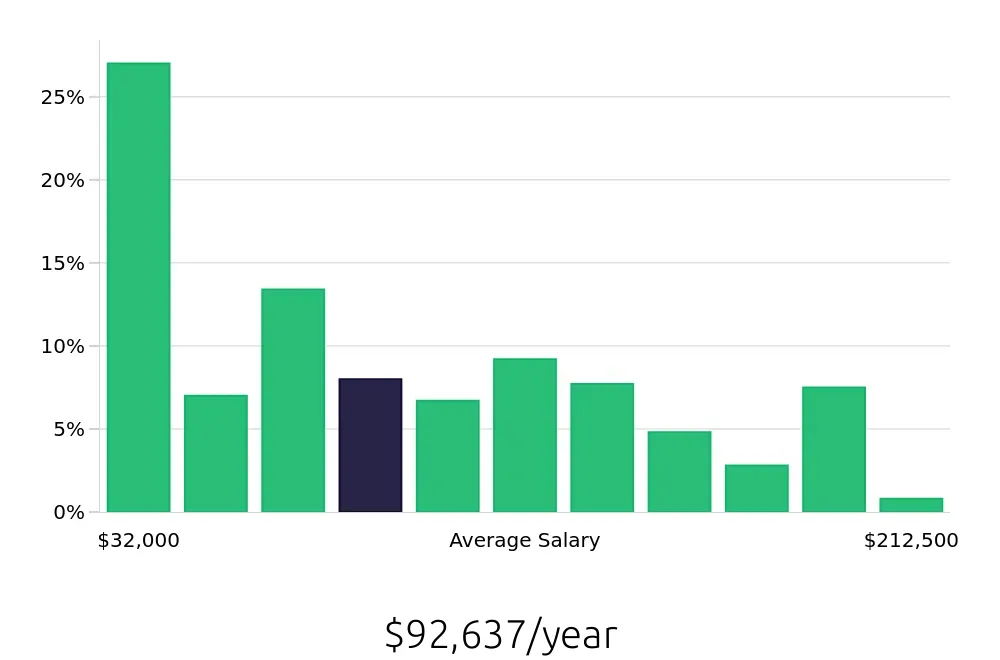

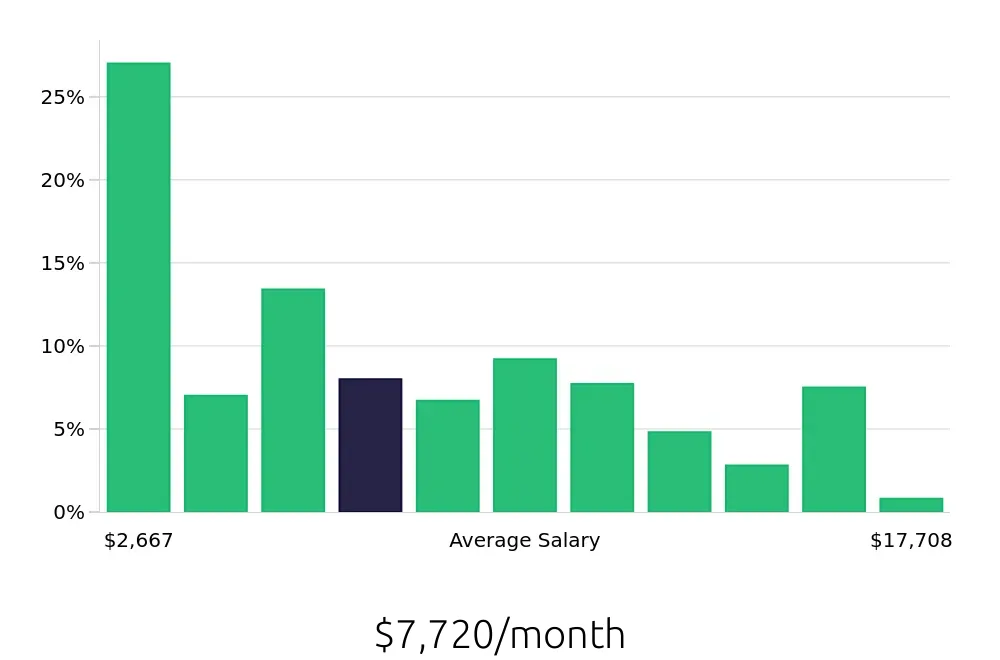

