastly, obtaining relevant certifications, such as the Certified Credit Expert (CCE) or the Credit Risk Analyst (CRA), can enhance credibility and job prospects.

Following these steps prepares individuals for a successful career as a Credit Manager. This role offers the opportunity to influence a company's financial health and customer relations. With dedication and the right qualifications, one can achieve a rewarding position in this field.

- Earn a relevant degree in finance or business.

- Gain experience in credit or finance roles.

- Develop strong analytical skills.

- Master credit management software.

- Obtain relevant certifications.

How long does it take to become a Credit Manager?

The time it takes to become a Credit Manager varies. It depends on education and experience. Most people start with a bachelor's degree in business or finance. This takes about four years. Some credit managers have a background in accounting, economics, or a related field.

After earning a degree, many gain experience in financial roles. This could be in banking, accounting, or collections. Experience levels can range from a few years to over a decade. Some employers may prefer candidates with certifications. The Certified Credit Professional (CCP) or Certified Credit Executive (CCE) can enhance a resume. These certifications show a deeper understanding of credit management. This can shorten the path to a Credit Manager role.

Credit Manager Job Description Sample

The Credit Manager will be responsible for overseeing credit policies, risk management, and ensuring optimal credit utilization within the organization. They will analyze credit applications, manage credit portfolios, and work closely with sales and finance teams to maintain healthy cash flow and minimize credit risk.

Responsibilities:

- Develop and implement credit policies and procedures that align with the organization's risk management framework.

- Evaluate credit applications from new and existing clients to determine creditworthiness.

- Monitor credit limits and payment terms, and make recommendations for adjustments based on financial analysis.

- Collaborate with sales, finance, and collection teams to ensure consistent credit management practices.

- Conduct regular reviews of accounts receivable to identify trends and areas for improvement.

Qualifications

- Bachelor’s degree in Finance, Accounting, Business Administration, or related field.

- Minimum of 5 years of experience in credit management or a related role.

- Strong analytical and problem-solving skills with the ability to interpret financial data.

- Excellent negotiation and communication skills.

- In-depth knowledge of credit risk management and financial analysis.

Is becoming a Credit Manager a good career path?

A career as a Credit Manager offers a range of responsibilities and opportunities. This role involves assessing the creditworthiness of clients, determining credit limits, and managing financial risks. It requires strong analytical skills and attention to detail.

This position provides an excellent chance to grow within a company. Many start as credit analysts and advance to Credit Manager with experience. Companies often value those with finance backgrounds or degrees in business administration.

Working as a Credit Manager comes with its own set of pros and cons. Consider these factors before making a decision:

- Pros:

- Opportunities to develop strong relationships with clients

- Chances to influence company policies and procedures

- Potential for higher earnings with experience and performance

- Job stability, especially in industries like finance and retail

- Cons:

- High responsibility for financial decisions

- Potential for high-stress situations during economic downturns

- May require long hours, especially during credit assessments

- Need to stay updated with financial regulations and credit policies

What is the job outlook for a Credit Manager?

The job outlook for Credit Managers is promising for those seeking a stable career in finance. The Bureau of Labor Statistics (BLS) reports an average of 69,600 job positions available each year, indicating a consistent demand for skilled professionals. With the projected job openings percent change from 2022 to 2032 at 16%, this role is expected to grow, offering many opportunities for job seekers.

Credit Managers play a crucial role in ensuring the financial health of businesses. They assess the creditworthiness of customers, set credit policies, and manage the credit risk. These responsibilities are essential for maintaining the cash flow of companies and are highly valued in today’s competitive market. The average national annual compensation for Credit Managers stands at $174,820, making it a lucrative career choice. Additionally, the average national hourly compensation of $84.05 reflects the expertise and skills required for this position.

For job seekers, the credit management field offers more than just a job. It provides a pathway to a rewarding and secure career. With the steady increase in job openings and competitive salaries, this role is ideal for those with a knack for finance and a desire to impact a company’s financial strategy. The BLS data highlights the importance and growth potential of this profession, making it an attractive option for anyone in the job market.

Currently 129 Credit Manager job openings, nationwide.

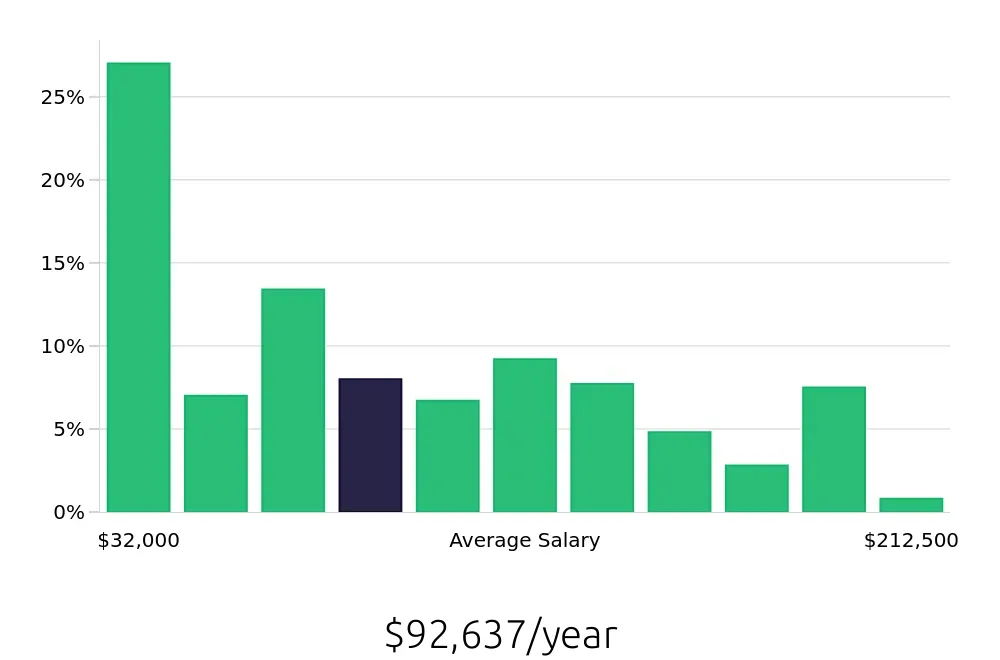

Continue to Salaries for Credit Manager