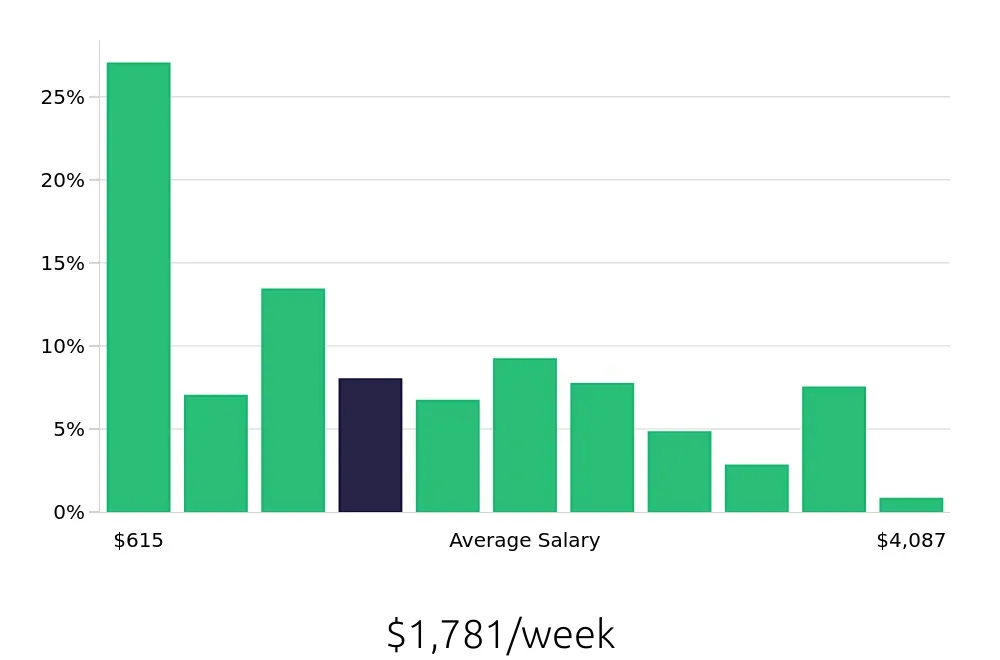

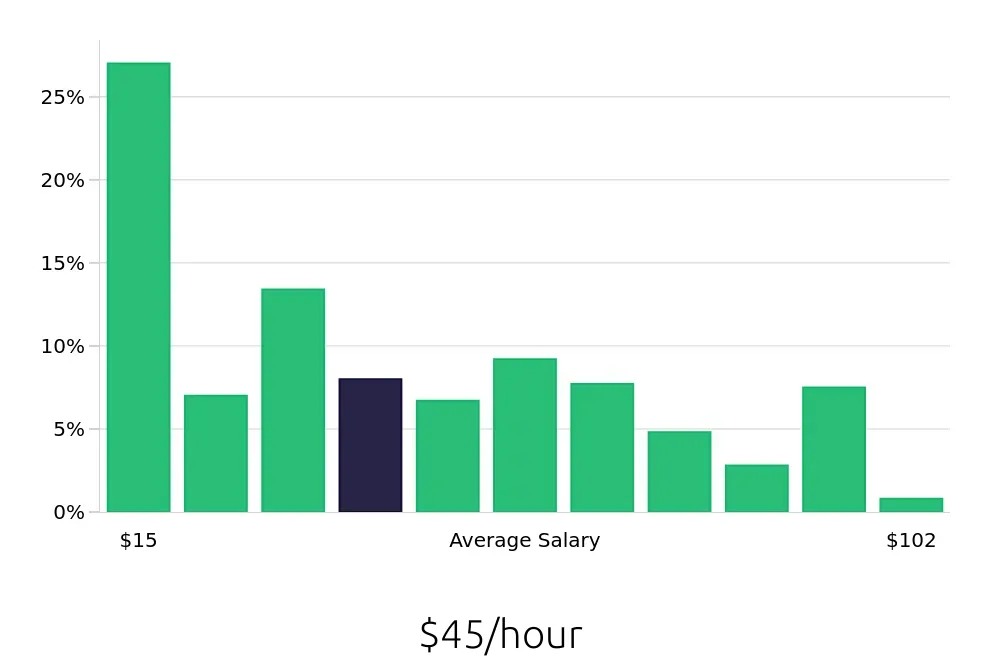

How much does a Credit Manager make?

A Credit Manager plays a vital role in ensuring a company's financial health by managing the credit for customers. These professionals help determine credit limits and collect payments. They analyze credit data and financial reports. The average yearly salary for a Credit Manager is around $92,637. However, this number can change based on experience, location, and industry.

The salary for a Credit Manager varies across different levels of experience. Entry-level positions might start around $32,000. Experienced managers can earn up to $196,000 or more. Here is a breakdown of the average salaries based on years of experience:

- Less than 1 year: $32,000

- 1-3 years: $48,409

- 4-6 years: $64,818

- 7-9 years: $81,227

- 10-19 years: $97,636

- 20+ years: $196,091

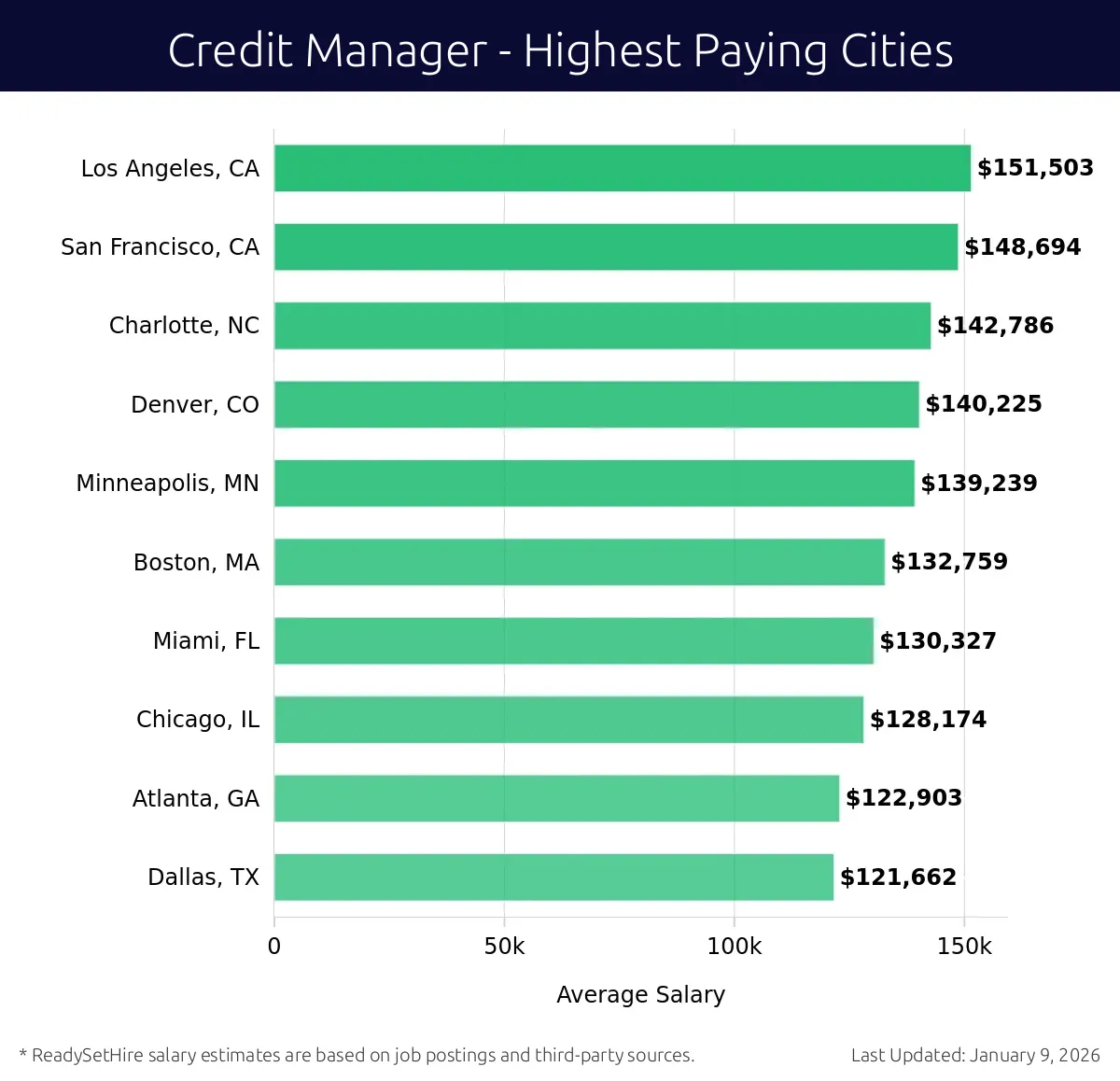

What are the highest paying cities for a Credit Manager?

-

Los Angeles, CA

Average Salary: $151,503

In Los Angeles, you can expect a dynamic work environment with diverse companies. Firms like T-Mobile and Sony require strong credit management skills. The city's thriving economy offers many opportunities for professionals to grow and excel.

Find Credit Manager jobs in Los Angeles, CA

-

San Francisco, CA

Average Salary: $148,694

San Francisco is home to tech giants and startups. Companies like Google and Salesforce need adept credit managers. Working here means facing unique challenges and gaining valuable experience in a fast-paced industry.

Find Credit Manager jobs in San Francisco, CA

-

Charlotte, NC

Average Salary: $142,786

Charlotte, known as the banking capital, has many financial institutions. Banks like Bank of America and Wells Fargo need skilled credit managers. The city offers stability and excellent career growth in the financial sector.

Find Credit Manager jobs in Charlotte, NC

-

Denver, CO

Average Salary: $140,225

Denver offers a mix of industries, from tech to energy. Companies like IBM and Xcel Energy look for credit managers with strong analytical skills. The city’s growing economy provides numerous opportunities for professionals.

Find Credit Manager jobs in Denver, CO

-

Minneapolis, MN

Average Salary: $139,239

Minneapolis is known for its corporate headquarters and financial services. Companies like Target and U.S. Bancorp require experienced credit managers. The city offers a balanced work-life environment with a vibrant community.

Find Credit Manager jobs in Minneapolis, MN

-

Boston, MA

Average Salary: $132,759

Boston, a hub for education and healthcare, has many opportunities for credit managers. Companies like Biogen and General Electric demand top-notch financial oversight. Working here means being part of a thriving professional community.

Find Credit Manager jobs in Boston, MA

-

Miami, FL

Average Salary: $130,327

Miami offers a diverse economic landscape with many opportunities for credit managers. Companies like Carnival Cruise Line and Lennar need strong financial skills. The city’s multicultural environment adds to its appeal.

Find Credit Manager jobs in Miami, FL

-

Chicago, IL

Average Salary: $128,174

Chicago is a major financial center with many opportunities for credit managers. Companies like Boeing and United Airlines require skilled professionals. The city offers diverse industries and a vibrant professional scene.

Find Credit Manager jobs in Chicago, IL

-

Atlanta, GA

Average Salary: $122,903

Atlanta is a key business hub with many industries needing credit managers. Companies like Coca-Cola and Delta Air Lines offer excellent career opportunities. The city's growth makes it a great place for professionals to thrive.

Find Credit Manager jobs in Atlanta, GA

-

Dallas, TX

Average Salary: $121,662

Dallas offers a robust economy with many opportunities for credit managers. Companies like AT&T and ExxonMobil require strong financial oversight. The city’s business-friendly environment supports career advancement.

Find Credit Manager jobs in Dallas, TX

What are the best companies a Credit Manager can work for?

-

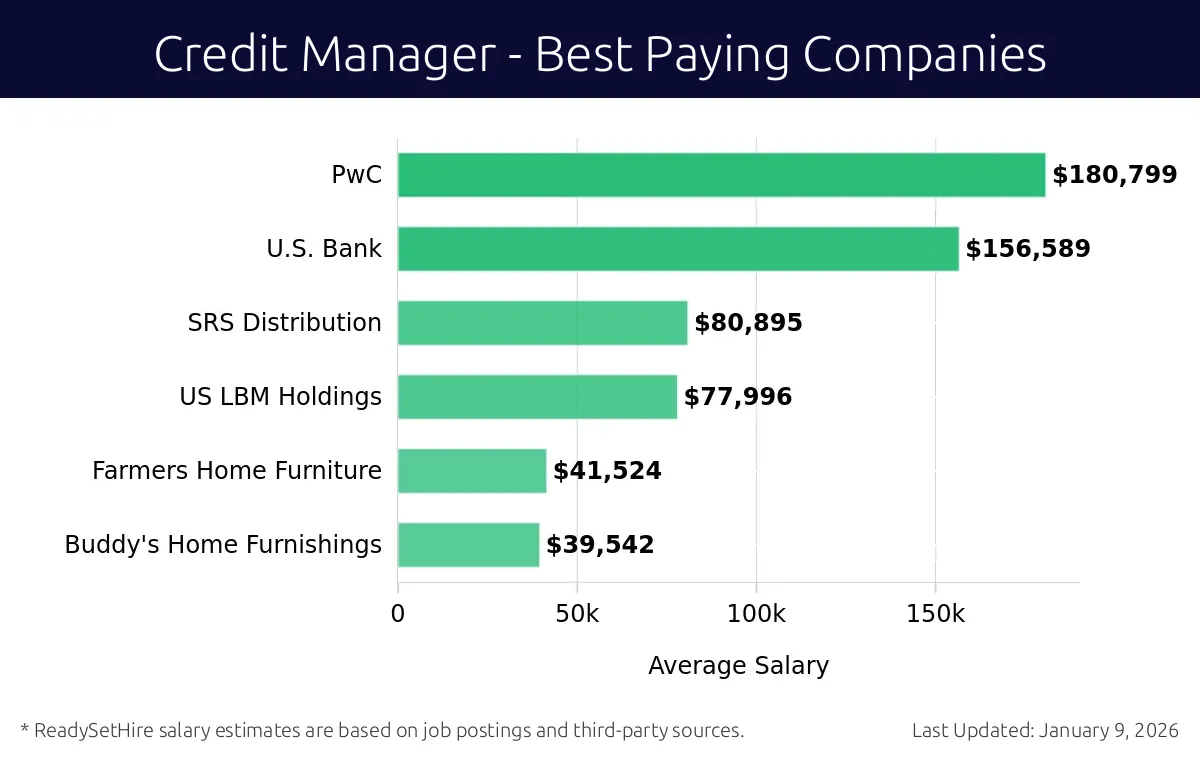

PwC

Average Salary: $180,799

At PwC, Credit Managers play a key role in evaluating credit risk and managing financial assets. The company operates globally, with offices in major cities. Credit Managers here use advanced tools to assess client creditworthiness. They often work with a diverse team and focus on strategic financial planning.

-

U.S. Bank

Average Salary: $156,589

U.S. Bank offers exciting opportunities for Credit Managers. These professionals analyze credit risks and manage large portfolios. The bank has branches across the United States. They collaborate with various departments to enhance credit policies and practices, ensuring the company's financial health.

-

SRS Distribution

Average Salary: $80,895

SRS Distribution provides opportunities for Credit Managers to thrive in a dynamic environment. They focus on credit evaluations and risk management. The company operates in multiple states, offering diverse experiences. Credit Managers here work closely with vendors and clients to maintain strong financial relationships.

-

US LBM Holdings

Average Salary: $77,996

US LBM Holdings offers a robust platform for Credit Managers to manage credit operations. They analyze credit risks and help improve financial strategies. The company has a presence in various markets across the country. Credit Managers here work in a team-oriented setting, focusing on client satisfaction and financial stability.

-

Farmers Home Furniture

Average Salary: $41,524

At Farmers Home Furniture, Credit Managers are vital to managing credit and financial risks. They work with a friendly team in multiple locations. The company focuses on providing quality home furnishings. Credit Managers here use their skills to ensure the company’s financial health while supporting customer satisfaction.

-

Buddy's Home Furnishings

Average Salary: $39,542

Buddy's Home Furnishings offers Credit Managers a chance to work in a retail environment. They assess credit risks and manage financial assets. The company operates in various locations, providing diverse experiences. Credit Managers here focus on maintaining good customer relationships while ensuring the company's financial health.

How to earn more as a Credit Manager?

A Credit Manager plays a crucial role in ensuring a company’s financial health by managing credit risks. To earn more in this role, focus on enhancing your skill set and leveraging opportunities for career advancement. Several factors can contribute to earning a higher salary as a Credit Manager. Improving these areas not only boosts your earning potential but also adds value to your organization.

Start by gaining advanced certifications in credit management and financial analysis. These credentials can distinguish you from your peers and make you a more attractive candidate for higher-paying positions. Continuing education in areas like risk management and financial forecasting can further enhance your expertise. Networking with industry professionals and joining relevant associations also opens doors to better job opportunities. Employers often value candidates who actively engage in professional development.

Here are some steps to increase your earning potential:

- Obtain Advanced Certifications: Get recognized credentials in credit management and financial analysis.

- Pursue Continuous Education: Take courses in risk management and financial forecasting.

- Network Professionally: Join associations and connect with industry experts.

- Seek Leadership Roles: Aim for managerial positions to increase your responsibilities and salary.

- Gain Experience in Multiple Industries: Diverse experience makes you a versatile candidate.